Ever heard the expression “It’s not if, but when..”? That is something that I’ve heard for a while now about a recession. With everything that has happened to our economy including rising interest rates, rising inflation, the government printing more and more currency and running up greater debt, it seemed inevitable we would see a recession. To officially be in a recession, the GDP (Gross Domestic Product) has to fall for two successive quarters. For the first quarter of this year, GDP declined at an annual rate of 1.6%. The second quarter GDP numbers won’t be released until later this month (July 28th) however, the GDPNow forecasting model of the Federal Reserve Bank of Atlanta is forecasting a decline of 2.1% in GDP for the 2nd quarter of this year at this point. If their forecast is correct, we will officially be in a recession.

What happens to St Louis home prices during a recession?

There are many factors at play in every recession that make them unique, such as unemployment rates, interest rates, etc, making it unrealistic to think that home prices are going to behave the same way during every recession, however, I thought it would be worth looking at what happened during the last couple of recessions.

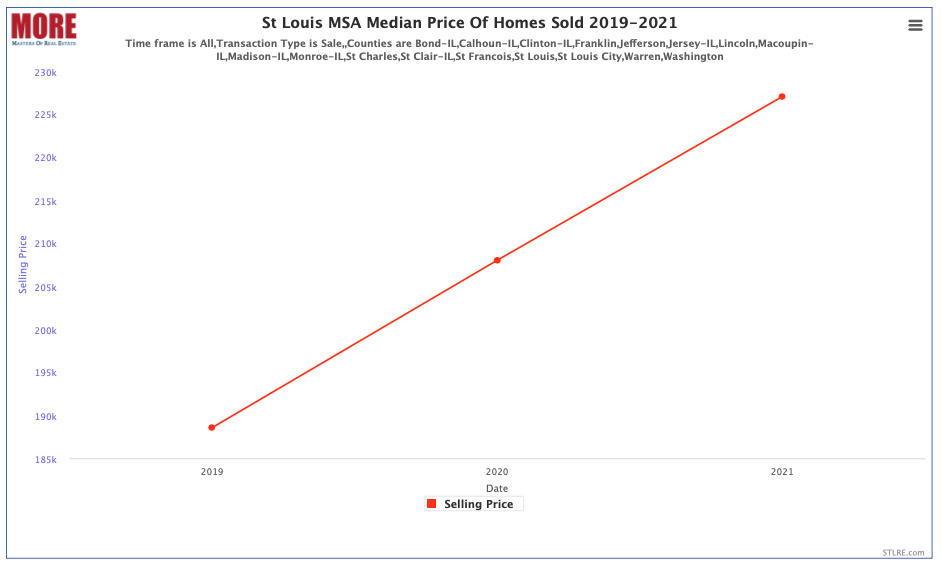

2020 Recession (Q1 and Q2)

We had a short recession in early 2020 caused primarily by COVID that only lasted the minimum period of two quarters. During this period, as the chart below shows, St Louis home prices continued to increase at a fairly consistent rate. In 2019 the median price of a home in the St Louis MSA was $188,575 and in 2020 it was $208,000, an increase of 10.3%. Then in 2021, the year after the recession, the median St Louis home prices was $227,000, an increase of 9.1% from the year before.

St Louis MSA Median Price of Homes Sold 2019-2021

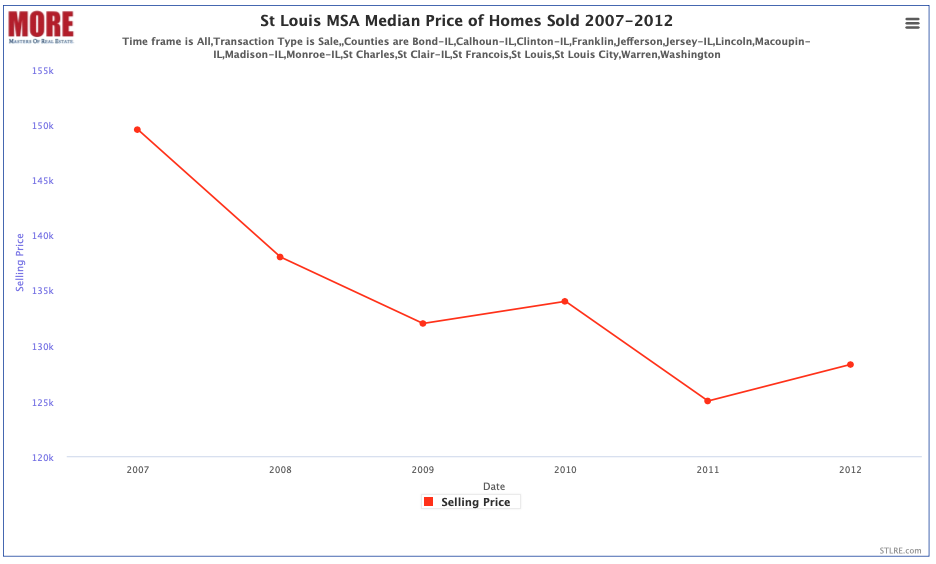

The Great Recession (Dec 2007 – June 2009)

While the “Covid Recession” above appeared to have little if any effect on St Louis home prices, we have to remember this was really caused by external forces, namely a pandemic. Prior to COVID, our economy was going strong and was in arguably the best shape it had been in some time. However, prior to that we had a recession that was brought on by economic conditions and was quite different. In fact, this was one of our worst recessions and had quite an impact on St Louis home prices.

As the bottom chart below shows, St Louis home prices declined during the recession and, after a mild recovery in 2010, declined until 2012. In 2007 the median price of a home in the St Louis MSA was $149,500, in 2008 it had declined nearly 8% to $138,000 and then in 2009 St Louis home prices declined another another 4% to $132,000. In 2010 St Louis home prices increased slightly to $134,000 before falling to $125,000 during 2011. In 2012 we saw home prices being to recover. So, from the beginning of the recession in 2007 until the end of 2011, St. Louis home prices had declined over 16% from $149,500 in 2007 to $125,000 in 2012.

St Louis MSA Median Price of Homes Sold 2007-2012

What will be the effect of the 2022 Recession on St Louis Home Prices?

There are so many moving parts that will affect this I don’t think anyone can really say with any certainty they know what will happen, definitely not me. However, from history, some of which I shared above, I think if we are fortunate enough to have this be just a 2 quarter recession then it may not be so bad. However, if these conditions continue for a longer period, it’s easy to see the longer the recession lasts the more impact it will have on home prices. One other thing that is clear to me is we won’t have to wait long to find out.