During a presentation today, National Association of Home Builders’ (NAHB) chief economist,  David Crowe, PhD., said he felt the housing market was recovering, although it was a “fragile” recovery and cautioned that it could be “affected both directions by the recent election results”. As you have heard me talk about so much, Crowe reminded us that real estate is very local and said that he felt there has been “no consistent national trend for some time” as the recovery has been from “relatively small and disparate” locations for about a year now. He did go on to say though that there are now enough locations experiencing a recovery that it is now showing in the national numbers.

David Crowe, PhD., said he felt the housing market was recovering, although it was a “fragile” recovery and cautioned that it could be “affected both directions by the recent election results”. As you have heard me talk about so much, Crowe reminded us that real estate is very local and said that he felt there has been “no consistent national trend for some time” as the recovery has been from “relatively small and disparate” locations for about a year now. He did go on to say though that there are now enough locations experiencing a recovery that it is now showing in the national numbers.

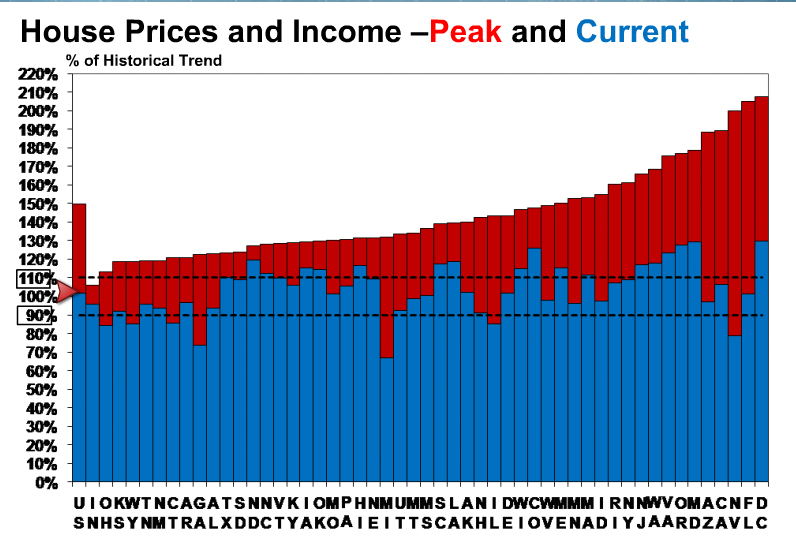

One of the things Crowe reviewed was the relationship between house prices and income, looking at the historical trend, where things went during the peak and where we are now. On a national level, the relationship between home prices and income peaked at 150 percent above the historical norm but had now returned to the “norm”. In Missouri, the home price/income ratio peaked at a little over 130 percent and is now back down to the historical normal as well.

Positive Signs for the Housing Industry:

House Prices and Income – Peak and Current:

Source: NAHB

Home price trend showing steady increase

Source: NAHB

Ratio of Home Prices to Income back on track with historical norm after 150 percent increase during bubble

Source: NAHB

Household formations in the U.S. are on the rise…will lead to increased demand for new homes

Source: NAHB

New home sales have increased and are expecting to grow rapidly in next 2 years

Source: NAHB

Youre so cool! I dont suppose Ive read something like this before. So nice to find someone with some unique ideas on this subject. realy thanks for beginning this up. this website is one thing that is wanted on the internet, someone with somewhat originality. useful job for bringing something new to the internet!