By Dennis Norman, on January 27th, 2016 Before I begin, I should point out that what I’m about to tell you runs contrary to what the National Association of REALTORS® (NAR), the largest trade association in the country and one I belong to and support, will tell you. The NAR position on the mortgage interest deduction (MID) is, quoting from their website, “the mortgage interest deduction (MID) is a remarkably effective tool that facilitates homeownership.” Many St Louis REALTORS® will echo the message of NAR but I think if more people took the time to look into the MID, and do a little simple math, they would see that the mortgage interest deduction does not appear to offer any real benefit to the ordinary, typical homebuyer in St Louis.

What brought this to mind this morning was a friend of mine on Facebook (who is a loan officer for a St Louis mortgage company) posted a link to an article written by an owner of a Chicago real estate company outlining the benefits of the MID and, while I think he did an excellent job of laying out the potential tax savings of deducting mortgage interest and property taxes on a home, I think he left out a key component, namely, the Standard Deduction.

Why the MID doesn’t help the normal home buyer in St Louis:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Find Your Home’s Value Online NOW!

See ALL Homes That Will Be Open In St Louis This Weekend

Get The Latest LIVE St Louis Home Prices, Sales and Other Market Data HERE

Continue reading “The Truth About The Mortgage Interest Deduction“

By Dennis Norman, on January 19th, 2016 The St Louis real estate market performed well in 2015 and, by all indications, 2016 should be an even better year for the St Louis real estate market!

Our newly released, 5-minute, video market update below will give you a quick overview of St Louis home prices, where the sellers markets are, the buyers markets and much more! If you are considering buying or selling a home, or are an investor or just a homeowner wanting to keep up on the market, you don’t want to miss this!

Whether you are thinking of buying or selling and would like me to look at your situation and your market to determine the best strategy, just call, or text me, at 314.332.1012 and I’ll be happy to help!

St Louis Home Price Trends By City/Municipality

St Louis Home Price Trends By Zip Code

St Louis Sellers Markets

Thinking of selling and want to know if your neighborhood is a seller’s market? Contact us and we’ll answer that question for you.

Continue reading “St Louis Real Estate Market Update VIDEO – January 2016“

By Dennis Norman, on August 13th, 2015 The Federal Reserve Bank of New York just released it’s Quarterly Report on Household Debt and Credit for the 2nd quarter of 2015 in which some encouraging facts were revealed with regard to the home mortgage market, including:

- New home loan originations during the quarter increased to $466 billion…this marks the fourth consecutive quarterly increase since originations hit a 14-year low a year ago

- As the chart below illustrates, roughly 95,000 individuals had a new foreclosure add to their credit report during the quarter, marking the lowest number of new foreclosures since the data was first tracked 16 years ago.

- Mortgage delinquencies improved with the share of seriously delinquent mortgages (90+ days) dropping to 2.5% from 3.0% during the prior quarter.

- Mortgage delinquencies improved again, with the share of mortgage balances 90 or more days delinquent decreasing slightly;

- The median credit score for borrowers obtaining a home mortgage during the 2nd quarter, as the chart below shows, rose to above 750, while the bottom 10th percentile of borrowers, also known as “sub-prime”, rose to 650. As the chart illustrates, back in 2000 the median was around 700 and the lowest percentile was barely above the 550 mark.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Continue reading “Mortgage Originations In 2nd Quarter Rise…4th Consecutive Rise Since 14 Year Low“

By Dennis Norman, on May 13th, 2015 A definite confirmation of an improving real estate market is the fact that, according to a report just released by RealtyTrac, loan originations, for the purchase of a home, during the first quarter of 2015 increased 17 percent from a year ago. Additionally, Kansas City, Missouri saw the 4th largest increase from a year ago, of major metro areas, with a 32 percent increase in home loans. St Louis made the top 20 list for year or year increases with a 13 percent increase.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

By Dennis Norman, on January 9th, 2015 Yesterday, President Obama announced that he will, by executive order, direct FHA to lower the mortgage insurance premium charged on FHA loans to home buyer from 1.35 percent to .85 percent, lowering home buyer’s house payments by about $900 per year on average. Chris Polychron, the President of the National Association of REALTORS® (NAR) showed his organizations support of the President’s action and highlighted the positive impact NAR felt it would have on the housing market stating “we (NAR) are optimistic that more affordable FHA loans will have a positive impact on first-time buyers who have been entering the market at a lower than normal rate.” NAR has stated that the lower cost of an FHA loan would add 90,000 to 140,000 additional annual home purchases.

The cost of the mortgage insurance premium on an FHA loan was .90% back in 2010, increased to 1.15% in 2011, then to 1.25% in 2012 and finally 1.35% in 2013. NAR first addressed this issue back in April 2014 when, then President, Steve Brown wrote a letter to Carol Galante, the Assistant Secretary for Housing at the time, to draw her attention to the impact the higher fees were having on the housing market and urging her to take action to lower the premiums. In the NAR letter, it was pointed out in 2014 FHA fees accounted for nearly 20 percent of a homeowners monthly mortgage payment.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “FHA To Lower Fees Opening The Door To Around 100,000 Home Buyers“

By Dennis Norman, on October 22nd, 2014 Around this time of year every year, people start asking me “Where is the real estate Market headed next year?” The real estate market is affected by so many factors that predictions on what the market will do are hard, however there are some basic fundamentals that can be looked at to make a good educated guess. One of the industry experts out there that I think does a good job at this and, offers a somewhat less biased look at the market than some, is Frank Nothaft, Chief Economist at Freddie Mac. Below are highlights of his most recent report on the outlook of the housing market along with my comments relating his projection to our St Louis market:

Home Sales:

- 5.31 million total homes (new and existing) sold in 2014, a 3.6% decrease from 2013. Projection for 2015 is an increase of 5.5% to 5.6 million homes sold.

- For St Louis (the 5-county core market), I am projecting that home sales will be down roughly the same as above, maybe just slightly higher, perhaps 4%, for 2014 from 2013. I would also project an increase in home sales in St Louis in 2015 at a rate close to the rate projected by Mr. Nothaft for the market as a whole.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “Where The Real Estate Market Is Headed In 2015“

By Dennis Norman, on October 8th, 2014 Millenial’s (people that are roughly 18 to 33 years old) are not as interested in buying homes today as their baby-boomer parents were at their age and, while there are probably some lifestyle issues that play a large part of it, the debt they are piling up in student loans may have something to do with their decision not to take on mortgage debt as well. According to information provided by TransUnion, the percentage of Millenial’s debt that is attributed to student loans is 36.8% today, an increase of over 185% from 2005 when student loans were responsible for just 12.9% of that age groups debt. On the hand, the percentage of the Millenial’s debt today that is for a home mortgage is 42.9%, down 32% from 2005 when it was 63.2%, according to TransUnion.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Millennial’s Today Racking Up Student Loans Not Home Loans“

By Peter Wright, on September 26th, 2014 Albert Einstein once said, “Nothing happens until something moves.” Well if you are looking to buy a home, lease a car, apply for credit cards or even look for a job…nothing happens until your credit score moves and moves up!

If you are have had credit issues in the past….simply ignoring what happened does not help. Ignoring a tooth-ache will not improve over time without treatment neither will your credit score!

If you have had credit issues in the past, it’s time you start establishing new (good) credit and start working on deleting old derogatory credit history like late payments, collections, judgments even bankruptcy or foreclosures from your credit report. Remember, with a low credit score Banks and Lenders will be reluctant to lend you money to buy a home, car or even offer you a credit card.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Continue reading “How to Build Credit Or Fix Credit Issues“

By Dennis Norman, on September 19th, 2014 Mortgage Interest Rates rose this week to an average of 4.23 percent for a 30-year fixed rate home loan, up from 4.12 percent last week, marking the largest one-week jump in interest rates we have seen thus far this year, according to data just released by Freddie Mac. Mortgage interest rates for fixed-rate loans have now hit the highest level since May 1st.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HEREMortgage interest rates from the Freddie Mac report:

- 30-year fixed rate mortgages averaged 4.23%

- Last week the rate was 4.12%

- Last year at this time the rate was 4.5%

- 15-year fixed rate mortgages averaged 3.37%

- Last week the rate was 3.26.

- Last year at this time the rate was 3.54

- 5-year hybrid adjustable rate mortgages averaged 3.06%

- Last week the rate was 2.99%

- Last year at this time the rate was 3.11%

- 1-year adjustable rate mortgages averaged 2.43%

- Last week the rate was 2.45%

- Last year at this time the rate was 2.65%

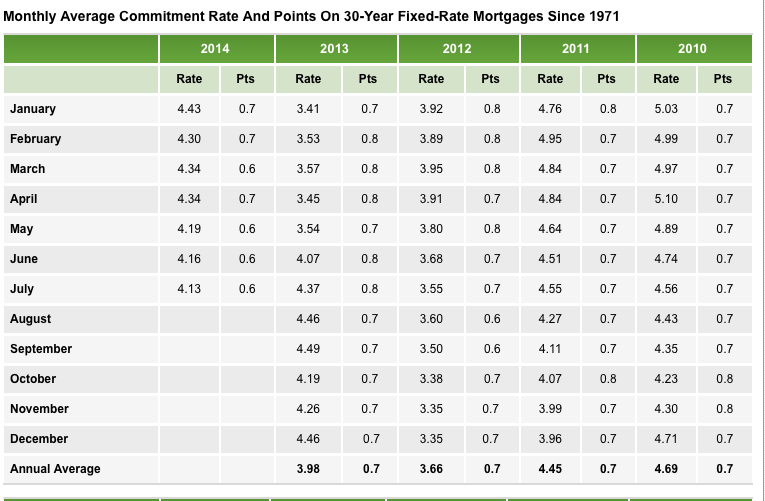

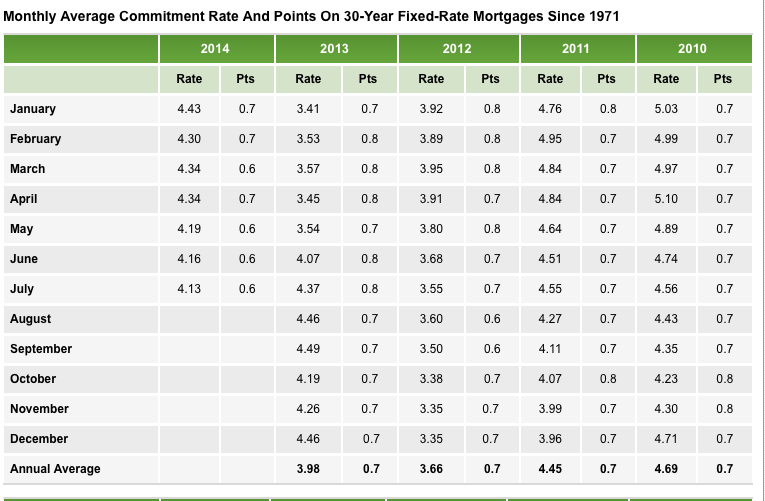

By Dennis Norman, on August 15th, 2014 Mortgage interest rates fell to an average of 4.13 percent in July on a 30-year fixed rate mortgage, marking the lowest mortgage interest rate we have seen in over a year. The last time mortgage interest rates were this low was back in June of 2013 when the average interest rate on a 30-year fixed-rate mortgage was 4.07 percent, according to the latest data from Freddie Mac.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE Source: Freddie Mac

By Dennis Norman, on August 4th, 2014 Missouri, along with it’s affordable home prices, also has the 3rd lowest mortgage closing costs according to data just released today by BankRate. According to the report, in Missouri, the average mortgage closing costs on a $200,000 home loan are $2,387.00, almost 6% less than the national average of $2,539.00. Holden Lewis, senior mortgage analyst at Bankrate, said mortgage closing costs have risen 6 percent in the past year and says “new mortgage regulations are the biggest reasons why closing costs went up“.

Texas, at $3,046, had the highest closing costs in the nation, followed by Alaska at $2,897 and New York, at $2,892. Nevada had the cheapest mortgage loan closing costs in the country at $2,265 followed by Tennessee with $2,366 and then Missouri.

Find the latest St Louis Mortgage Loan Interest Rates Here.

Search ALL St Louis Homes For Sale Here

(We work hard on this and sure would appreciate a “Like”)

By Dennis Norman, on July 18th, 2014 Mortgage interest rates, in spite of predications to the contrary by many, are actually lower today than a year ago, according to the latest date available from Fredde Mac. According to Freddie Mac, the U.S. average interest rate for a 30 year mortgage was 4.15 percent on July 10, 2014, down significantly from July 11, 2013 when the average 30 year mortgage rate was 4.51 percent.

As the interactive chart below from the St Louis Fed Reserve shows, mortgage interest rates have definitely risen from the historic lows we say in 2012 and part of 2013 however are still lower than 5 years ago. So, will this trend continue and will the predictions of interest rates topping 5 percent next year not come to fruition? It’s very hard to say as a lot of it hinges upon what happens in the economy and the housing market as well. My guess is, there is a much better chance of rates increasing over the next year than decreasing but that’s just my opinion.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Get current mortgage interest rates, mortgage calculators and more HERE.

Continue reading “Mortgage Interest Rates Lower Today Than A Year Ago To The Surprise of Many“

By Dennis Norman, on June 17th, 2014 Mortgage default rates, as tracked by the S&P/Experian Consumer Credit Default Indices, on first mortgages were at .92 in May 2014, down from 1.01 the month before and down almost 30% (29.7%) from May 2013 when the first mortgage default rate index was at 1.31. The default rate index on second mortgages is improving as well with the index for May 2014 at .57, down from .63 in April and from .60 in May 2013, according to the report.

This is good news for the housing market and consistent with the trend we have seen lately of lower delinquencies and fewer defaults which lead to fewer foreclosures and fewer REO’s, all of which put downward, or negative, pressure on home prices.

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 We hear lots of advice these days about how to improve a credit score. However, not all advice is good advice. Here are nine credit score myths that could actually do more harm than good:

Myth #1 – Closing out old, inactive accounts will help your score.

Thirty percent of your credit score is based on your utilization rate – your total balances versus the total amount of credit available to you. Canceling old accounts reduces the total amount of your available credit, changing that ratio. Any balance will utilize a higher percentage of your credit, which will hurt your score.

Myth #2 – Opening (but not using) accounts will help your score.

To improve their utilization rate and, theoretically, their credit scores, some people open as many accounts as they can. According to Rod Griffin, director of public education for the credit bureau Experian, “Your score is affected by how well you manage the credit you do have over a period of time, not by how many credit cards you have or the available balances.”

(We work hard on this and sure would appreciate a “Like”) Continue reading “Nine Credit Score Myths“

By Dennis Norman, on January 30th, 2014

Home loan rates have been near historic lows for a while now but the $64 question is, where are home loan rates headed in the future? While there are, of course, a variety of opinions out there, the majority of the noteworthy ones are thinking interest rates are headed upward. In the Well’s Fargo Securities Economic Outlook report for 2014, interest rates in the year ahead (2014) was addresses, saying “we expect long-term rates to exhibit an upward bias as Fed tapering moves forward. However, the extent of any increase in long-term rates should be modest, given continued low inflation and a reduced federal budget deficit “. PNC Bank, in their Economic Outlook report for 2014 forecast that 30 year mortgage rates would increase to 4.95% during 2014, about 1% higher than 2013. Oh yeah, I should also mention, according to a recent poll by Rasmussen Reports, 50% of the consumers surveyed say they expect higher interest rates a year from now. So there you have it…higher rates on the horizon.

[iframe http://research.stlouisfed.org/fredgraph.png?g=rwt 580 400]

By Tyler Frank NMLS # 942420, on January 3rd, 2014  Tyler Frank,

Paramount Mortgage

NMLS ID 942420 The Federal Housing Authority (FHA) has made some changes for 2014, which took effect January 1 and affect FHA home loans. First and foremost, you will see a drop in the maximum allowable loan. In the St. Louis metro area, for example, the new max loan amount for a single-family home has been lowered to $271,050 from $281,250.

Other items of note regarding FHA have not changed; so as a refresher let’s look at FHA qualifications and rules:

- Borrower must put 3.5% down based on sales price. 100% of the buyer’s contribution can be in the form of a gift. There are no reserve requirements; however, reserves can help to build a stronger case for a “tight” loan.

- The seller can contribute 6% of the sales price towards closing cost, points and pre-paid items.

- There is an up-front mortgage insurance premium (UFMIP) of 1.75% for all loan terms and amounts added to the base loan amount.

Some underwriting items include: Continue reading “Important Changes to FHA Home Loans Now In Effect“

By Tyler Frank NMLS # 942420, on December 13th, 2013  Tyler Frank,

Paramount Mortgage

NMLS ID 942420 On January 10, 2014 the mortgage world is going to go through some changes. These changes will affect consumers and their ability to qualify for a home loan. Is it doom and gloom? Not really.

A “Qualified Mortgage” or QM, is something we at Paramount Mortgage have been doing for a while. It is all about the consumer having the ability to repay the loan and verifying, to the best of our ability, through paperwork, all the facets of a loan approval. It is very possible additional paperwork may be requested from the borrower to accomplish verification going forward. Is it the end of the world? No. We as a team, agent and loan officer, need to relay that information to the client.

We, for the most part, have already been doing that.

The biggest change will be the stringent enforcement of the debt-to-income ratio at 43%. This will be Continue reading “What is QM?“

By Dennis Norman, on October 15th, 2013  January 10, 2014 new QM rules (qualified mortgage) will go into effect and will most likely negatively impact the ability of some home buyers to obtain a mortgage. In terms of how many borrowers the new rules will affect, it is hard to say. There have been several analysis’ done of the percentage of home loans originated in 2012 would not have met the QM rules and the estimates vary from 12 percent to more than half. Personally, I think the lower estimates are probably closer to accurate, but it is still a significant number…potentially somewhere around 1 of every 9 home buyers may not be able to obtain a mortgage that, absent the new QM rules, would have been able to. January 10, 2014 new QM rules (qualified mortgage) will go into effect and will most likely negatively impact the ability of some home buyers to obtain a mortgage. In terms of how many borrowers the new rules will affect, it is hard to say. There have been several analysis’ done of the percentage of home loans originated in 2012 would not have met the QM rules and the estimates vary from 12 percent to more than half. Personally, I think the lower estimates are probably closer to accurate, but it is still a significant number…potentially somewhere around 1 of every 9 home buyers may not be able to obtain a mortgage that, absent the new QM rules, would have been able to.

UPDATE 12/06/13 – Read/download the CFPB Compliance Guide for new QM rule

Watch CFPB Video on QM Rule Here

What are the QM Rules and who do they affect? Continue reading “New QM Rules Going To Put Home Loans Out of Reach For Some Buyers Come January“

By Dennis Norman, on October 9th, 2013  Lawrence Yun, chief economist for the National Association of REALTORS (NAR), cautioned today that, given the fact the U.S. Government spends one dollar for every 75 -80 cents it takes in, if the debt ceiling isn’t raised, the government will have to decide where to cut its spending. Should the government choose not to pay its interest obligations, “we can expect interest rates on Treasury bonds to rise…and if that happens, mortgage rates will rise, because mortgage rates follow Treasury rates.” Lawrence Yun, chief economist for the National Association of REALTORS (NAR), cautioned today that, given the fact the U.S. Government spends one dollar for every 75 -80 cents it takes in, if the debt ceiling isn’t raised, the government will have to decide where to cut its spending. Should the government choose not to pay its interest obligations, “we can expect interest rates on Treasury bonds to rise…and if that happens, mortgage rates will rise, because mortgage rates follow Treasury rates.”

Yun went on to say that if mortgage interest rates do rise we can expect home sales to drop by around 350,000 to 450,000 homes per year for every 1 percent increase in mortgage interest rates.

My advice to anyone in the market to buy a home is to buy sooner than later and, if possible, lock in your mortgage interest rate now before rates go up (think you can’t lock in your rate until after you have found a home? Wrong, contact me and I’ll tell you how).

Search St Louis Homes For Sale Using St Louis’ BEST Search Site – Click Here for Immediate Access

By Dennis Norman, on August 3rd, 2013

St Louis mortgage interest rates are on the rise and hitting levels we have not seen in the past year and a half and the 3.x percent rates we have become somewhat accustomed to are gone. However, before you panic or think the housing market is headed toward another crash as a result, you should keep in mind that todays rates (see below for current rates) of about 4.5 percent for a 30 year fixed rate mortgage is still lower than the average monthly mortgage interest was for more than 40 years proceeding 2012. Granted, looking back, 2012 was the year to buy a house with an average interest rate of 3.66 percent and lower home prices, but hindsight is always 20-20. The bottom line is, instead of worrying about the recent increases in mortgage rates home buyers should be thankful that rates remain at historic lows.

Current St Louis Mortgage Interest Rates From Tyler Frank, Paramount Mortgage: Continue reading “St Louis Mortgage Interest Rates On The Rise But Still Historically Low“

By Dennis Norman, on July 26th, 2013

The truth on the Mortgage Interest Deduction

Currently, lawmakers in Washington D.C., while looking for ways to “close loopholes” and cut spending, are looking hard at something once considered “untouchable”, the mortgage interest deduction (MID). While there is probably little chance of totally eliminating the ability for homeowners to deduct the mortgage interest they paid on their homes, there is a possibility the deduction could be altered significantly or capped, and, perhaps, even phased out over time.

Like most current events, there are stories out there with varying degrees of accuracy about the benefit of the mortgage interest deduction as well as who it benefits. In response to the rhetoric out there, economists with the National Association of Home Builders have published a list of ten common claims about the MID and their findings as to the validity of those claims after researching data from the IRS, Census Bureau as well as other sources. The complete results are shown below:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “The Mortgage Interest Deduction…Truth vs Fiction“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 St Louis Mortgage companies were not making many 30-year, fixed-rate jumbo mortgages a year ago, but now many St Louis Mortgage companies are offering fixed jumbos – with very competitive rates, including my firm, Paramount Mortgage.

As interest rates start to rise, homeowners are thinking they may not see rates this low in the future and if their ARM is maturing a couple of years from now, they could be in a tough spot.

Continue reading “St Louis Mortgage Companies Seeing Fixed Rate Jumbo Mortgages Make Comeback“ Continue reading “St Louis Mortgage Companies Seeing Fixed Rate Jumbo Mortgages Make Comeback“

By Dennis Norman, on June 5th, 2013  The average home buyer in Missouri makes a down payment of 13.2 percent and borrows an average amount of $172,998.59, according to the latest data from LendingTree.com. The state with the lowest average down payment is Mississippi at 11.9 percent and the highest, New Jersey at 20.5 percent. The average home buyer in Missouri makes a down payment of 13.2 percent and borrows an average amount of $172,998.59, according to the latest data from LendingTree.com. The state with the lowest average down payment is Mississippi at 11.9 percent and the highest, New Jersey at 20.5 percent.

Continue reading “Missouri Has 5th Lowest Average Down Payment In Nation“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Since the real estate market crash, millions of homeowners have lost their homes in a foreclosure, been forced to do a short sale to get out from a home they were underwater on or file bankruptcy as a result of financial hardship as a result of the the market crash and general economic downturn. Many of these homeowners have resorted to renting or living with relatives but, as time passes and the financial wounds heal, are now wanting to buy a home again prompting the question, “how long do I have to wait after a foreclosure, short-sale, deed-in-lieu or bankruptcy before I can get a home loan again?”.

Fortunately, it is possible for former homeowners who have faced financial hardships to obtain a home loan again, but it does take time and effort on their part. Before obtaining a home loan after a foreclosure, short-sale or bankruptcy, the borrower will have to reestablish credit and establish a stable income that will support the home loan they wish to obtain. In addition, time will have to pass as (see the chart below), no matter how well the borrowers situation has improved, there are still some minimum timeframes that will have had to pass in order to be eligible for most types of home loans. There is no “one size fits all” answer though, so I highly suggest if you are in this situation and want to know what your options are, to use the form below to contact me, I’ll be happy to help. Continue reading “How Long Do You Have To Wait To Get A Home Loan After Foreclosure, Short Sale or Bankruptcy?“

One-third of Homebuyers Surveyed Are Ill-prepared to Get a Mortgage

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 According to a survey recently conducted by Zillow, many homebuyers are really not armed with the information they should have before attempting to obtain a mortgage. For example, over one-third (34 percent) of the prospective homebuyers surveyed did not know that a qualified borrower can obtain a home loan today with less than a five percent downpayment.

In addition, many homebuyers have misinformation that can prevent them from obtaining the best possible mortgage interest rate. For example, 26 percent of the homebuyers said they thought they were obligated to obtain their home loan with the lender that pre-approved them, and 24 percent believed that all lenders are required to charge the same amount for credit reports and appraisals.

Continue reading “Survey Shows One-Third Of Homebuyers Lack Info Needed To Get Mortgage“

By Dennis Norman, on April 25th, 2013  Mortgage interest rates keep falling and this week the interest rate on a 15 year fixed-rate mortgage hit a new record low of 2.8 percent, according to a weekly national survey conducted by Bankrate.com. Interest rates on a 30-year fixed rate mortgage averaged 3.57 percent this week, a four month low. Mortgage interest rates keep falling and this week the interest rate on a 15 year fixed-rate mortgage hit a new record low of 2.8 percent, according to a weekly national survey conducted by Bankrate.com. Interest rates on a 30-year fixed rate mortgage averaged 3.57 percent this week, a four month low.

As the Bankrate report below for St. Louis shows, St. Louis interest rates are even better: Continue reading “Mortgage Interest Rates Hit Record Low“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Free Credit Scores are Not Part of the Free Annual Credit Report Consumers Currently Receive

Consumers currently have the right to request their free credit report once a year, but a credit report does not include free credit scores. These two items are often confused to be the same, which they are not.

You generally must pay to see your credit score. It’s a three-digit grade that predicts how risky you are to a lender.

Earlier this month, bills were introduced in the House and Senate to allow all consumers free access to credit scores once a year. The Free Access to Credit Scores Act was authored by U.S. Sen. Bernie Sanders of Vermont and U.S. Rep. Steve Cohen of Tennessee.

Continue reading “Free Credit Scores As A Result of New Act“ Continue reading “Free Credit Scores As A Result of New Act“

By Robert Fishel, on February 27th, 2013  It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing. It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.

By following the simple guidelines below, you are assured a smooth and error-free closing.

Continue reading “How to make getting a home loan easier; St Louis Mortgage Interest Rate Update“ Continue reading “How to make getting a home loan easier; St Louis Mortgage Interest Rate Update“

By Robert Fishel, on February 13th, 2013  “Nobody ‘wants’ to pay PMI, it’s just that we have no choice, especially if you want to buy a house and don’t have say an extra $50k to $80k lying around for a down payment, which most first-time buyers don’t.” Chris Durst, a first-time homebuyer and commenter on Investopedia.com. “Nobody ‘wants’ to pay PMI, it’s just that we have no choice, especially if you want to buy a house and don’t have say an extra $50k to $80k lying around for a down payment, which most first-time buyers don’t.” Chris Durst, a first-time homebuyer and commenter on Investopedia.com.

The credit experts at MGIC, the nation’s largest private mortgage insurer, wants Realtors® and Lenders alike to know that financing with MI creates opportunities for borrowers: Continue reading “Nobody ‘wants’ to pay PMI; St. Louis Mortgage Interest Rate Update“

By Robert Fishel, on February 6th, 2013  FHA Interest Rate Change: MHDC’s Cash Assistance Loan (CAL) is now 4%! (APR 4.93) FHA Interest Rate Change: MHDC’s Cash Assistance Loan (CAL) is now 4%! (APR 4.93)

MHDC is raising mortgage interest rates offered to first-time homebuyers. First-time home buyers receive a forgivable 3% cash assistance loan for down payment and closing costs.

Continue reading “Interest Rate Change; St. Louis Mortgage Interest Rate Update“ Continue reading “Interest Rate Change; St. Louis Mortgage Interest Rate Update“

|

Recent Articles

|

January 10, 2014 new QM rules (qualified mortgage) will go into effect and will most likely negatively impact the ability of some home buyers to obtain a mortgage. In terms of how many borrowers the new rules will affect, it is hard to say. There have been several analysis’ done of the percentage of home loans originated in 2012 would not have met the QM rules and the estimates vary from 12 percent to more than half. Personally, I think the lower estimates are probably closer to accurate, but it is still a significant number…potentially somewhere around 1 of every 9 home buyers may not be able to obtain a mortgage that, absent the new QM rules, would have been able to.

January 10, 2014 new QM rules (qualified mortgage) will go into effect and will most likely negatively impact the ability of some home buyers to obtain a mortgage. In terms of how many borrowers the new rules will affect, it is hard to say. There have been several analysis’ done of the percentage of home loans originated in 2012 would not have met the QM rules and the estimates vary from 12 percent to more than half. Personally, I think the lower estimates are probably closer to accurate, but it is still a significant number…potentially somewhere around 1 of every 9 home buyers may not be able to obtain a mortgage that, absent the new QM rules, would have been able to.

The average home buyer in Missouri makes a down payment of 13.2 percent and borrows an average amount of $172,998.59, according to the latest data from LendingTree.com. The state with the lowest average down payment is Mississippi at 11.9 percent and the highest, New Jersey at 20.5 percent.

The average home buyer in Missouri makes a down payment of 13.2 percent and borrows an average amount of $172,998.59, according to the latest data from LendingTree.com. The state with the lowest average down payment is Mississippi at 11.9 percent and the highest, New Jersey at 20.5 percent.

It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.

It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.