There is little doubt that lower-income individuals and, subsequently, lower-income neighborhoods, were impacted more negatively by the housing market bubble burst in 2008 than other areas. This resulted in extremely high mortgage delinquency rates, high foreclosure rates, and declining home values. Afterward, citing “loose” lending standards, sub-prime mortgages, etc, the mortgage market tightened the reins on mortgage lending making it more difficult for everyone to get a loan, but particularly, those folks in the lower income brackets.

As time has passed, home loan requirements have eased and it is now easier to obtain a home loan. Some of the requirements that have eased are minimum credit scores, down-payment requirements as well as rules affecting seller paid closing costs, gifts, etc, which has, in particular, helped lower and moderate-income home buyers. The Consumer Financial Protection Bureau (CFPB), the government “watch-dog” of all things financial, tracks and reports data related to home mortgages which reveal that, in fact, home mortgage lending has increased to the highest levels in over a decade in low and moderate-income areas. The CFPB charts below reveal:

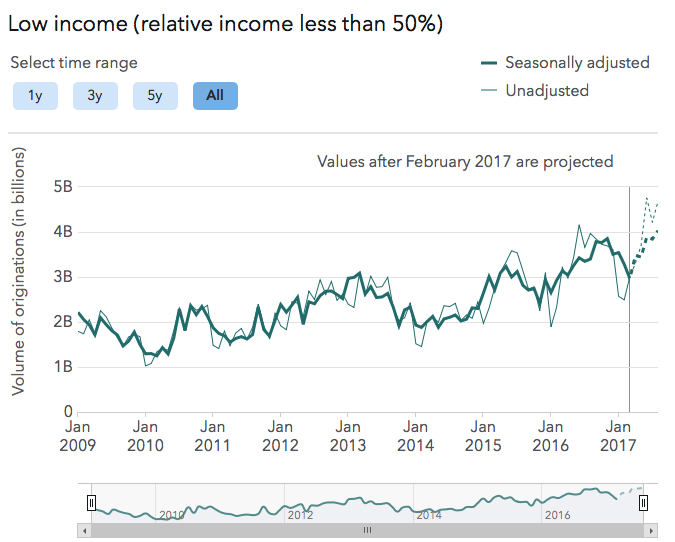

- Home loan volume in low-income areas topped $3.8 Billion in November 2016, the highest level since the CFPB began tracking this data in January 2009. The CFPB forecast, predicts that, once the data is in, a record $4 Billion in home loans will be reported for August 2017.

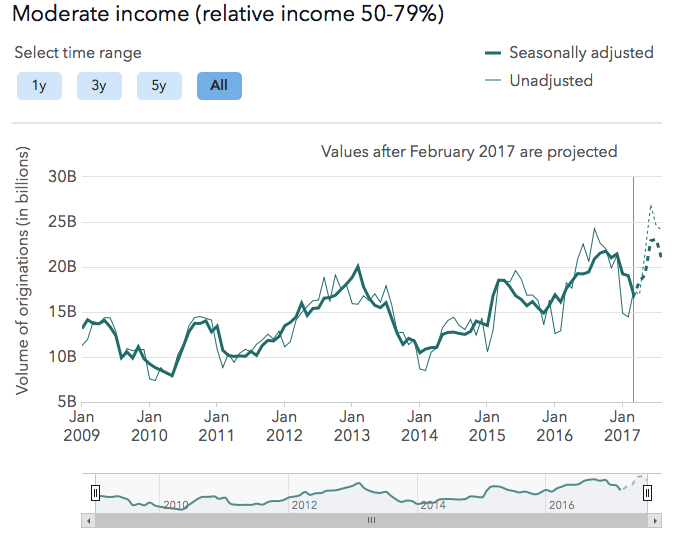

- Home loan volume in moderate-income areas hit $21.7 Billion in October 2016, also the highest level since the CFPB began tracking this data in January 2009. The CFPB forecast, predicts that, once the data is in, a record of $23+ Billion in home loans will be reported for July 2017.

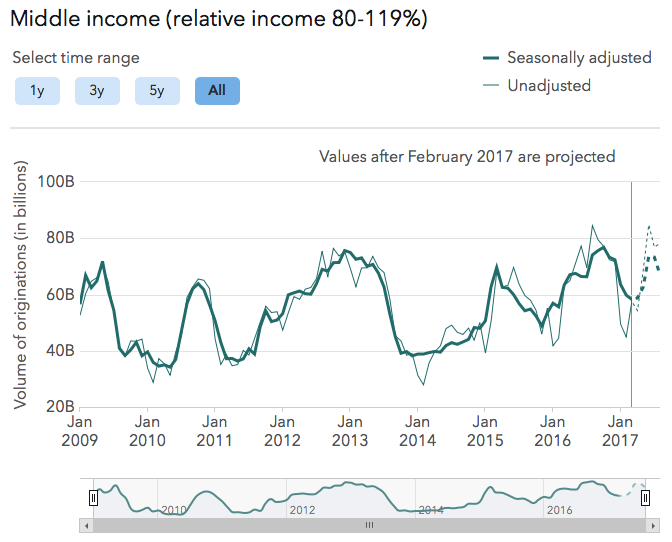

- The middle-income areas have fared well also with home-loan volume hitting a record $76.8 Billion in October 2016. Unlike the low and moderate income area forecasts, the CFPB is forecasting a slight cooling in the middle-income areas with home loan volume dropping to $73.5 Billion for June 2017 and then slightly lower in July once the data is in.

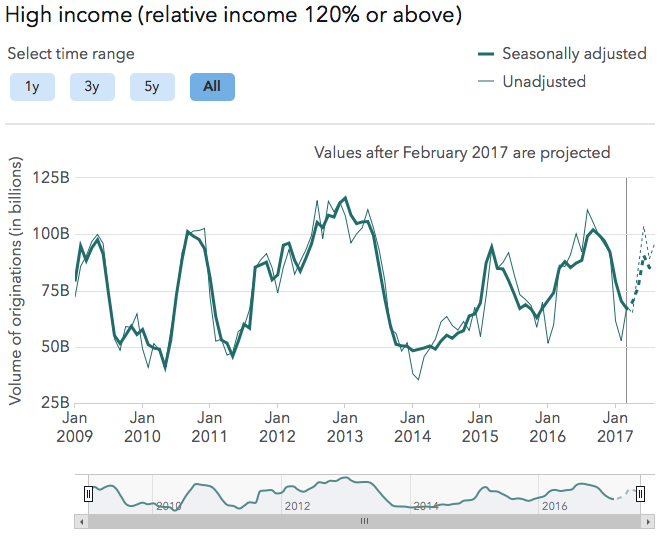

- High-income areas are trailing the other areas in terms of home loan volume having peaked at $116 Billion over 4-years ago, in January 2013. The CFPB is predicting lending data will show $90.5 Billion in home loans in high-income areas for June 2017.

Low-Income Areas – Home Mortgage Volume

Moderate-Income Areas – Home Mortgage Volume

Middle-Income Areas – Home Mortgage Volume

High-Income Areas – Home Mortgage Volume