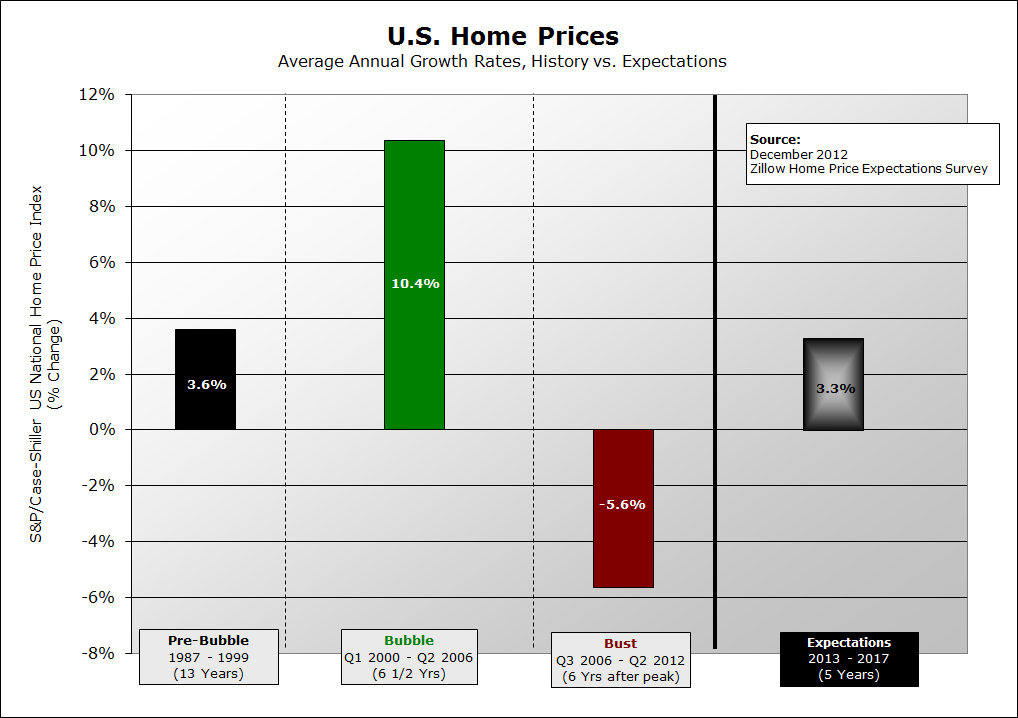

A panel of 105 professional economic forecasters from all around the country expect home prices to increase 3.1 percent in 2013, according to the December 2012 Zillow Home Price Expectations Survey. Forecasters are more optimistic about home prices than they were just three months earlier when they predicted 2013 home prices would only increase by 2.4 percent. If the experts are correct, then home prices in 2013 will be increasing at nearly the “pre-bubble” average of 3.6 percent per year (see chart below).

A panel of 105 professional economic forecasters from all around the country expect home prices to increase 3.1 percent in 2013, according to the December 2012 Zillow Home Price Expectations Survey. Forecasters are more optimistic about home prices than they were just three months earlier when they predicted 2013 home prices would only increase by 2.4 percent. If the experts are correct, then home prices in 2013 will be increasing at nearly the “pre-bubble” average of 3.6 percent per year (see chart below).

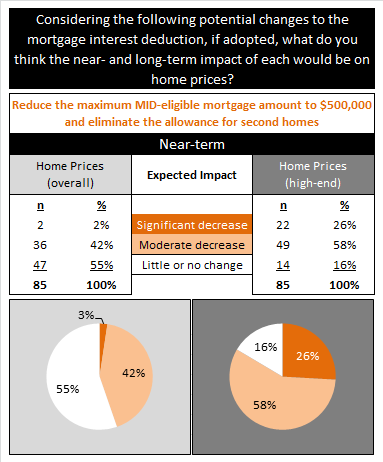

Something else I found very interesting in the report was that most (55 percent) of the forecasters felt there would be no impact on home prices if the Mortgage Interest Deduction (MID) was changed as is being discussed in negotiations by politicians trying to avoid the fiscal cliff (see chart below). Many housing groups, including the National Association of REALTORS, have fought vehemently for the MID over the years saying any change to MID (which has been in existence since 1913) would negatively impact the housing market, however this group of forecasters doesn’t seem to feel that way. For what it’s worth, I have often questioned whether changing, or even eliminating, MID would actually have a negative impact on the housing market and, in fact, thought it may have a positive impact if we look at the big picture. Like the forecasters in the Zillow report, I agree that changes to MID would impact the highest-priced homes but I don’t see it having much impact on the homes the other 90 percent of the population buys. After all, it is said that part of the American Dream is home ownership….not for the sake of being able to deduct mortgage interest, or even necessarily as an investment, but for a whole host of other reasons which I covered in other articles. As for the “big picture” I was referring to, the MID actually encourages borrowing and debt instead of rewarding buying within one’s means and striving to pay off a home rather than create more debt. Enough on that topic for now, we will have to wait and see what our elected officials in D.C. end up doing, if anything, to change MID and then in time will see who is correct on this debate.

Source: December 2012 Zillow Home Price Expectations Survey

Source: December 2012 Zillow Home Price Expectations Survey

Leave a Reply

You must be logged in to post a comment.