For those that have been reading my articles for a while, you know I am not a Pollyanna when it comes to the real estate market, opting instead to tell it like it is, even when the news is not so encouraging. For that reason, as well as the data behind my opinion, I think my suggestion that now is a good time to buy a home in St Louis should be considered to be a credible opinion from an industry insider.

So, why buy a home in St Louis now?

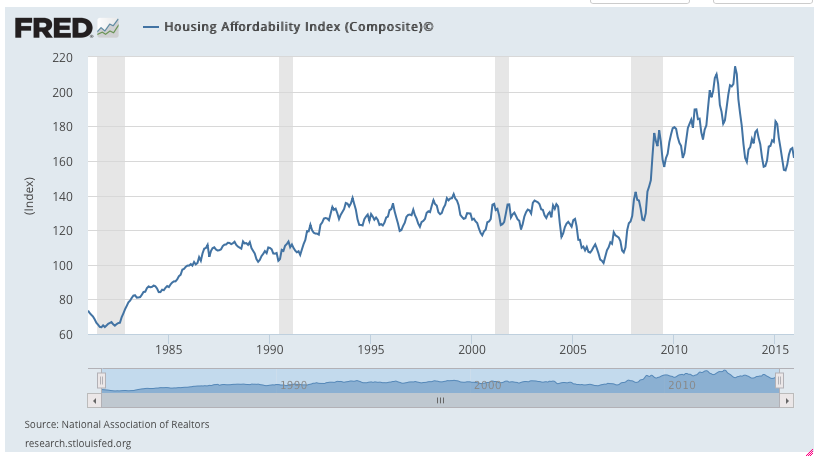

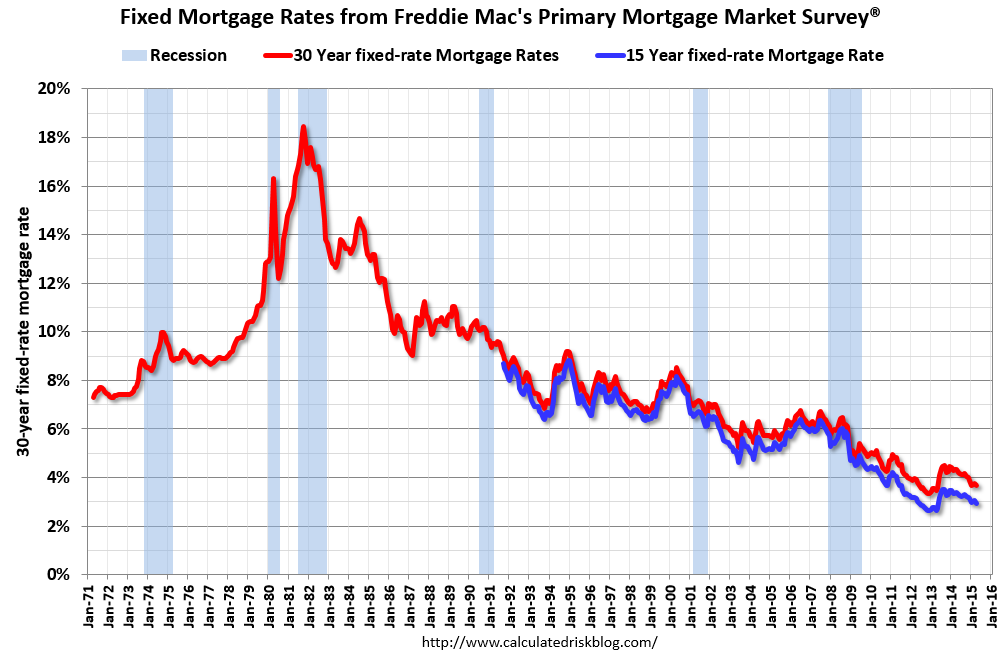

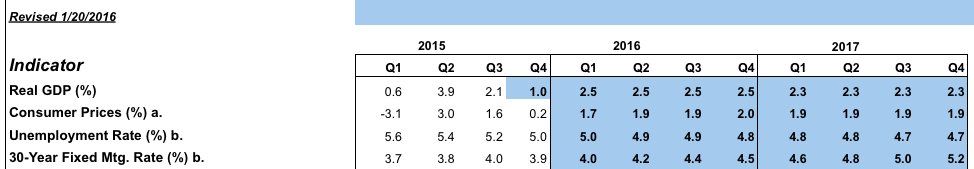

- Interest rates are LOW. As the chart below shows, the current average 30 year fixed rate mortgage interest rate in the U.S. is 3.65%, almost an historic low. Interest rates are not forecasted to remain this low. Freddie mac, as the table below shows, is forecasting that mortgage interest rates will rise this year to 4.5% by year end and continue to rise in 2017 until hitting 5.25% by the end of 2017. An increase from the current rate, even to just the projected rate by year-end of 4.5% increases the payment on a typical St Louis home by over 10%, therefore, the same money buys less house!

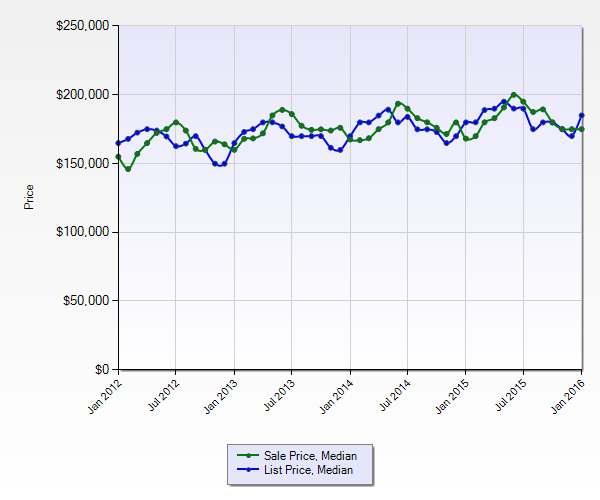

- Home prices are on the rise. As the chart below shows, St Louis home prices have risen about 4% during the past year and the trend has been fairly consistent. As the median list prices show (the blue line on the chart) list prices of homes for sale is on the rise at a greater rate than the increase in recent sold prices. Granted, this may be the result of overly optimistic sellers that believe spring will bring increased home prices (as is the norm) but even if prices remain flat, increased interest rates will still make the home more costly.

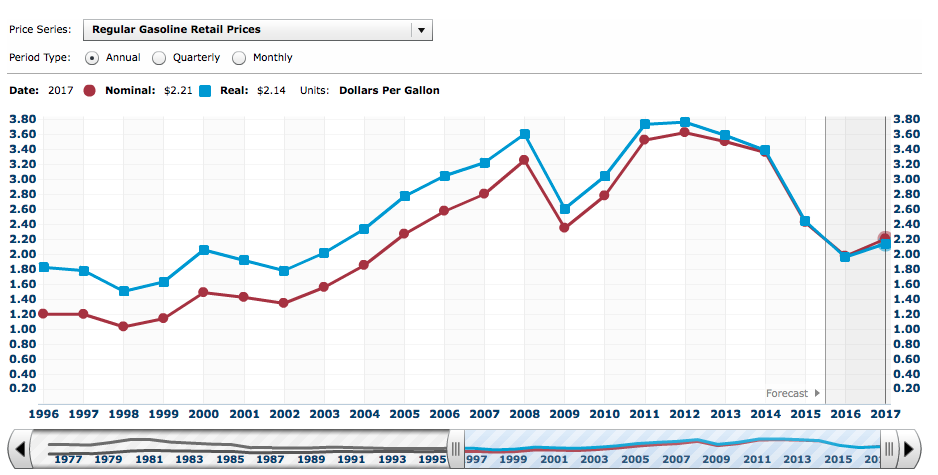

- Gas prices are low and forecasted to remain the same. As the chart below from the U.S. Energy Administration illustrates, gasoline prices this year have hit the lowest price level in about 14 years and the forecast for the rest of this year and through 2017 shows gas prices remaining low. This, along with the other issues noted, should help the St Louis real estate market remain healthy and fairly strong in the short term which will most likely result in continued price appreciation, particularly for areas that are farther out and subject to gas prices.

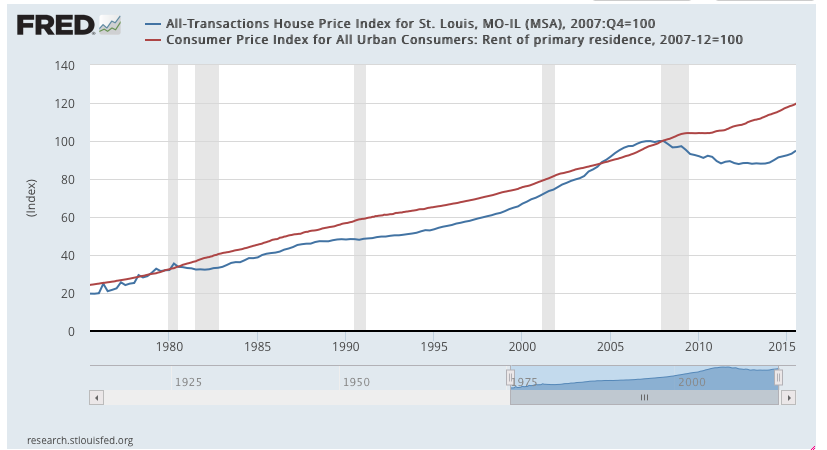

- More affordable to buy than rent but may change soon. There are two charts at the bottom of this article that illustrate what I’m talking about here. The first is a chart from the St Louis Federal Reserve that shows the St Louis home price index and home rental rates from 1970 to present. The chart illustrates that rental rates increase at a very consistent rate and home prices follow along at a similar pace. Presently, home prices have fallen behind rental rates which, based upon history, will result in home prices increasing. Therefore, currently, in many markets it is more expensive to rent than it is to buy but the savings of homeownership will probably shrink, and perhaps disappear, as home prices rise going forward, particularly if home price appreciation begins outpacing rental rate appreciation, which is likely the happen. The next chart, the Housing Affordability Index from the St Louis Federal Reserve, also illustrates how affordable home ownership is presently. Granted, not as affordable as when home prices hit bottom in 2012, the result of the housing bubble burst in 2008, but illustrating that home ownership is more affordable now than at any time prior to the housing bubble burst in 2008.

St Louis Home Price Trends By City/Municipality

2016 SMART Guide For Home Buyers

2016 SMART Guide For Home Sellers

Mortgage Interest Rates – 1971 – Present

Freddie Mac Mortgage Interest Rate Forecast

St Louis 5-County Core Market Median Home Sold Price & Median List Price

Gas Prices – Chart – Historical and Forecast – US Energy Administration

St Louis Home Price Index & CPI For Rent Of Primary Residence – St Louis Federal Reserve

Housing Affordability Index – St Louis Federal Reserve