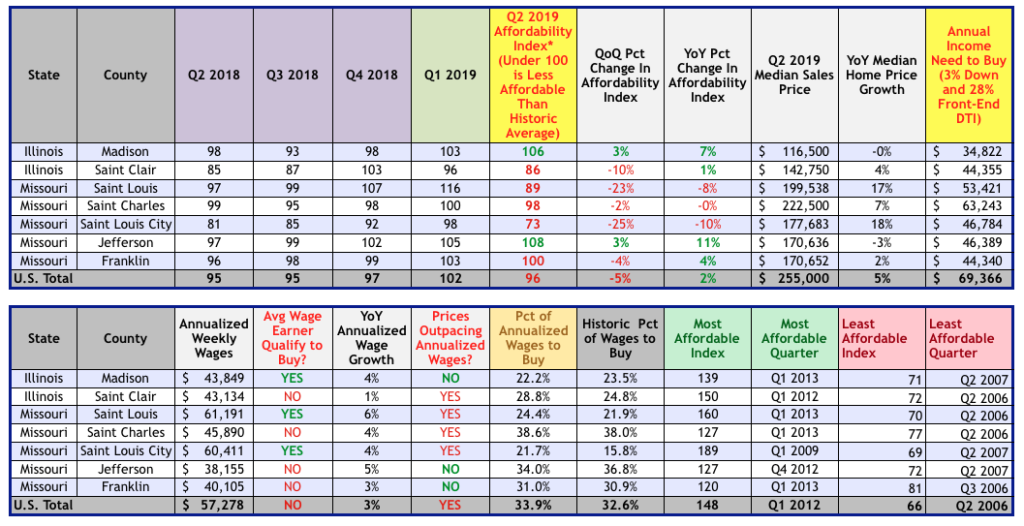

Home affordability declined in the City of St Louis from a 98 on the affordability index in the first quarter to an index of 73 this quarter, for a decline of 25% in home affordability in the City of St Louis, according to the latest data from ATTOM Data Research. In neighboring St Louis County, the affordability was 116 in the first quarter and 89 the 2nd quarter, for a decline of 23%. On the affordability index, anything under 100 indicates homes are less affordable than the historical average and anything over 100 indicates homes are more affordable than the historical average.

Homes became more affordable in Jefferson County and Madison County, IL. during the 2nd quarter. As the table below shows, Jefferson County improved from an already good 105 on the affordability index for the 1st quarter to 108 during the 2nd quarter and Madison County, IL from 103 to 106.

The affordability index takes into account the median home price for the county as well as the median wages for the county, computing what percentage of wages it takes for people in that county to buy a home. In spite of the decrease in affordability in the City of St Louis, it still takes the small percentage of wages (21.7%) to buy a home there. The national average is 33.9%.

Home prices are outpacing wages in 4 of the 7 counties covered…

As the second table below shows, home prices are increasing at a greater rate than wages in four of the seven counties in the St Louis MSA covered in this report. The exceptions are Madison County in Illinois and Jefferson and Franklin Counties in Missouri.

St Louis MSA Home Affordability By County – 2nd Quarter 2019