By Dennis Norman, on June 13th, 2023 As of April 1, 2023, the Federal Emergency Management Agency (FEMA) has put into action the National Flood Insurance Program’s (NFIP) Risk Rating 2.0, a newly devised pricing methodology. According to FEMA, this contemporary approach to flood risk assessment uses state-of-the-art technology and conforms to industry’s highest standards. The aim of this new model is to ensure that FEMA provides flood insurance rates that are not only actuarially justified, but also more equitable and comprehensible, and most importantly, they accurately represent the flood risk associated with a specific property.

There has been a fair amount of negative reports about the change in flood insurance pricing with 77% of the people with flood insurance seeing an increase in premiums as a result. For Missouri, 29.3% of homeowners with flood insurance will see a decrease in their flood insurance premium as a result with about 40% of these decreases being $50 per month or more. On the flip side, 62.4% will see an increase up to $10 per month, 6.1% with an increase from $11 to $20 per month and just 2.2% of the homeowners will see their flood insurance premiums increase by more than $20 per month.

Resources for more information on FEMA’s Risk Rating 2.0 as well as flood insurance:

By Dennis Norman, on May 21st, 2020 It’s no wonder home buyers are tripping over themselves and getting into bidding wars to buy a house as the supply of homes for sale is at or near historic lows. As our table below shows, there are currently 40 zip codes in the St Louis MSA with a one-month or less supply of homes for sale (7 of the zips have no homes for sale) and a total of 76 of the 127 (60%) zip codes within the St Louis MSA have a supply of homes for sale of 2 months or less.

This low inventory, along with low-interest rates and pent-up demand from the COVID-19 induced stay at home orders, is creating a real feeding frenzy of sorts for homebuyers in the St Louis market. For sellers, this is a dream come true, plenty of demand and little competition! Granted, this is not true in all areas and all price ranges, but for the most common prices ranges in the more popular areas it is very true.

Sellers should sell now!

If you are someone that has been thinking about selling, I would act on those thoughts now and take advantage of the current low-inventory conditions. While I don’t know that I agree, there are folks out there predicting that the market is going to get flooded with homes for sale shortly turning the tide on sellers. For me, I’ll believe that when I see it, but nonetheless, now is definitely a great time to sell.

[xyz-ips snippet=”Seller-Resources—Listing-Targeted”]

Continue reading “40 Zip Codes In The St Louis MSA Have 1 Month Or Less Supply Of Homes For Sale“

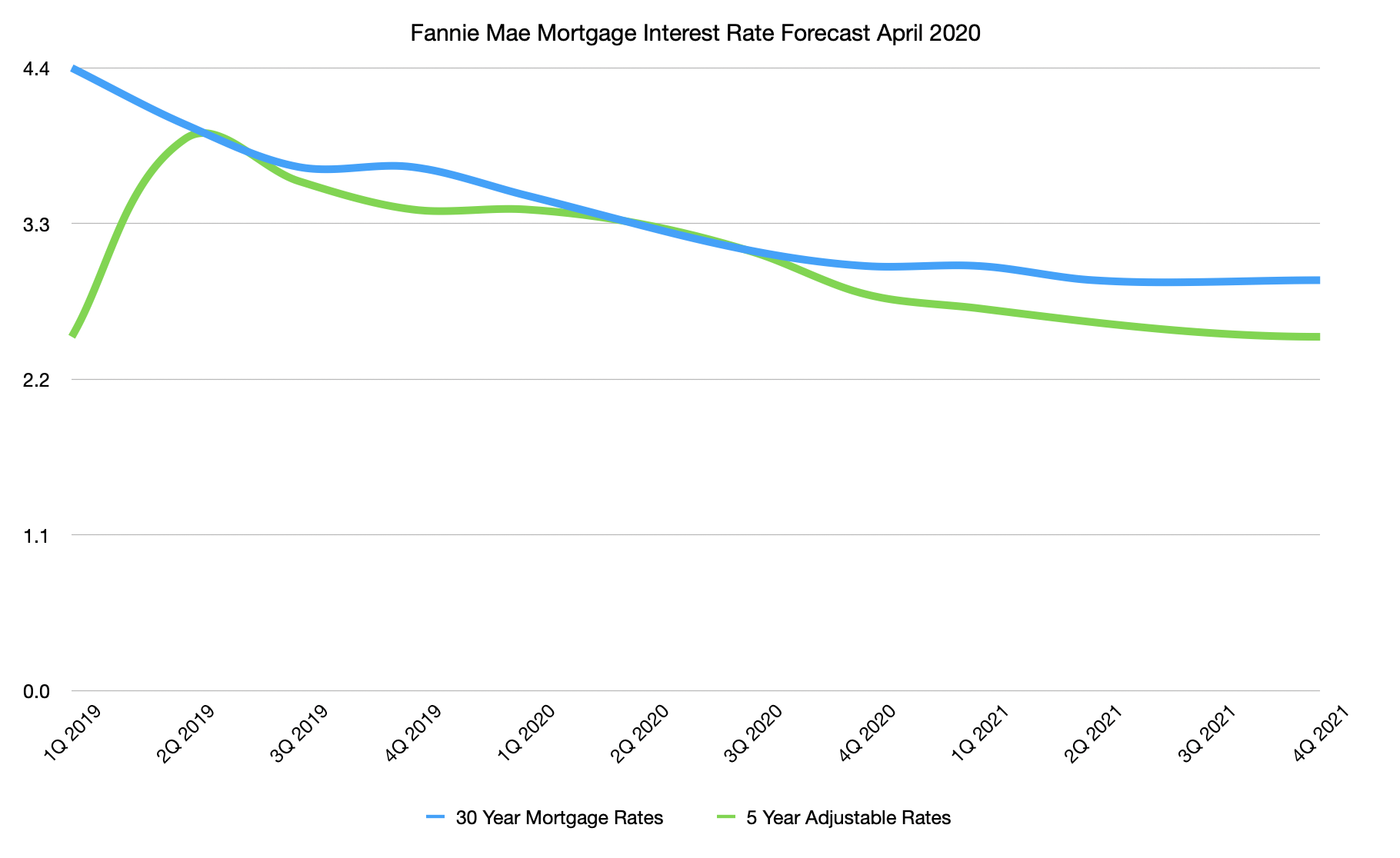

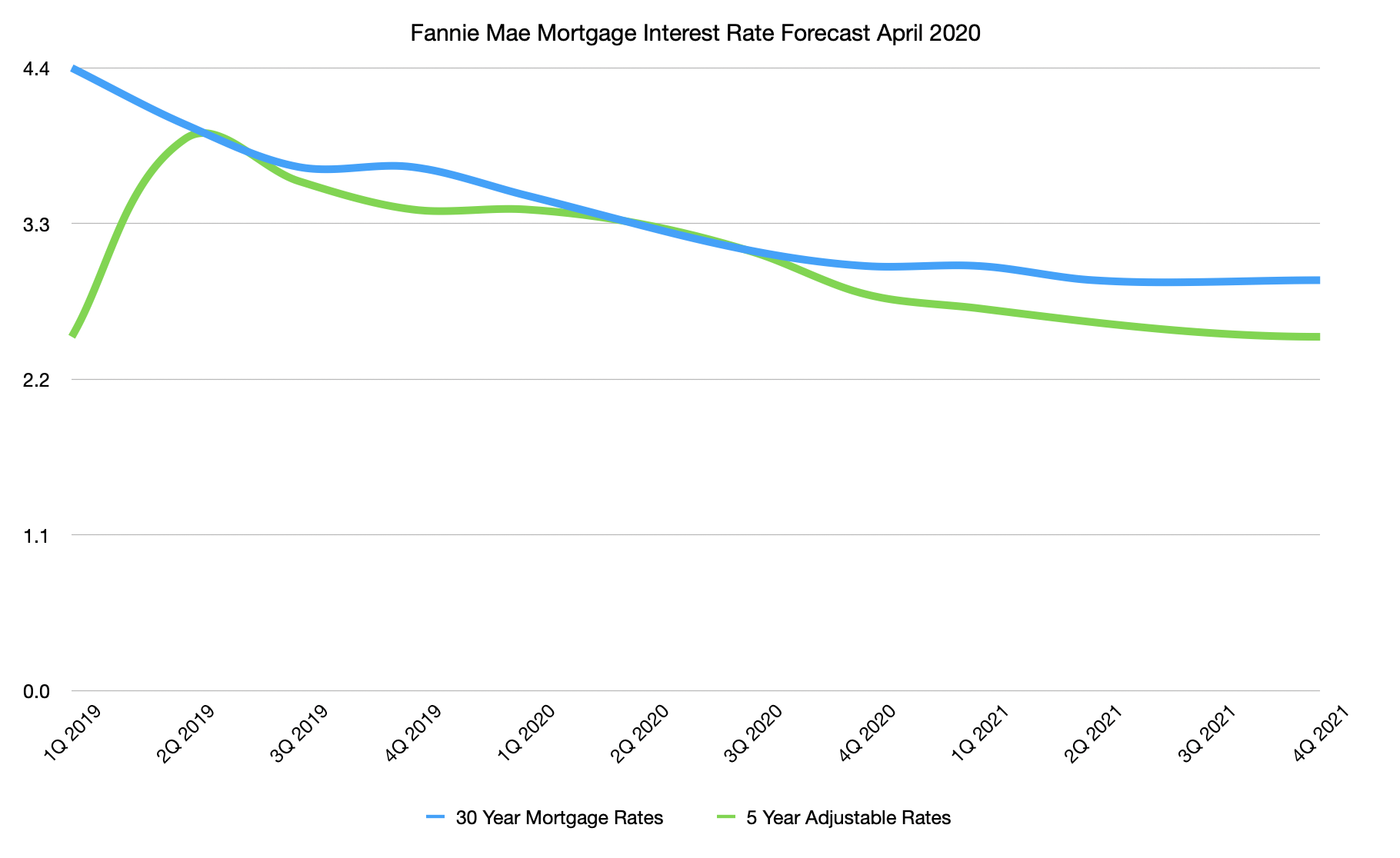

By Dennis Norman, on April 23rd, 2020 Fannie Mae issued their monthly housing forecast for April which includes, among other data, a forecast of what mortgage interest rates will be in the coming months. Last months forecast had projected that mortgage rates would continue to decline moving forward but only to a low of 3.1% before the end of 2021 while the April forecast predicted the interest rate on a 30-year fixed-rate mortgage would fall to 2.9% in the 2nd quarter of 2021 and stay there through the balance of the year.

If you’re able, now’s the time to buy!

While the effects of the COVID-19 pandemic, such as job loss, is going to take some would-be home buyers out of the market, for those that are still able to buy, now is a great time to buy a home. There are many factors that play in favor of buyers today, such as the fact that there are about 1/3 fewer of them (buyers in the market) now than this time last year, sellers that want to have fewer people coming through their homes and interest rates. As our chart below shows, not only are rates low now, they are projected to go much lower even.

Why not wait until next year when the rates hit their lowest?

Good question, but there are several reasons not to wait. First off, the rates shown on my chart are “projections”, or to put it another way “an educated guess”, so there is no guarantee rates will actually come down as predicted. In addition, once the stay at home orders go away and we start moving back to something closer to normal, I anticipate there will be a flood of buyers to the market which, along with lower interest rates (if that happens) will likely drive home prices up. So, for buyers that are able, they may get a better buy today, with less competition, still get a good interest rate and then if rates do fall as predicted can easily refinance to take advantage of lower rates.

[xyz-ips snippet=”Homes-For-Sale”]

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

Fannie Mae Mortgage Interest Rate Forecast April 2020 (Chart)

Data source: Fannie Mae – Copyright ©2020 St Louis Real Estate News, all rights reserved

By Dennis Norman, on June 21st, 2018 The St Louis 5-county core had a total population of 2,027,996 in 2017, up from 2,000,405 in 2010. The population increase os 27,591 represents a very modest population increase of just 1.36% for the 7-year period, according to the latest date from the U.S. Census Bureau. As the table below shows, the number of Asian people in St Louis grew by 11,913 during the period, an amount equal to 43% of the total St Louis population growth.

The St Louis 5-county core consists of the city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin. As shown below, three of the five counties experienced a growth in population from 2010 to 2017 with St Charles having the greatest growth at over 8.5%. The city of St Louis experienced the largest population decline with a loss of about 3.5% of its population during the 7-year period.

Another interesting tidbit in the data below is the growth in the male population in the St Louis 5-county core. During this period, the male population increased by 1.6% while the female population increased just 1.14%. While it may seem that significant, that is a 40% higher growth rate for males.

Continue reading “St Louis Area Population Growth Nearly Flat But Asians and Males on The Rise“

By Dennis Norman, on May 10th, 2017 The Missouri Insurance Department announced they will have Consumer specialists in place this week and next at Multi-Agency Resource Centers (MARC) throughout the state to assist flood victims with their insurance claims. The consumer specialists will be at the locations below, on the dates indicated and will be able to assist victims of the recent flooding with understanding their insurance policies as well as with filing insurance claims. The Missouri Insurance Department did point out however that “generally, homeowners insurance does not offer protection against flood losses. Homeowners should check their policies for exclusions, such as ‘water damage’.”

Consumers that have questions or concerns about their insurance coverage can also contact the Missouri Insurance Department’s Consumer Hotline at 800-726-7390 or visit insurance.mo.gov.

Multi-Agency Resource Centers (MARC) Where MO Insurance Dept Consumer Specialists will Be

| May 10 |

Ellington |

Ellington City Hall, 100 Tubbs Avenue |

| May 10 |

West Plains |

West Plains Civic Center, 110 St. Louis St. |

| May 11 |

Poplar Bluff |

Memorial Baptist Church 2215 South Broadway Bldg. C |

| May 11 |

Eminence |

United Methodist Church, 18321 Church St. |

| May 12 & 13 |

Van Buren |

Van Buren Youth & Community Center, CR 1204 State Hwy D |

| May 12 & 13 |

Valley Park |

Manchester United Methodist Church, 129 Woods Mill Rd. |

| May 15 |

Thomasville |

TBA |

| May 15 |

Pacific |

Pacific Eagles, 707 West Congress Pacific, MO 63069 |

| May 16 |

Gainesville |

Gainesville School District, Gymnasium |

| May 16 |

House Springs |

Northwest Valley Middle School, 4300 Gravois Rd. |

| May 17 |

Doniphan |

Caring Community Partnership, 209 Highway St. |

| May 18 |

Arnold |

Arnold First Baptist Church, 2012 Missouri State Rd. |

While it is too late to help with the recent flood, there is flood insurance available through the National Flood Insurance Program (NFIP). You purchase flood insurance, just like homeowners insurance, through insurance agents. There are requirements to be eligible as well as generally a waiting period before the coverage takes affect. If you would like to know more about flood insurance available through the National Flood Insurance Program (NFIP), you can contact them at 800-427-4661.

Want to know if your property is located in a flood zone? Go to STLflood.com for an interactive flood map where you can enter your address and view your property on the flood map to determine if it is located within a flood hazard area:

By Dennis Norman, on August 25th, 2016 ATTOM Data Solutions just released their 2016 Natural Hazard Housing Risk Report, in which they score counties across the nation on risks posed to housing from natural hazards. As the heat map below illustrates, St Louis County has the highest natural hazard ranking in the St Louis area at 59.8, followed by the City of St Louis at 55.3. Granted, the scale goes all the way to 360, so, in the scheme of things, I guess these scores don’t sound so bad.

The biggest threats…

Not surprising, the biggest threats to St Louis, in terms of natural hazards, come from tornado and hail damage with the threat of both at “very high” for both St Louis County and St Louis City. With all the recent flooding we have seen, I’m a little surprised that for both of those counties, flood risk is shown as “low”. Oh yeah, to put your mind at ease, St Louis is ranked as “very low” for risk of hurricane storm surge or wildfires.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum PriceGet a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

Continue reading “St Louis County Has Highest Natural Hazard Risk For Housing In The Area“

By Dennis Norman, on February 25th, 2016 The St Louis real estate market is off to a good start for 2016 but that doesn’t mean there aren’t St Louis neighborhoods that are experiencing a buyer’s market giving home buyers an advantage over sellers, at least to an extent. The most sure-fire way to turn an area into a buyers market is to flood it with inventory, or supply of homes for sale. When seller’s face increased competition, typically prices suffer giving home buyer’s an opportunity to negotiate harder and more aggressively in those areas than in others, particularly those experiencing a seller’s market.

The table below shows 13 of the 21 St Louis area cities that, at the time I wrote this, were experiencing a buyers market due to a larger than normal supply of homes available for sale in that city. If you click on the table you can see the live, real-time list of all buyer’s markets in St Louis.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

St Louis Market Data (Home Prices, Sales, Trends and MORE) By City, Zip or County

Continue reading “Cities In St Louis Where Home Buyers Have The Advantage“

By Dennis Norman, on January 25th, 2016 Today, the U.S. Department of Homeland Security’s Federal Emergency Management Agency (FEMA) announced that federal disaster assistance has been made available to residents of 33 counties in Missouri that suffered damage as the result of severe storms, tornadoes, straight-line winds, and flooding that occurred between December 23, 2015 and January 9, 2016.

Residents in the following counties are eligible for the assistance:

- Barry, Barton, Camden, Cape Girardeau, Cole, Crawford, Franklin, Gasconade, Greene, Hickory, Jasper, Jefferson, Laclede, Lawrence, Lincoln, Maries, McDonald, Morgan, Newton, Osage, Phelps, Polk, Pulaski, Scott, St. Charles, St. Francois, St. Louis, Ste. Genevieve, Stone, Taney, Texas, Webster, and Wright counties.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Find Your Home’s Value Online NOW!

See ALL Homes That Will Be Open In St Louis This Weekend

Online Interactive Flood Map- See If Your Property Is In Flood Hazard Area

Continue reading “FEMA Announces Disaster Assistance Is Now Available to Missouri Flood and Storm Victims“

By Dennis Norman, on September 4th, 2015 It seems when we think of natural disasters and property damage, most people think of hurricanes and coastal areas which would be true and would certainly not apply to Missouri however, Missouri has threats to property from natural disasters as well. In fact, according to RealtyTrac’s annual U.S. Natural Disaster Housing Risk Report, while Missouri does not have any counties that fall in the “Very High Risk” category when it comes to risk to housing from natural disasters, Missouri does have three counties that are in the “High Risk” category two of which, Jasper and Newton, are in the Joplin area in the southwest portion of the state and the third, Madison, is in the southeast area of Missouri.

In assessing the risk of property damage from natural disaster to counties, RealtyTrac looked at five natural disasters that pose a risk to housing: earthquake risk, hurricane risk, tornado risk, flood risk and wildfire risk. As the table below shows, risk of hurricanes and wildfires is pretty low in Missouri but we definitely have the other three threats here to varying degrees. In the St Louis area, Jefferson County scored in the “Moderate Risk” category but the remaining counties in the “Low Risk” category.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Continue reading “Three Missouri Counties At High Risk For Property Damage From Natural Disasters“

By Shelly Clark, on February 3rd, 2015 Flood zones are land areas identified by the Federal Emergency Management Agency (FEMA). Each area of land is mapped and labeled into a flood zone. FEMA flood maps include zones that are broken into several areas.

Here are the most common flood zone areas that you will see in Missouri:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Continue reading “What Does It Mean To Be In A Flood Zone?“

By Dennis Norman, on December 2nd, 2014 I spent most of my childhood as well as my early adulthood living in Ferguson and have fond memories of those days. I remember, as a young child, walking down South Florissant Road, south of Carson Road, past a head shop surrounded by hippies in a building on the east side of the street where now is just a parking lot, thinking how strange everyone looked and wondering what a head shop was. I also remember riding my bike all the way from my parents house on Spring to E.J. Korvette’s in Cool Valley to buy my mom a mothers day present. Oh yeah, I also remember being “busted” by the railroad police when me and my dad were attempting to make off with an empty 55 gallon drum from the railroad property near the old train station. I was a teenager by this time and my latest “wild hair” was to build a forge to heat railroad spikes to the point I could pound them into some sort of art or whatever I had in mind. In either event, I needed a 55 gallon drum and found one just laying around by the railroad tracks…who would have known the railroad cared so much about their trash?

I never dreamed that some day Ferguson would be a household name, albeit for the wrong reasons. In the past month I have spoke with reporters from the St Louis Post Dispatch, Fox 2 News, Reuters and even the Wall Street Journal, all wanting to know about the Ferguson real estate market. I don’t know if the real estate market is just another angle to report about or if that many people are genuinely interested in the Ferguson real estate market, but it’s safe to say there are plenty of people talking about it. An interesting thing hit me this morning….no one has asked me anything about the people that live in Ferguson, just about home prices, whether there has been “white flight”, if the market is being flooded by people wanting out, etc. So, while I’ve been gone from Ferguson long enough not to personally know too many people there I decided to do some research and at least give some stats on who lives in Ferguson today.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]Who Lives in Ferguson Today? Continue reading “Who Lives In Ferguson?“

By Shelly Clark, on October 2nd, 2014 You’ve owned your home for 20 years, and you’ve never been required to have flood insurance on your property. So why did you get a notice saying that you are required to have flood insurance or else your lender is going to impose it upon you now – after all these years?

Simply stated, The Federal Emergency Management Agency (FEMA) believes that your lot is now at risk for being flooded in the event of a 100 year flood. FEMA creates Flood Insurance Rate Maps (FIRMs) which depict and show where it is calculated that the water will spread in the event of a flood. Because our communities’ landscape is constantly changing due to construction and population increase, the FIRMs become outdated and are no longer accurate. In order to accurately depict where the flood waters will expand to, the FIRMs are updated as needed.

Interactive Online Flood Map for the U.S. Here

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Continue reading “Why did I get a notice that says I have to have flood insurance?“

By Dennis Norman, on September 12th, 2014

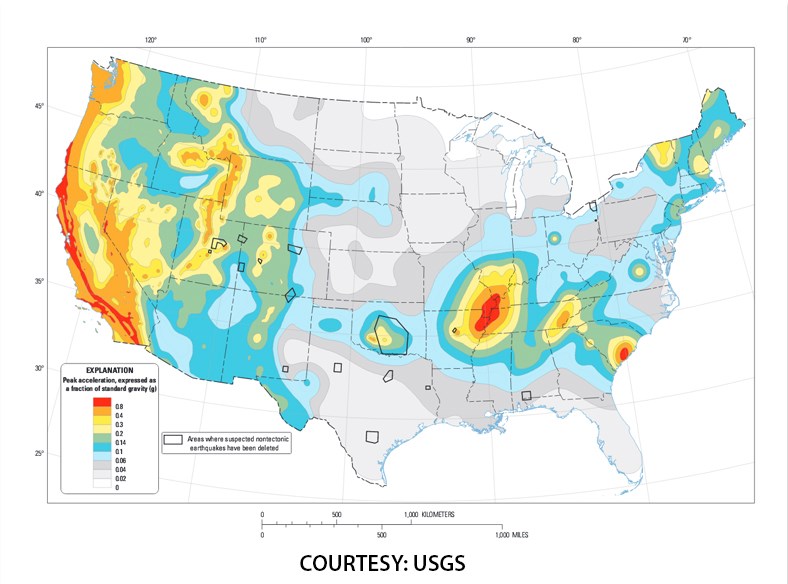

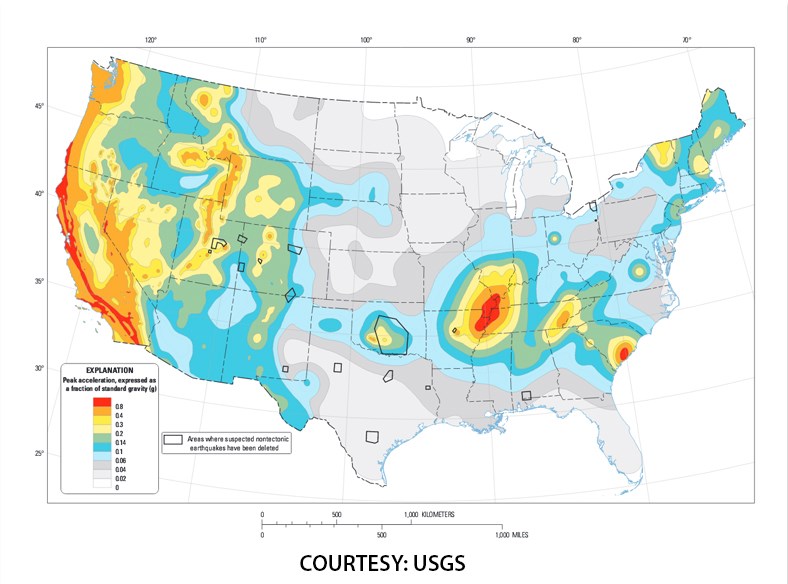

According to a report just released by Corelogic, Florida has the highest risk of property damage from a natural hazard of any state in the country (shocker, right?). At the other end of the list is Michigan with the lowest risk and Missouri came in at 19th no doubt due to flood risk, tornadoes and the New Madrid fault that makes it’s home in the southeast portion of our state.

According to an updated map published by the folks at U.S. Geological Survey, an earthquake on the New Madrid fault could impact all of the State of Missouri with the exception of the northwest corner of the state.

The map below is a map of the U.S. which shows the hazard risk score by color indicating the severity. For the most part, the coasts are red which shouldn’t come as a surprise.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “Missouri Rank’s 19th On List of States with Highest Natural Hazard Risk“

By Dennis Norman, on October 7th, 2013  As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal. As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal.

Shelly Clark, President of Cardinal Surveying, said that there should not be any impact on obtaining a survey, however there will be some impact for homes located in a flood zone Continue reading “How Will The Government Shut Down Affect The St Louis Real Estate Market?“

By Dennis Norman, on July 24th, 2013  The great flood of ’93 revealed the importance of flood insurance to many St Louis area property owners that found their homes either underwater or threatened by flood though they never before thought it possible. As a result of that flood as well as subsequent floods brought on by hurricanes in coastal areas and other major storms inland, the National Flood Insurance Program (NFIP) found itself in a position where major changes were needed in order to continuing providing flood coverage and at fair rates. Therefore the Biggert-Waters Flood Insurance Reform Act of 2012 was passed which makes sweeping changes to the flood insurance program. This short (4 minute) video from FEMA does a great job explaining changes to the program that will come about as a result of the act. The great flood of ’93 revealed the importance of flood insurance to many St Louis area property owners that found their homes either underwater or threatened by flood though they never before thought it possible. As a result of that flood as well as subsequent floods brought on by hurricanes in coastal areas and other major storms inland, the National Flood Insurance Program (NFIP) found itself in a position where major changes were needed in order to continuing providing flood coverage and at fair rates. Therefore the Biggert-Waters Flood Insurance Reform Act of 2012 was passed which makes sweeping changes to the flood insurance program. This short (4 minute) video from FEMA does a great job explaining changes to the program that will come about as a result of the act.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

[iframe http://player.vimeo.com/video/67831515 500 281]

By Dennis Norman, on February 11th, 2013

Before you get all excited, no, St. Louis did not make the top ten list of the best cities in America for young singles to relocate for love. Wait, before you think I have lost my mind, or are using a cheesy seasonal top-ten list for readership, it’s not my doing….it’s actually Zillow’s idea. This week, Zillow introduced their “In the Move for Love Index“, which lists the best cities for young singles to relocate for love. In evaluating locations for their list, Zillow considered the cost of rent versus income, walkability of the city as well as “supply and demand”…well, um, “the ratio of, and abundance of, single males to single females under 35“.

So here you go, “The Top 10 Cities To Find your Valentine” (don’t blame me..blame Zillow): Continue reading “The best cities for romance and real estate“

By Shelly Clark, on January 15th, 2013

Do you have a property in the flood zone? Do you question as to whether or not FEMA “got it right” when assessing the location of your property and if you really are in the flood zone?

Typically, in order to find out if your home is located in a flood zone, you have to hire a land surveyor or engineer to perform an elevation certificate on your property. The certificate takes FEMA data and actual elevations of the structure and compares them to the FEMA Base Flood Elevation. If your structure is located above the Base Flood Elevation, then you most likely won’t be required to carry flood insurance. The problem is that FEMA does not store this data, unless you make a Letter of Map Change (LOMC) or Letter of Map Amendment (LOMA) request. Continue reading “Does FEMA show your property in a flood zone? How to find out if they got it right.“

By Dennis Norman, on December 28th, 2012  I don’t know that “hot” comes to mind when I think about any St Louis real estate market today, however, relative to the rest of the market, I think I can identify some St. Louis real estate markets that I feel are poised to perform better in 2013 than other St Louis markets. Below are my charts showing some key market data for the top markets. Included in my data are 4 pieces of information that I think are key to determining the health of a local real estate market: I don’t know that “hot” comes to mind when I think about any St Louis real estate market today, however, relative to the rest of the market, I think I can identify some St. Louis real estate markets that I feel are poised to perform better in 2013 than other St Louis markets. Below are my charts showing some key market data for the top markets. Included in my data are 4 pieces of information that I think are key to determining the health of a local real estate market:

- Home prices – I show what prices have done over the past 12 months. For a “healthy” market we would expect prices to be generally on the rise however, we don’t want them increasing at too fast of rate as, like we learned from the bubble, this is not good.

- Inventory of homes for sale – Excess inventory of homes for sale put a damper on the market for some time and, as the basic law of supply and demand dictates, generally brings prices down…therefore I’m looking for inventories that have declined to near normal levels.

- Days on market – another indicator of supply and demand in a market….for a market to be healthy we would expect to see homes sold within a reasonable period of time

- Market Action Index – This gives us a quick snapshot of the health of the market focusing primarily on the balance of supply and demand. A “30” would be a balanced market not favoring buyers or sellers, above a 30 (up to a maximum of 60) indicates a “hot” market favoring sellers, below 30 (down to a low of 0) indicates a “cold” market and favors buyers. After what the real estate market has been through over the past 5 years, anything in the mid 20’s is great and a 30 is a real eye opener today.

Continue reading “What are going to be the hot St Louis real estate markets in 2013?“

By Jason Earle, on July 23rd, 2012

We fix sick homes. Every day, people with asthma, allergies, sinus problems – and a plethora of other sometimes seemingly unrelated maladies – suspect something in their home might be at the root of their woes and call upon us to do the sleuth work. More often than not, when we find a mold problem and it gets corrected, people begin to see improvements in their health and quality of life, sometimes dramatic improvements.

I’m writing this article because I am constantly faced with this preconception that getting rid of mold somehow involves killing it first, as if you have to sneak up behind it and snuff it out before it knows you’re there. Yes, this stuff can be dangerous, but not like that. Continue reading “The Argument Against Biocides; Why We Dont Need To Kill Mold“

By Robert Fishel, on January 18th, 2012

What income is required to qualify for a mortgage? That largely depends on your monthly debt payments and the current interest rate. This calculator collects these important variables and determines your required income to qualify for your desired mortgage amount.(click here)

Mortgage interest rates have fallen this year to historical lows and with them so have the costs of home ownership. Regardless of a borrower’s loan amount, bargain-basement interest rates have brought a home buyer’s monthly mortgage payment down to levels never seen in history. Continue reading “St. Louis Mortgage Rate Update; What income is required for a mortgage?“

By Dennis Norman, on January 11th, 2012

First-time home buyers receive a forgivable 3% cash assistance loan for down payment and closing costs.

The Missouri Housing Development Commission (MHDC) provides a competitive interest rate on a safe 30-year fixed rate 1st mortgage. Your 3% advance loan is treated as a 2nd mortgage and is completely forgivable after five years of continuous occupancy. MHDC will have the monies available for the borrowers regardless of bond issuance through Constant Funding. Continue reading “St. Louis Mortgage Rate Update; Forgivable down-payment assistance loan available for first-time homebuyers“

By Robert Fishel, on January 4th, 2012

The National Association of Realtors’ research staff recently released its comprehensive annual report: Profile of Home Buyers and Sellers for 2011.

Market researcher, Paul C. Bishop, Ph. D., Vice President and Jessica Lautz, Manager of Consumer Survey Research state that they’ve identified “trends that have not been seen in the last 10 years,” which will affect the housing market as we enter 2012. Continue reading “St. Louis Mortgage Rate Update; Trends that will affect the housing market in 2012“

By Robert Fishel, on December 28th, 2011

The characteristics of home buyers has changed fairly significantly in the past year, according to the National Association of REALTORS (NAR) annual Profile of Home Buyers and Sellers. Last year, first-time home-buyers made up 50 percent of the market and in 2011 made up only 37 percent of the market. Continue reading “St. Louis Mortgage Rate Update; Who are the home-buyers?“

By Thomas J. Lucier, on October 5th, 2011

As far as I’m concerned, the Internet is one of the greatest inventions of all time, and ranks right up there with flush toilets, sliced bread, and basketball! For real estate investors, the Internet is the single best property due to diligence research tool available. Especially for investors who are located in counties where property tax rolls are online.

If your county’s property records are available online, you can quickly find out who owns a property, when it was purchased, how much it costs and its tax-assessed Continue reading “How To Use The Internet To Perform Due Diligence On Real Property“

By Dennis Norman, on June 21st, 2011  Today’s existing home sales report from the National Association of REALTORS® shows existing home sales in May were at at a seasonally adjusted-annual rate of 4.81 million units which is a decrease of 3.8 percent from the month before and is a decrease of 15.3 percent from a year ago and is the lowest rate of home sales since November 2010 when it was 4.64 million. Continue reading “US Existing home sales in May fall to lowest level this year; St. Louis has largest decrease for third consecutive month“ Today’s existing home sales report from the National Association of REALTORS® shows existing home sales in May were at at a seasonally adjusted-annual rate of 4.81 million units which is a decrease of 3.8 percent from the month before and is a decrease of 15.3 percent from a year ago and is the lowest rate of home sales since November 2010 when it was 4.64 million. Continue reading “US Existing home sales in May fall to lowest level this year; St. Louis has largest decrease for third consecutive month“

By Dennis Norman, on May 11th, 2011  Spring storms in April caused 8 areas of the U.S. to be declared a National Disaster area, and another 9 more so far in May. As a result of tornadoes, severe storms and flooding on April 19th, five counties in Missouri, Butler County, Mississippi County, New Madrid County, Saint Louis County, and Taney County, were declared a National Disaster areas on May 9th, making homeowners eligible for assistance, including possible mortgage payment relief and/or protection from foreclosure. Continue reading “Mortgage Relief and Foreclosure Moratorium for Missouri Homeowners Impacted by Recent Storms“ Spring storms in April caused 8 areas of the U.S. to be declared a National Disaster area, and another 9 more so far in May. As a result of tornadoes, severe storms and flooding on April 19th, five counties in Missouri, Butler County, Mississippi County, New Madrid County, Saint Louis County, and Taney County, were declared a National Disaster areas on May 9th, making homeowners eligible for assistance, including possible mortgage payment relief and/or protection from foreclosure. Continue reading “Mortgage Relief and Foreclosure Moratorium for Missouri Homeowners Impacted by Recent Storms“

By Dennis Norman, on April 28th, 2011  A report released this morning by Trulia shows that when it comes to the question “should I rent or buy” the answer is to buy in 80 percent of the 50 largest U.S. cities. Trulia’s “Rent vs. Buy Index” compares the cost of buying and renting a two-bedroom apartment, condominium or townhouse and for the 2nd quarter of 2011 this index shows that buying is the way to go from an affordability standpoint for most areas….the only cities where renting was cheaper than buying were New York, Fort Worth and Kansas City. Continue reading “Buying a home more affordable than renting in four out of five major cities“ A report released this morning by Trulia shows that when it comes to the question “should I rent or buy” the answer is to buy in 80 percent of the 50 largest U.S. cities. Trulia’s “Rent vs. Buy Index” compares the cost of buying and renting a two-bedroom apartment, condominium or townhouse and for the 2nd quarter of 2011 this index shows that buying is the way to go from an affordability standpoint for most areas….the only cities where renting was cheaper than buying were New York, Fort Worth and Kansas City. Continue reading “Buying a home more affordable than renting in four out of five major cities“

By Dennis Norman, on March 17th, 2011  As spring approaches (say good bye to winter!! ) many homeowners face the risk of potential flooding of their homes or investment properties. Thanks to the requirements of most lenders for a borrower to obtain a flood letter to determine if their property is in a flood plain and, if so, obtain flood insurance, possible flood damage is a “known” threat to most homeowners affected. Continue reading “What is the risk of flood for your home?“ As spring approaches (say good bye to winter!! ) many homeowners face the risk of potential flooding of their homes or investment properties. Thanks to the requirements of most lenders for a borrower to obtain a flood letter to determine if their property is in a flood plain and, if so, obtain flood insurance, possible flood damage is a “known” threat to most homeowners affected. Continue reading “What is the risk of flood for your home?“

By Dennis Norman, on March 11th, 2011  The Insurance Information Institute (I.I.I.) just published the results of a survey of homeowners that showed almost half of the homeowners surveyed believe that coverage limits of their homeowners insurance policy are linked to the value of their home. However, this is not the case according to the I.I.I. “The real estate value of a home, that is the price you can buy or sell it for, has absolutely nothing to with the amount of insurance needed to financially protect the homeowner in the event of a fire or other disaster,” said Jeanne M. Salvatore, senior vice president and consumer spokesperson for the I.I.I. “Reducing insurance coverage because the market value of a home has decreased can result in being dangerously underinsured.” Continue reading “Five Insurance Mistakes for Homeowners to Avoid“ The Insurance Information Institute (I.I.I.) just published the results of a survey of homeowners that showed almost half of the homeowners surveyed believe that coverage limits of their homeowners insurance policy are linked to the value of their home. However, this is not the case according to the I.I.I. “The real estate value of a home, that is the price you can buy or sell it for, has absolutely nothing to with the amount of insurance needed to financially protect the homeowner in the event of a fire or other disaster,” said Jeanne M. Salvatore, senior vice president and consumer spokesperson for the I.I.I. “Reducing insurance coverage because the market value of a home has decreased can result in being dangerously underinsured.” Continue reading “Five Insurance Mistakes for Homeowners to Avoid“

By Dennis Norman, on February 1st, 2011  Yesterday my wife received a letter from the condo association for a complex she owns a rental in with “OWNER ALERT!!!!!!!” (yes, that many exclamation points) at the top of it in big letters. The reason for the “alert” was to let condo owners know that FHA certification for this condominium complex expired December 31, 2010 (as it did for many complexes across the country) and that, in order to be eligible for FHA-insured financing the complex would have to obtain re-certification. Yesterday my wife received a letter from the condo association for a complex she owns a rental in with “OWNER ALERT!!!!!!!” (yes, that many exclamation points) at the top of it in big letters. The reason for the “alert” was to let condo owners know that FHA certification for this condominium complex expired December 31, 2010 (as it did for many complexes across the country) and that, in order to be eligible for FHA-insured financing the complex would have to obtain re-certification.

Now, in this particular case, the board is using this as a scare tactic to try to convince the owners to vote to change by-laws to prohibit rentals (something they tried last year and failed at and something I have major issues with, but that’s a topic for another story..) but I realized this is a very real problem or concern for many condo-owners, boards and associations across the country so I thought I would gather and share some info on the issue. Continue reading “FHA Condominium Recertification Requirements“

|

Recent Articles

|

As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal.

As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal. The great flood of ’93 revealed the importance of flood insurance to many St Louis area property owners that found their homes either underwater or threatened by flood though they never before thought it possible. As a result of that flood as well as subsequent floods brought on by hurricanes in coastal areas and other major storms inland, the National Flood Insurance Program (NFIP) found itself in a position where major changes were needed in order to continuing providing flood coverage and at fair rates. Therefore the Biggert-Waters Flood Insurance Reform Act of 2012 was passed which makes sweeping changes to the flood insurance program. This short (4 minute) video from FEMA does a great job explaining changes to the program that will come about as a result of the act.

The great flood of ’93 revealed the importance of flood insurance to many St Louis area property owners that found their homes either underwater or threatened by flood though they never before thought it possible. As a result of that flood as well as subsequent floods brought on by hurricanes in coastal areas and other major storms inland, the National Flood Insurance Program (NFIP) found itself in a position where major changes were needed in order to continuing providing flood coverage and at fair rates. Therefore the Biggert-Waters Flood Insurance Reform Act of 2012 was passed which makes sweeping changes to the flood insurance program. This short (4 minute) video from FEMA does a great job explaining changes to the program that will come about as a result of the act.

I don’t know that “hot” comes to mind when I think about any St Louis real estate market today, however, relative to the rest of the market, I think I can identify some St. Louis real estate markets that I feel are poised to perform better in 2013 than other St Louis markets. Below are my charts showing some key market data for the top markets. Included in my data are 4 pieces of information that I think are key to determining the health of a local real estate market:

I don’t know that “hot” comes to mind when I think about any St Louis real estate market today, however, relative to the rest of the market, I think I can identify some St. Louis real estate markets that I feel are poised to perform better in 2013 than other St Louis markets. Below are my charts showing some key market data for the top markets. Included in my data are 4 pieces of information that I think are key to determining the health of a local real estate market:

Today’s existing home sales

Today’s existing home sales  Spring storms in April caused 8 areas of the U.S. to be declared a National Disaster area, and another 9 more so far in May. As a result of tornadoes, severe storms and flooding on April 19th, five counties in Missouri, Butler County, Mississippi County, New Madrid County, Saint Louis County, and Taney County, were declared a National Disaster areas on May 9th, making homeowners eligible for assistance, including possible mortgage payment relief and/or protection from foreclosure.

Spring storms in April caused 8 areas of the U.S. to be declared a National Disaster area, and another 9 more so far in May. As a result of tornadoes, severe storms and flooding on April 19th, five counties in Missouri, Butler County, Mississippi County, New Madrid County, Saint Louis County, and Taney County, were declared a National Disaster areas on May 9th, making homeowners eligible for assistance, including possible mortgage payment relief and/or protection from foreclosure.  The Insurance Information Institute (I.I.I.) just published the results of a survey of homeowners that showed almost half of the homeowners surveyed believe that coverage limits of their homeowners insurance policy are linked to the value of their home. However, this is not the case according to the I.I.I. “The real estate value of a home, that is the price you can buy or sell it for, has absolutely nothing to with the amount of insurance needed to financially protect the homeowner in the event of a fire or other disaster,” said Jeanne M. Salvatore, senior vice president and consumer spokesperson for the I.I.I. “Reducing insurance coverage because the market value of a home has decreased can result in being dangerously underinsured.”

The Insurance Information Institute (I.I.I.) just published the results of a survey of homeowners that showed almost half of the homeowners surveyed believe that coverage limits of their homeowners insurance policy are linked to the value of their home. However, this is not the case according to the I.I.I. “The real estate value of a home, that is the price you can buy or sell it for, has absolutely nothing to with the amount of insurance needed to financially protect the homeowner in the event of a fire or other disaster,” said Jeanne M. Salvatore, senior vice president and consumer spokesperson for the I.I.I. “Reducing insurance coverage because the market value of a home has decreased can result in being dangerously underinsured.”