Dennis Norman

St. Louis Mortgage Delinquencies and St. Louis Foreclosure Rate hit Record Highs

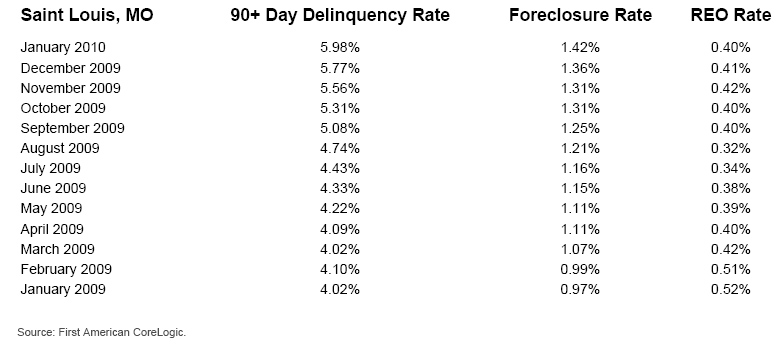

A report released by First American CoreLogic showed the St. Louis metro area to have a foreclosure rate in January of 1.42 percent up slightly from December’s rate of 1.36 percent and an increase of 46.39 percent from the year prior when the rate was 0.97 percent.

The national foreclosure rate for January remains over twice the rate of St. Louis at 3.19 percent and was an increase of 60.3 percent from a year ago when the national foreclosure rate was 1.99 percent.

From new data on mortgage delinquencies, it appears we are going to continue to see the St. Louis foreclosure rate remain at, or above, the current levels for some time. St. Louis homeowners that are are seriously delinquent on their mortgages (90+ days delinquent) rose in January to 5.98 percent of the mortgages in St. Louis. This represents an increase of 4.36 percent from December’s delinquency rate of 5.73 percent and is an increase of 48.76 percent from a year ago when the rate was 4.02 percent. The U.S. rate for seriously delinquent mortgages in January was 8.66 percent, an increase of over 56 percent from a year ago when the rate was 5.53 percent.

So while some of the housing reports for St. Louis are getting better and showing some signs that we may have hit the “bottom” of the market, the foreclosure rate and mortgage delinquency rate hangs over us like a dark cloud. These things lead to distressed sales which bring downward pressure on the market and sometimes makes it hard to establish a bottom and certainly hinders a recovery.

To show you what I mean I’ll share a short story. I had lunch this week with a St Louis real estate agent that has some new homes listed in a new development in a nice part of the city. The list price of his homes is in the $290,000 range, down significantly (15-20 percent) from what the prices were before the crash. The agent said that the price reductions just weren’t enough though, that he was being hurt by REO’s. For example, one home in the development that had sold new a couple of years ago for over $400,000 (it was loaded with extras and upgrades) was foreclosed on and just sold as an REO for $260,000, making his new home, without all the upgrades, at 15 percent more not look like such a bargain. Granted, that was just one REO and it is gone now, but with the St Louis delinquency rates and St Louis foreclosure rates what they are there will be more REO’s.

Leave a Reply

You must be logged in to post a comment.