Yesterday afternoon, the Federal Reserve released a statement that was quite a vote of confidence for how the economy is doing. The Fed Reserve’s statement included “…the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low.” and went on to say “Market-based measures of inflation compensation remain low;”.

As a result of the positive economic conditions, the Federal Open Market Committee announced it would lower the target range for the federal funds rate to 2 to 2-1/4 percent. The committee went on to give a very positive outlook on the future economy as well saying that “sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes…”.

Will the move by the Fed Reserve cause lower mortgage interest rates?

It’s hard to say if this announcement will prompt immediate lower interest rates as the mortgage market takes a little longer view of things. However, while we don’t know if mortgage rates will decline or, if so by how much, I think, absent some major shift or change in the economy, it is safe to say that mortgage rates are not going up at this time or in the very near future.

Mortgage interest rates have been at historic lows for years…

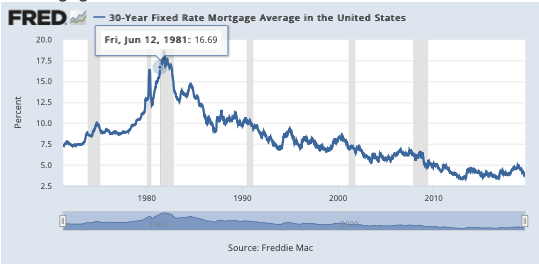

Since the average interest rate on a 30-year fixed-rate mortgage has been below 5 percent since February 2011, I realize this seems like the norm however if you look at the chart from 1971 to present below, you will see that, from 1971 until sometime in 2009, interest rates stayed above 5 percent. If you really want an appreciation of just how low today’s rates are, look at 1981 on the chart when interest rates hit 18%. Yes, I’m talking about mortgage interest rates, not credit card rates! I was 2-years into the real estate business at the time and really wondered what kind of mess I had gotten myself into.

Mortgage Interest Rates – 30 Year Fixed-Rate – 1971 – Present (Chart)

(click on chart for live chart)

Just how much impact do interest rates have on the cost of owning a home?

Yesterday, I wrote an article in which I showed how the rate of increase in rents substantially outpaced the increase in interest rates. Below is an illustration of the positive impact of the recent lower interest rates on homeownership.

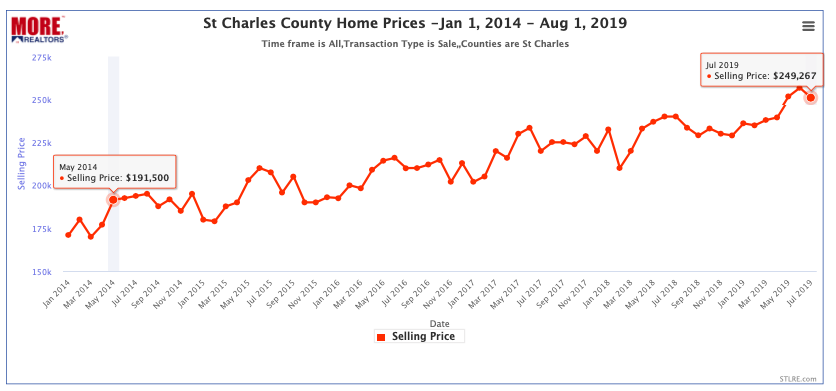

Let’s say someone bought a home in St Charles County in the early spring of 2014 and they bought a median-priced home. As the chart below shows, the median home price in St Charles County in May 2014 was $191,500. The interest rates at that time were 4.29%, which is still quite low, but higher than today. Let’s further assume that the buyer borrowed 95% of the purchase price, $181,925, giving them a principal and interest payment of $899.00. Now, let’s flash forward to today, the median price of a home in St Charles County today has increased by 30% to $249,267. If we again assume the buyer borrows 95% of the price, $236,803, then at the current rate (before the announcement by the Fed even) of 3.75%, their principal and interest payment will be $1,097.00, an increase of just 22% from the payment 5 years ago for the same home. So, while the home price increased by 30%, the payment only increased by 22% thanks to lower interest rates.

St Charles County Home Prices – Jan 1, 2014 – August 1, 2019

[xyz-ips snippet=”Seller-Resources—Listing-Targeted”]