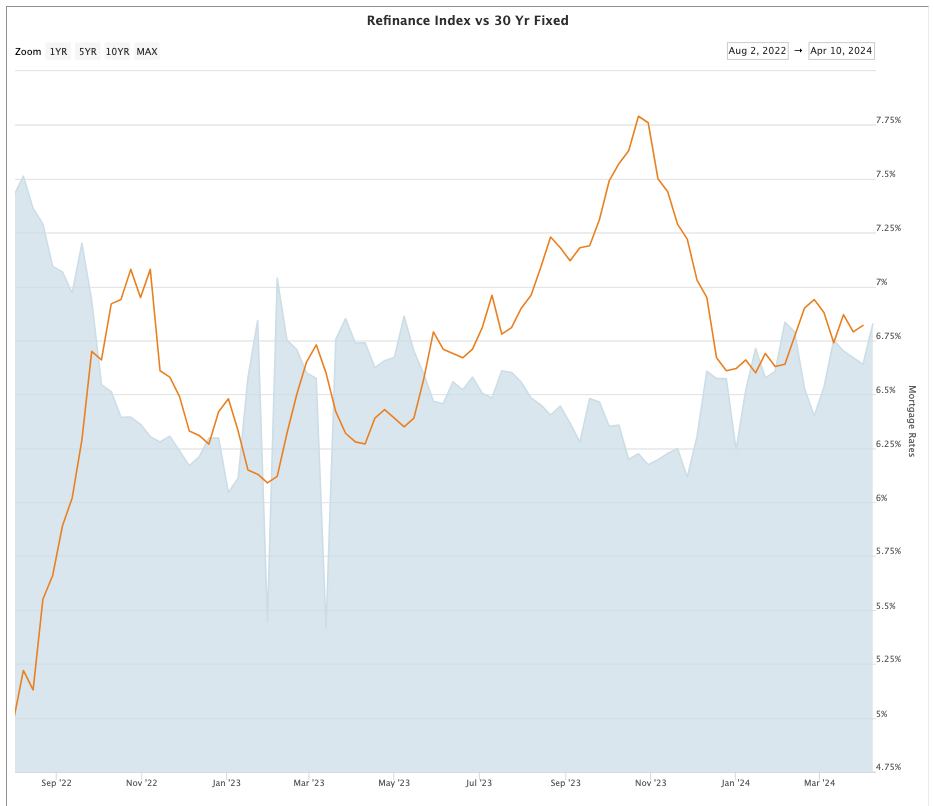

Joel Kan, MBA’s Vice President and Deputy Chief Economist, attributed the rising rates to the Federal Reserve’s cautious stance on adjusting policy amidst persistent inflation and resilient economic indicators, including strong employment data. Despite the unfavorable rate environment, the demand for refinancing, especially VA refinancing, remained robust.

Other notable trends include a decrease in average loan sizes, with purchase loan sizes—often viewed as a proxy for home prices—dropping to $449,400 from $453,000. Additionally, there was a shift in the composition of mortgage applications, with increases in FHA and VA loan shares.

So, what explains the rising number of homeowners refinancing their mortgages even with rising mortgage interest rates? There are numerous reports indicating that many homeowners across the country are becoming cash-strapped and having a difficult time paying bills, thus resorting to pulling out equity from their homes, even if it means accepting a higher interest rate. I’ve also observed reports indicating that consumer credit card debt is at historically high levels, with interest rates on this debt being astronomical. This situation is prompting people to refinance their home loans again, even at higher rates, because even though their mortgage may be at a higher rate, it still appears to be a bargain compared to the 27 or 28% on a credit card. I haven’t seen enough verifiable data to confirm if either of these situations is true, but both are plausible.

One of the issues receiving significant attention following the announcement of the REALTOR® commission suit settlement is the topic of buyer commissions, specifically regarding whether a buyer has to pay them and how lenders will treat the commissions.

In a recent letter to the Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA), Fannie Mae, and Freddie Mac, NAR and MBA sought confirmation on the treatment of buyer agent commissions following a proposed settlement agreement in the Burnett et al and Moehrl et al cases.

What does this mean for homebuyers? Under the settlement, cooperative commissions will no longer be displayed on Multiple Listing Services (MLS), but listing brokers and sellers will still be able to offer compensation for buyer broker services through other means. Additionally, the settlement does not prohibit home sellers from paying buyer agent commissions directly.

NAR and MBA believe that FHA and Government-Sponsored Enterprise (GSE) policies should continue to exclude seller or listing agent payments of buyer agents’ commissions from Interested Party Contributions (IPCs). IPCs are concessions from the seller to the buyer for items traditionally paid by the buyer, such as loan closing costs or rate buy-downs. Maintaining this practice is essential to ensure that the flow of mortgage capital to homebuyers remains uninterrupted.

As a homeowner or potential buyer, it’s important to stay informed about these developments and how they may impact your buying or selling process. NAR and MBA have requested confirmation from the FHFA, FHA, Fannie Mae, and Freddie Mac as soon as possible to prevent any confusion and potential disruptions that may cost you money or even jeopardize your home purchase.

In an era of rapid evolution in the real estate business, it’s crucial for St. Louis REALTORS® to stay ahead of the curve. We are excited to invite you to our upcoming webinar, “Adapt & Thrive: Navigating the New Landscape of Real Estate Post-Sitzer v. NAR,” on Wednesday, November 29th at 10:00 AM.

Why This Webinar Is Critical for Your Career The Sitzer v. NAR verdict marks a significant turning point in our industry. This webinar is crafted to help you understand and leverage these changes for your professional growth. Expect to gain:

- Comprehensive Insights on the Sitzer v. NAR Verdict: Delve into the verdict’s details and its broader legal implications.

- Industry Impact Evaluation: Discover how these shifts will influence your business and the real estate market at large.

- Strategies for Navigating Change: Learn effective ways to adapt and thrive in the evolving real estate environment.

- Exploration of Innovative Tools: Uncover cutting-edge resources to enhance your business operations and market analysis.

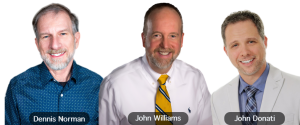

Panel of Experienced Voices As your host, Dennis Norman, with 45 years in the St. Louis real estate scene, I aim to share insights that blend practical experience with strategic foresight. Joining me are my business partners, John Williams and John Donati, both seasoned professionals with deep insights into these recent developments. Our collective experience in leadership within the REALTOR® organization and MLS will provide you with a rich perspective on adapting to industry changes.

Panel of Experienced Voices As your host, Dennis Norman, with 45 years in the St. Louis real estate scene, I aim to share insights that blend practical experience with strategic foresight. Joining me are my business partners, John Williams and John Donati, both seasoned professionals with deep insights into these recent developments. Our collective experience in leadership within the REALTOR® organization and MLS will provide you with a rich perspective on adapting to industry changes.

Growth and Networking Opportunities This webinar is more than a learning experience—it’s a platform for professional growth and networking with peers dedicated to excellence and adaptation in real estate. It’s an avenue for you to connect with trends, tools, and strategies that will define the future of our industry.

Reserve Your Spot Now Ensure your participation in this pivotal discussion by securing your place at the webinar. Visit MORETrainingCenter.com or scan the QR code below to register. Let’s embark on this journey of growth and adaptation together in the St. Louis real estate market.

A little over two weeks ago I wrote my most recent article addressing St Louis home prices titled “Will St Louis Home Prices Decline?” in which my short answer was “yes”, but kind of tongue in cheek and based upon the seasonality of home prices, but my longer answer was more vague. I mentioned that there certainly is a correction coming but pointed out that there are so many variables that will affect prices that it is hard to say to what extent this correction will be. While this is still true, a lot has happened in the short time period since that article that has caused me to become more bearish on the St Louis real estate market to the point where I’m confident St Louis home prices will decline.

What has changed in the last 16 days…

- While it doesn’t directly impact the St Louis market, hurricane Ian has wreaked havoc on a lot of Florida and other areas and will no doubt impact the overall housing market and economy and likely in more of a negative way.

- Interest rates have risen another 1/2% hitting and staying near 7%.

- The Mortgage Bankers Association (MBA) just announced that mortgage applications dropped over 14% during the last week of September, the biggest one-week drop in 17 months and pushed their index down to the lowest point since 1997.

- The percentage of active listings that have reduced the asking price at least once broke the 40% mark.

- The 12-month home sales trend for St Louis for the period ending September 30, 2022 fell to the lowest point in over 2-years.

- Active listings in St Louis have been for sale a median of 43 days over four times higher than the median time to sell during the past 2 years of 10 days.

Market data pointing to lower St Louis home prices…

- The declining sales trend mentioned above. As chart 1 below shows, home sales during September in St Louis were down nearly 19% from last September.

- The declining home price trend. Chart 1 also reveals the median price of homes sold during September 2022 was $267,500, only 2.8% from then September 2021 when the median sold price was $260,000 which was a 8.3% increase from September 2020 when the median price was $240,000.

- Showings on active listings continues to decline. Chart 2 shows there are almost 10% fewer showings of active listings now then there were in the first week of January (the slowest time of the year). Last year at this time showing activity was over 30% higher than now and in 2020 it was abut 55% higher. Fewer showings mean fewer sales in coming.

- The widening gap between home prices and rental rates. Chart 3 shows the home price index (blue line) rising above the rental rates (red line) at a fairly steep rate. Historically, such as the late 1980’s – 2000 shown on the left side of the chart, these two lines track closely with home prices slight below the rental rates line. The last time home prices started increasing more than rents was in the early 2000’s and this continue until the gap widened to the point that something had to give…either home prices had to fall or rents had to increase. In 2008, the bubble burst and home prices fell. While the present gap is not as large as it was during the height of the housing market bubble in 2006-07, we’re headed that way.

- CPI and St Louis Home Price Index are hitting bubble levels. Chart 4 shows the rate of change (year over year) in CPI and the St Louis home price index. The rate of change in both has already exceeded what in the past (with the exception of 1979 when it went a little higher) has triggered home prices to fall.

- Home price and interest rate increases are killing St Lous home affordability. Table 5 shows that currently, based upon median home prices and interest rates, one year of house payments (principal and interest only) take about 30% of the median household income for St Louis. In 2007, at the peak of the housing bubble, it was only 21% and in 2000, which many economists use as a “normal” or baseline year, it was 20%. So the real cost of a typical St Louis home to a typical St Louis family is about 50% higher now than normal.

Continue reading “Why St Louis Home Prices Are Going To Decline“

Let me begin with this is not a political statement and the purpose of this site is not about politics but about real estate. Having said that, this morning I came across the plans for the housing market that Bernie Sanders is proposing if he is elected President which I had not seen before. Upon reviewing his plan (it is on his official site) I realized that while many of the components of it sound good (like “End homelessness and ensure fair housing for all”) many of his promises in this area sound like things that would negatively impact investors and the housing market as a whole.

The following are the Key Points to the Bernie Sanders housing plan from his website (I have included the complete list):

- End the housing crisis by investing $2.5 trillion to build nearly 10 million permanently affordable housing units.

- Protect tenants by implementing a national rent control standard, a “just-cause” requirement for evictions, and ensuring the right to counsel in housing disputes.

- Make rent affordable by making Section 8 vouchers available to all eligible families without a waitlist and strengthening the Fair Housing Act.

- Combat gentrification, exclusionary zoning, segregation, and speculation.

- End homelessness and ensure fair housing for all

- Revitalize public housing by investing $70 billion to repair, decarbonize, and build new public housing.

Under the “When Bernie is president, he will” section are some of the things he plans to do to accomplish the above goals (this list is rather extensive on his site so I have only included a sampling of the items that appear will negatively impact investors and homeowners):

- Enact a national cap on annual rent increases at no more than 3 percent or 1.5 times the Consumer Price Index (whichever is higher) to help prevent the exploitation of tenants at the hands of private landlords.

- Allow states and cities to pass even stronger rent control standards.

- Implement a “just-cause” requirement for evictions, which would allow a landlord to evict a tenant only for specific violations and prevent landlords from evicting tenants for arbitrary or retaliatory reasons.

- Place a 25 percent House Flipping tax on speculators who sell a non-owner-occupied property, if sold for more than it was purchased within 5 years of purchase.

- Impose a 2 percent Empty Homes tax on the property value of vacant, owned homes to bring more units into the market and curb the use of housing as speculative investment.

Again, this is not a political piece, but given the strong housing market we have enjoyed over the past several years, which has helped many Americans build equity and recover wealth lost during the housing bubble burst of 2008, I think it’s worth noting proposed plans, by any party or power, that could negatively impact the market. Also, these are just talking points from someone running for office, so whether it’s Bernie Sanders or any other candidate, or even the current President, Donald J. Trump, they can all have ideas but getting them implemented takes cooperation of Congress and that is not always so easy so it doesn’t mean any of their plans ever actually come to fruition.

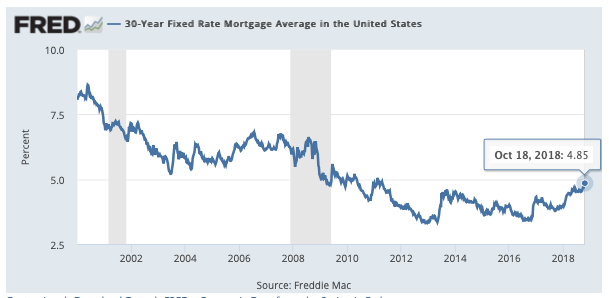

The Mortgage Bankers Association (MBA), in their Mortgage Finance Forecast released this week predicted that interest rates on home mortgages will continue to rise this year and will hit 5% early next year. According to the report, the interest rate on a 30-year fixed rate mortgage is expected to come in at an average of 4.6% for the 3rd quarter, which just ended and then rise to an average of 4.9% during the last quarter of this year. Interest rates are then forecast to hit 5.0% during the 1st quarter of 2019, rise to 5.1% by the second quarter, then stay around 5.1% through the end of 2020, according to the report.

St Louis Mortgage Interest Rates

(click on chart for live, interactive chart)

New mortgage applications for a home purchase declined last week 7.0 percent from the prior week, according to a report just released by the Mortgage Banker’s Association (MBA). The MBA’s Market Composite Index, which is how they track the volume of loan applications, fell to it’s lowest level for home loans for a purchase since January 2016.

Interest rates decline as well…

While the number of loan applications declined, so did the interest rate on home mortgages, according to the MBA report:

- 30 year fix rate conventional mortgages decreased to 3.71 percent from 3.73 the week before,

- 30 year fixed rate jumbo loans (larger than $417,000) decreased to 3.71 percent from 3.72 percent the week before,

- FHA loans bucked the trend with interest rates increasing to 3.56 percent from 3.54 percent the week before,

- 5/1 ARMS decreased to 2.93 percent from 2.97 percent.

St Louis home sales increase 5 percent during the same period:

The tables below reflect St Louis home sales for the same one-week period, compared with prior week, as in the MBA’s report and illustrate that St Louis perhaps appears to be bucking the trend. St Louis saw an increase in home sales during the most recent week, which, theoretically, should translate into an increase in home mortgage applications, contrary to what we see in the MBA report on a national basis.

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

LIVE Mortgage Interest Rates – Updated Daily Continue reading “Home Loan Applications Decline As Do Mortgage Interest Rates; St Louis bucks trend“

Missouri Attorney General, Chris Koster, has joined in with Attorney Generals from around the U.S. to combat time share buying scams. According to Koster, deceptive timeshare resellers will often falsely claim to have buyers or renters in place who are ready to pay top dollar for consumers’ timeshare properties. The scamming companies ask timeshare owners to pay hefty up-front fees and do nothing in turn.

The Missouri Attorney General’s office offers the following tips to avoid becoming the victim of a timeshare scam: Continue reading “Missouri Attorney General Offers Tips To Avoid Timeshare Scams“

In spite of warning from the Mortgage Bankers Association (MBA), the St. Louis Association of REALTORS (SLAR) and other housing-related groups of the damage the “Mortgage Foreclosure Intervention Code” (Bill #174 introduced by Hazel Erby, District 1) could do to the already struggling St Louis housing market, including increasing the cost of home mortgages, last month the St. Louis County Council passed the bill, it was signed into law by County Executive Charlie Dooley and will go into effect on September 28, 2012. Then, just last week, Lewis Reed, President of the St. Louis Board of Alderman, introduced what is a basically the same bill in an attempt to get the same law enacted by the City of St. Louis.

Opponents of the law, including SLAR and the MBA, say this law will likely lead to higher cost mortgages in St Louis County (and, assuming they pass it, the city of St Louis) as lenders will increase fees to cover additional costs they will have in complying with this new law and proponents of the law say this is not so. I think the proponents of the bill are wrong and am confident that this will lead to higher cost mortgages in areas that have enacted the Mortgage Foreclosure Intervention Code or similar laws. So, why am I so sure? It just so happens that yesterday, the Federal Housing Finance Agency (FHFA), the agency charged with overseeing Fannie Mae and Freddie Mac, issued a notice of a proposal to increase mortgage fee pricing (guarantee fees that Fannie Mae and Freddie Mac charge) on loans in states where, due to laws and the requirements imposed upon lenders (or other investors) to “manage a default, foreclose and obtain marketable title to the property backing a single-family mortgage“, foreclosures take longer. Continue reading “Home mortgages may become more costly in St. Louis thanks to local law“

Are you ready to tackle that bathroom renovation you’ve been putting off? Before you pick up the phone and hire a contractor, why not save some cash and try your hand at it. Considering the cost of renovations for homeowners, DIY has gained popularity. The following list, created by Construction Management Degree.com, contains 100 of the top DIY websites to help guide your home improvement projects, in no particular order. We arrived at this list through our own research, and for the benefit of our readers. The list is organized by area of the home including; General Remodeling, Interior Decorating, Kitchen and Bathroom, Office and Workspaces, Landscaping and Exterior, Basement, Storage, and Closets. Continue reading “Top 100 web sites for do it yourself home improvement“

The Justice Department, the Department of Housing and Urban Development (HUD) and 49 state attorneys general announced today the filing of their landmark $25 billion agreement with the nation’s five largest mortgage servicers to address mortgage loan servicing and foreclosure abuses. Continue reading “Bank of America, J.P. MOrgan Chase, Wells Fargo, Citigroup and Ally Financial reach $25 Billion Agreement with Fed & State Government over Foreclosure Abuses“

“We may indeed being seeing the beginning of at least a ‘soft landing’ in housing,” said Michael Feder, President and CEO of Radar Logic.

“We may indeed being seeing the beginning of at least a ‘soft landing’ in housing,” said Michael Feder, President and CEO of Radar Logic.

The latest housing market report by RadarLogic contained said, while trends in home prices remain negative in most major U.S. metropolitan areas, there are indications that market conditions are starting to improve. Continue reading “Is the housing market seeing the beginning of a "soft landing"?“

Over the past few years many people that had never faced financial trouble found themselves in foreclosure, doing a short-sale or deed in lieu or filing bankruptcy as a result of the burst of the housing bubble, record unemployment and a weak economy in general. People in this situation, many of whom were homeowners for years, were forced to lived with relatives or friends, or rent until they were able to get through their financial crisis. Now, many of these folks have been able to get back on their feet and want to buy a home again but don’t know when, or if they will be able to get a home loan again due to their past. Continue reading “How long after a foreclosure or short sale do you have to wait to get a home loan?“

Over the past few years many people that had never faced financial trouble found themselves in foreclosure, doing a short-sale or deed in lieu or filing bankruptcy as a result of the burst of the housing bubble, record unemployment and a weak economy in general. People in this situation, many of whom were homeowners for years, were forced to lived with relatives or friends, or rent until they were able to get through their financial crisis. Now, many of these folks have been able to get back on their feet and want to buy a home again but don’t know when, or if they will be able to get a home loan again due to their past. Continue reading “How long after a foreclosure or short sale do you have to wait to get a home loan?“

HUD released its U.S. Housing Market Conditions report for the 2nd quarter of 2011 which stated “housing data for the second quarter of 2011 indicate that the recovery in the housing market continues to remain fragile.” This did not come as a surprise, but what I did find a little surprising was the report showed that the market for new homes performed better than that for existing homes. The number of new homes sold rose in the second quarter and the year-over-year median sales price of new homes was up slightly. In contrast, the number of existing homes sold in the second quarter fell and the year-over-year median sales price of existing homes was down. Continue reading “HUD Report says housing market continues to remain fragile“

HUD released its U.S. Housing Market Conditions report for the 2nd quarter of 2011 which stated “housing data for the second quarter of 2011 indicate that the recovery in the housing market continues to remain fragile.” This did not come as a surprise, but what I did find a little surprising was the report showed that the market for new homes performed better than that for existing homes. The number of new homes sold rose in the second quarter and the year-over-year median sales price of new homes was up slightly. In contrast, the number of existing homes sold in the second quarter fell and the year-over-year median sales price of existing homes was down. Continue reading “HUD Report says housing market continues to remain fragile“

The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland. Continue reading “FBI Report Shows Mortgage Fraud Continues at Elevated Levels“

The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland. Continue reading “FBI Report Shows Mortgage Fraud Continues at Elevated Levels“

Would you like to buy one of those foreclosure or REO bargains, but don’t have the cash to have the necessary work done? There’s a new rehab loan program in St. Louis that will help homeowners do just this! This program allows buyers to buy Bank Owned or Foreclosed Property (let’s call them “distressed homes”) and also borrow funds for the rehabilitation of these properties. Continue reading “Local Rehab Loan Program Allows Buyers To Take Advantage of Distressed Sale Bargains“

Would you like to buy one of those foreclosure or REO bargains, but don’t have the cash to have the necessary work done? There’s a new rehab loan program in St. Louis that will help homeowners do just this! This program allows buyers to buy Bank Owned or Foreclosed Property (let’s call them “distressed homes”) and also borrow funds for the rehabilitation of these properties. Continue reading “Local Rehab Loan Program Allows Buyers To Take Advantage of Distressed Sale Bargains“

The national mortgage delinquency rate for homeowners that are 60 or more days past due decreased in the first quarter of 2011 marking the fifth consecutive quarterly decline according to a report released today by TransUnion. The report shows mortgage delinquencies for the first quarter of 2011 were down 3.4 percent from the prior quarter and down 8.6 from a year ago. Continue reading “Mortgage Loan Delinquency Rate Decreased for 5th Consecutive Quarter; Mortgage Loan Demand down as well“

The national mortgage delinquency rate for homeowners that are 60 or more days past due decreased in the first quarter of 2011 marking the fifth consecutive quarterly decline according to a report released today by TransUnion. The report shows mortgage delinquencies for the first quarter of 2011 were down 3.4 percent from the prior quarter and down 8.6 from a year ago. Continue reading “Mortgage Loan Delinquency Rate Decreased for 5th Consecutive Quarter; Mortgage Loan Demand down as well“

Lee Bentley Farkas, the former chairman of a private mortgage lending company, Taylor, Bean & Whitaker (TBW), was convicted today for his role in a more than $2.9 billion fraud scheme that contributed to the failures of Colonial Bank, one of the 25 largest banks in the United States in 2009, and TBW, one of the largest privately held mortgage lending companies in the United States in 2009. Continue reading “Former Chairman of Taylor, Bean & Whitaker Convicted for $2.9 Billion Fraud Scheme That Contributed to the Failure of Colonial Bank“

The Mortgage Bankers Association released the results of it’s National Delinquency Survey for the 4th quarter of 2010 and it shows very mixed results. On the positive side of things, overall mortgage loan delinquency in the U.S. has dropped to 8.22 percent which is the lowest rate since 4th quarter 2008 when the rate was 7.88 percent. On the flip side of the coin, the overall foreclosure rate for the quarter was 4.63 percent which ties the highest rate on record which was hit in the 1st quarter of 2010. Continue reading “Mortgage loan delinquency hits 2 year low; foreclose rate ties highest on record“

The Mortgage Bankers Association released the results of it’s National Delinquency Survey for the 4th quarter of 2010 and it shows very mixed results. On the positive side of things, overall mortgage loan delinquency in the U.S. has dropped to 8.22 percent which is the lowest rate since 4th quarter 2008 when the rate was 7.88 percent. On the flip side of the coin, the overall foreclosure rate for the quarter was 4.63 percent which ties the highest rate on record which was hit in the 1st quarter of 2010. Continue reading “Mortgage loan delinquency hits 2 year low; foreclose rate ties highest on record“

Today, CoreLogic released its “U.S. Housing and Mortgage Trends Report” which stated “their research indicates that the most popular measure of existing home sales is overstated by 15 percent to 20 percent. ”

Today, CoreLogic released its “U.S. Housing and Mortgage Trends Report” which stated “their research indicates that the most popular measure of existing home sales is overstated by 15 percent to 20 percent. ”

Continue reading “New report shows home sales may be worse than reported“

You finally reach a deal with a buyer to sell your house, or strike a deal with the seller of your dream home, only to see the deal fall apart later when the house doesn’t appraise for the price that has been agreed upon…what are you to do? This is a plight that has become all too common today for many buyers and sellers. Why? Several reasons….appraisers have, after being blamed by many for causing or contributing to the downfall of the housing market, understandably so become cautious and somewhat conservative when putting a value on a home today. Not to mention, since about a third of the home sales are distressed sales and prices are still falling somewhat in many markets, the “value” of a home is a moving target.

You finally reach a deal with a buyer to sell your house, or strike a deal with the seller of your dream home, only to see the deal fall apart later when the house doesn’t appraise for the price that has been agreed upon…what are you to do? This is a plight that has become all too common today for many buyers and sellers. Why? Several reasons….appraisers have, after being blamed by many for causing or contributing to the downfall of the housing market, understandably so become cautious and somewhat conservative when putting a value on a home today. Not to mention, since about a third of the home sales are distressed sales and prices are still falling somewhat in many markets, the “value” of a home is a moving target.

What can home sellers and buyers do to avoid appraisal problems? Continue reading “Tips to Avoid Appraisal Problems“

A new report release by Trulia reveals that, in December, the number of listings with at least one price cut grew to 27 percent which is a 23 percent increase from December 2009 when 22 percent of the listings had at least one price cut. In terms of the size of the price cut, that has remained about the same at 11 percent. Continue reading “Twenty-three percent increase in price reductions by home sellers“

A new report release by Trulia reveals that, in December, the number of listings with at least one price cut grew to 27 percent which is a 23 percent increase from December 2009 when 22 percent of the listings had at least one price cut. In terms of the size of the price cut, that has remained about the same at 11 percent. Continue reading “Twenty-three percent increase in price reductions by home sellers“

Settlement Provides $2 Million to African-American Borrowers Who Paid Higher Interest Rates

PrimeLending, a national mortgage lender with 168 offices in 32 states at the end of 2009, has agreed to pay $2 million to resolve allegations that it engaged in a pattern or practice of discrimination against African-American borrowers between 2006 and 2009. Continue reading “Justice Department Reaches Settlement with Prime Lending to Resolve Allegations of Lending Discrimination“

Last week the co-chairs of the National Commission on Fiscal Responsibility and Reform (the group that is supposed to figure out how to rescue our country out of the financial quicksand it’s in) issued a draft proposal of a plan the committee says “will make America better off tomorrow than it is today”.

In addition to such enlightening statements such as “America cannot be great if we go broke” the report outlines a plan that makes five basic recommendations: Continue reading “Mortgage Bankers Cautions Against Cutting Back Mortgage Interest Deduction“

Dennis Norman

In a letter to the Federal Housing Finance Agency, John A. Courson, the President and Chief Executive Officer of the Mortgage Bankers Association (MBA) said that the MBA “opposes the practice of private third parties, such as developers, builders, licensing companies and real estate brokers, imposing private transfer fee covenants on residential real estate for the purpose of extracting future income.” However, in his letter Mr. Courson goes on to say that the “MBA is concerned thatencumbering housing transactions with these types of PTFs will impede the marketability and affect the valuation of properties and thus the value of the loans and securities backed by such loans.” In addition, the MBA points out that “distinctions among PTFs (private transfer fees) are necessary” as they do not oppose private transfer fee covenants that are: Continue reading “Mortgage Bankers urge Feds not to ban all private transfer fees“

“It is particularly disheartening then that lenders are often the subject of ill considered accusations regarding discrimination, accusations based upon analyses that lack statistical rigor”

– Michael Fratantoni, MBA’s Vice President of Research and Economics

Dennis Norman

This week the Mortgage Bankers Association (MBA) released a paper, “A Review of Statistical Problems in the Measurement of Mortgage Market and Credit Risk” conducted by Professor Anthony M. Yezer of the George Washington University and sponsored by MBA’s Research Institute for Housing America (RIHA). This paper examines the fundamental assumptions that are often used as an analysis of whether their is discrimination present in the process of mortgage lending. Continue reading “‘Flawed models’ are cause of false mortgage discrimination findings“

| For Immediate Release August 12, 2010 |

United States Attorney’s Office District of New Jersey Contact: (973) 645-2888 |

|

Alleged Schemes Defrauded Investors in Multiple States and Abroad NEWARK, NJ—Eliyahu Weinstein, aka “Eli Weinstein,” was arrested at his home this morning by federal agents on charges that he ran an investment fraud scheme causing losses of at least $200 million, U.S. Attorney Paul J. Fishman announced. Weinstein, 35, of Lakewood, N.J., was charged with one count of bank fraud and one count of wire fraud in connection with the alleged scheme. Vladimir Siforov, 43, of Manalapan, N.J., was also charged with one count of wire fraud in connection with the scheme and remains at large. Weinstein is expected to appear later today before U.S. Magistrate Judge Esther Salas in Newark federal court. Continue reading “Leader of $200 Million Real Estate Investment Scam Arrested for Fraud“ |

|

Dennis Norman

While there has been much discussion about the causes and effects of the Housing Boom as well as the Bust (including by yours truly in prior posts) I don’t think we need to refrain from continuing to examine this part of history that is affecting millions of people across the country. Perhaps we can learn some lessons from this that will help us avoid another such collapse of the housing market in the future.

My topic today actually has a silver lining of sorts. The topic is debt and how so many homeowners across the country leveraged themselves into a mountain of debt during the housing boom only to later have that mountain collapse on them. My attention was drawn to this subject by a presentation done by Karen Dynan of the Brookings Institution entitled “Household Leveraging and Deleveraging“.

American’s Debt Grew At a Much Faster Pace Than Income

As you can see from the chart below the percentage of American’s disposable personal income that is needed to pay debt payments on mortgage and consumer debt peaked in the mid to late ’80s just over the 12 percent range but then dropped back down to just below 11 percent by the early 90’s. By the height of the real estate boom this percentage had grown significantly and peaked at just under 14 percent in 2007. Clearly the cost of home ownership during the boom was increasing at a faster pace than homeowners income.

Chart by Information St. Louis, Inc. - Data Source Board of Governors of the Federal Reserve

Dynans’ report attributes the rise in debt to having probably been “the combination of increasing house prices and financial innovation.” I think “financial innovation” is a nice way to describe sub-prime, interest only and other such creative ways to finance homes that became prevalent during the boom.

As the chart below depicts, consumers mortgage debt grew dramatically during the housing boom even though “other debt” remained fairly constant.

Source: Household Leveraging and Deleveraging - Karen Dynan

“Everyone” Was Borrowing – Not Just Sub-Prime Borrowers

Contrary to what is sometimes portrayed, it wasn’t just sub-prime borrowers that were racking up debt during the housing boom. The chart below shows a fairly consistent increase in household debt across several demographics.

Source: Household Leveraging and Deleveraging - Karen Dynan

Obviously this rather rapid and intense increase in household debt, particularly mortgage debt, is a major factor behind the record number of mortgage delinquencies and foreclosures we are currently seeing. Rising home prices (at astonishing rates in some markets) during the boom forced many homeowners to take on more mortgage debt than they should. Many even admit buying homes with initial “teaser” interest rates realizing they would not be able to afford the payment in two years when the teaser is gone, but simply planned to sell the home (at a profit) beforehand and move on. This, like musical chairs, works until the music stops as it did in 2007.

The Importance of Defaults

If you have defaulted on your mortgage or lost a home in foreclosure, you are helping out our economy! Well, sort of. According to Dynan’s report, the record rates of charge-offs by lenders of mortgages as a result of defaults and foreclosures that have occurred in the past year has resulted in mortgage debt in 2009 declining 2 percent rather than staying flat.

Source: Household Leveraging and Deleveraging - Karen Dynan

Now for the Silver Lining-

I promised you a silver lining and here it is. American’s now have less household debt! Beginning with the 2nd quarter of 2008 consumers home mortgage debt, after increasing over a trillion dollars just two years before, actually decreased and has continued decreasing every quarter since. Consumer started decreasing as well in the 4th quarter of 2008 but has grown slightly again in the 1st quarter of this year.

Source: Household Leveraging and Deleveraging - Karen Dynan

In addition, as the debt-service chart at the beginning of this post shows, the portion of income that is necessary to pay debts for the American consumer has fallen over 1 percent from it’s peak and is still headed downward.

Is This Self-Control Or Is There No Choice?

Ah, critics could argue that the consumer has not really learned anything from the housing bust and the only reason debt has dropped is that banks and other lenders aren’t lending. Well, it is certainly true that lending standards have tightened significantly and bankers are acting like, uh, well, bankers again (the pre-boom ones) as shown by the chart below. However, Dynan’s report indicates that 20 percent of senior loan officers reported in May 2010 that demand for consumer loans had fallen relative to 3 months earlier. Probably better proof that consumers are exercising self-control is the MBA mortgage application survey which, in recent weeks, have shown a decrease in mortgage applications from both home-buyers as well as home owners seeking to refinance.

Source: Household Leveraging and Deleveraging - Karen Dynan

What Does The Future Hold In Store?

Karen Dynan suggests that we are going to see consumers continue the trend of reducing debt. She bases this on the high ratio of average household debt to assets which, as the chart below illustrates, peaked in the past year at a level that was 50 percent higher than in 2000.

Source: Household Leveraging and Deveraging - Karen Dynan

Dynans’ report goes on to say the following about the future:

- Mortgage charge-offs are likely to remain high

- Foreclosures will be on the rise again after being delayed by HAMP and other factors

- Even when lender’s ease up, new borrowing is going to be dampened due to borrowers lacking home equity

I spent this morning reading a sobering and, quite frankly depressing, report issued by the Center for Responsible Lending that focused on the demographics of people losing their homes as a result of foreclosure. The report is done well and looks at the impact of foreclosures on different races and ethnicity’s and then addresses what they believe to be the cause of this crisis.

While the reports main subject was eye opening, what really got my attention as I went through the report were some of the facts and figures being quoted. This caused me to dig through the reports extensive four-pages of references and citations and then follow those back to the source. A couple of hours, and about 300 pages of paper (there goes my Sierra-Club membership) later I overwhelmed with the sobering statistics I had found concerning foreclosures.

This is a topic that is obviously on-going and affecting many people’s lives and deserves more space than I will give the topic here, but I’ll be talking more about it in the future as well.

Here are some of the facts and figures from the report from the Center for Responsible Lending as well as from some of the various sources their references lead me to:

- During the first three years of the foreclosure crisis, from January 2007 through the end of 2009, they (CRL) estimates there have been 2.5 Million foreclosures completed.

- 83% of these foreclosures were on loans that originated between 2005 and 2008.

- 82% of the foreclosures were on owner-occupied homes.

- According to the Mortgage Bankers Association 4.63 percent of mortgages in the U.S. are in the foreclosure process. This is not only a historic high but is five times higher than the average of all quarterly rates reported by the MBA from 1979 to 2007.

- The CRL estimates that, when combining borrowers that are two or more payments behind on their mortgage with borrowers already in the foreclosure process, there are 5.7 million borrowers at imminent risk of losing their homes to foreclosure.

- The CRL estimates that 17% of Latino homeowners, 11% of African-American homeowners and 7% of non-Hispanic White homeowners have already lost or are at imminent risk of losing their home.

- The CRL estimates that subprime loans account for 64% of the foreclosures during this crisis period, but only account for 22% of the loans originated during the period.

- The foreclosure rate on subprime loans is 16.5%, Jumbo Loans 4.4%, Government Insured Loans 3.8% and conventional loans 2.3%.

- Credit Suisse, in their December 2008 Foreclosure Update, forecast that 8.1 million mortgages would be in foreclosure over the next four years (this represents 16% of all mortgages in the U.S.- almost 1 out of ever 6 mortgages).

- The Credit Suisse estimate for foreclosures, under a recession (which we had) was increased to 9.0 to 10.2 million foreclosures through the end of 2012.

- Goldman Sachs, in their Global Economics Paper, Jan 13, 2009) projected 13 million foreclosures by 2014.

- A report by Urban Institute estimated the financial cost to local governments of a single foreclosure at $19,229.

- CRL estimates that $1.86 trillion will be lost in home equity between 2009 and 2012 due to depreciated home values associated with nearby foreclosures.

When you see these facts and figures I think it is easy to understand why I have a rather conservative outlook on when the housing market will recover. Until the foreclosure crisis begins to show signs of coming to an end, which by the facts above appears to be at least 2 if not 3 or 4 years away, the housing market, and home prices, are going to continue to be impacted negatively by the foreclosures.

According to a press release issued by the FBI, nearly 500 people have been arrested in a nationwide mortgage fraud take-down as part of “Operation Stolen Dreams.” This operation was launched on March 1, 2010 and, according to the FBI, has lead to a total of 485 arrests, 330 convictions and the recovery of nearly $11 million. The FBI estimates that losses from a variety of fraud schemes are estimated to exceed $2 billion.

Operation Stolen Dreams is the government’s largest mortgage fraud take-down to date. But FBI Director Robert S. Mueller cautioned that there is still much work to be done. The Bureau is currently pursuing more than 3,000 mortgage fraud cases, he said, which is almost double the number from the last fiscal year.

“The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.”

“The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.”

A few examples:

-

In Miami, on Wednesday two people were arrested for targeting the Haitian-American community, claiming they would assist them with immigration and housing issues. Instead, they used victims’ personal information to produce false documents to obtain mortgage loans.

-

In California, a prominent home builder used straw buyers to sell his houses at inflated prices. The scheme inflated prices on other homes in the area, creating artificially high comparable sales and affecting the overall new-home market.

-

And in Detroit yesterday, FBI agents arrested several individuals in a $130 million scheme orchestrated by the local chapter of a motorcycle gang. The conspirators posed as mortgage brokers, appraisers, real estate agents, and title agents and used straw buyers to obtain around 500 mortgages on only 180 properties.

The FBI says to combat the problem, their National Mortgage Fraud Task Force helps identify mortgage frauds such as loan origination schemes, short sales, property flipping, and equity skimming. In addition, they have 23 mortgage fraud task forces in “hot spots” around the country, from California and Texas to Florida and New York.

Unlike previous mortgage fraud sweeps, Operation Stolen Dreams focused not only on federal criminal cases, but also on civil enforcement and restitution for victims. Federal agencies participating included the Department of Housing and Urban Development, the Treasury Department, the Federal Trade Commission, the Internal Revenue Service, the U.S. Postal Inspection Service, and the U.S. Secret Service. Many state and local agencies were also involved in the operation.

The FBI has produced a video for consumers to help make you aware of the scams that are out there and show you how to avoid them. To watch the video click the link below: