By Dennis Norman, on October 26th, 2010  Dennis Norman This morning S&P/Case-Shiller Index report for August was released showing a deceleration in the annual growth rates of home prices from the month before in 17 of the 20 Metro areas covered by the report. The Case-Shiller Home Prices Indices for the 20 metros showed a decrease of 0.2 percent in home prices in August from July and an increase of 1.7 percent in home prices from the year before. Continue reading “Case-Shiller issues disappointing report on home prices“

By Dennis Norman, on October 26th, 2010  Dennis Norman According to a report issued yesterday by CoreLogic, home prices in the St. Louis area decreased in August 2010 by 3.53 percent from the year before, over twice the US rate of price decline for the same period of 1.5 percent. However, distressed home sale prices are to blame and appear to be causing more damage in the St. Louis housing market than on the US housing market on average.

I say this because the data shows if we exclude the distressed sales then home prices in St. Louis only declined 0.28 percent for the same period, so the distressed sales have increased the rate of decline by over 11 times! On a national level, excluding distressed sales reduces the decline to 0.4 percent, or just over a fourth of the rate with them included.

f distressed sales are excluded then there was a 0.4 percent decrease in home prices from August 2009 to August 2010. Continue reading “Distressed home sales bring down prices in St. Louis“

By Dennis Norman, on October 7th, 2010 Number of price-reduced homes on Market Rose 24 percent in September from 2009..

According to a report released by ZipRealty, the number of price-reduced homes on the market increased 2.1 percent in September compared to August. ZipRealty’s monthly review of MLS-listed properties in 26 major markets found that 47.8 percent of “for sale” homes had at least one price reduction and the average seller actually slashed their list price twice to attract buyers. Continue reading “More Sellers Reduce Home Prices in September“ According to a report released by ZipRealty, the number of price-reduced homes on the market increased 2.1 percent in September compared to August. ZipRealty’s monthly review of MLS-listed properties in 26 major markets found that 47.8 percent of “for sale” homes had at least one price reduction and the average seller actually slashed their list price twice to attract buyers. Continue reading “More Sellers Reduce Home Prices in September“

By Dennis Norman, on September 10th, 2010 “..if a buyer hasn’t walked through the door in 30 to 45 days, a seller needs to lower their asking price. If a home hasn’t had an offer in six months, it’s time to rethink the sale..”

According to a report released by ZipRealty, the number of price-reduced homes on the market increased 3.26 percent in August compared to July. ZipRealty’s monthly review of MLS-listed properties in 26 major markets found that 47 percent of “for sale” homes had at least one price reduction and the average seller actually slashed their list price twice to attract buyers. Continue reading “Nearly half of all homes listed for sale in August had price cut“ According to a report released by ZipRealty, the number of price-reduced homes on the market increased 3.26 percent in August compared to July. ZipRealty’s monthly review of MLS-listed properties in 26 major markets found that 47 percent of “for sale” homes had at least one price reduction and the average seller actually slashed their list price twice to attract buyers. Continue reading “Nearly half of all homes listed for sale in August had price cut“

By Dennis Norman, on August 16th, 2010

Dennis Norman According to a report issued today by CoreLogic, home prices in St. Louis increased in June by 1.4 percent over June 2009. This ends the four-month streak of increasing year-over-year home prices which for May was 3.49 percent. Continue reading “St Louis Home Prices Increase in June; Rate of increase slows“

By Dennis Norman, on August 9th, 2010  Dennis Norman A report just issued by Zillow shows that home values in the United States continued to decline in the second quarter of 2010, with the Zillow Home Value Index falling 3.2 percent year-over-year and 0.6 percent from the first quarter to $182,500. The national rate of decline decelerated from the first quarter, marking the second consecutive quarter of slowing declines. Continue reading “U.S. Home Values Fall In 2nd Quarter; Negative Equity Declines Though“

By Dennis Norman, on July 27th, 2010  Dennis Norman This morning S&P/Case-Shiller Index report for May was released showing that the annual growth rates in 15 of the 20 Metro Area’s their reports cover improved in May compared to April 2010. The 10-city composite is up 5.4 percent from the year before and the 20-city composite is up 4.6 percent from the year before. Continue reading “Case-Shiller; Housing market not in any form of sustained recovery“

By Dennis Norman, on July 23rd, 2010  Dennis Norman Multiple Offers and Homes Selling for prices ABOVE list price? Is this a reprint of a post from 2005?

Nope. Believe it or not, this is exactly what was in a report released this morning by Zip Realty. The report is based upon home sales activity in the second quarter of this year and says that, despite slowdowns in home sales across the country, California is still the nation’s hottest spot for home buying activity.

California was home to 91 out of the country’s 100 “hottest” zip codes in terms of home sales during the quarter. Zip Realty’s definition of a “hot” market is one in where “homes were selling on average for most above list price“. So being the cynic that I can sometimes be, and, seeing how economists and reporters are constantly “playing with” stats to make them illustrate their point (I would never do this of course:) ) I guess from this report one could instead say that more California home owners under-price their homes more than anywhere else in the U.S. But let’s just stick with the “glass is half-full” approach and say the California market is hot.

Highlights from the report:

- Berkeley, CA 94703 is the country’s “hottest” zip code with homes selling on average for almost 8 percent above the asking price.

- Winchester, CT 06098 was the nations “coldest” zip code, with homes selling there on average 30 percent under list price.

- ZIP codes in California, and specifically the Bay Area, remain the “hottest” for buyer demand, including ZIP codes in Berkeley, Oakland and San Jose. See the chart below for the full list of the country’s ten hottest ZIP codes.

- The country’s “coldest markets” have warmed slightly since Q2 of 2009 — with homes in the country’s 10 coldest ZIP codes selling for an average of 18 percent below asking price in Q2 of this year, as compared to an average of 22 percent below asking price in Q2 2009.

- High-end housing markets nationwide continue to offer relative bargains for buyers. For example, in Miami’s Palm Beach (33480), buyers paid an average of around $1.1 million for a home in Q2, an average of $232,492 below list price. In Cape Cod’s Osterville (02655), homes sold on average for 16 percent below asking price, or an average of $180,437 under asking.

- According to the total number of home searches on Zip Realty, Phoenix and its surrounding neighborhoods continue to be the most popular searched areas in the country.

By Dennis Norman, on July 23rd, 2010  Dennis Norman Home sales activity was up in May, but the mix of sales shifted toward less-expensive properties in many cities throughout the U.S. according to the May 2010 Radarlogic Housing Market Report. In addition, the report states that while their home price composite index for the 25 metro areas covered did increase in May by 2.1 percent on a year-over-year basis, the “ gains were not large enough to be described as a recovery” and “ there was more evidence of weakness in the market than strength.”

Highlights from the report include:

- Home prices have remained stagnant since the beginning of 2009- while there were seasonal periods of strength sine then, overall the trend has been relatively flat.

- Property sales in the 25 metros covered by the index increased in May by 41 percent from the year before.

- Motivated sales decreased as a percent of total sales on a year-over-year basis but still accounted for 24 percent of home sales (RPX does not include short-sales in this number).

- Since January 2009 sales has increased in the 25 metros covered by 45 percent.

- Only nine of the 25 metros tracked by Radar Logic showed annual price improvement. Only 20 showed month-over-month improvement.

The 25 metro areas that make up the Radar Logic composite index are: Atlanta, Boston, Chicago, Charlotte, Cleveland, Columbus, Detroit, Denver, Jacksonville, Los Angeles, Las Vegas, Miami, Minneapolis, Milwaukee, New York, Philadelphia, Phoenix, Sacramento, Seattle, San Francisco, San Diego, San Jose, St. Louis, Tampa and Washington, D.C.

By Dennis Norman, on July 14th, 2010  Dennis Norman According to a report released by Trulia.com, 24 percent of the homes for sale as of July 1, 2010 have experienced at least one price cut. This is a 9 percent increase from the prior month.  The average discount for price-reduced homes continues to hold at 10 percent off of the original listing price. The average discount for price-reduced homes continues to hold at 10 percent off of the original listing price.

Western U.S. Leads with Price Reduction Increases

For the first six months of this year, cities in the Western U.S. saw a reduction in their price declines, however for this month those same cities have experienced some of the largest surges in price reductions in the U.S. when compared to the prior month. Oakland saw a 38 percent increase in price reductions, San Diego 25 percent, Honolulu (wow, way west) 21 percent and Las Vegas reductions increased by 20 percent.

Most of the largest U.S.cities saw Price Reduction Increases

Twenty two of the top 50 cities across the U.S. experienced price reduction levels at 30 percent or more, compared to just 10 cities in the previous month. Minneapolis leads the way with 40 percent of its home listings experiencing at least one price cut. This is the third straight month that Minneapolis has held the top spot and no other city has reached the 40 percent mark since Trulia started tracking home price reductions in April 2009. With an average discount for price-reduced homes at nine percent, the city’s total dollar amount slashed from home prices was $30.1 million.

Luxury Market Still Hardest Hit

Luxury homes (those listed at $2 million and above) continue to be hit the hardest by price reductions with the average discount being 14 percent off list price.

To see Trulia’s report showing price reductions for the 50-largest cities in the U.S. as of July 1, 2010 click here.

By Dennis Norman, on July 13th, 2010  Dennis Norman According to a report issued today by CoreLogic, their home price index shows home prices in the U.S. increased in May, marking the fourth-consecutive month there was a year-over-year increase in home prices. U.S. home prices in May 2010 increased by 2.9 percent over May 2009.

St. Louis home prices did better than the U.S. average, increasing by 3.49 percent in May 2010 compared with May 2009.

No doubt some of the good news was the result of buyers rushing to buy a home before the April 30th deadline to receive tax credits. This will affect the market, and home prices, in a positive manner until these “tax-credit-induced” sales close by the recently extended deadline of September 30, 2010.

By Dennis Norman, on June 29th, 2010  Dennis Norman This morning S&P/Case-Shiller Index report for April was released showing that theannual growth rates of all 20 Metro Area’s their reports cover improved in April compared to March 2010. The 10-city composite is up 4.6 percent from the year before and the 20-city composite is up 3.8 percent from the year before.

However, in spite of this little bit of encouragement, David Blitzer, Chairman of the Standard & Poor’s Index Committee casts a negative light on the market by pointing out the, while this report does show some price gains, “many of the gains are modest and somewhat concentrated in California….moreover, nine of the 20 cities reached new lows at some time since the beginning of this year…”.

Tax-Credit Boost to Market-

Blitzer also stressed the impact of the homebuyer tax credit deadline on the market by saying “the month-over-month figures were driven by the end of the Federal first-time home buyer tax credit program on April 30th…eighteen cities saw month-to-month gains in April compared to six in the previous month.”

A Recovery Does Not a Tax Credit Make-

The Case-Shiller report shows results for April that, if fueled by a “real” market, may be sustainable but since it has clearly been fueled temporarily by the tax credits, it is not necessarily an indication that home prices have fully stabilized or that a housing recovery is underway. In the report Blitzer confirms this saying “other housing data confirm the large impact, and likely near-future pullback, of the federal program….recently released data for May 2010 show sharp declines in existing and new home sales and housing starts….inventory data and foreclosure activity have not shown any signs of improvement.”

When Will Home Prices and The Housing Market Stabilize? Where’s the Recovery?

Blitzer expects that it will be next year before we see “consistent and sustained boosts to economic growth from housing”. For what it’s worth, I agree…I don’t see much happening this year other than, hopefully, some markets finding their bottom and then beginning to stabilize.

By Dennis Norman, on May 25th, 2010  Dennis Norman Today the S&P/Case-Shiller Index report for the first quarter of 2010 was released showing that the U.S. National Home Price Index fell 3.2 percent in the first quarter of 2010, but remains above it’s level from a year-earlier.

In March, 13 of the 20 MSA’s covered by the Case-Shiller report, as well as both the 10-city and 20-city composites, were down for the month however both the composites as well as 10 of the 20 MSA’s showed year-over-year gains. The report cites the end of the tax incentives and the increasing foreclosure rate as reasons the housing market is seeing some “renewed weakness“.

Other highlights from the report –

- The S&P/Case-Shiller U.S. National Home Price Index for first quarter 2010 is up 2.0 percent from the first quarter of 2009.

- In March the 10-City Composite was up 3.1 percent from the first quarter of 2009, and the 20-City Composite was up 2.3 percent for the same period.

- These two indices are reported monthly and have seen improvements in their annual rates of return every month for the past year.

“The housing market may be in better shape than this time last year; but, when you look at recent trends there are signs of some renewed weakening in home prices,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “In the past several months we have seen some relatively weak reports across many of the markets we cover. Thirteen MSAs and the two Composites saw their prices drop in March over February. Boston was flat. The National Composite fell by 3.2% compared to the previous quarter and the two Composites are down for the sixth consecutive month.

“While year-over-year results for the National Composite, 18 of the 20 MSAs and the two Composites improved, the most recent monthly data are not as encouraging. It is especially disappointing that the improvement we saw in sales and starts in March did not find its way to home prices. Now that the tax incentive ended on April 30th, we don’t expect to see a boost in relative demand.”

FHFA Shows Lower Home Prices in First Quarter Also: FHFA Shows Lower Home Prices in First Quarter Also:

The Federal Housing Finance Agency (FHFA) released their report on first quarter home prices today as well. The FHFA report data and methodology differs from NAR and Case-Shiller, in that the FHFA home price index is based only on the sale prices of homes that are financed with a conforming loan (by Fannie Mae and Freddie Mac’s standards).

The FHFA report for the first quarter of 2010 shows home prices fell 1.9 percent from the quarter before, so not terribly far off from the 3.2 percent decline the Case-Shiller report showed. In contrast to the Case-Shiller report however, the FHFA report showed March’s home prices rose 0.3 percent from February. Also, the FHFA report shows home prices for this quarter fell 3.1 percent from a year ago.

St. Louis Home Prices Doing Better:

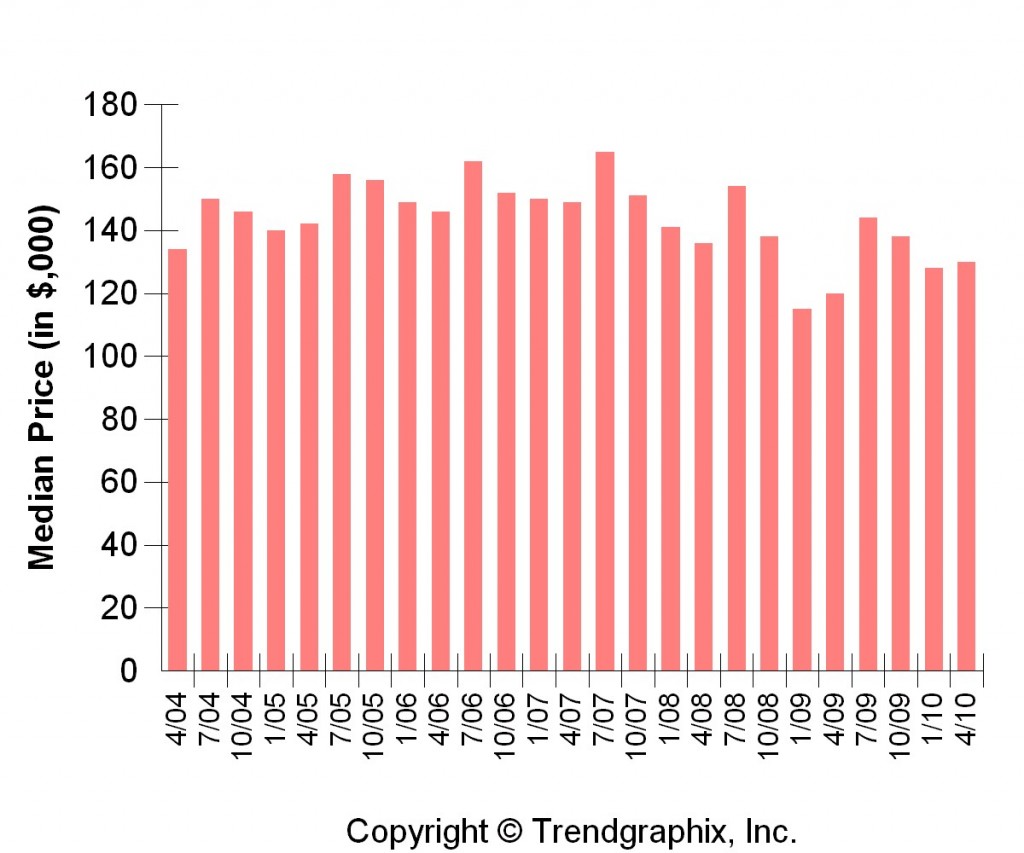

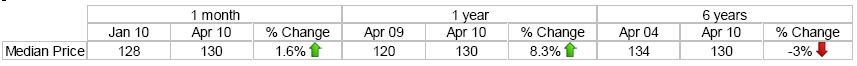

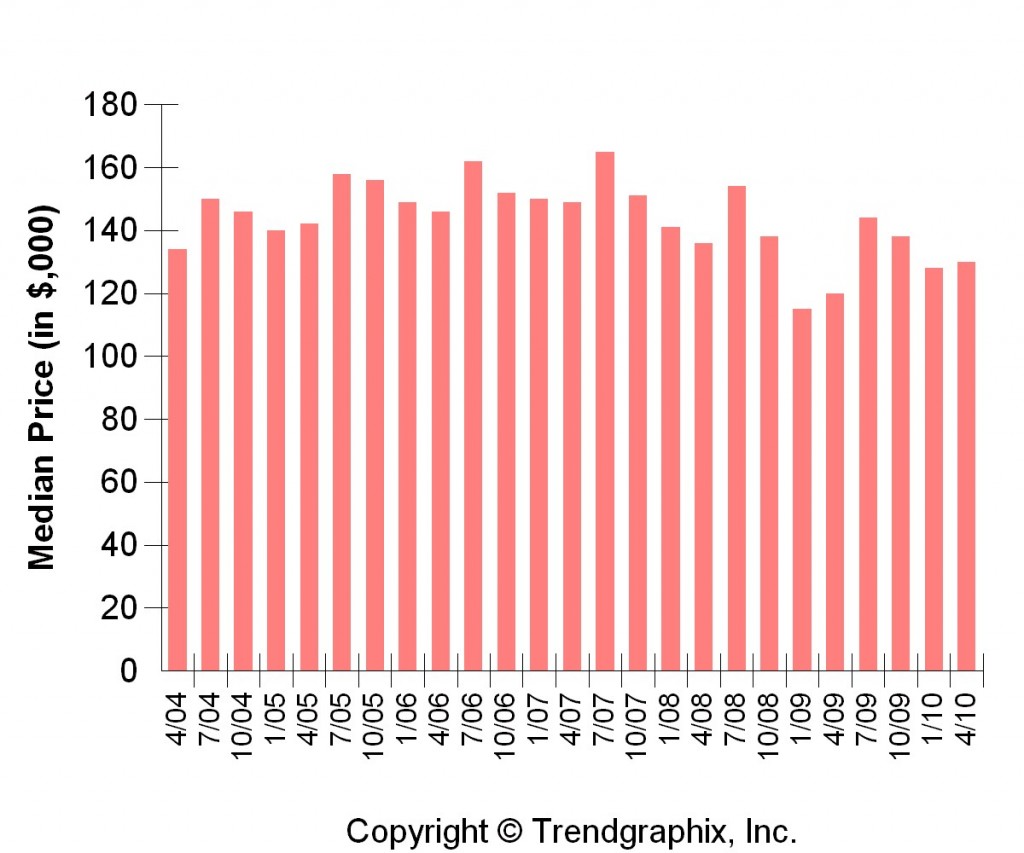

For the St. Louis metro and surrounding areas, the median home price for the quarter ended April 30, 2010 was $130,000 an increase of 1.6 percent from the prior quarter’s median price of $128,000 and an increase of 8.3 percent from a year ago when the median home price was $120,000. In case you are wondering, the median home price for the St. Louis area has dropped 3.0 percent in the past six years.

Median Home Prices in St. Louis Metro and Surrounding Areas for Past Six Years - Source: Mid America Regional Information Systems (MARIS)

Comparison of St. Louis Median Home Prices to Prior Periods - Source: Mid America Regional Information Systems (MARIS)

Where are home prices headed?

As we are frequently reminded, “all real estate is local”, so there will be markets that do better than others, but in general I think we are in store for soft home prices for a while. I think after the “sugar-rush” of the tax credit incentive wears off as the deals close over the next couple of months, and the next wave of foreclosures hit the market we will see prices regress again in many markets, enough so to bring overall home prices in the US down modestly in the coming months.

By Dennis Norman, on April 27th, 2010

Dennis Norman This morning the S&P/Case-Shiller Index report for February was released showing that, for the first time since December, 2006, the annual rates of change for their two composite home-price indices were positive. The 10-City Composite is up 1.4 percent from a year before and the 20-City Composite is up 0.6 percent from the same time last year. Unfortunately, 11 of the 20 cities included in the 20-City Composite had declines from the prior year, meaning that this positive bit of news is not “market-wide” but is the result of some metros with stronger markets.

On a positive note, 18 of the 20 metro areas in the 20-City Composite showed an improvement in their annual rates with February’s readings compared to the January 2010 figures, with Dallas and Portland being the only exceptions.

We are not “out of the woods” yet – the fat lady hasn’t sang –

“Beginning last November, each report showed gains as fewer cities reported year-over-year declines than in the previous month; those gains ended with this report. Further, in six cities prices were at their lowest levels since the prices peaked three-to-four years ago. These data point to a risk that home prices could decline further before experiencing any sustained gains. While the year-over-year data continued to improve for 18 of the 20 MSA’s and the two Composites, this simply confirms that the pace of decline is less severe than a year ago. It is too early to say that the housing market is recovering” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “Nineteen of the 20 MSAs and both Composites declined in February over January. Fourteen of the MSAs and both Composites have now fallen for at least four consecutive months. In addition, prices reached recent new lows for six cities in February – Charlotte, Las Vegas, New York, Portland, Seattle and Tampa – sending a more cautionary message compared to the annual figures. While 14 MSAs and the two composites show improvement over their trough values reached in the spring 2009, we are not completely out of the woods“, said Blitzer.

Foreclosures still overshadow the good news –

“Existing and new home sales, inventories and housing starts all show tremendous improvement in their March statistics. The homebuyer tax credit, available until the end of April, is the likely cause for these encouraging numbers and this may also flow through to some of our home price data in the next few months. Amidst all the news, however, we should also pay heed to foreclosure activity, which have reached their highest level in at least the last five years. As these homes are put up for sale, we may see some further dampening in home prices“, said Blitzer.

Other highlights from the report –

- As of February 2010, average home prices across the U.S. are at similar levels to where they were in late summer/early autumn of 2003

- From their peak in June/July 2006 through the trough in April 2009, the 10-City Composite is down 33.5 percent and the 20-City Composite is down 32.6 percent.

- From peak through February 2010 prices are down 30.7 percent on the 10-city index and 30.3 percent on the 20-city index.

- San Diego was the only market that continued to show improvement in home prices between January and February. All other metros and the two composites showed declines from their January levels.

- 12 of the MSAs home prices fell by at lest 1.0 percent during the month.

- 6 of the MSAs, Charlotte, Las Vegas, New York, Portland, Seattle and Tampa, posted new index lows.

- Charlotte and Cleveland have shown seven consecutive months of negative monthly returns.

- Atlanta, Boston, Denver, New York and Tampa are not far behind, with six consecutive negative reports.

By Dennis Norman, on April 13th, 2010

- Dennis Norman

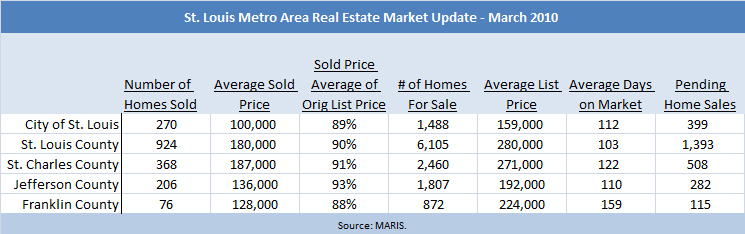

The month of March brought us some pretty great weather and also helped bring some home buyers out into the market. The homebuyer tax credits that are set to expire at the end of April probably played a role as well.

As you can see from the chart below, March brought sales to the metro area, but as the average prices of homes sold show, it is definitely the lower end, or first-time homebuyer, market that is seeing the bulk of the activity. In most of the counties the average price of the homes sold in March is only about 2/3 of the average price of the homes listed for sale. The chart also shows that most the homes sold are selling at prices equal to about 90 percent of the original list price.

By Dennis Norman, on March 30th, 2010

Dennis Norman

Annual Rates of Decline In Home Prices Improving

This morning the S&P/Case-Shiller Index report for January was released showing that home prices in their 10 city and 20 city composite indexes decreased from December, the 10-city index was down 0.2 percent and the 20-city index down 0.4 percent. The 10-city January index was exactly even with January 2009, and the 20-city January index was down 0.7 percent from a year ago. The indexes include the major metropolition areas in the U.S. (details for metros included are in chart that follows).

All 20 metro areas and both Composites showed an improvement in their annual rates of decline with January’s numbers compared to December 2009. As of January 2010, average home prices across the United States are at similar levels to where they were in the autumn of 2003. From the peak in June/July of 2006 through the lowest period in April 2009, the 10-City Composite is down 33.5 percent and the 20-city composite is down 32.6 percent. The peak through January 2010 figures are -30.2 percent and -29.6 percent respectively.

David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s said, “the report is mixed. While we continue to see improvements in the year-over-year data for all 20 cities, the rebound in housing prices seen last fall is fading. Fewer cities experienced month-to-month gains in January than in December 2009, on both a seasonally adjusted and unadjusted basis.”

By Dennis Norman, on March 19th, 2010

Dennis Norman

Increased prices on distressed home sales in St Louis are the reason for St Louis’s home price gains.

A report released by First American CoreLogic shows St. Louis metro area home prices, including distressed sales, increased 0.60 percent in January 2010 compared to January, 2009. December 2009’s home price index for St. Louis was up 1.54 percent from the year before. Excluding distressed sales, the January 2010 home price index was actually down 0.55 percent from a year ago, compared with December 2009’s home price index which was up 0.59 percent from the prior year.

First American CoreLogic is projecting the 12-month forecast for St. Louis home prices, including distressed sales, will be 0.90 percent. The forecast for the State of Missouri as a whole is better, with home prices expected to increase 1.60 percent in the next twelve months, including distressed sales, and 1.30 percent excluding distressed sales.

Nationally, home prices in January decreased by 0.7 percent compared with a year ago, which is a significant improvement from December 2009’s decrease of 3.4 percent from the year prior. Excluding distressed sales, national home prices in January declined by 0.4 percent.

By Dennis Norman, on February 25th, 2010  Dennis Norman According to a report issued this morning by the the Federal Housing Finance Agency (FHFA) St. Louis area home prices increased by 1.32 percent in 2009. Granted that’s not much but, hey, after what we’ve seen the last couple of years in the housing market I think this is very good news.

This information comes for the FHFA’s purchase-only price index which is based upon repeat sales of the same single-family properties therefore making it a much more accurate barometer of the market than just looking at median prices of homes sold as many reports do. In addition, since FHFA obtains the sales data from mortgage records of Fannie Mae and Freddie Mac, which form the nation’s largest database of conventional mortgage transactions (more than 5 million repeat transactions) which represents probably the most comprehensive sampling of data available.

One thing to remember though, is Fannie Mae loan limits are $417,000, so the data compiled does not reflect what is happening in the upper end of the market with loans in excess of $417,000 however here in St. Louis that makes up a very small part of the market . In 2009 there were 23,565 homes and condos sold in the St. Louis metro area and only 808 of them (3.4 percent) sold for $500,000 or above.

Other highlights from the report:

- St. Louis ranked 8th of the 25 largest metro areas in terms of price appreciation for 1 year. Washington-Arlington-Alexandria topped the list at 10.55 percent. Miami-Miami Beach-Kendall, FL was at the bottom of the list iwth -12.86 percent

- For the 4th quarter of 2009 St. Louis home prices increased 0.83 percent.

- St. Louis home prices have appreciated 3.91 percent in the past 5 years, coming in 7th of the 25 largest metros. Houston-Sugar Land-Baytown, TX came in 1st at 21.63 percent and Riverside-San Bernardino-Ontario, CA came in last at -37.18 percent.

- Since 1991 St. Louis home prices have increased 99.17 percent, coming in at 14th place of the 25 largest metros. Denver-Aurora-Broomfield, CO had the highest appreciation in that period at 177.80 percent and Warren-Troy-Farmington Hills, MI came in last at 30.99 percent.

So there you go….some good news from me for a change. :)

By Dennis Norman, on December 28th, 2009  Dennis Norman

To answer this question I turned to the housing forecast just released by Fannie Mae to see what their economists were predicting. Here are the highlights from the report, showing actual numbers for the 3rd quarter of this year as well as Fannie Mae’s projection for 4th quarter of this year as well as 4th quarter of 2010:

- New Home Starts (seasonally adjusted annual rate)

- 3rd quarter actual- 499,000

- 4th quarter 09 projection – 502,000 (+0.06 % from 3rd quarter)

- 4th quarter 10 projection – 650,000 ( +29.4% from the year before)

- New Home Sales (seasonally adjusted annual rate)

- 3rd quarter actual- 413,000

- 4th quarter 09 projection – 442,000 (+7.02 % from 3rd quarter)

- 4th quarter 10 projection – 510,000 ( +15.38% from the year before)

- Existing Home Sales (seasonally adjusted annual rate)

- 3rd quarter actual- 5,290,000

- 4th quarter 09 projection – 5,623,000 (+6.29 % from 3rd quarter)

- 4th quarter 10 projection – 5,492,000 ( -2.32% from the year before)

- Median Home Prices-New Homes

- 3rd quarter actual- $210,400

- 4th quarter 09 projection – $214,600 (+2.0 % from 3rd quarter)

- 4th quarter 10 projection – $211,400 (-1.5% from the year before)

- Median Home Prices-Existing Homes

- 3rd quarter actual- $178,300

- 4th quarter 09 projection – $175,200 (-1.73 % from 3rd quarter)

- 4th quarter 10 projection – $172,600 (-1.48% from the year before)

- Mortgage Interest Rates (fixed-rate mortgage)

- 3rd quarter actual- 5.16 percent

- 4th quarter 09 projection – 4.88 percent

- 4th quarter 10 projection – 5.32 percent

So there you have it. A somewhat encouraging forecast for the housing industry for next year. A prediction of increased new home sales, a little bump in existing home sales at the end of this year (from the homebuyer tax credit no doubt) and then a slight drop in sales next year from that rate, a slight drop in home prices in the next year and interest rates that are still attractive. If all this pans out 2010 will no doubt end up being a kinder year to the housing industry than 2009 was.

Ah, but wait…I know what you’re thinking…same thing as me. What do these guys know? After all wasn’t it Fannie Mae that had accounting issues, management problems and has been blamed by some to be a contributor to the housing bust? Well, lets take a look at their housing forecast from a year ago and how accurate their projections were then. For the sake of this comparison we will compare their forecast for the 3rd quarter of 2009 with the actual numbers from above:

New Home Starts (seasonally adjusted annual rate)

3rd quarter 2009 actual- 499,000

3rd quarter forecast – 526,000 (over by 5.41%)

New Home Sales (seasonally adjusted annual rate)

3rd quarter2009 actual- 413,000

3rd quarter forecast – 472,000 (over by 14.29%)

Existing Home Sales (seasonally adjusted annual rate)

3rd quarter 2009 actual- 5,290,000

3rd quarter forecast – 5,003,000 (under by 5.42%)

Median Home Prices-New Homes

3rd quarter 2009 actual- $210,400

3rd quarter forecast – $208,600 (under by 0.85%)

Median Home Prices-Existing Homes

3rd quarter 2009 actual- $178,300

3rd quarter forecast – $186,600 (over by 4.66%)

Mortgage Interest Rates (fixed-rate mortgage)

3rd quarter 2009 actual- 5.16 percent

3rd quarter forecast – 5.44 percent (over by 5.42%)

Considering all the factors that affect the housing market I actually think Fannie Mae did pretty good in their forecast last year. They overshot new home sales a fair amount but undershot existing home sales by a much smaller percentage. Overall on combined home sales they got within 4% of predicting the number of sales. I also think they did pretty good on median home prices.

So, since Fannie Mae’s projections last year were fairly accurate lets hope the current projections will prove to be as well. If so, then it will be clear that the worst is behind us.

By Dennis Norman, on November 23rd, 2009  Dennis Norman National Association of REALTORS released a report today saying US Home Sales in October increased 10.1 percent for the month and are 23.5 percent higher than a year ago; I did an analysis of the data based just on ACTUAL sales and came up with an increase for the month of 6.6 percent and an increase of less than 1 percent from a year ago…When looking at the Actual sales number for US home sales, the St Louis market is performing pretty close…(to see my complete post and analysis of the NAR report click here)

Here in the St. Louis metro area (in which I include the City of St. Louis and the counties of St Louis, St Charles, Jefferson and Franklin) home and condo sales for October increased 7.0 percent to 2,375 units up from 2,219 units for September. As I reported last week in my St. Louis Real Estate News St. Louis Real Etate Market Update, through the end of October home sales in St. Louis are down 4.8 percent from the same period last year. Continue reading “St. Louis area home sales increase 7.0 percent in October from September; down 4.8 percent from a year ago“ Here in the St. Louis metro area (in which I include the City of St. Louis and the counties of St Louis, St Charles, Jefferson and Franklin) home and condo sales for October increased 7.0 percent to 2,375 units up from 2,219 units for September. As I reported last week in my St. Louis Real Estate News St. Louis Real Etate Market Update, through the end of October home sales in St. Louis are down 4.8 percent from the same period last year. Continue reading “St. Louis area home sales increase 7.0 percent in October from September; down 4.8 percent from a year ago“

By Dennis Norman, on November 19th, 2009

- Dennis Norman

According to a report issued by First American CoreLogic national home prices continue to decline with their HPI (Loan Performance Home Price Index) declining by 9.8 percent in September 2009 compared with the year before. If you take the distressed sales out (foreclosures, short sales, etc) the nation decline in HIP for the same period was 6.2 percent.

By Dennis Norman, on November 18th, 2009  Dennis Norman Home sales in the St.Louis area through October 31st are down 4.8 percent from the same period a year ago, however this is a decrease of almost 40 percent from the month before when sales were down 7.9 percent from the same period the year before. St. Louis area median home prices for the period are down 6.5 percent from a year before however this is also an improvement from the 7.1 percent decrease for the month before. The average time it takes to sell a home in the St. Louis area is 2.2 percent less than a year ago, which is also an improvement from the month before when it is 1.1 percent less than the year before.

All the counties included in this report saw an improvement in sales, median home prices and average time to sell from the month before when comparing to last year. While that is encouraging we need to remember that the St. Louis Housing Market for this year is still not able to keep up with last year, and last years numbers were not good. Therefore I think we have a ways to go before we can get too excited. Continue reading “St. Louis Real Estate News St. Louis Real Estate Market Update“

By Charles Hugh Smith, on November 4th, 2009 Loose lending standards in government-backed mortgages is setting up the next wave of defaults and sharp declines in housing prices.

Charles Hugh Smith, Of Two Minds Beneath the hype that housing has bottomed is an ugly little scenario: lending standards are still loose and the low-down payment, high-risk loans being guaranteed by government agencies are setting up the next giant wave of defaults and foreclosures.

You might have thought that the near-demise of risky-mortgage mills Fannie Mae and Freddie Mac would have cooled the supply of highly leveraged government-guaranteed mortgages–but you’d be wrong, for the Feds have compensated for the implosion of the Fannie/Freddie housing-bubble machines by ramping up their other two mortgage mills: FHA and Ginnie Mae. Continue reading “Setting Up the Next Leg Down in Housing“

By Dennis Norman, on October 23rd, 2009

- Dennis Norman

Due to the overwhelming demand for up to date information on the St. Louis housing market, as well as the positive response to our prior reports we have published, at St. Louis Real Estate News we will now be publishing “St Louis Real Estate Market Update Reports on a regular basis. We hope that you enjoy the information and we certainly hope the reports start having more positive news in them soon. If there is any data we are not including that you would like to see please let us know in a comment. Continue reading “St. Louis Real Estate Market Update – 3rd Quarter Report“

By Dennis Norman, on September 22nd, 2009

- Dennis Norman

By: Dennis Norman

Today the Federal Housing Finance Agency (FHFA) reported that U.S. home prices rose 0.3 percent on a seasonally-adjusted basis from June to July and are down 4.2 percent for the past year. Missouri is included by the FHFA in the West North Central division which was right on target with the US with an increase of 0.3 percent from June to July. Our region was only down 1.5 percent from last year according the report.

Many of the reports I’ve seen in the press on this are saying this is a sign of the housing market recovering:

The Wall Street Journal, on WSJ.Com, Reported “U.S. Home prices climbed in July as some of the country’s worst-hit housing markets showed signs of recovering.”

The AP reported “U.S. home prices rose slightly in July from a month earlier, according to a government index, further evidence the housing market is stabilizing.”

By Dennis Norman, on September 15th, 2009

- Dennis Norman

Before the sub-prime mortgage implosion Karen Weaver warned of the coming crisis. Karen Weaver, the Global Head of Securitization Research for Deutsche Bank, said last month that she expected home prices to continue to drop through the 1st quarter of 2011. She also predicted that nearly half of the homeowners with mortgages would end up being underwater on their mortgages.

Yesterday Ms. Weaver said that in spite of the recent positive news on the housing market that she had not changed her position and is still predicting home prices to fall another 10 percent before finally reaching bottom. Ms. Weaver said “serious delinquencies are still rising rapidly in mortgages, unemployment reached a new cycle high, inventory in most parts of the country is elevated and in some areas affordability is backtracking.” Continue reading “Deutsche Banks’ Weaver says housing market has not hit bottom yet“

By Dennis Norman, on August 24th, 2009

- Dennis Norman

According to a report issued by First American CoreLogic national home price declines continue to improve citing that national housing prices fell 7.8 percent in June 2009 compared to June 2008 representing the small est year-over-year decline recorded to date in 2009. This was a 0.7 percent improvement over Mays decline of 8.5% from the prior year.

|

Recent Articles

|

According to a report released by

According to a report released by

FHFA Shows Lower Home Prices in First Quarter Also:

FHFA Shows Lower Home Prices in First Quarter Also:

Here in the St. Louis metro area (in which I include the City of St. Louis and the counties of St Louis, St Charles, Jefferson and Franklin) home and condo sales for October increased 7.0 percent to 2,375 units up from 2,219 units for September. As I reported last week in my St. Louis Real Estate News

Here in the St. Louis metro area (in which I include the City of St. Louis and the counties of St Louis, St Charles, Jefferson and Franklin) home and condo sales for October increased 7.0 percent to 2,375 units up from 2,219 units for September. As I reported last week in my St. Louis Real Estate News