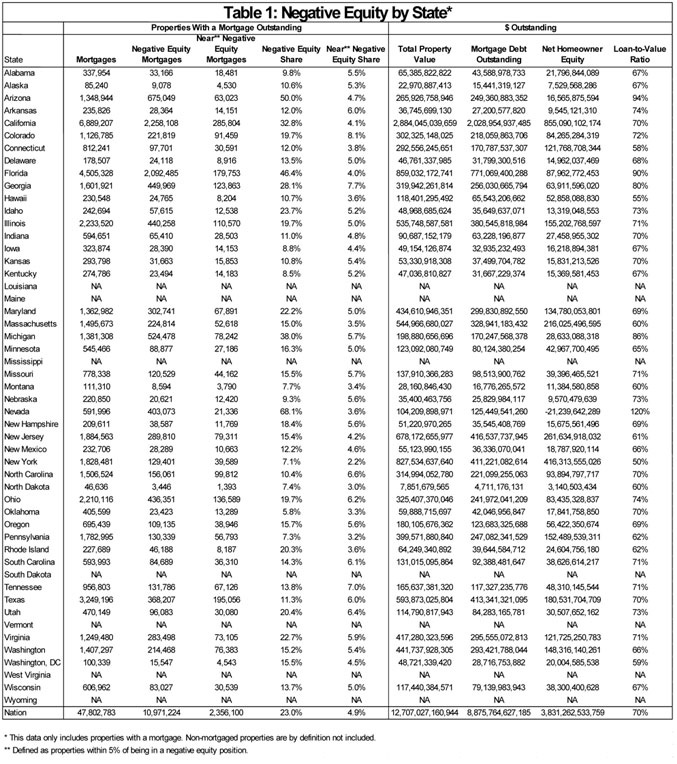

A report released this morning by CoreLogic shows negative equity, after decreasing for the three prior quarters, increased in the fourth quarter of 2010 for residential properties. The CoreLogic reports that 11.1 million, or 23.1 percent, of all residential properties with mortgages were in negative equity at the end of the fourth quarter of 2010, up from 10.8 million and 22.5 percent in the prior quarter.

An additional 2.4 million borrowers had less than five percent equity in the fourth quarter bringing the total of negative equity and near-negative equity mortgages to 27.9 percent of all residential properties with a mortgage nationwide.

Negative equity, often referred to as “underwater” or “upside down,” means that borrowers owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in value, an increase in mortgage debt or a combination of both.

Report Highlights

- Nevada had the highest negative equity percentage with 65 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (47 percent), Michigan (36 percent) and California (32 percent).

- At 118 percent, Nevada had the highest average loan-to-value (LTV) ratios for properties with a mortgage, followed by Arizona (95 percent), Florida (91 percent), Michigan (84 percent), and Georgia (81 percent). New York had the lowest LTV at 50 percent, followed by Hawaii (54 percent), District of Columbia (58 percent), Connecticut (60 percent), and North Dakota (60 percent).

- The distribution of LTV varies greatly by state. For example, California has a higher share of borrowers with 60 percent or less LTV compared to Texas even though California has a negative equity share that is 3 times higher than Texas. Florida and Michigan have fairly similar concentrations of low LTV loans, but above 70 percent LTV the profiles of the states begin to diverge with Florida significantly worse than Michigan.

- The consensus is that home prices will fall another 5 percent to 10 percent in 2011. If so, the most that negative equity will rise is another 10 percentage points, all else equal . What’s important is not just the share of at-risk loans (i.e., loans with less than 10 percent equity) but current price movements. At the safe end of the spectrum, New York, North Dakota and Hawaii have very low shares of at risk loans (less than 7 percent) and prices are still increasing, so the risk is minimal (Figure 5). Colorado, Tennessee and North Carolina appear to be the riskiest because they each have the largest percent of loans at risk (16 percent or more). However, each is only experiencing moderate price declines so the impact in these states will be small to moderate. Given price declines, the largest risk to future increases in negative equity lies in Alabama, Idaho, and Oregon which have a high share of loans that are near negative equity and rapid home price depreciation.

“Negative equity holds millions of borrowers captive in their homes, unable to move or sell their properties. Until the high level of negative equity begins to recede, the housing and mortgage finance markets will remain very sluggish,” said Mark Fleming, chief economist with CoreLogic.

Soucre: CoreLogic

Leave a Reply

You must be logged in to post a comment.