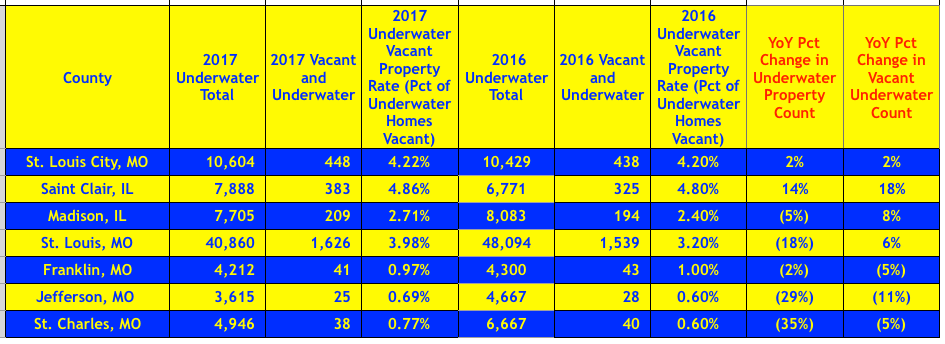

Over the past couple of years, as the St Louis real estate market has continued performing well, mortgage delinquencies and foreclosures have continued to decline. Rising home value has also caused the number of “underwater” homeowners, also known as homeowners in a negative-equity position (meaning their mortgage balance exceeds their homes current value) to decline as well. As the table below shows, 5 of the seven St Louis area counties listed saw a decline in the number of underwater properties in the 3rd quarter of this year from a year ago. The largest decline in underwater properties was St Charles with a 35% decline. The two exceptions, the city of St Louis and St Clair County, Il, saw an increase in underwater property of 2% and 14% respectively.

St Louis Underwater (Negative-Equity) Properties – 3rd Quarter 2017

Are You Underwater And Looking for Options? Get Complete Info Here

Search St Louis Homes For Sale HERE