By Dennis Norman, on March 17th, 2017 My headline is a rhetorical question and I personally don’t think landlords and tenants are bad people but, after seeing so many municipalities work so hard over the past few years passing ordinances that, in many cases, in my humble opinion, tramples the property rights of landlords as well as the rights of tenants, one would have to believe that landlords and tenants must be some pretty bad people. After all, if not, why would some municipalities work so hard to discourage them from entering their cities and work hard to chase them out?

For example, the most recent egregious example of this comes from the north-county city of Berkeley, where, last September, the city council passed an ordinance (#4320-bill can be seen at bottom) that put a “30-percent limitation of single-family rental homes per residential block“. Bill number 4456, which was the bill introduced that became the ordinance, gave the purpose of the new ordinance to be:

“The City (Berkeley) seeks to create a positive impact in city neighborhoods by creating an atmospher for residents to enjoy a good quality of life by creating a 30-percent limitation of single family rental homes per residential block”

Since the city of Berkeley seems to equate “a good quality of life” with a “limitation of single family rental homes‘ I think, by negative inference, we can come to the conclusion that Berkeley is saying rental homes, and I would guess either the people that own them, or the tenants that live in them, must negatively impact, or run counter to, “a good quality of life” in their neighborhoods which now brings us back to my initial question, are landlords and tenants bad people?

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

How to Buy Foreclosures – Advice From a 2,000+ Home Investor

Find The Value Of Any Home In Under A Minute!

Continue reading “Are Landlords and Tenants Bad People?“

By Dennis Norman, on February 19th, 2017 Investors that rental property may find their best returns, relative to the price of the homes they buy, in the City of St Louis, according to some county-level rental data compiled by MORE, REALTORS. As the tables below illustrate, over the past 12 months the median price of homes sold in the City of St Louis was $106.57 per square foot and the median annualized price per foot homes lease for was $11.04 which works out to a gross annual return on investment of 10.4% in the City of St Louis, the highest of the four St Louis area counties we looked at. The next best return is found in Jefferson County with a 9.8% return, followed by St Charles County at 9.3% and finally, St Louis County, at 9.1%.

Data limitations…

There is an excellent source of very accurate market data available with regard to prices of homes sold, that being the REALTOR MLS which is where our sold data comes from. One of the reasons this data is so accurate is because the lions share of homes sold in St Louis are done through REALTORS and the data that is reported on those sales to the MLS is subject to strict guidelines and rules to insure accuracy. When it comes to rental and lease data however, the data is much harder to assimilate. This is because the majority of rentals are leased without the assistance of REALTORS and therefore the lease data does not make it’s way to the MLS and there really is no other reputable data source available for it. When it comes to rental data for larger apartment complexes and the like, there is such data available, but not for single family homes. Therefore, we have worked to produce rental data from the leases that are handled by REALTORS. As you can see from the tables below, the number of leases reported in the MLS is much smaller than sales (1,283 vs 13,330 for St Louis County for example) however, there are enough reported I believe to make the data statistically significant.

We can drill it down more…

We can drill down the data to a more local level, such as at the school district, city or zip level, and do this for our investor clients, but what I’ve compiled here gives an overall view of the market at the county level. Another thing I suggest investors evaluate as well before investing their money, is the appreciation rate of homes in that area. This is data we also compile and, when you put the rental return rate data next to the price appreciation data you get a pretty good picture of the areas that make the most overall sense to invest in.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

How to Buy Foreclosures – Advice From a 2,000+ Home Investor

Find The Value Of Any Home In Under A Minute!

Continue reading “Landlords Get Best Return With Rentals In City Of St Louis“

By Dennis Norman, on January 20th, 2017 When I first got in the real estate business in 1979 buying foreclosed property was something pretty well limited to speculators at the time. People like the broker I started with, and what I became a few years later, that bought property for cash, as-is generally to fix up and resell. Foreclosures, and how to buy them, were a mystery at the time, not only to the general public but to many in the real estate business as well. This is what gave us speculators an edge…we knew how to get the information on foreclosures and how the process worked. Ditto for tax sales and sheriff sales and short sales were something that didn’t even exist at the time.

Today, it’s all different however. Thanks largely to the internet and reality TV, it seems everyone knows about foreclosures, tax sales, and just about every other way of finding and buying distressed property. While this is good for sellers and for listing agents, it’s made it tough on investors and other buyers looking to take advantage of the opportunity offered through distressed sales. The result has been a highly competitive market and higher prices. This was evidenced by the sales data from last year. As the tables below show, most of the distressed homes sold during 2016 sold for a median of 100% of the current list price at the time of sale.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE Continue reading “Want To Buy A Foreclosure Or Short Sale? Better move quick and pay up!“

By Dennis Norman, on December 29th, 2016 The number of distressed home sales in St Louis has been on the decline while distressed home prices have remained relatively flat. For the purposes herein, a “distressed” home sale includes short sales, foreclosures, bank-owned and government-owned homes. Thus far, as the chart below illustrates, there have been 2,170 distressed home sales in the St Louis 5-County Core market (the City of St Louis and Counties of St Louis, St Charles, Jefferson and Franklin) this year which is a decline of 23% from last year when there were 2,871 distressed homes sold and down 38.4% from 2014 when there were 3,533 distressed home sales in St Louis. The median price of distressed homes sold in St Louis has not fluctuated much over the past 3 years however, with the median price of distressed sales in 2014 at $61,750, then decreased to $60,000 in 2015 then went up to $62,500 this year.

As the table below the chart shows, currently there are 394 active listings of distressed homes at a median list price of $64,950 which, based upon current sales trends, is a supply of just under 3 months.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE Continue reading “Number of Distressed Home Sales In St Louis Declines Nearly Forty Percent In 2016 From Two Years Ago“

By Dennis Norman, on November 4th, 2016 A report recently released by ATTOM Data Solutions revealed shows distressed home sales in the U.S. (foreclosures, short sales and bank-owned real estate) accounted for just 12.9 percent of the home and condo sales in the U.S. during the 3rd quarter of this year which is down from 15 percent during the 2nd quarter and down from 15.9 percent a year before. This is the lowest level for distressed home sales since the 3rd quarter of 2007, according to the report. Distressed home sales peaked during the first quarter of 2009 when they accounted for 43.9 percent of all home and condo sales in the U.S.

St Louis Distressed Home Sales:

St Louis distressed home sales have followed suit and are on the decline as well. As the chart below shows, there were 167 distressed home sales last month, down 17 percent from a year ago when there were 207 distressed homes sold during the same period. However, if look at the past 3 months, there were 561 distressed homes sold in St Louis, down just 6.7 percent from the same period a year ago when there were 601 distressed home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE Continue reading “Distressed Home Sales Fall To Lowest Level In 9 Years“

By Dennis Norman, on October 29th, 2016 The rental vacancy rate in the St Louis MSA the U.S. during the third quarter of this year rose to 9.5 percent from 5.5 percent the prior quarter, according to the latest data released by the U.S. Census Bureau. It is worth noting though that the 5.5 percent vacancy rate seen during 2nd quarter was, as the historical table below shows, the lowest quarterly vacancy rate for the St Louis MSA in well over a decade and 9.5 percent for the 3rd quarter of 2016 is still much lower than the 13.9 percent vacancy rate we saw for St Louis during the 3rd quarter of last year.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “St Louis Rental Vacancy Rate Rises In 3rd Quarter But Still Down From A Year Ago“

By Dennis Norman, on October 21st, 2016 The city of St Louis is one of the “Top 17 Single Family Rental Millennial Meccas“, according to a report just released by Attom Data Solutions. As the interactive info graphic below shows, St Louis joins the likes of Baltimore Maryland, Milwaukee Wisconsin and El Paso Texas, along with others, as a place that is ripe for investors to rent homes to millennials. For the report, millennial were defined as people born between 1979 and 1993. According to the report, investors that purchased rental homes in the city of St Louis during the first half of 2016 saw a gross rental yield of 12%, nearly 50% higher than the national average of 8.7%. In addition, millennials make up nearly a third of the population of the city of St Louis (29.3%) and 29.8% of the city is rental property, making for a solid rental market. On the downside, the average wages in the city of St Louis is down 2% from last year.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

How To BUY Foreclosures From a 2,000+ Home Investor

Continue reading “City of St Louis Makes List of Top Millennial Rental Meccas“

By Dennis Norman, on October 16th, 2016 On October 10th (well, technically October 11th since the final vote was not taken until reportedly 1:00 am) the city of Florissant dealt it’s latest blow to landlords and tenants. The blow by way of Crime Free Bill No. 9226 which was introduced by the Florissant City Council as a whole and was passed unanimously by the council in spite of opposition to the bill expressed by the St Louis Association of REALTORS, EHOC and others. I have provided below a complete copy of Article XVII: Residential Real Estate of the city of Florissant ordinances as this was the section that was changed by the bill.

Highlights of changes as a result of Crime-Free Bill No. 9226:

(We work hard on this and sure would appreciate a “Like”)

Get Live St Louis Real Estate Market Data By City, Zip or County HERE Continue reading “Florissant Tramples the Rights of Landlords and Tenants With Passage of Crime Free Bill“

By Dennis Norman, on October 13th, 2016 There were 293,190 foreclosure filings in the U.S. during the 3rd quarter of 2016, which is a decrease of 10 percent from a year ago, according to a report released today by Attom Data Solutions. This marks the fourth consecutive quarter in which foreclosure activity has decreased on a year-over-year basis and continues the steady downward decline in foreclosure activity we have seen for 6 years and has now finally fallen back to levels we saw prior to the housing bubble.

St Louis Distressed Home Sales Decline

Given the downward trend in foreclosure activity, it is not surprising that distressed home sales in St Louis (foreclosures, REO’s and short-sales) have declined as well. As the chart below shows, over the past 24 months distressed home sales in the St Louis core market (the city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) peaked in April of 2015 with 300 distressed home sales but have trended downwardly since to 165 distressed home sales last month. St Louis distressed home prices have remained fairly constant over the past 24 months. with a median sales price of $61,276 over the 2-year period and a median sold price of $60,550 in September.

By Dennis Norman, on September 27th, 2016 There were 184 distressed homes (short-sales and foreclosures) sold in St Louis (the 5-county core market) during the month of August, an increase of 44 percent from July when there were just 128 distressed home sales. As the chart below shows, distressed home sales in August 2016 declined 5 percent from August 2015 when there were 194 distressed homes sold in St Louis.

As the table below shows, the median price of distressed homes sold over the past two years was $61,000 and for the most recent month, August 2016, the median price was $$65,050.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Search Short Sales for Sale HERE

Search St Louis Foreclosures For Sale HERE

Continue reading “St Louis Distressed Home Sales Increase Over 40 Percent In August“

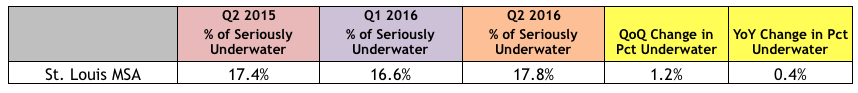

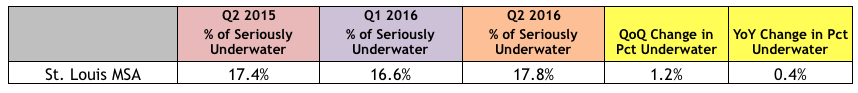

By Dennis Norman, on August 11th, 2016 The number of homeowners that are “seriously underwater“, or in a negative-equity position, increased during the 2nd quarter of this year, according to a report just released by Attom Data Solutions. During the 2nd quarter of 2106, 17.8% of the homeowners, with a mortgage, in the St Louis MSA were in a negative equity position, up from 16.6% the quarter before and up just slightly from 17.4% during the 2nd quarter of 2015.

To be included in this report, a homeowner has to owe 125% of the current value of their home, so these people are definitely “seriously underwater”. Obviously, there are many more people that are in a negative equity position, meaning they owe anywhere from 100% to 125% of the value of they home in mortgages.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

St Louis Market Data (Home Prices, Sales, Trends and MORE) By City, Zip or County

By Dennis Norman, on July 14th, 2016 There were 4,935 foreclosure filings on homes in the St Louis metro area during the first six months of 2016, a decline of 27.1% from the second half of 2015 when there were 6,770 foreclosure filings and down 9.75% from the first half of 2015 when there were 5,468 filings, according to a report just released by RealtyTrac.

As the table below shows, for the first half of 2016, foreclosures decreased in 13 of 15 counties in the St Louis area from the 2nd half of 2015 and 10 declined from the same period a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE Continue reading “Foreclosures In St Louis During First Half of 2016 Down Over 27 Percent From Prior Period“

By Dennis Norman, on June 16th, 2016 Foreclosure activity in the St Louis metro area during the month May occurred at a rate of 1 foreclosure action for every 1,267 homes, an increase of 20.3 percent from the month before, but a decrease of 9.75% from a year ago, according to a report just released today by RealtyTrac.

As the table below illustrates, 5 of the seven Missouri counties, and 2 of the eight Illinois counties, saw a decline in foreclosure activity in May from the year before, and 1 Missouri county, and 3 Illinois counties, saw a decline from the month before. Of the fifteen counties reported, only 3 saw a decline in foreclosure activity in May both from the month before, as well as year before, those being the City of St Louis in Missouri and Jersey and Monroe counties in Illinois.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE Continue reading “St Louis Foreclosure Activity Declines Nearly Ten Percent in May From Year Ago“

By Dennis Norman, on June 10th, 2016 UPDATE February 3, 2017 –

Representative Gary Cross has introduced HB 705 which would repeal this legislation. Ironically, Rep Cross is the representative that first introduced the original legislation, HB 1862. I’m guessing he has come to realize the problems this legislation has caused, which I believe were unintended consequences, and has chosen to fix the issue which I praise him for!

##

This legislative session, the Missouri State Legislature passed HB. 1862, which modifies provisions relating to the existing landlord-tenant law in Missouri, specifically, it repeals sections 534.350, 534.360, 535.030, 535.110, 535.160 and 535.300 of the Revised Statutes of Missouri and replaces them with five new sections as described in the bill. The bill has been delivered to Governor Nixon and, if signed by him, will go into effect August 28th of this year.

Why This New Law May Force Landlords (even licensed real estate agents) To Use Property Managers:

While this bill has some good things in it, such as establishing some reasonable procedures and time lines for a landlord regaining possession of a property as well as doing a little housekeeping with regard to what can be deducted from a security deposit, the bill also makes, what I believe to be, a very damaging change to the law with regard to security deposits. With regard to security deposits held by landlords, the bill changes section 535.300 (2) to read (emphasis is mine):

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Get a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

Continue reading “New Landlord-Tenant Bill Make Force Missouri Landlords To Use Property Managers-UPDATED Feb 3, 2017“

By Dennis Norman, on June 2nd, 2016 Home flipping accounted for 8.1 percent of all the home sales in the St Louis MSA during the 1st quarter of this year according to a report released today by RealtyTrac. This is up 20 percent from the prior quarter however is a decline from the first quarter of 2015 when flipped homes accounted for 8.3% of all the homes sold.

Home flipping in St Louis peaked in 2006…

During the first quarter of 2016, over 1 out of every ten home sales (10.7%) in St Louis was a flip, the highest level ever seen in St Louis since RealtyTrac began tracking flips.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here. Continue reading “Home Flipping in St Louis Declines In 1st Quarter From Year Ago“

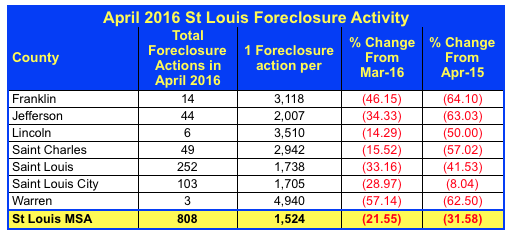

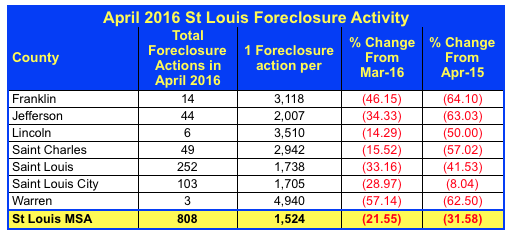

By Dennis Norman, on May 19th, 2016 St Louis foreclosure activity during the month of April decreased to 1 foreclosure action for every 1,524 homes, a decline of 31.58 percent from April 2015, according to a report just released by RealtyTrac.

As the table below illustrates, foreclosure activity during the month of April decreased from the month before, as well as the year before, in all seven Missouri counties that make up the bulk of the St Louis market.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

By Dennis Norman, on April 23rd, 2016 Earlier this month, General Counsel for the U.S. Department of Housing and Urban Development (HUD) issued guidance on the “Application of Fair Housing Act Standards to the Use of Criminal Records by Providers of Housing and Real Estate-Related Transaction“. This guidance has caused concern among many landlords as many, in an effort to assure safe housing for their tenants, do criminal background checks on prospective tenants and have a policies against renting to applicants with a criminal background, a practice that, according to this guidance, may very well be considered to be discriminatory now.

Do landlord have to rent all all convicted felons?

While the guidance does not appear to remove a landlord’s ability to establish some restrictions on who they rent to with regard to prior convictions, however does say:

By Dennis Norman, on April 22nd, 2016 Today is earth day, so here are some interesting housing facts from the U.S. Census Bureau, related, more or less, to earth day issues:

- 48.8% of all homes in the U.S. have gas as a primary heat source;

- 2.1% of all homes in the U.S. have wood as a primary heat source;

- <1% of all homes int he U.S. have solar energy as their primary heat source;

- 91% of the new single-family homes built in the U.S. in 2014 have air conditioning;

- The median size of a new single-family house completed in 2014 was 2,453 square feet.

- The median price of a new single-family house completed in 2014 was $345,800

- There were 11,000 multi-family buildings built in the U.S. in 2014 – 63% of them have electricity for their primary heat source.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search ALL Homes For Sale – Updated MLS-Direct Every 5 Minutes!

2016 SMART Guide For Home Buyers

2016 SMART Guide For Home Sellers

By Mike Hejna, on April 8th, 2016

St. Louis County is entertaining the idea of adding the City of St. Louis to its list of incorporated municipalities. All legal opinions firmly show that the County will absorb NONE of the City’s nancial responsibilities. If this were to happen the City of St. Louis will be no different than municipalities such as Clayton, Ellisville, or Chester eld. It would simply be another city located in St. Louis County. I am an advocate for this move. The City needs to cease County functions and turn them over to the County. Currently, practices and city functions run at inefficient levels.

If the city were to join the St. Louis County roster then we would have about 91 municipalities in the County. It should be noted though that 23 of them have less than 1,000 in population. Why does that make sense for a few blocks of St. Louis County to incorporate? If you ask them, they want to control their neighborhood, perhaps a worthy endeavor. However, we then have 90+ City Administrations for a population of 1.3 million (City and County). Some may suggest that this is very inefficient and a misuse of funds. But how inefficient is it really?

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

St Louis Market Data (Home Prices, Sales, Trends and MORE) By City, Zip or County

Continue reading “What do 90 municipalities cost?“

By Dennis Norman, on February 19th, 2016 St Louis foreclosure activity in January was at the rate of 1 in every 1,533 households, which is down almost 16 percent from December and down over 25 percent (25.79%) from a year ago, according to the latest data from RealtyTrac. As the table below shows, the county in the St Louis MSA with the lowest foreclosure rate in January 2016 was Calhoun County Illinois, with no foreclosure activity for the month, and the county with the highest rate was St Clair County Illinois with 1 of every 1,223 housing units having foreclosure activity during the month. St Louis County had the highest foreclosure rate of the Missouri counties within the St Louis MSA, with one in every 1,386 housing units having a foreclosure activity.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “St Louis Foreclosure Activity In January Declines Over Twenty Five Percent From Year Ago“

By Dennis Norman, on January 15th, 2016 During 2015, a total of 10,391 housing units, or 1 out of 118 units, in the St Louis MSA had a foreclosure filing, according to a report just released by RealtyTrac. This is an increase of 38.29% in foreclosure activity from 2014.

As the table below shows, Jefferson County had the highest rate of foreclosure in 2015 with 1 of every 114 housing units receiving a foreclosure action during the year and Warren County the lowest with just 1 of every 278 housing units receiving a foreclosure filing.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “St Louis Foreclosure Activity During 2015 Tops 2014 By Nearly Forty Percent“

By Dennis Norman, on January 12th, 2016 Last night, the City Council for the City of Florissant passed bill number 9135 which, if approved by voters in April, will increase residential rental real estate license fees. In addition to increasing the rental real estate license fee from $15.00 to $50.00, this ordinance also changes the calculation of the fee from a “per owner” fee to a “per unit” fee. A memorandum from the Pubic Works Department distributed with the bill indicates that, under the current law, there were 1,475 rental licenses issued during 2015 generating a total of $22,125 in fees, and, under the proposed new law, there would be approximately 7,000 licenses issues (one per unit instead of one per owner) and would generate approximately $350,000 in fees, an increase of nearly 1,500 percent (1,482%)!

Subject to A Vote by “Qualified Voters”…

Proponents of this outrageously large fee, which will no doubt lead to increased rents for tenants, may defend the action by saying it is subject to a vote of “the people”. Unfortunately, as the ordinance reads, it will be submitted to the “qualified voters of the city of Florissant” which will most likely, not include the majority of the people impacted by the tax, the landlords. Given that, according to the latest census data, 73.4 percent of the residents of the city of Florissant are homeowners and homeowners will not be negatively impacted in any way by the tax (but will receive benefit in terms of the additional revenue to the city) they have very little reason NOT to approve the tax. In addition to the people affected being the minority of the population (tenants and landlords) the majority of the landlords won’t even have a vote given they don’t live in the city of Florissant.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Find Your Home’s Value Online NOW!

See ALL Homes That Will Be Open In St Louis This Weekend

Get The Latest LIVE St Louis Home Prices, Sales and Other Market Data HERE

Continue reading “Florissant City Council Passes Ordinance Increasing Landlord License Fees By Nearly 1500 Percent“

By Dennis Norman, on January 8th, 2016 Yesterday, St. Louis County Circuit Court Judge Gloria Reno granted a temporary restraining order against St Louis County to stop implementation of their recently adopted rental licensing ordinance. This is a huge victory for landlords, and property owners in general, as the new ordinance, as I wrote about previously, trampled property rights in many ways.

In response to the passage of the landlord licensing ordinance, the St Louis Association of REALTORS® file a lawsuit against St Louis County on December 29, 2015 in an effort to stop the legislation.

Hopefully, the temporary restraining order will be become a permanent injunction by the time the case comes to a close.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Find Your Home’s Value Online NOW!

See ALL Homes That Will Be Open In St Louis This Weekend

Get The Latest LIVE St Louis Home Prices, Sales and Other Market Data HERE

By Dennis Norman, on December 11th, 2015 St Louis Foreclosure activity increased in November to 1 foreclosure activity on 1 of every 1,086 housing units in the St Louis MSA, a decrease of 8.06 percent from the month before but an increase of 62.59 percent from November 2014, according to a report just released by RealtyTrac.

St Louis 5-County Core Market…

As the table below shows, all of the 5 counties that make up the St Louis core market (St Louis city and the counties of St Louis, St Charles, Jefferson and Franklin), with the exception of Jefferson, saw a decline in foreclosures from October 2015. However, like the St Louis metro area as a whole, they all had increased activity from the year before with three of the counties (St Louis city and St Louis and St Charles County) seeing a triple digit increase and Jefferson and Franklin double digit increases.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “St Louis Foreclosure Activity In November Increased Over 60 Percent From Year Ago“

By Dennis Norman, on December 3rd, 2015 Distressed home sales in St Louis during the month of October 2015 accounted for about 11.6 percent of all home sales during the month, a decline of about 50 percent from a year ago when St Louis distressed home sales accounted for 23 percent of the all home sales, according to the latest data just released by RealtyTrac. Distressed home sales would include foreclosures, REO’s (homes that have been foreclosed upon and now being sold by a bank or other lender) and short sales.

As the table below shows, the St Louis metro area saw a decline in all types of distressed home sales in October from the month before, however some of the counties in the area saw an increase such as the city of St Louis that saw distressed home sales increase from 20.9% in September 2015 to 25.3% in October.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “St Louis Metro Area Distressed Home Sales Share Of Market Drops By Nearly Half From Year Ago“

By Dennis Norman, on November 16th, 2015 Foreclosure activity, after an extended downward trend, has trended upward lately in the St Louis metro area and October was no exception seeing an increase of over 13 percent (13.17%) in activity from the month before and, on a 12-month rolling average, an increase of almost 30 percent (29.85%) from a year ago, according to the latest data from RealtyTrac.

St Charles County bucks the trend…

The table below shows foreclosure activity for the 15 major counties that make up the St Louis MSA, 7 of which are in Missouri and the other 8 in Illinois and, as the table reveals, St Charles County is bucking the trend and, even though foreclosure activity there rose 14.85 percent from the month before, it was down over 80 percent from a year ago and the 12-month rolling average was down 18.48 percent from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “Foreclosure Activity Trending Upward In St Louis Metro Area But Not In St Charles“

By Dennis Norman, on November 11th, 2015 Today most, if not all, landlords are aware of the Federal Fair Housing Act with regard to making various types of discrimination illegal when it comes to housing and, even if they don’t have a thorough understanding of all of the nuances of the act, at least have a basic understanding of it. However, today, a lack of a thorough understanding of the law, as well as the risks associated with violating it, or even being accused of violating it, can be quite costly to a landlord. Therefore, if you are considering becoming a landlord, or perhaps are already in the midst of building your real estate empire, spending time studying and understanding the Federal Fair Housing Act and how it applies to you would be time well spent and it would also be a great move to align yourself with a real estate professional with a good understanding of it that can help you navigate the regulatory waters a landlord must navigate today.

The Case of HUD vs Pebble Beach Apartments –

In July 2013 there was a fair housing violation complaint filed against the owner and manager of the Pebble Beach Apartments alleging they discriminated against a tenant based on familial status in violation of the Fair Housing Act.

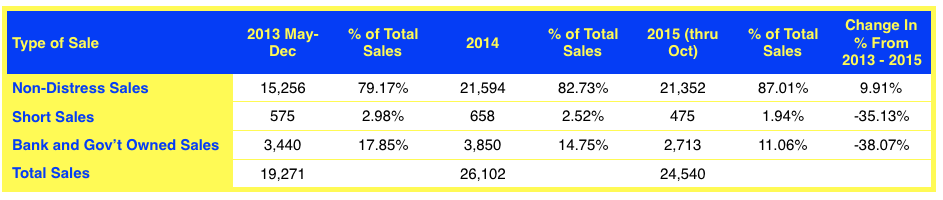

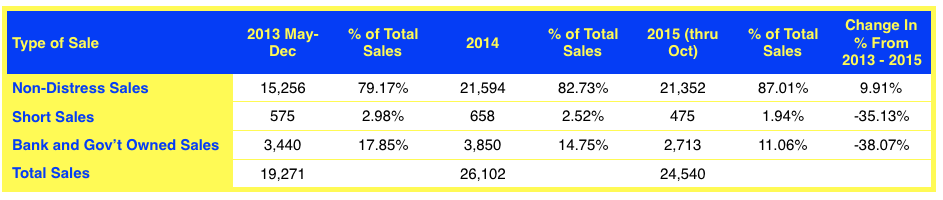

By Dennis Norman, on November 4th, 2015 Distressed Home Sales accounted for just 13 percent of St Louis home sales thus far in 2015, a decline of 37.6 percent from two years ago when over 1 in every 5 (20.83%) St Louis home sales was a short sale or foreclosure. As the table below shows, through the end of October this year, there have been just 475 short sales in the 5-county core St Louis real estate market, or just under 2 percent of total home sales, and just 2,713 sales of bank and government-owned homes, just over 11 percent of total home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Copyright 2015 St Louis Real Estate News – All Rights Reserved

By Dennis Norman, on October 16th, 2015 St Louis Foreclosures spiked during the 3rd quarter of this year with all of the counties in Missouri that are in the St Louis MSA seeing an increase of double digits in foreclosure activity from a year ago, according to a report just released by RealtyTrac.

Below is a table showing foreclosure data for all of the counties that make up the St Louis metro area on the Missouri side of the Mississippi revealing that St Charles County saw the greatest increase in foreclosure activity from a year ago with a 283 percent increase during 3rd quarter 2015 from 3rd quarter 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

Continue reading “St Louis Foreclosures Spike During 3rd Quarter“

By Dennis Norman, on October 14th, 2015 My, how fast things change! Nine days ago I wrote about a bad piece of legislation St Louis Councilman Michael O’Mara had proposed with regard to the licensing of landlords and then, two days later, updated the article with the good news that the bill was voted down. Well, in a last minute move, reportedly just minutes before the 6:00 pm start time of the council meeting last night, Representative Michael O’Mara, according to an article in STLTODAY this morning, “seized on a procedural loophole to return the issue to the council agenda.”

While the bill that was introduced last night, Substitute Bill No. 3 for Bill no 204, was slightly different than the bill proposed the last time, it’s still littered with issues that affect private property rights of individuals and should concern everyone, not just the landlords and tenants that are the largest of this legislation.

“I thought it was a travesty of government.”

According to the STLTODAY article, St Louis County Councilman Mark Harder (and real estate broker) said “I thought it was a travesty of government. This bill was brought to us moments before we walked on the dais tonight, and that is not the way you handle a transparent government…We were steamrolled.”

THERE IS STILL TIME TO STOP THIS! The St Louis County Council will take the final vote on this bill on October 20th, so you still have time to be heard! If would like to voice your opinion on this bill, I would suggest contacting the bills sponsor, St Louis County Councilman Michael O’Mara as soon as possible. You can contact him through the St Louis County Council website here or you can email him at MOmara@stlouisco.com or call him at 314.615.5439.

|

Recent Articles

|