Loose lending standards in government-backed mortgages is setting up the next wave of defaults and sharp declines in housing prices.

Charles Hugh Smith, Of Two Minds

Beneath the hype that housing has bottomed is an ugly little scenario: lending standards are still loose and the low-down payment, high-risk loans being guaranteed by government agencies are setting up the next giant wave of defaults and foreclosures.

You might have thought that the near-demise of risky-mortgage mills Fannie Mae and Freddie Mac would have cooled the supply of highly leveraged government-guaranteed mortgages–but you’d be wrong, for the Feds have compensated for the implosion of the Fannie/Freddie housing-bubble machines by ramping up their other two mortgage mills: FHA and Ginnie Mae.

These GSEs (government sponsored enterprises) have been around for decades, and have been generally successful due to tightly controlled lending standards.

But the order “save the housing market at all costs!” has been passed down, and the spigots of easy mortgage money have opened. Where FHA only underwrote 3% of the mortgages originated in 2006, now it guarantees about 25%. Between FHA and its VA mortgage sibling, these two GSEs now back fully 40% of all mortgages.

Down payments are as low as 3.5%, and so a first-time buyer making use of his/her $8,000 tax credit could essentially buy a $225,000 house with virtually no money down.

This is moral hazard writ large. Let’s see, the mortgage originator can’t lose because the FHA or Ginnie Mae assumes the risk of default, and the borrower can’t lose more than the few hundred bucks he/she “invested” in closing costs.

In other words, the Federal government has attempted to keep the housing market afloat by ramping up its remaining mortgage mills to fill the easy-money mortgage gap left by the insolvent Freddie and Fannie.

The only problem with this blatant pumping is that a staggering number of these wonderful FHA and Ginnie Mae mortgages are in default and thus doomed to enter the foreclosure pipeline.

Here is a report on the looming FHA fiasco from the Wall Street Journal:

Loan Losses Spark Concern Over FHA:

In the past two years, the number of loans insured by the FHA has soared and its market share reached 23% in the second quarter, up from 2.7% in 2006, according to Inside Mortgage Finance. FHA-backed loans outstanding totaled $429 billion in fiscal 2008, a number projected to hit $627 billion this year.Rising defaults have eaten through the FHA’s cushion. Some 7.8% of FHA loans at the end of the second quarter were 90 days late or more, or in foreclosure, according to the Mortgage Bankers Association, a figure roughly equal to the national average for all loans. That is up from 5.4% a year ago.

Some economists say the FHA’s lending has been crucial to preventing a deeper bust in property. Thomas Lawler, an independent housing economist, said “the alternative could have been a complete meltdown of housing finance” that would have ultimately led to much larger losses. Critics have said the FHA, which has never had a chief risk officer, isn’t able to manage such a large portfolio in an unstable market.

Policymakers have used the FHA to stabilize the housing market by pushing it to offer credit with far easier terms than that offered by most private lenders. For example, it will back loans with down payments as low as 3.5%.

Much of the FHA’s risk comes from its growing exposure to the broader economic downturn. The FHA is particularly sensitive to home-price declines because of the small down payments it will accept, which can quickly become wiped out by a fall in home values.

It isn’t just FHA loans which are in trouble: the supposedly “low-risk” prime mortgages are defaulting, too:

Troubles For ‘Prime’ Borrowers Intensify

The mortgage-delinquency rate among so-called subprime borrowers reached 25% in the first quarter but appears to be leveling off, rising only slightly in the second quarter. The pace of delinquencies for prime borrowers is accelerating. Since prime loans account for 80% of U.S. bank exposure to mortgages and credit cards, these losses could ultimately exceed those from weaker borrowers.”The subprime pain is in the rearview mirror,” says Sanjiv Das, head of Citigroup Inc.’s mortgage business, which is seeing delinquencies rise among prime borrowers, who make up three-quarters of its mortgage portfolio.

In many cases, these “prime” customers, whose high credit scores afforded them the best interest rates on mortgages and credit cards, lost their jobs over the past few months and only now are running out of temporary fixes that have been keeping them afloat.

The trend signals more bad news for U.S. banks. Rising delinquencies on prime mortgages helped drive the total mortgage-delinquency rate to a record 9.24% in the second quarter, according to the Mortgage Bankers Association. The data reflect loans at least one payment past-due.

Such delinquencies on mortgages made to prime customers rose 5.8% in the second quarter, compared with a rise of 1.8% among subprime customers. Still, the delinquency rate for prime loans was 6.4%, far below the 25.4% rate for subprime loans, according to the Washington-based trade group.

About 40% of the strapped consumers seeking help from the OnTrack Financial Education & Counseling center in Asheville, N.C., are prime borrowers, up from 15% last year, says Tom Luzon, director of counseling services at the United Way agency.

Let me try to describe the mortgages packaged by Ginnie Mae last year: there is a lit fuse about an inch from a box of dynamite. Courtesy of Zero Hedge, here is a report on the mortgage-backed securities bundled by Ginnie Mae last summer. It’s filled with industry lingo and acronyms (LTV = loan to value, etc.) but I think you’ll get the gist: a significant percentage of these loans are already delinquent.

An Insider look at Ginnie Mae MB:

here’s a look at a random GNMA MJM 6%cpn (G2 4216) collateral issued in Aug 2008 – around 1300 loans to start, original principal $1b, median 95% LTV, WAOLS ~$466k… 94 loans paid off (how many short sales do you think?)… another ~225 30+ days delinquent… reminder, this is ONE YEAR LATER and July numbers….Here’s a GNMA MJM 7%cpn (G2 4218) from Aug 2008 – only 26 loans in this one, $12mil at issue, 95% median LTV, WAOLS ~$498k…. 15 of those loans are delinquent. 7 loans are 90+ days – several probably never made a payment.

According to your Tuesday, July 21, 2009 entry, “Fed Mortgage Report – What’s Ginnie Mae Up To?”, GNMA gtd loan amount outstanding has expanded by close to 50% from 2Q 08 to 2Q 09….. if these MJM’s are any sign, in my estimation, we (taxpayers) will be taking losses with 20-40% severities on those new loans…

The more traditional GNMA securities made up of ‘conforming loan amounts’ are likely not much better: mostly bought with 3.5% down to 1st time buyers – oh, and they also got to monetize their tax-credit, so really have no skin in the game at all….

Here’s a random conforming loan size GNMA pool (G2 4170) from June 2008 – 12,224 loans, $199k WAOLS, 97% median LTV, $2.46bil original pool size: 227 paid off, 2700 delinquent.

That means 22% of these mortgages are already delinquent. That’s roughly the same rate as the despised subprime loans (25%). And as I pointed out in The Pareto Principle and the Next Wave Down in Real Estate (August 24, 2009), delinquencies feed the foreclosure pipeline.

As noted in my article Housing bottom premature. The clue? Foreclosure pipeline full, the “cure rate”–the rate at which mortgage holders “catch up” and become current in their payments–has fallen drastically, which means that the majority of delinquent mortgages will end up in foreclosure.

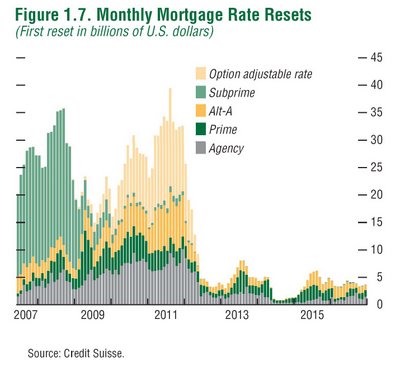

Let’s not forget all those mortgage re-sets coming up. Maybe rates will still be low in 2010-2011, but maybe not–and in any event, those with interest-only mortgages will get hit with principal for the first time, increasing their monthly payment:

As an Exotic (interest-only) Mortgage Resets, Payments Skyrocket (N.Y. Times)

Here’s a chart of exponentially rising bank credit–gee, did that have anything to do with the housing bubble?:

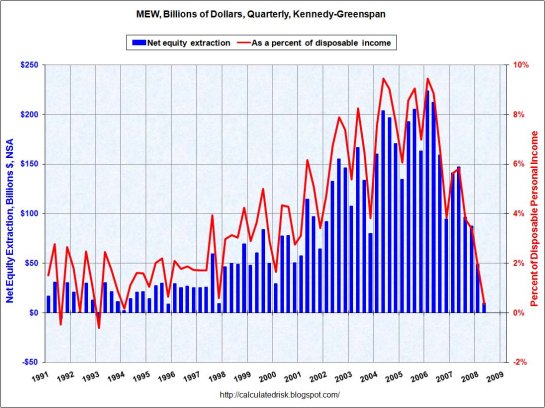

And just as a reminder that one-third of all homeowners are underwater in their mortgages, i.e. they have no equity to extract:

Which may have something to do with this chart of consumer spending:

All these mortgage delinquencies and defaults are filling the pipeline of future foreclosures–a tsunami of supply which will swamp demand. How can prices rise when the supply will keep rising as FHA, Ginnie Mae and “prime” mortgages are all souring?

And with home equity gone, so too is consumer spending–and exactly where are all the jobs going to come from to support a new wave of mortgage borrowing and home buying?

Yes, you can essentially give houses away with “free money” tax credits and near-zero down payments–but then those people have no incentive to keep paying if things get dicey, and the mortgage originators have no incentive to manage risk as long as the government will guarantee any high-risk toxic mortgage you want to write.

The incentives are all perverse, and so why should we expect the consequences to be anything but perverse?

Bottom line: if you’re looking for the bottom in housing, be patient. We haven’t seen the final decline by any stretch of the imagination.

Permanent link: Setting Up the Next Leg Down in Housing

If you want more troubling/revolutionary/annoying analysis, please read Free eBook now available: HTML version: Survival+: Structuring Prosperity for Yourself and the Nation (PDF version (111 pages): Survival+)

“Your book is truly a revolutionary act.” Kenneth R.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

Leave a Reply

You must be logged in to post a comment.