By Dennis Norman, on August 19th, 2014 Today, the owners and operators of the Alger Meadows Apartments in Grand Rapids, Michigan, agreed to pay $550,000 in damages as well as terminate their property manager to settle a sexual harassment lawsuit that was filed against them by the U.S. Department of Justice.

With the increasing popularity of rental property as an investment, there are many new investors and landlords getting into the business and they need to realize the importance of being familiar with the laws and regulations that may affect them and their business in order to avoid problems. Even though, according to the press release issued by the DOJ, the property manager is the one that was alleged to have committed the sexual harassment, the DOJ also included the owners of the complex and alleged they were liable for the property managers actions. So, just because you, as a landlord, may use a property manager, that does not necessarily mean that you are in the clear or not liable for what goes on in your behalf. Therefore, the better informed you are as an investor and landlord, they better off you will be!

I have bought and sold 2,000 homes and have owned and managed apartments and rental homes and enjoy using this experience to help new, as well as seasoned, investors not only find good deals to invest in, but get educated on the things they need to know about such as Federal Fair Housing Laws. If I can help you, please contact me.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

By Dennis Norman, on July 30th, 2014 The rental vacancy rate in the U.S. was at 7.5% for the 2nd quarter of 2014, down from 8.3% the quarter before and at the lowest level in 20 years, according to data just released by the U.S. Census Bureau. The U.S. rental vacancy rate has not been this low since the 4th quarter of 1994 when the rate was 7.4%.

Here in the Midwest region of the U.S., the rental vacancy rate was 7.5% during the 2nd quarter of 2014, the lowest rate in 16 years! The last time the Midwest Region of the U.S. saw rental vacancy rates as low as this was back in the 2nd quarter of 1998 when the vacancy rate fell to 7.3%.

Perhaps it’s time to expand your rental portfolio or, begin building your portfolio?

(We work hard on this and sure would appreciate a “Like”) Continue reading “Rental Vacancy Rate Falls To Lowest Level In 20 Years“

By Dennis Norman, on July 3rd, 2014 I’ll begin with a disclaimer. I realize this is a VERY subjective topic and there are about a hundred different criteria one may use to determine the best area to invest in rental property however, having said that, I attempted to do a broad brush analysis from 30,000 feet. I decided to look at which area, in general, offers the best return on investment when it comes to rental property. For the sake of my analysis, I looked at single family homes as rental properties since they are the most common investment by individual investors.

To determine the best rate of return I looked at the median rent for the area as well as median vacancy rate of rentals and median home price. I then determined a rent/value ratio and the area with the highest ratio determines the area with the best potential return on investment. In computing the ratio I multiplied the median rent by 12 to get the annual rate, then reduced that amount by the vacancy rate and divided the result into the median property value.

As the table below shows, the city of St Louis came out on top with the highest rent to value ratio, 6.48% followed by St Louis County with a 5.45%.

Foreclosure Properties For Sale – Click HERE

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “The Best Place In St Louis To Buy Rental Property“

By Dennis Norman, on May 1st, 2014 Last month I wrote an article about a residential rental property licensing ordinance that was proposed in St Louis County by Councilman Michael O’Mara which I felt was a bad piece of legislation and an egregious violation of the private property rights of property owners. I heard from many readers that felt the same way I did and in fact, many of you turned out at the County Council meeting earlier this week to voice your opposition to the bill. I’m happy to say that the ordinance, which was on the agenda to be perfected, was in fact not voted upon by the council and therefore did not become law, yet. Hopefully, the outcry of opposition from the public as well as from organizations such as the St Louis Association of REALTORS and the Metropolitan St. Louis Equal Housing Opportunity Council, has convinced the members of the council to no longer pursue passage of bill 73.

See below for public comments that were made at the council meeting in opposition to the ordinance, as recorded in the St Louis County Council journal for the meeting of April.

(We work hard on this and sure would appreciate a “Like”) Continue reading “Update on St Louis County Residential Rental Property Licensing Ordinance“

By Dennis Norman, on April 7th, 2014 A residential rental property licensing ordinance has been proposed in St Louis County by Councilman Michael O’Mara which would prohibit an owner of residential property in unincorporated St. Louis County from renting or leasing their property without first paying a fee and obtaining a residential rental license. The bill, which has been kept relatively quiet and is impossible to find on the website for the St Louis County Council other than listed on the agenda, will most likely be passed at the meeting of the St Louis County Council tomorrow evening.

While there are several municipalities in the St Louis area that currently require some sort of licensing or registration of rental property, and the issue of whether that is an infringement of property rights or not, is a topic I’m not going to address today. Instead, I will just focus on some of the things in this proposed legislation that I feel, in my humble opinion, are egregious violations of property owner’s private property rights. The bill, a draft of which can be read here, is bad in many ways, however below are the parts that violate private property rights the most. followed by my comments on each section: (We work hard on this and sure would appreciate a “Like”) Continue reading “St Louis County Residential Rental Property Licensing Ordinance Tramples Property Rights“

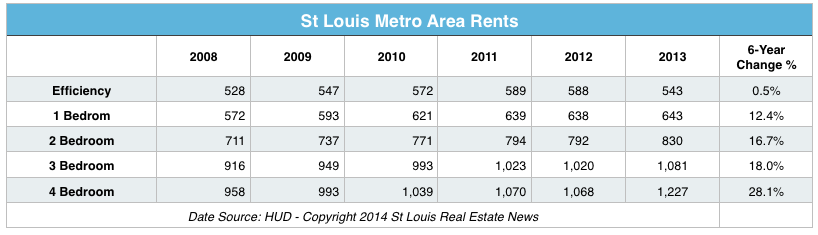

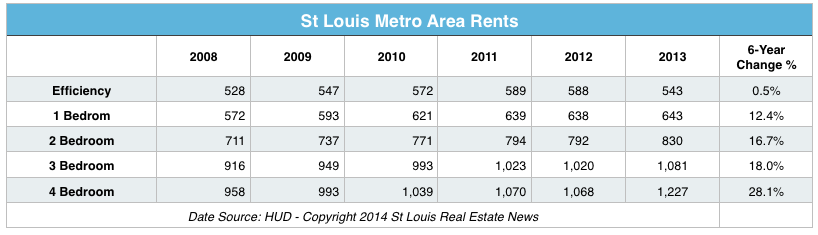

By Dennis Norman, on March 6th, 2014 St Louis rents have risen 18% since the real estate bubble burst (based upon HUD fair market rents for 3 bedrooms) while median home prices have fallen 12% during the same period. Part of the reason behind has been the increased demand for rentals as a result of many homeowners who, after the real estate bubble burst, lost their homes in foreclosure or were forced to do a short sale and then had to seek a rental while they rebuild their credit. This, couple with almost no new apartment construction for several years has created the right environment for increasing rents.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rents Rose While Home Prices Declined Post Boom“

By Dennis Norman, on February 3rd, 2014 The St Louis rental vacancy rate for the 4th quarter of 2013 was 10.1 percent, the lowest rate since the 3rd quarter of 2012 when the rate was 8.2 percent, according to the latest dates just released by the Census Bureau.

See the table below for quarterly vacancy rates from 2010 through 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rental Vacancy Rate Falls To Lowest Level In Over A Year“

By Dennis Norman, on November 8th, 2013 The St Louis rental vacancy rate dropped to the lowest level of 2013 in the 3rd quarter coming in at 13.1 percent for the St. Louis metro area, according to the latest data available from the U.S. Census Bureau. This year started off with a vacancy rate of 15.6 percent for the first quarter, the same rate 2012 started out with as well, however, in 2012 the vacancy rate fell to just 8.2 percent during the 3rd quarter. Due to holidays and weather, the 4th quarter usually sees a significant increase in vacancy rates from the 3rd quarter so we could easily see the highest vacancy rates next quarter we have seen in years if the trend continues.

See the table below for quarterly vacancy rates from 2011 through 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rental Vacancy Rate For 3rd Quarter Hits Lowest Level Of The Year“

By Dennis Norman, on February 25th, 2013

More than half (52 percent) of current renters said they anticipate buying a home in the next five years, according to a survey conducted by ORC International. Tenants with children under 13 are most likely to buy a home with 69 percent of them responding that they anticipate becoming a homeowner in the next five years followed by single family tenants in general, with 60 percent of those tenants anticipating buying a home and just 44 percent of apartment renters planning on buying a home within five years.

Top three reasons tenants don’t want to own a home: Continue reading “More than half of current renters plan to be homeowners within 5 years“

By Dennis Norman, on February 14th, 2013  Apartments and their residents in Missouri contribute $11.6 billion to the Missouri economy and support 276,000 jobs, according to a report by The National Multi Housing Council (NMHC) and the National Apartment Association (NAA). The report says there are 409,198 residents living in 271,500 apartment homes in Missouri with spending power of $4.6 billion. Apartments and their residents in Missouri contribute $11.6 billion to the Missouri economy and support 276,000 jobs, according to a report by The National Multi Housing Council (NMHC) and the National Apartment Association (NAA). The report says there are 409,198 residents living in 271,500 apartment homes in Missouri with spending power of $4.6 billion.

Source: weareapartments.org

By Dennis Norman, on February 5th, 2013  Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter. Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter.

Top Five Reasons Why Previous Homeowners Now Rent: Continue reading “Number of homeowners becoming tenants on the rise“

By Dennis Norman, on January 7th, 2013  If you have tried to buy a rental property lately in St. Louis then you have discovered you are not alone and the competition for good rental property is quite intense. The reason is simple, experienced investors as well as new ones see real estate as a safe investment and, in many ways, a much better alternative to other investments. Part of the reason for this is the demand for rental housing, brought on as a result of many former homeowners that have been forced, or have chosen, to rent instead of own and “would-be” homeowners that are unable to meet tougher requirements for mortgages thereby forced to remain tenants. According to information just released by the Bipartisan Policy Center, the demand for rental housing is not going to subside anytime soon as five to six million new renter households are expected to form in the next ten years alone. If you have tried to buy a rental property lately in St. Louis then you have discovered you are not alone and the competition for good rental property is quite intense. The reason is simple, experienced investors as well as new ones see real estate as a safe investment and, in many ways, a much better alternative to other investments. Part of the reason for this is the demand for rental housing, brought on as a result of many former homeowners that have been forced, or have chosen, to rent instead of own and “would-be” homeowners that are unable to meet tougher requirements for mortgages thereby forced to remain tenants. According to information just released by the Bipartisan Policy Center, the demand for rental housing is not going to subside anytime soon as five to six million new renter households are expected to form in the next ten years alone.

Continue reading “Demand for rental property likely to increase over next two decades“

By Dennis Norman, on October 28th, 2012  The St. Louis area has seen a fairly dramatic change in the make-up of the housing occupants with a shift from home-owners to renters over the past six years. After the crash of the real estate market we have experienced, as well as massive unemployment and a weak economy, this is not surprising, but is something that I think needs to be recognized. The five-county St Louis core market (St Louis County, St. Louis City, St Charles County, Jefferson County and Franklin County) as a whole saw owner-occupied units drop almost 3.5 percent during the period while, at the same time, renter-occupied units increased almost 15 percent resulting in renter’s making up almost 31 percent of all the occupied housing units in 2011, up 13.14 percent from 2005 when they accounted for 27.29 percent. The St. Louis area has seen a fairly dramatic change in the make-up of the housing occupants with a shift from home-owners to renters over the past six years. After the crash of the real estate market we have experienced, as well as massive unemployment and a weak economy, this is not surprising, but is something that I think needs to be recognized. The five-county St Louis core market (St Louis County, St. Louis City, St Charles County, Jefferson County and Franklin County) as a whole saw owner-occupied units drop almost 3.5 percent during the period while, at the same time, renter-occupied units increased almost 15 percent resulting in renter’s making up almost 31 percent of all the occupied housing units in 2011, up 13.14 percent from 2005 when they accounted for 27.29 percent.

As we drill-down to the county level, we can see that the results vary fairly significantly by county. For example, Jefferson County saw the largest increase in renter-occupied housing units with a 35.38 percent increase during the six-year period, while Franklin County had a decrease of almost 9 percent in renter occupied units during the period. Continue reading “St. Louis Area Renter Occupied Housing On the Rise While Owner Occupied Housing Declines“

By Dennis Norman, on September 14th, 2012  Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home. Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.

1Trulia looks at homes for sale and for rent and calculates the average rent and sale price across all listed properties in a metro area. Then, Trulia factors in the total costs of homeownership (e.g., closing costs, maintenance, insurance, taxes, etc) and total cost of renting (e.g., renter’s insurance and security deposit). The starting assumptions are that a prospective homebuyer can get a low mortgage rate of 3.5 percent, itemizes their federal tax deductions, is in the 25 percent tax bracket, and will stay in their home for seven years. People in the 35% federal income tax bracket are also assumed to pay 5% state income tax. To account for the opportunity costs, Trulia calculates the net present value of the payment streams for renting and owning.

By Dennis Norman, on August 2nd, 2012

As long as you plan to stay put for at least 2.5 years, you are better off financially to buy a home in St. Louis versus renting a home, according to a new report by Zillow. On a national level, the average that you needed to stay in a home before buying a home made sense over rental was 3 years.

In calculating the “cost” of owning or renting a home, Zillow took into account the down payment (or deposit), mortgage and rental payments, transaction costs, property taxes, utilities, maintenance costs, tax deductions and opportunity costs, while adjusting for inflation and forecasted home value and rental price appreciation. The table below shows the results for the 30 largest metro areas in the U.S. Continue reading “Should you buy or rent a home in St. Louis?“

By Dennis Norman, on July 3rd, 2012  A report just released by Trulia today which is based on the for-sale homes and rentals listed on Trulia, shows that asking prices for Saint Louis homes for sale decreased 2.4 percent from a year ago however Saint Louis rental rates increased 3.2 percent during the same period. A report just released by Trulia today which is based on the for-sale homes and rentals listed on Trulia, shows that asking prices for Saint Louis homes for sale decreased 2.4 percent from a year ago however Saint Louis rental rates increased 3.2 percent during the same period.

Nationally, home prices increased 0.3 percent in June from a year ago and rents were 5.4 percent higher in June than a year ago. Continue reading “St. Louis home prices falling; St Louis rents on the rise“

By Dennis Norman, on May 16th, 2012  According to a new report, The Shifting Nature of U.S. Housing Demand, by The Demand Institute, average home prices will increase by up to 1 percent in the second half of 2012. By 2014, home prices will increase by as much as 2.5 percent. From 2015 to 2017, the study projects annual increases between 3 and 4 percent. Since the real estate market is very local, it is not surprising that the report says this recovery will not be uniform across the country, and the strongest markets could capture average gains of 5 percent or more in the coming years. Continue reading “Report says housing market recovery to be led by demand by investors for rental property“ According to a new report, The Shifting Nature of U.S. Housing Demand, by The Demand Institute, average home prices will increase by up to 1 percent in the second half of 2012. By 2014, home prices will increase by as much as 2.5 percent. From 2015 to 2017, the study projects annual increases between 3 and 4 percent. Since the real estate market is very local, it is not surprising that the report says this recovery will not be uniform across the country, and the strongest markets could capture average gains of 5 percent or more in the coming years. Continue reading “Report says housing market recovery to be led by demand by investors for rental property“

By Dennis Norman, on March 16th, 2012  St Louis made the list of the “Best 100 U.S. Markets to Invest in Rental Property“, developed by HomeVestors and Local Market Monitor, coming in right in the middle at number 50. Las Vegas was in the number 1 slot and California was the star of the show with 12 metros on the list St Louis made the list of the “Best 100 U.S. Markets to Invest in Rental Property“, developed by HomeVestors and Local Market Monitor, coming in right in the middle at number 50. Las Vegas was in the number 1 slot and California was the star of the show with 12 metros on the list

“There are good opportunities for investors in every one of the top 100 markets,” said HomeVestors’ co-president, David Hicks. “But investors would be wise to take into account other dynamics for the ideal timing to enter the market.” Hicks sites job growth as a key indicator of a market prime for investment. “Higher job growth rates normally indicate a stronger market for rentals,” he said. “Strong growth rates and higher risk-return premiums usually point to the best markets to invest in now.” Continue reading “St Louis makes list of 100 best places to invest in rental property“

|

Recent Articles

|

Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter.

Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter.

Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.

Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.

St Louis made the list of the “Best 100 U.S. Markets to Invest in Rental Property“, developed by HomeVestors and Local Market Monitor, coming in right in the middle at number 50. Las Vegas was in the number 1 slot and California was the star of the show with 12 metros on the list

St Louis made the list of the “Best 100 U.S. Markets to Invest in Rental Property“, developed by HomeVestors and Local Market Monitor, coming in right in the middle at number 50. Las Vegas was in the number 1 slot and California was the star of the show with 12 metros on the list