By Dennis Norman, on May 5th, 2011  Dennis Norman The St. Louis foreclosure rate in February was 1.78 percent, an increase of over 26 percent from a year ago, and just a slight decrease from January’s rate of 1.79 percent, according to a report published by CoreLogic. On a positive note, the report shows that the St. Louis Mortgage Delinquency rate (Serious delinquency, 90+ days delinquent) decreased slightly to 5.09 percent in February from 5.16 percent the month before and down over 13 percent from a year ago.

Continue reading “St. Louis Foreclosure Rates Decrease Slightly in February; still up 26 percent from year ago“

By Dennis Norman, on April 7th, 2011  According to a report released this morning by CoreLogic, St. Louis home prices (including distressed sales) declined by 8.29 percent in February 2011 from the year before. The prior month showed home prices had declined 7.24 percent from the year before, so the bad news is this shows home prices are continuing to trend downward. The good news is, if you remove the distressed sales from the mix then St. Louis home prices in February only declined by 1.07 percent from the year before and in the month before declined by 2.38 percent from the year before showing that home price decline for home prices on “normal” St Louis home sales is slowing and prices are moving toward stabilization. According to a report released this morning by CoreLogic, St. Louis home prices (including distressed sales) declined by 8.29 percent in February 2011 from the year before. The prior month showed home prices had declined 7.24 percent from the year before, so the bad news is this shows home prices are continuing to trend downward. The good news is, if you remove the distressed sales from the mix then St. Louis home prices in February only declined by 1.07 percent from the year before and in the month before declined by 2.38 percent from the year before showing that home price decline for home prices on “normal” St Louis home sales is slowing and prices are moving toward stabilization.

Unfortunately distressed sales are not going away any time soon so they will continue to put downward pressure on St Louis home prices however we are beginning to see the light at the end of the tunnel.

By Dennis Norman, on April 6th, 2011  Dennis Norman The St. Louis foreclosure rate increased 1.7 percent in January to 1.79 percent, according to a report published by CoreLogic. On a positive note, the report shows that the rate of serious mortgage delinquencies in St. Louis (90+ days delinquent) decreased slightly to 5.14 percent in December from 5.18 percent the month before.

Continue reading “St. Louis Foreclosure Rates Increase for Fourth-Consecutive Month“

By Dennis Norman, on March 30th, 2011

A report released this morning by CoreLogic shows that the current residential “shadow” inventory as of January 2011 declined to 1.8 million units, down slightly from 2.0 million units a year ago. This current shadow inventory represents a 9 month supply, same as the suply a year ago. Continue reading “Shadow Inventory Drops Slightly but still at Nine-Month Supply“

By Dennis Norman, on March 22nd, 2011  Dennis Norman The St. Louis foreclosure rate increased 4.8 percent in December to 1.76 percent, according to a report published by CoreLogic. On a positive note, the report shows that the rate of serious mortgage delinquencies in St. Louis (90+ days delinquent) decreased slightly to 5.14 percent in December from 5.18 percent the month before.

Continue reading “St. Louis Foreclosure Rates Increase for Third-Consecutive Month“

By Dennis Norman, on March 10th, 2011

A report released this morning by CoreLogic shows home prices in the U.S. declined in January by 5.7 percent from the year before, marking the sixth-consecutive month year-over-year home prices have dropped, according to their index.

The January data shows home prices continuing to slide. Mark Fleming, chief economist with CoreLogic, said, “A number of factors continue to dampen any recovery in the housing market. Negative equity, which limits the mobility of homeowners, weak demand and the overhang of shadow inventory all continue to exert downward pressure on housing prices. We are looking out for renewed demand in the coming months as the spring buying season gets underway to hopefully reduce the downward pressure.” Continue reading “Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month“

By Dennis Norman, on March 8th, 2011

A report released this morning by CoreLogic shows negative equity, after decreasing for the three prior quarters, increased in the fourth quarter of 2010 for residential properties. The CoreLogic reports that 11.1 million, or 23.1 percent, of all residential properties with mortgages were in negative equity at the end of the fourth quarter of 2010, up from 10.8 million and 22.5 percent in the prior quarter. Continue reading “Number of Homeowners Underwater on Mortgage Increases“

By Dennis Norman, on February 16th, 2011  Today, CoreLogic released its “U.S. Housing and Mortgage Trends Report” which stated “their research indicates that the most popular measure of existing home sales is overstated by 15 percent to 20 percent. ” Today, CoreLogic released its “U.S. Housing and Mortgage Trends Report” which stated “their research indicates that the most popular measure of existing home sales is overstated by 15 percent to 20 percent. ”

Continue reading “New report shows home sales may be worse than reported“

By Dennis Norman, on February 8th, 2011  Today, CoreLogic released its December Home Price Index (HPI) showing that home prices in the U.S. declined for the fifth-straight month. The report shows home prices declined by 5.46 percent in December 2010 compared with December 2009. Today, CoreLogic released its December Home Price Index (HPI) showing that home prices in the U.S. declined for the fifth-straight month. The report shows home prices declined by 5.46 percent in December 2010 compared with December 2009.

St. Louis home prices fell by 8.74 percent in December 2010 compared with December 2009, a decline of over 60 percent higher than the national home price decline. Home prices for the state of Missouri fell 8.82 percent during the period, slightly higher than St. Louis and high enough to put Missouri at number 5 in the country for home price declines for the period. Ugh..

Continue reading “Home prices fall in St. Louis almost 9 percent in December; Missouri ranks 5th in U.S. in home price declines“

By Dennis Norman, on January 25th, 2011  Dennis Norman The St. Louis foreclosure rate shot up 7 percent in November to 1.67 percent, according to a report published by CoreLogic. The report also shows that the rate of serious mortgage delinquencies in St. Louis (90+ days delinquent) increase slightly to 5.18 percent in November from 5.17 percent the month before.

Continue reading “St. Louis Foreclosures and Delinquencies on the rise in November“

By Dennis Norman, on January 13th, 2011

A report released by CoreLogic showed that the St. Louis foreclosure rate increased in October marking the fourth-consecutive month of increases. The report shows St. Louis to have a foreclosure rate in October of 1.58 percent, a slight increase from September’s 1.57 percent, however an increase of over 11 percent from a year ago. The foreclosure rate in the U.S. in October was 3.33 percent, an increase of 14 percent from the year before.

Continue reading “St. Louis Foreclosure Rates Increase for Forth Consecutive Month“

By Dennis Norman, on November 30th, 2010

A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in September of 1.57 percent, and increase of over 25 percent (25.6%) from a year ago, and an increase of a little over 3 percent from the month before. The national foreclosure rate in September was 3.29 percent, a slight increase from 3.20 percent the month before.

Continue reading “St Louis Foreclosure rate up 25 percent from a year ago“

By Dennis Norman, on November 23rd, 2010  A report released today by CoreLogic shows that, while the overall inventory of homes for sale has remained the same in the past year at 4.2 million new and existing homes for sale as of August, the number of homes in “shadow inventory” has grown from 6.1 million a year before to 6.3 million as of August, 2010. Continue reading “Report suggests distressed sales will hurt housing market for some time to come“ A report released today by CoreLogic shows that, while the overall inventory of homes for sale has remained the same in the past year at 4.2 million new and existing homes for sale as of August, the number of homes in “shadow inventory” has grown from 6.1 million a year before to 6.3 million as of August, 2010. Continue reading “Report suggests distressed sales will hurt housing market for some time to come“

By Dennis Norman, on November 1st, 2010  Dennis Norman A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in August of 1.52 percent which is a slight increase from July’s rate of 1.48 percent but is an increase of 25.6 percent from the year prior when the rate was 1.21 percent. Comparatively speaking, St. Louis is in good shape as the national foreclosure rate for August was 3.2 percent, almost double our rate here. Continue reading “St Louis Foreclosure rate up over 25 percent from year ago“

By Dennis Norman, on September 28th, 2010  Dennis Norman A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in July of 1.48 percent up slightly from June’s rate of 1.43 percent and an increase of 27.6 percent from the year prior when the rate was 1.16 percent. Continue reading “St. Louis foreclosures on the rise in July“

By Dennis Norman, on September 17th, 2010  Dennis Norman A report by CoreLogic shows that in June 2010 almost one in five (19.3 percent) of the home sales in St. Louis are distressed home sales, such as foreclosure or a short sale. The report cautions that recent data showing improvements in negative equity, serious mortgage delinquency and a decrease in market share of short-sales, has been distorted as a result of the short-term boost in the “non-distressed” housing market by the homebuyer tax credit program, which recently ended. Continue reading “One in five St Louis home sales are distressed sales; more ‘distress coming’“

By Dennis Norman, on August 26th, 2010  Dennis Norman After a couple of days of writing about bad reports on the housing market (existing home sales and new home sales to name two) I’m excited that I actually get to write something today that is positive! According to newly released data from CoreLogic, the percentage of homeowners in the U.S. with negative equity in their homes declined slightly at the end of the second quarter of 2010 making it the second consecutive month of declines.

According to the CoreLogic report, 11 million, or 23 percent, of all residential properties with mortgages were in negative equity at the end of the second quarter of 2010, down from 11.2 million and 24 percent from the first quarter of 2010. Unfortunately as much I would like to say this was from home price appreciation, unfortunately it appears to have been driven primarily by foreclosures removing some of the homes with negative equity from the scene. Continue reading “Homeowners with negative equity declines for second consecutive quarter“

By Dennis Norman, on August 16th, 2010

Dennis Norman According to a report issued today by CoreLogic, home prices in St. Louis increased in June by 1.4 percent over June 2009. This ends the four-month streak of increasing year-over-year home prices which for May was 3.49 percent. Continue reading “St Louis Home Prices Increase in June; Rate of increase slows“

By Dennis Norman, on August 10th, 2010  Dennis Norman A report just released by CoreLogic estimate the financial impact of short-sale fraud to be $310 million annually. It is estimated there is fraud in one in every 53 short sale transactions resulting in an unnecessary loss to the lender of $41,000 per transaction on average. Continue reading “Report Shows Fraud in Short-Sales Cost Lenders $310 Million Annually“

By Dennis Norman, on August 2nd, 2010  Dennis Norman Report looks at impact of the BP Deepwater Horizon Oil spill on Florida Coastal home values

According to a report released this morning by CoreLogic the impact of the BP DeepWater Horizon oil spill on home values in the coastal area’s along the Gulf coast is expected to range from $648 million over one year to as much as $3 billion over five years. This estimate is for the communities that are already impacted by the spill, if the unlikely worst-case scenario occurs and the spill reaches down to the area of the Florida Keys and up the Florida Atlantic coast then additional losses could reach up to $28 billion over five years according to the report. Continue reading “Gulf Oil spill could cost coastal homeowners up to $3 Billion in home values“

By Dennis Norman, on July 28th, 2010  Dennis Norman A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in June of 1.48 percent up slightly from May’s rate of 1.46 percent and an increase of 28.7 percent from the year prior when the rate was 1.15 percent. Continue reading “St. Louis Foreclosures Increase in June“

By Dennis Norman, on July 16th, 2010  Dennis Norman Missouri one of 32 States Identified as “Low” risk of mortgage fraud

According to the 2010 Mortgage Fraud Trends Report released by CoreLogic this week, fraud risk in the mortgage industry has declined by 25 percent since it peaked in the third quarter of 2007. Even though the trend is down it is still estimated that there were $14 billion in fraud losses experienced in 2009 alone.

CoreLogics’ fraud index can drill down to show states, cities and even streets that have the highest mortgage fraud risk. Highlights of the report:

- Overall mortgage fraud risk has been steadily decreasing since 2006 and appears to have leveled off in 2009

- Short sale volume from first quarter of 2008 through fourth quarter of 2009 increased by more than 300 percent

- Nearly one in every 200 short sales were deemed “very suspicious” by lenders meaning the property was resold less than 60 days after the short sale and the sale price was more than 20 percent higher than the short sale price.

- The most common type of mortgage fraud (31 percent) is related to the borrower’s income.

- States with the highest mortgage fraud risk are Florida, South Carolina, North Carolina, California and Georgia.

- The highest risk zip codes are Jamaica, N.Y., Orlando, FL, Miami, FL, Atlanta, GA and Detroit, Mich.

- The top scoring street for mortgage fraud is in Orlando. In fact, 5 of the top 10 ten streets with the highest risk of mortgage fraud in the report were in Orlando. Other cities with streets in the top 10 were Prior Lake, MN, Chicago, IL, Oakland, CA, Atlanta, GA and Urbana, IL.

How about that? They can even identify the “risky street”. In the case of the street in Orlando the report didn’t give a name but did say there were 28 loans on the street from 2007 to 2008, the same company was the seller in most cases and the properties are now selling for about 10 percent of what they originally “sold” for.

By Dennis Norman, on July 13th, 2010  Dennis Norman According to a report issued today by CoreLogic, their home price index shows home prices in the U.S. increased in May, marking the fourth-consecutive month there was a year-over-year increase in home prices. U.S. home prices in May 2010 increased by 2.9 percent over May 2009.

St. Louis home prices did better than the U.S. average, increasing by 3.49 percent in May 2010 compared with May 2009.

No doubt some of the good news was the result of buyers rushing to buy a home before the April 30th deadline to receive tax credits. This will affect the market, and home prices, in a positive manner until these “tax-credit-induced” sales close by the recently extended deadline of September 30, 2010.

By Dennis Norman, on July 9th, 2010  Dennis Norman For way too long I’ve been writing about record, or near- record, levels of foreclosures and mortgage delinquencies. My ongoing concern about this, in terms of the housing market, is that I just don’t see how we are going to have a sustainable recovery of the housing market while we have 1 in 8 homeowners with a mortgage in the U.S. currently either delinquent on their mortgage or in some stage of the foreclosure process.

Lately there has appeared to be some leveling off of mortgage delinquencies and foreclosure growth is at a slowing rate, both of which are good things. Earlier this week I wrote about a report that came out from LPS Applied Analytics, one of the largest mortgage servicers in the U.S., that discussed the mortgage delinquency rate for May. This morning I was giving more thought to something in the report that I saw the other day but it didn’t hit me at the time but now I realize it is potentially the 800 lb gorilla in the room.

According to the report, the average number of days for a loan to move from 30 days delinquent to foreclosure sale has been steadily increasing and is now at an all-time high of 449 days. So, if you add the initial delinquency, that means on average 479 days lapse from the time a borrower misses a payment until they are foreclosed on. While I love the amount of time the struggling homeowner has to stay in their home before losing it, it concerns me greatly that it is taking about 16 months for the lender to complete a foreclosure, and that this is a record high amount of time. What that tells me is, for one reason or another, lenders are stalling and slowing the foreclosure process so any encouragement we have seen of late in this area may be “artificially created” as the result of lenders reluctance to foreclose rather than a result of the housing market and economy actually improving.

The problem is the lenders can’t put off the inevitable forever…at some point they are going to have to pick up the pace and start foreclosing on loans rather than stalling and that I’m afraid is going to keep the foreclosure rates at levels that will negatively impact the housing market.

By Dennis Norman, on June 4th, 2010  Dennis Norman A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in April of 1.49 percent up slightly from March’s revised rate of 1.45 percent and an increase of 34.2 percent from the year prior when the rate was 1.11 percent.

The national foreclosure rate for April remains over twice the rate of St. Louis at 3.20 percent and was an increase of 30.1 percent from a year ago when the national foreclosure rate was 2.46 percent. For the State of Missouri the April foreclosure rate was 1.33 percent, a 30.4 percent increase from a year ago when Missouri’s rate was 1.02 percent.

Looks like more foreclosures to come…

Unfortunately, as I have been saying for a while now, I don’t think we are going to see much, if any, improvement in the foreclosure rate anytime soon. The rate of serious mortgage delinquencies continues to increase. For April 2010, 6.17 percent of the home loans in St. Louis were 90 days or more delinquent on their mortgage payments, an increase of 51.2 percent from a year ago when the delinquency rate in St. Louis was 4.1 percent.

Nationally, the rate of serious delinquency on home mortgages in April 2010 hit 8.90 percent, an increase of 47.6 percent from a year ago when the national rate was 6.03 percent.

Foreclosures will put downward pressure on the Market…

Over the past couple of months the housing market has had some reason to celebrate as home sales increased at fairly significant rates. Unfortunately this little bit of Utopia is probably going to be short-lived as it was nothing more than a “false-market” created by the home-buyer tax credits. Now that the April 30th deadline for the tax credits has passed we are going to no doubt see the sales numbers drop as the underlying problems are still there…unemployment and uncertainty about our country’s financial future, to name a couple. Even during these recent “good times” we have seen pricing pressures resulting in home prices continuing to decline in many markets. So, couple the drop in sales we no doubt have coming, along with the still-increasing foreclosure and mortgage delinquency rate, and, in my opinion, we have a recipe to continue to beat on home prices for some time to come.

To end on a positive note though…If you are one of the fortunate people out there that are comfortable in your financial position and are looking to make a move, you have an abundance of homes available out there, with record-low interest rates and prices that we haven’t seen, in many cases, in years!

By Dennis Norman, on May 11th, 2010  Dennis Norman According to a report released by CoreLogic, there were 11.2 million homeowners that were in a negative equity, or “underwater“, position on their mortgages as of the end of the first quarter of this year. This number is equal to 24 percent of all homeowners with a mortgage in the U.S., which is the same percentage as the prior quarter, however the actual number of underwater borrowers was down slightly from 11.3 million borrowers that were underwater in the prior quarter. In addition, there are an additional 2.3 million borrowers that have less than five percent equity in their homes, bring the total of negative equity and near-negative borrowers to over 28 percent of all homeowners with a mortgage nationwide.

A serious decrease in the percentage of mortgages underwater would be better news, but this news is still positive as it shows the rate of borrowers going underwater has stalled out and hopefully we have seen the worst of it.

Highlights of the report:

- Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (34 percent).

- In terms of metro areas Las Vegas continues to have the highest percentage of negative equity with 75% of mortgaged properties being underwater, followed by Stockton (65%), Modesto (62%), Vallejo-Fairfield (60%) and Phoenix (58%).

- Phoenix had more than 550,000 underwater borrowers, the most households of any metropolitan market in the country. Riverside (463,000), Los Angeles (406,000) Atlanta (399,000) and Chicago (365,000) round out the top five markets.

The share of borrowers whose mortgage debt exceeds the property value by 25% or more fell slightly to 10.4% or 4.9 million borrowers, down from 10.6% or 5 million borrowers.

The two most important triggers of default, negative equity and unemployment, have stabilized over the last six months. As house prices grow again and borrowers pay down their mortgage debt negative equity levels will begin to diminish. The typical underwater borrower is likely to regain their lost equity over the next five to seven years,” said Mark Fleming, chief economist with CoreLogic.

Source: CoreLogic

By Dennis Norman, on May 6th, 2010  Dennis Norman A report released by CoreLogic showed the St. Louis metro area to have a foreclosure rate in March of 1.49 percent up slightly from February’s rate of 1.44 percent and an increase of 39.3 percent from the year prior when the rate was 1.07 percent.

The national foreclosure rate for March remains over twice the rate of St. Louis at 3.23 percent and was an increase of 73.9 percent from a year ago when the national foreclosure rate was 2.32 percent.

No End In Site

Unfortunately, I don’t think we are going to see much, if any, improvement in the foreclosure rate anytime soon. The rate of serious mortgage delinquencies continues to rise. For March 2010, 6.22 percent of the home loans in St. Louis were 90 days or more delinquent on their mortgage payments, an increase of 55 percent from a year ago when the delinquency rate in St. Louis was 4.02 percent.

Nationally, the rate of serious delinquency on home mortgages in March 2010 hit 8.93 percent, an increase of 54.23 percent from a year ago when the national rate was 5.79 percent.

Continued Pressure on the Market

For the past couple of months we have seen some good reports come out about the housing industry which are indicating that the market may have bottomed out and is starting to stabilize a little finally. Unfortunately, foreclosures bring a lot of downward pressure on the housing market and with the rising foreclosure and delinquency rate, we are assured of feeling this pressure for some time to come. If the economy could rebound strong, unemployment drop, and interest rates remain affordable, then perhaps the housing market could absorb this inventory of foreclosures and their downward pressure on pricing, but that is a big IF.

By Dennis Norman, on April 26th, 2010  Dennis Norman Report Cautions That Shadow Inventory and End of Tax Credit Program May Result in Further Declines – Predicts a 3.01 Percent Home Price Decline in St. Louis In Next 12 Months.

A report released today by First American CoreLogic shows that national home prices increased 0.3 percent in February 2010 compared to February 2009 and the home price index for St. Louis increased 1.50 percent in February 2010 compared to February 2009

On a month-over-month basis, the national average home price index fell by 2.0 percent in February 2010 compared to January 2010, which was steeper than the previous one-month decline of 1.6 percent from December to January. Prices are typically weak in the winter months, so seasonal effects may be driving this one-month change.

Highlights from the February 2010 Report:

- Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to February 2010) is -30.6 percent. Excluding distressed properties, the peak-to-current change in the HPI is -21.7 percent.

- When distressed sales were included, Idaho (-13.7) moved into first place as the top-ranked state for annual price depreciation in February, followed by Nevada (-12.9 percent), Florida (-8.5 percent), Illinois (-8.3) and Oregon (-7.7 percent). All of these states also showed month-over-month decreases in their HPI between January and February. The distressed share in Idaho increased by about 11 percentage points over the past year, pulling down the annual price appreciation. The HPI for Idaho excluding distressed sales showed a much smaller annual decline (-5.2 percent).

- Excluding distressed sales, the worst five states for year-over-year price declines changes slightly. Nevada (-12.0 percent) is the top decliner, followed by Michigan (-9.1 percent), Florida (-7.5 percent), Arizona (-7.1 percent) and Utah (-5.8 percent).

- The five best states for year-over-year price appreciation excluding distressed sales are North Dakota, Hawaii, the District of Columbia, California, and Maine.

- Including distressed sales, 58 of the top 100 CBSAs declined on a year-over-year basis in February. This is down from 65 CBSAs in January. Orlando-Kissimmee, FL held the spot of top decliner, with a 14.8 percent year-over-year decline in February.

What Lies Ahead?

The CoreLogic report forecast was not as optimistic as it has been in the past and is showing a softer recvoery than in previous forecasts. The forecast calls for an increase in the inventory of homes for sale as interest rates are expected to rise, tax credits expire, and slower than expected sales over the winter due to the weather are all adding to the inventory.

Highlights from the forecast:

- Home prices in St. Louis are epected to deline 3.01 percent in the coming 12 months.

- After a modest increase this spring and summer, the national single-family combined index is projected to decline by 3.4 percent from February 2010 to February 2011 assuming the expiration of current Federal Housing Stimulus programs.

- 29 of the 45 largest Core Based Statistical Areas (CBSAs) are projected to experience continued price depreciation on a year-to-year basis according to the current forecast, compared to only 14 out of 45 in last month’s forecast.

- Markets that are expected to experience the largest amount of price depreciation through February 2011 are Detroit (-16.4 percent), Seattle (-5.8 percent), Atlanta (-4.5 percent), Cleveland (-4.1 percent) and Indianapolis (-3.8 percent). Markets that are expected to experience the biggest appreciation are Denver (5.2 percent), Las Vegas (5.0 percent), Riverside, CA (3.0 percent), and Houston (3.0 percent).

- The preponderance of distressed sales continues to exert downward pressure on the indices. When distressed sales are excluded from the data, the forecast becomes significantly more optimistic about the future direction of home prices outside of this market segment. The national HPI is projected to increase 4.9 percent year-to-year when these transactions are omitted from the analysis. The same is true of many states and CBSAs. For example, there is a 10-percentage point difference in the year-to-year HPI forecasts for California when distressed sales are included (-1.8 percent) compared to when they are not (8.0 percent.)

By Dennis Norman, on March 5th, 2010

Dennis Norman

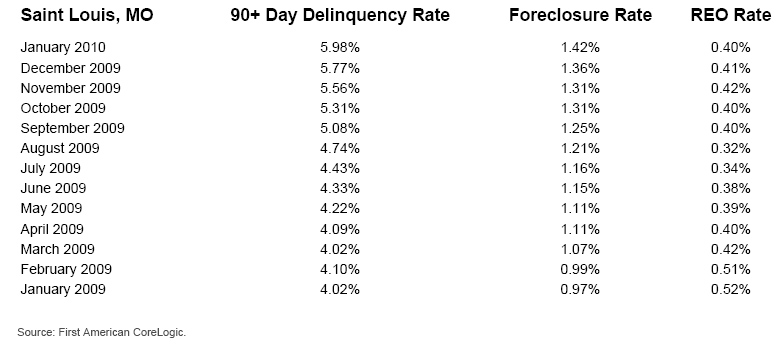

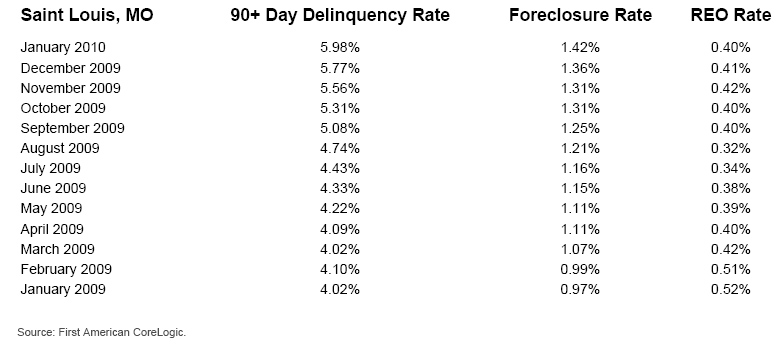

St. Louis Mortgage Delinquencies and St. Louis Foreclosure Rate hit Record Highs

A report released by First American CoreLogic showed the St. Louis metro area to have a foreclosure rate in January of 1.42 percent up slightly from December’s rate of 1.36 percent and an increase of 46.39 percent from the year prior when the rate was 0.97 percent.

The national foreclosure rate for January remains over twice the rate of St. Louis at 3.19 percent and was an increase of 60.3 percent from a year ago when the national foreclosure rate was 1.99 percent.

From new data on mortgage delinquencies, it appears we are going to continue to see the St. Louis foreclosure rate remain at, or above, the current levels for some time. St. Louis homeowners that are are seriously delinquent on their mortgages (90+ days delinquent) rose in January to 5.98 percent of the mortgages in St. Louis. This represents an increase of 4.36 percent from December’s delinquency rate of 5.73 percent and is an increase of 48.76 percent from a year ago when the rate was 4.02 percent. The U.S. rate for seriously delinquent mortgages in January was 8.66 percent, an increase of over 56 percent from a year ago when the rate was 5.53 percent.

So while some of the housing reports for St. Louis are getting better and showing some signs that we may have hit the “bottom” of the market, the foreclosure rate and mortgage delinquency rate hangs over us like a dark cloud. These things lead to distressed sales which bring downward pressure on the market and sometimes makes it hard to establish a bottom and certainly hinders a recovery.

To show you what I mean I’ll share a short story. I had lunch this week with a St Louis real estate agent that has some new homes listed in a new development in a nice part of the city. The list price of his homes is in the $290,000 range, down significantly (15-20 percent) from what the prices were before the crash. The agent said that the price reductions just weren’t enough though, that he was being hurt by REO’s. For example, one home in the development that had sold new a couple of years ago for over $400,000 (it was loaded with extras and upgrades) was foreclosed on and just sold as an REO for $260,000, making his new home, without all the upgrades, at 15 percent more not look like such a bargain. Granted, that was just one REO and it is gone now, but with the St Louis delinquency rates and St Louis foreclosure rates what they are there will be more REO’s.

By Dennis Norman, on February 23rd, 2010 Over Fifteen Percent of Missouri Borrowers are Underwater-Another 5.6 Percent Are Almost Underwater

Dennis Norman According to a report released today by First American CoreLogic more than 11.3 million U.S. mortgages, or 24 percent of all mortgaged properties, are in a negative equity position meaning the borrowers owe more on their mortgage than their home is worth as of December 31, 2009.

There were approximately 600,000 more borrowers underwater on December 31, 2009 than just three months earlier. In addition, there were an additional 2.3 million mortgages approaching negative equity at the end of last year  . .

Together, negative equity and near-negative equity mortgages account for nearly 29 percent of all residential properties with a mortgage nationwide.

Like foreclosures, borrowers with negative equity are concentrated in five states: Nevada, which had the highest percentage of negative equity with 70 percent of all of the states mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (35 percent). Among these five states the average negative equity is 42 percent of the mortgages compared with an average of 15 percent for the remaining 45 states.

Other highlights from the report are:

- The states with the highest percentage increases in negative equity during 4th quarter 2009 were Nevada, Georgia and Arizona.

- The rise in negative equity is closely tied to increases in foreclosures and is a major factor in changing the behavior of homeowners. According to the report, once a homeowner has over 25 percent negative equity or the mortgage balance is $70,000 higher than the current property value, homeowners begin to default with the same propensity as investors. In other words, they stop looking at their home from an emotional standpoint and start treating it like a bad investment.

- The average negative equity in 4th quarter was $70,700, up from $69,700 in 3rd quarter.

- Of the over 47 million homeowners with a mortgage, the average loan to value ratio (LTV) is 70 percent. More than 23 million, or 49 percent, of all homeowners with a mortgage have at least 25 percent equity in their home, and over 12 million have at least 50 percent equity in their homes.

Even though the housing market is showing signs of stabilizing in many areas, the number of people underwater on their mortgages is something that gives me great concern. As shown in the corelogic report, the average amount of negative equity has now broken the $70,000 threshold where homeowners are more easy to succumb to walking away. As borrowers due this, we will see the mortgage delinquency rates, which are already at record highs, continue at a record pace, and we will see the shocking foreclosure rate continue for some time. This will continue to put downward pressure on the housing market making an actual recovery that much more difficult.

I hate to sound gloom and doom, but I think unless some good things start happening (a whole lot less unemployment for one) this will be reality.

|

Recent Articles

|

According to a report released this morning by CoreLogic, St. Louis home prices (including distressed sales) declined by 8.29 percent in February 2011 from the year before. The prior month showed home prices had declined 7.24 percent from the year before, so the bad news is this shows home prices are continuing to trend downward. The good news is, if you remove the distressed sales from the mix then St. Louis home prices in February only declined by 1.07 percent from the year before and in the month before declined by 2.38 percent from the year before showing that home price decline for home prices on “normal” St Louis home sales is slowing and prices are moving toward stabilization.

According to a report released this morning by CoreLogic, St. Louis home prices (including distressed sales) declined by 8.29 percent in February 2011 from the year before. The prior month showed home prices had declined 7.24 percent from the year before, so the bad news is this shows home prices are continuing to trend downward. The good news is, if you remove the distressed sales from the mix then St. Louis home prices in February only declined by 1.07 percent from the year before and in the month before declined by 2.38 percent from the year before showing that home price decline for home prices on “normal” St Louis home sales is slowing and prices are moving toward stabilization.