The Millennial generation, consisting of people born between 1980 and the mid-2000s, make up about one-third of the U.S. population and, as more of them are becoming adults, have been seen as perhaps the saving grace to a lagging home market. Unfortunately, thus far, the Millennial’s have appeared to favor renting rather than buying, although that may be more the result of necessity than desire, the result of increased student loan debt and tight lending standards. However, according to a survey of Millenial’s recently conducted by the California Association of REALTORS, a majority of the Millenial’s plan to buy a home in the next five years and over half (54%) of the 18-34 year-olds surveyed gave homeownership and importance of “8” on a scale of 1 to 10.

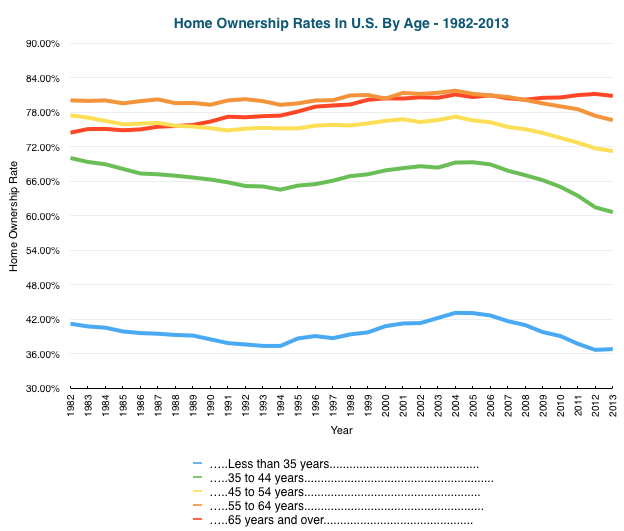

This is good news for the housing industry as, like the chart below illustrates, the homeownership rate by people less than 35 years old has been at historic lows at just over 36.5% the last couple of years after peaking at 42.6% in 2006. Considering there are 24.8 million people in this category, if the rate of home ownership increases by just 1% that could increase home sales by 250,000 sales.

Search ALL St Louis Homes For Sale

See ALL Homes That Will Be Open In St Louis This Weekend

Copyright 2014 – St Louis Real Estate News – All Rights Reserved