According to a report just released by the Consumer Financial Protection Bureau (CFPB), titled “Housing insecurity and the COVID-19 pandemic“, there are over 2 million homeowners that have fallen behind at least three months on their mortgage payments. This represents a 250% increase from pre-Covid-19 levels and is now at a level we haven’t seen since the height of the Great Recession in 2010.

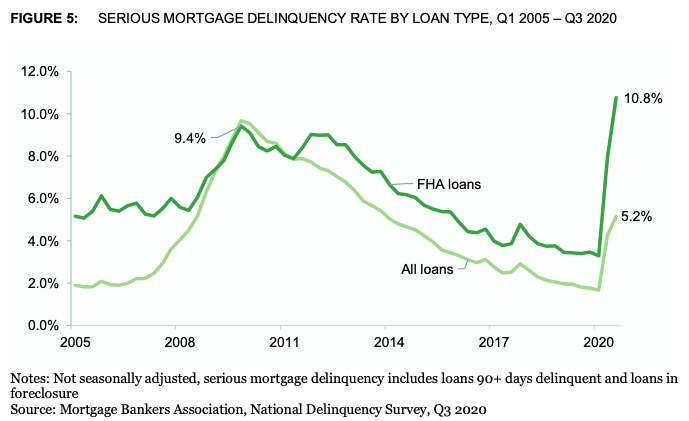

Homeowners with an FHA mortgage delinquency rates double rate for all loans:

As the chart below shows, homeowners with an FHA mortgage hit a serious mortgage delinquency rate of 10.8% during the 3rd quarter of 2020, with the rate for all mortgages was just under half that at 5.2%.

Serious Mortgage Delinquency Rate By Loan Type- Q1 2005 – Q3 2020

[xyz-ips snippet=”Homes-For-Sale”]

Renters impacted more than homeowners..

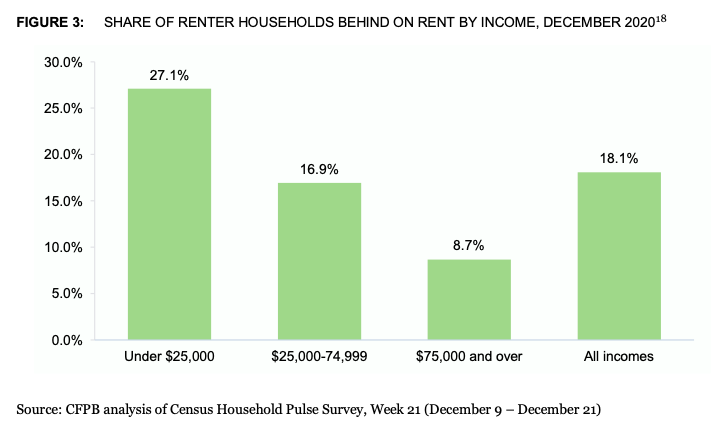

The economic plight that is a result of restrictions city, county and state officials have imposed because of the pandemic which has put many companies out of business or if not that, then dealt a serious blow to them financially, has not just affected homeowners of course but is affecting renters as well. The report states we are facing a rental crisis as well with over 8 million rental households behind in their rent.

Lower income renters impacted the most:

As the chart below shows, over 1 in 4 (27.1%) renters that have a household income of less than $25,000 is behind in their rent compared with just 8.7% of households with an income fo $75,000 and above.

Renters Behind On Rent By Income – December 2020

What the future holds in store:

While it’s impossible to know what the outcome of this will be or even when it will be, the data gives us an idea of what to expect.

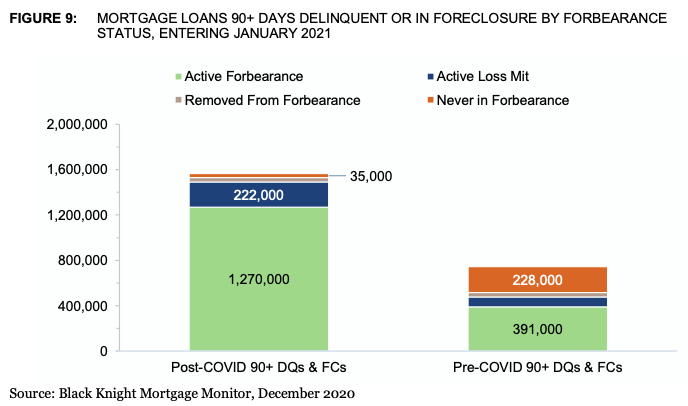

The chart below shows the number of homeowners that are in forbearance status which means they are delinquent but they are working with the lender to avoid foreclosure. The number of borrowers in forbearance as of January 2021 is 1,270,000 a 225% increase from the pre-COVID-19 period when there were 391,000 borrowers in forbearance. The reality is, unfortunately, many of the people in forbearance will end up in foreclosure once the foreclosure moratorium expires. If the number of people in forbearance is 225% of the pre-COVID-19 levels, then I think it’s safe to estimate the number of foreclosures will see in the coming months will more than double pre-COVID-19 levels.

Borrowers in Forbearance Status Post-COVID-19 vs Pre-COVID-19

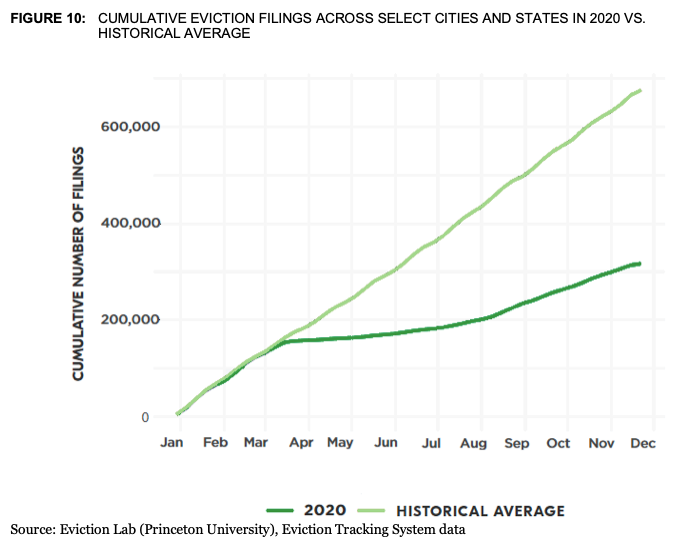

The outlook for renters is definitely bleak given the large number of renters that are currently delinquent on their rent. Eviction moratoriums in place in many areas have helped them avoid eviction thus far, which is why, as the chart below illustrates, evictions for the last 3 quarters of 2020 were well below the historic norm of about 900,000 evictions per year. However, for many renters, it’s just delaying the inevitable, and, according to the report, as many, as 13 to 17 million renters were at risk of eviction over the course of the pandemic. Therefore, in the coming months, the number of evictions could be staggering.

Cumulative Eviction Filings in 2020 vs Historical Average

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]