One month ago yesterday, officer Darren Wilson shot Michael Brown and suddenly Ferguson, the little city where I grew up and began my career in real estate in 1979, became the focus of national news and headlines for days and weeks ahead. Unfortunately, the coverage of the shooting has cast Ferguson in a very negative light and no doubt will hurt the progress the city has made over the past several years to revitalize its city and make it an attractive place to live, work and start a business. This website is about real estate, so while I think this is a tragic event and have prayed for the Michael Brown family, Darren Wilson and his family as well as the community as a whole, and continue to pray that all the facts are revealed so justice will prevail, the focus of this article is the Ferguson real estate market and the impact this has had, and will have, on it.

Ferguson Home Prices Have Been Recovering From The Trough…

Search Ferguson Homes For Sale

Source: MARIS.

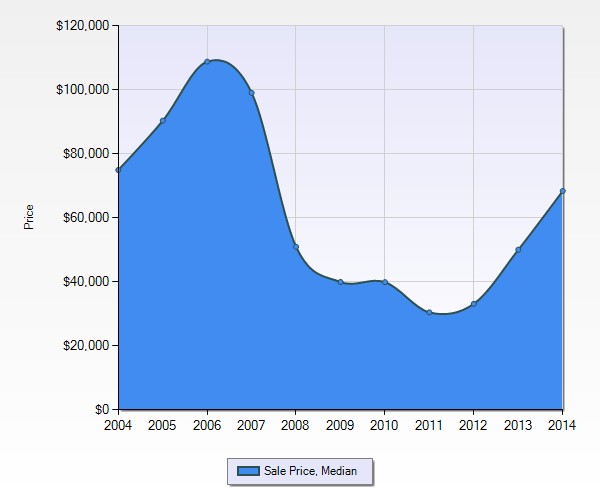

Ferguson home prices, as the chart to the right shows, peaked in 2006 just like they did throughout the St Louis area but then declined after the bubble burst much more than in many areas. Ferguson homes sold for a median price of $108,900 during the peak in 2006 then fell 72% until hitting the trough in 2011 when the median price of homes sold in Ferguson was just $30,488. For the St Louis area as a whole the decline from “peak to trough” in home prices was just 17%, considerably lower than the 72% Ferguson saw.

In spite of the huge decline in home prices, Ferguson home prices have been steadily rising since bottoming out in 2011 and, in fact, have risen 125% since the trough to a median sold price for 2014 thus far of $68,450. So, as of today, Ferguson home prices have climbed back to about 63% of what they were at the peak of the market.

Ferguson Real Estate MLS Stats…

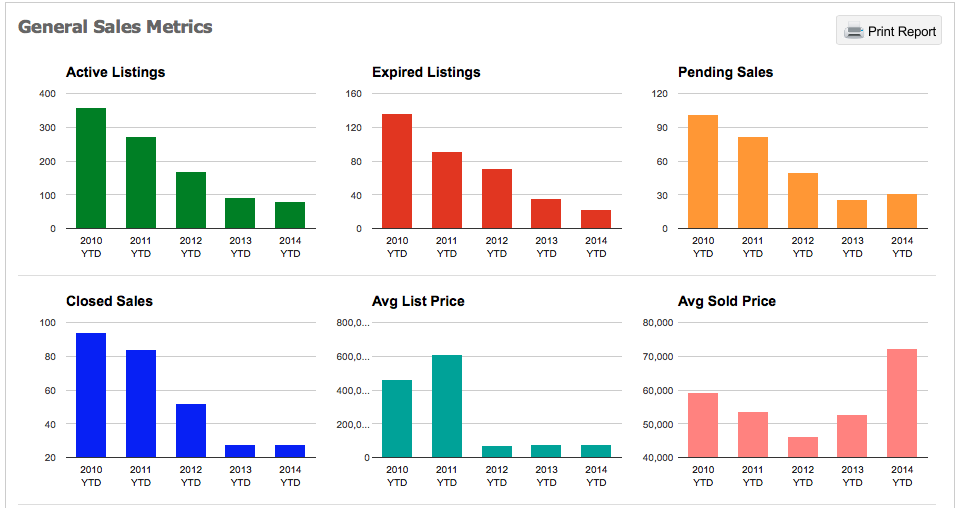

The charts below show MLS activity for the city of Ferguson year-to-date for this year as well as for the same year to date time period for the 4 earlier years. For many of the stats shown the trend is consistent with what we are seeing for the St Louis area as a whole such as fewer active listings now than in years before, fewer expired listings and an increase in sold prices from the year before. The one difference between the Ferguson MLS stats and the St Louis area, is in Pending Home sales. Ferguson pending home sales thus far this year are up 19% from last year while St Louis area pending home sales for the same period are down 4.7%.

The Ferguson Real Estate Since The Shooting…

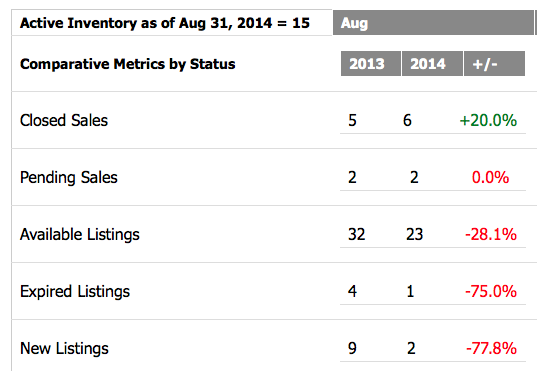

In the month after the shooting of Michael Brown most of the real estate activity in Ferguson looks fairly normal and, as the table below for August shows, pretty well in line with the activity for the same month last year, with the exception being new listings. There was a new listing in Ferguson that hit the market the day of the shooting, on August 9th, but in the 31 days after the shooting not one Ferguson home has been newly listed for sale in the MLS. The two listings shown in the table below came on the market earlier in the month, before the shooting.

The Future of The Ferguson Real Estate Market…

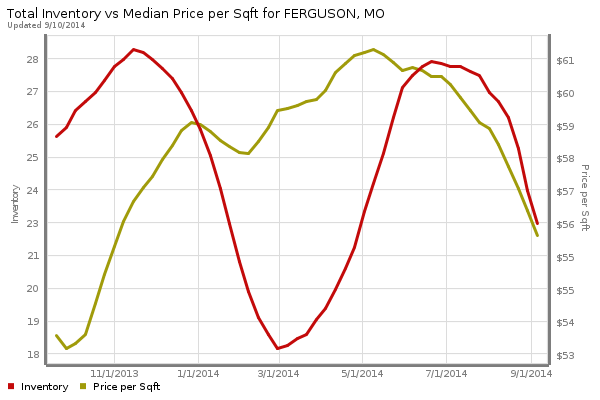

It is impossible to say just how long the Ferguson market will be affected or to what extent home prices and sales will suffer, but I think it’s safe to say there will some fallout from everything that has taken place. As I have shown in this article, the Ferguson real estate market was gaining some traction on a recovery, or at least at a minimum, stability, but it has come to a halt somewhat. How long would-be sellers will hold off listing their homes for sale for fear that they won’t sell or that prices are too soft I don’t know and can’t predict. However, as the chart below, which reflects the median price per foot of homes in Ferguson for the past year as well as the median inventory of homes for sale, shows, prices are on the decline in Ferguson but that is typical for this time of year and we don’t see any change in the trend subsequent to the date of the shooting and the current price is still higher than this time last year. The inventory of homes for sale, like home prices, is showing a seasonal decline however is actually lower than the same time last year. Normally, when I see this combination I would predict increased home prices however, the other factor that drives prices up, in addition to inventory, is demand. What the level of demand for homes in Ferguson will be is hard to predict but in the coming months we should get a pretty good idea of where things are headed.

Copyright 2014 – St Louis Real Estate News