By Karen Moeller, on January 23rd, 2026

Dual agency is legal in Missouri, but it is frequently misunderstood. At first glance, it can sound efficient. One agent. One transaction. Fewer moving parts. What is often overlooked is the trade-off. When dual agency is established, the agent must step back from full advocacy for both the buyer and the seller.That limitation is significant, and it fundamentally changes the agent’s role in the transaction.

Understanding that shift is essential before agreeing to dual agency.

What dual agency means in Missouri

In Missouri, dual agency occurs when the same brokerage represents both the buyer Continue Reading →

By Karen Moeller, on January 22nd, 2026

Few phrases in real estate create more confusion than “As-Is.”

Buyers often see it as a warning label.Sellers sometimes view it as a shield.In reality, it is neither.

I regularly hear buyers say they will not even consider a home once they see “As-Is” in the listing. I also frequently hear buyers assume that “As-Is” means the seller is desperate or that the property can be purchased for pennies on the dollar. That expectation rarely aligns with reality. In most cases, the seller has already considered the condition of the home and priced it Continue Reading →

By Dennis Norman, on January 22nd, 2026

The St. Louis real estate market is experiencing mixed movements in mortgage rates as of January 22, 2026. The 30-year fixed-rate mortgage has seen a slight decrease, now standing at 6.20%, down by 0.01%. In contrast, the 15-year fixed rate has edged up to 5.76%, reflecting a minor increase of 0.01%. These subtle shifts in rates can influence the decision-making process for both homebuyers and sellers in the region.

For prospective buyers in St. Louis, the marginal drop in the 30-year fixed rate presents a slight relief, potentially lowering monthly payments and overall interest costs. However, those considering a 15-year Continue Reading →

By Karen Moeller, on January 22nd, 2026

For many years, homeowners insurance followed a predictable script. The house itself mattered most. Age of the roof. Square footage. Replacement cost. Claims history.

That is changing.

Across the St. Louis region, insurance underwriting is becoming increasingly location-specific, meaning where a home sits now plays a larger role in coverage terms and pricing than many buyers and sellers expect. This shift is not universal across all insurers, but it is widespread enough to be affecting real estate transactions in noticeable ways.

Communities like Eureka often feel this change sooner, not because something Continue Reading →

By Dennis Norman, on January 21st, 2026

The St. Louis City real estate market experienced notable shifts in December 2025. Homes sold for a median price of $235,000, marking a 4.82% increase from December 2024’s median price of $224,200. However, this represents a 6.00% decrease from November 2025, when the median sold price was $250,000. The median list price in December 2025 was $200,000, a significant decrease of 14.89% compared to $235,000 in December 2024.

The number of home sales also saw a decline, with 239 homes sold in December 2025, down 9.47% from 264 sales in December 2024. These figures highlight a dynamic market environment, Continue Reading →

By Dennis Norman, on January 20th, 2026

The Franklin County real estate market has experienced notable growth as of January 2026, with December 2025 data revealing a substantial increase in home values and sales activity. Homes in Franklin County sold for a median price of $284,900 during December 2025, marking a 12.83% rise from December 2024’s median of $252,500. This figure also reflects a 13.51% increase compared to November 2025, when the median sold price was $251,000.

The upward trend extends to the listing prices as well, with the median list price reaching $311,900 in December 2025, up 16.42% from $267,900 in December 2024. Additionally, the market Continue Reading →

By Dennis Norman, on January 19th, 2026

The St. Louis County real estate market experienced notable changes as of December 2025. Homes sold for a median price of $262,000, marking a 2.75% increase from December 2024’s median of $255,000. This figure also reflects a slight rise of 0.77% from November 2025’s median price of $260,000. In contrast, the median list price decreased significantly to $224,900, down 19.39% from $279,000 in December 2024.

Home sales in St. Louis County totaled 1,043 in December 2025, a minor decrease of 2.07% compared to the 1,065 homes sold in December 2024. These statistics are illustrated in the chart below, available exclusively Continue Reading →

By Dennis Norman, on January 19th, 2026 Seventeen years ago, on the day we celebrated the life of Dr. Martin Luther King, Jr., I wrote the article below on a personal blog. This morning, while reflecting on Dr. King’s legacy, I revisited it and felt it was still as relevant and meaningful today as it was then. While a few of the statistics are now outdated, the message and intent remain important and timely. So, in honor of Dr. King’s birthday today, I’m republishing it with some updates and perspective for 2026.

Originally published January 19, 2009…

Today we celebrate the life of Dr. Martin Luther King, Continue Reading →

By Karen Moeller, on January 19th, 2026

The little brick bungalow on a quiet tree-lined street.The creaky front porch where neighbors waved and kids dropped their bikes in a heap.The basement that smelled faintly like mildew and ambition, where a ping pong table leaned against wood-paneled walls and a “rec room” became the setting for birthday parties, teenage angst, and late-night conversations.

Most of us in St. Louis grew up in some version of that house.

It was not fancy. It was not open concept. The refrigerator was probably avocado or harvest gold. There was a “good couch” nobody was allowed Continue Reading →

By Karen Moeller, on January 18th, 2026

Recent U.S. Census data confirmed that the St. Louis metro added population last year.

But the bigger question clients keep asking me is this: are we actually growing, or are people simply moving around inside the region?

For years, the St. Louis region has worn a familiar label. Flat. Stagnant. Losing people.

So when a client recently asked me a deceptively simple question, it stopped me in my tracks.

Is Greater St. Louis actually growing, or are people just moving from one municipality to another inside the same metro?

It is a fair question. It is also a more important Continue Reading →

By Dennis Norman, on January 17th, 2026

The St. Louis metropolitan area has witnessed a subtle shift in its housing market dynamics this year, with a total of 34,383 homes sold through December 2025. This figure marks a slight decrease of 0.60% from the 34,590 homes sold during the same period last year. Despite this modest reduction, the market remains robust, reflecting a stable environment for both buyers and sellers. The consistency in sales figures over the past year suggests a balanced market, offering opportunities for families looking to settle in this vibrant region spanning counties in both Missouri and Illinois.

For those interested in the most Continue Reading →

By Karen Moeller, on January 17th, 2026

When a multi‑billion‑dollar development is proposed a few blocks from someone’s front porch, it stops being a business headline and becomes a neighborhood story.

The newly unveiled plan to transform the historic Armory and the adjacent former Macy’s/Famous‑Barr warehouse into what developers are calling the Armory Innovation District is one of the largest private development proposals the region has seen in years. It includes renovation of the Armory into office space and construction of a hyperscale data center on the warehouse site, with a stated goal of positioning St. Louis as a serious player in the national tech and AI Continue Reading →

By Dennis Norman, on January 17th, 2026

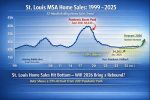

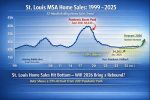

The SLT Market Chart below, available exclusively from MORE, REALTORS®, shows a full monthly history of St. Louis MSA home sales since 1999, and if you’re a data geek (like me) or just trying to get a real read on where this market is going, this chart is gold.

Here’s what stands out immediately: 2021 was the peak, no debate. In September 2021, the 12-month rolling total for home sales in the St. Louis metro hit 48,633 homes, an all-time high. For the calendar year 2021, sales totaled 48,328. Nothing before or after even comes close.

Continue Reading →

By Dennis Norman, on January 16th, 2026

In the dynamic real estate market of the St. Louis metropolitan area, certain zip codes are experiencing rapid sales, making them hotspots for both buyers and sellers. Leading the pack is a zip code in St. Clair, Illinois, where homes are flying off the market in just 19 days on average. With five active listings, the average list price stands at an attractive $54,580, presenting a unique opportunity for families looking to settle in a vibrant community.

Close behind is a zip code in Clinton, Illinois, where properties spend an average of 37 days on the market, followed by a Continue Reading →

By Karen Moeller, on January 15th, 2026

How Entry-Level Homes Got Bigger, Fancier and Harder To Afford

Ask three different generations what a starter home looks like and you will get three very different answers.

Your grandparents might picture a 2-bedroom bungalow with 1 bath, wood paneling and a carport. Your parents might think of a 3-bed, 1.5-bath ranch that needed wallpaper scraped and a deck added someday. A lot of today’s buyers walk into their first place looking for an en suite bath, walk-in closets, an attached garage and a kitchen that is already Instagram ready.

Starter homes have not disappeared in St. Louis, but Continue Reading →

By Dennis Norman, on January 15th, 2026

In the St. Louis real estate market, mortgage rates showcase a mixed yet predominantly falling trend as of January 2026. The 30-year fixed mortgage rate remains stable at 6.07%, maintaining its position slightly above the 6% mark. Meanwhile, the 15-year fixed mortgage rate has seen a slight decrease, now sitting at 5.58%. This subtle shift may provide some relief for prospective homebuyers looking to finance their homes over a shorter term.

The current market dynamics present both opportunities and challenges for St. Louis area buyers and sellers. While the stability of the 30-year fixed rate suggests a level of predictability Continue Reading →

By Karen Moeller, on January 15th, 2026

The City of Ballwin will officially expand its municipal boundaries in April after city officials approved plans to annex two residential neighborhoods and a school currently located in unincorporated St. Louis County.

Annexations are far less common today than they were decades ago, which makes Ballwin’s decision notable. While modest in scale, the move offers insight into how municipalities across St. Louis County are quietly rethinking governance, service delivery, and long-term planning.

Annexation is the legal process by which a city brings nearby land into its municipal boundaries. While it once played a major Continue Reading →

By Karen Moeller, on January 15th, 2026

When people talk about what drives home values, the same factors tend to dominate the conversation. Interest rates. Inventory. Schools. Taxes.

What receives far less attention is public park investment, even though in communities like Eureka, it plays a meaningful role in shaping buyer behavior and long-term market stability.

This is not about trendy amenities or short-term demand spikes. It is about how permanently protected land, trail systems, and outdoor infrastructure function as a form of market stability that does not fluctuate with economic cycles.

Parks as Fixed Infrastructure

Route 66 Park Continue Reading →

By Dennis Norman, on January 15th, 2026

In December 2025, the Jefferson County real estate market saw notable activity, with homes selling at a median price of $277,450. This marks a 4.01% increase from December 2024, when the median price was $266,750. However, compared to November 2025, there was a slight decrease of 0.91% from the previous median price of $280,000. The market also experienced a significant rise in the median list price, reaching $334,100, which is a 16.11% increase from $287,750 in December 2024.

The number of home sales in December 2025 totaled 240, reflecting an 11.11% increase from the 216 homes sold in December 2024. Continue Reading →

By Karen Moeller, on January 12th, 2026

When a federal housing official publicly tells homebuilders to “build more,” it sounds simple enough. More homes should mean more supply, and more supply should ease affordability pressures.

That logic works at a national level. On the ground in the St. Louis region, the story is far more complicated.

Recently, **Federal Housing Finance Agency Director Bill Pulte called on builders to accelerate construction on lots they already control, arguing that housing affordability will not improve without increased production. The message was clear and widely shared.

What matters just as much is where Continue Reading →

By Karen Moeller, on January 12th, 2026

If you want a quick snapshot of how people feel about change in Kirkwood, you do not need a formal survey. You just need to scroll for a moment. Reactions to the newly approved downtown apartment project range from enthusiastic to uneasy, with plenty of thoughtful pause in between.

That mix of responses makes this a good moment to step back and look at what was approved, what it replaces, and why this particular project is sparking conversation.

First, a quick clarification

This project is separate from the previously discussed development planned between South Continue Reading →

By Dennis Norman, on January 12th, 2026

Home buyers and sellers in the St. Louis metropolitan area, encompassing both Missouri and Illinois, are witnessing a dynamic real estate market, particularly in school districts where homes are selling rapidly. Leading the charge is the Bayless School District in St. Louis, boasting 14 active listings that typically spend just 38 days on the market, with an average list price of $209,571. This district’s swift turnover highlights its appeal to families seeking a vibrant community with accessible amenities.

Following closely is the Wolf Branch DIST 113 in St. Clair, Illinois, where properties average 42 days on the market, reflecting strong Continue Reading →

By Dennis Norman, on January 9th, 2026

The Metro East real estate market experienced notable shifts as of January 2026, with homes selling for a median price of $191,500 in December 2025. This represents a 4.93% increase from the median price of $182,500 in December 2024. However, this figure also marks a 10.93% decrease from November 2025, when the median sold price was $215,000. The median list price for December 2025 was $215,000, showing a 4.88% rise from $205,000 in December 2024.

In terms of sales volume, there were 611 home sales in December 2025, a slight decrease of 0.33% from the 613 homes sold in Continue Reading →

By Dennis Norman, on January 9th, 2026

St. Louis homebuyers can breathe a small sigh of relief as mortgage rates continue to trend downward, albeit slightly. As of January 8, 2026, the 30-year fixed mortgage rate has decreased by 0.01%, settling at 6.19%. This marks a modest but notable shift in the market, providing some relief for buyers facing higher borrowing costs in recent months. Meanwhile, the 15-year fixed rate also saw a decrease, down to 5.73%.

For those considering different mortgage options, the 30-year FHA rate is now at 5.80%, while the adjustable-rate mortgage (7/6 SOFR ARM) has decreased to 5.70%. However, the 30-year jumbo rate Continue Reading →

By Karen Moeller, on January 9th, 2026

You may have seen recent news about the federal Radiation Exposure Compensation Act, often referred to as RECA. For many St. Louis–area families, this is not an abstract policy discussion. It is personal.

The challenge is that most people do not know what the law actually covers, who it applies to, or whether it is worth looking into at all. This article is not about fear, speculation, or legal advice. It is about practical, factual guidance.

What RECA is and what it is not

The Radiation Exposure Compensation Act is a federal compensation program, Continue Reading →

By Karen Moeller, on January 8th, 2026

Housing affordability has returned to the national conversation. Recently, a senior White House economic adviser said the entire Cabinet is working on ideas to address housing challenges across the country. No formal policy has been released yet, but the statement itself has prompted questions in local markets like St. Louis.

The most important question for homeowners, buyers, and builders here is not what Washington is saying today, but what could realistically change looking ahead to 2026.

St. Louis Has Housing. The Issue Is Fit.

St. Louis does not face the same inventory crisis as Continue Reading →

By Dennis Norman, on January 8th, 2026

The St. Charles County real estate market continues its upward trajectory as of January 2026, with homes selling for a median price of $369,500 in December 2025. This marks a 5.59% increase compared to December 2024, when the median sold price was $349,950. Additionally, the December 2025 median sold price reflects a 2.64% rise from the previous month of November 2025, which had a median sold price of $360,000.

The median list price in December 2025 was $439,750, showcasing a significant 22.15% increase from $360,000 in December 2024. The market also experienced a boost in activity, with 474 homes sold Continue Reading →

By Karen Moeller, on January 7th, 2026

Because changing the messenger doesn’t change the message.

When a home doesn’t sell, the most tempting explanation is also the simplest one.

“It must be the agent.”

That conclusion feels productive. Change the sign. Change the outcome.

But in the St. Louis market, most stalled listings aren’t suffering from a marketing problem. They’re stalled because a hard decision hasn’t been made yet.

Price versus reality.

I recently worked with a seller who had already tested the market once. When we looked at the data together, one Continue Reading →

By Dennis Norman, on January 7th, 2026

The St. Louis MSA real estate market demonstrated notable resilience as 2025 came to a close. In December 2025, homes in the region sold for a median price of $275,000, marking a 5.77% increase from December 2024, when the median price was $260,000. However, this figure represents a slight dip of 3.51% from November 2025, when the median sold price was $285,000. The median list price also saw a significant rise, reaching $299,000 in December 2025, up 6.41% from $281,000 the previous year.

The volume of home sales in December 2025 was 2,816, a 1.99% increase from the 2,761 homes Continue Reading →

By Dennis Norman, on January 1st, 2026

As the new year unfolds, St. Louis homebuyers and sellers are navigating a mortgage market characterized by rising trends, albeit with the 30-year fixed-rate mortgage holding steady at 6.20% as of January 1, 2026. This rate, while unchanged from its previous level, reflects a stable yet elevated plateau above the 6% mark, signaling ongoing challenges for those entering the housing market. Meanwhile, the 15-year fixed rate has inched upward to 5.76%, a slight increase of 0.01%, indicating a subtle upward pressure across the board.

For prospective homebuyers in the St. Louis area, these rates mean careful consideration of financial plans Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|