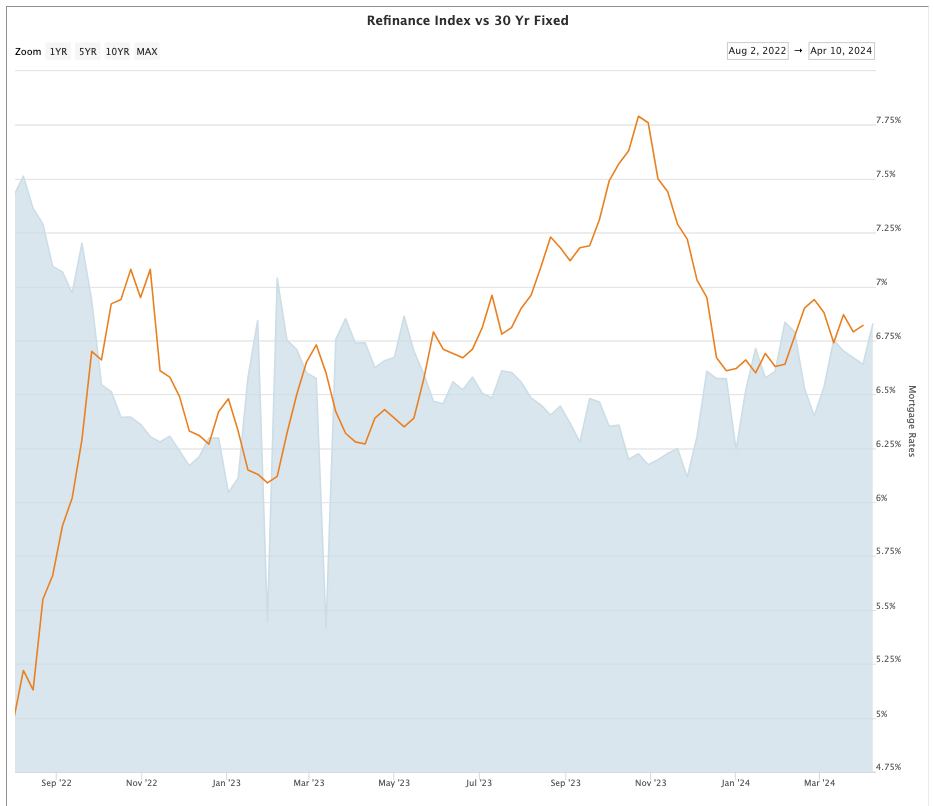

Joel Kan, MBA’s Vice President and Deputy Chief Economist, attributed the rising rates to the Federal Reserve’s cautious stance on adjusting policy amidst persistent inflation and resilient economic indicators, including strong employment data. Despite the unfavorable rate environment, the demand for refinancing, especially VA refinancing, remained robust.

Other notable trends include a decrease in average loan sizes, with purchase loan sizes—often viewed as a proxy for home prices—dropping to $449,400 from $453,000. Additionally, there was a shift in the composition of mortgage applications, with increases in FHA and VA loan shares.

So, what explains the rising number of homeowners refinancing their mortgages even with rising mortgage interest rates? There are numerous reports indicating that many homeowners across the country are becoming cash-strapped and having a difficult time paying bills, thus resorting to pulling out equity from their homes, even if it means accepting a higher interest rate. I’ve also observed reports indicating that consumer credit card debt is at historically high levels, with interest rates on this debt being astronomical. This situation is prompting people to refinance their home loans again, even at higher rates, because even though their mortgage may be at a higher rate, it still appears to be a bargain compared to the 27 or 28% on a credit card. I haven’t seen enough verifiable data to confirm if either of these situations is true, but both are plausible.

For quite a while now we have enjoyed the positive effects on the real estate market from low mortgage rates but it looks like it’s going to get even better! Yesterday’s announcement by the Fed of the emergency step of lowering the benchmark U.S. interest rate by one-half of one percent, in an effort to offset the negative effect tot eh financial markets from the coronavirus will likely lead to even lower mortgage interest rates.

What’s the connection between the federal funds rate and mortgage interest rates? This is something often asked not only by homebuyers but is even within the real estate community as since the Federal Reserve doesn’t “set” mortgage rates, the connection is not always clear. I’m not an expert in this area by no means, but I have a decent understanding of it and will share it from the perspective of the most popular home mortgage, the 30-year fixed-rate mortgage. First, we have to understand where the money for those mortgages comes from. It comes from investors, investors that compare an investment in 30-year mortgages to other comparable investments. One of those comparable investments would be the 30-year treasury.

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

Continue reading “Mortgage Interest Rates….How low can they go??“

Buying a home for veterans will get a little easier come January 1, 2020, especially those veterans moving up to a more expensive home, as a result of the Blue Water Navy Veterans Act of 2019 signed into law by President Trump in June 2019. The primary focus of the Act was to provide disability benefits to veterans who served in Vietnam, it also made significant changes to the VA Home Loan benefit available to all veterans. The VA home loan changes go into effect on January 1, 2020. Below are highlights of the changes to the VA home loan benefit:

- Conforming Loan Limits – There will no longer be a limit, or cap, on the amount for a no-downpayment home loan to a veteran.

- VA funding fee increase – The VA charges a funding fee to support the VA home loan program. The fee is currently 0.15% for Veterans and Servicemembers and on January 1st will increase to 0.30%.

- Purple Heart – The VA funding fee will be waived for active Servicemembers who have earned a Purple Heart.

- Native America Direct Loan – As of January 1st, the existing cap of $80,000 will be removed for Veterans using their entitlement for a VA Native American Direct loan to purchase (or build) a home on Federal trust land.

To find out more about the changes to the VA home loan program, click on the button below to connect with Mike McCarthy,

[xyz-ips snippet=”Mike-McCarthy—FHA-VA-Loan-Specialist”]

This past Tuesday night, President Trump signed into law H.R. 299, the “Blue Water Navy Vietnam Veterans Act” was signed into law by President Trump on Tuesday night. H.R. 299, which, among other things good for veterans, eliminates the cap on VA Loans. Currently, the VA can only “guarantee” (they insure 25% of the loan amount for lenders, which is why lenders are willing to make 100% loans to veterans) loans up to the limit established by the Federal Home Loan Mortgage Corporation Act (FHLMCA). Currently, the loan limit is $484,350 however, after the new law goes into effect on January 1, 2020, the VA will be able to provide their guarantee to lenders on loan amounts of any size for veterans.

This is a huge victory for veterans as well as for the real estate industry.

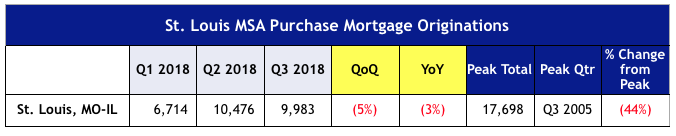

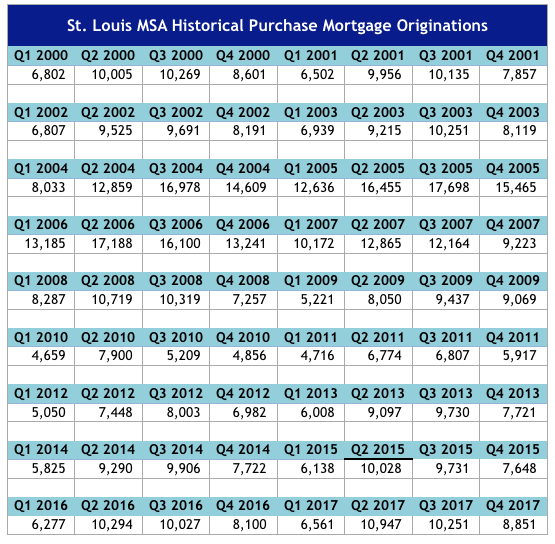

There were 9,983 home purchase mortgage loans originated in the St Louis metro area during the 3rd quarter of this year, a decline of 5% from the prior quarter and a decline of 3% from a year ago, according to a report just released by ATTOM Data Services. This is the lowest number of home purchase loan originations for the 3rd quarter since 2015 when there were 9,731 home purchase mortgage loans originated. As the historical table below shows, the peak for loan originations in St Louis was in the 3rd quarter of 2005 when there were 17,698 purchase mortgage loans originated.

St Louis MSA Purchase Mortgage Originations

St Louis MSA Historical Purchase Mortgage Originations

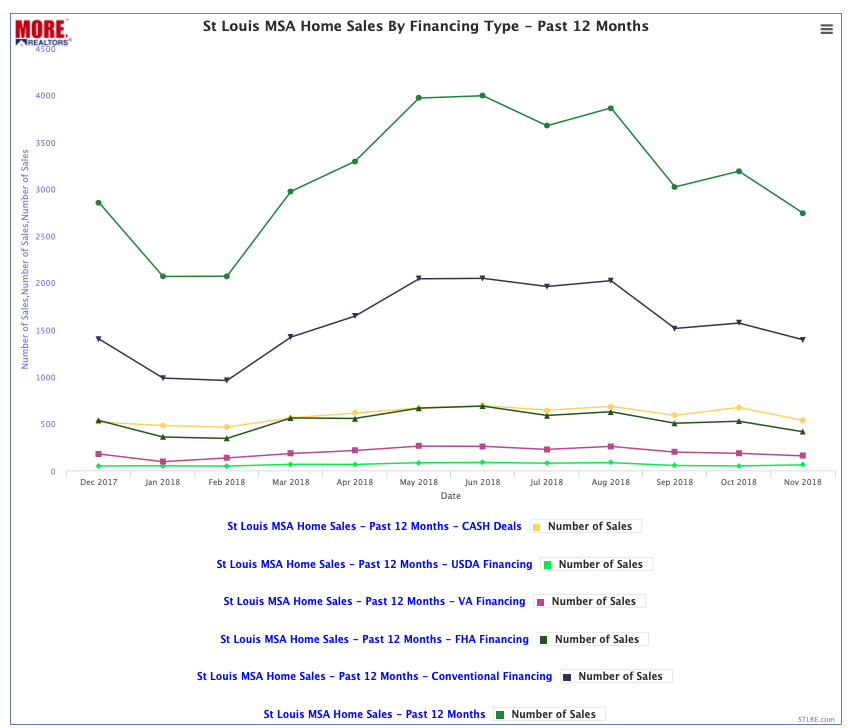

There were 37,721 homes sold in the St Louis metropolitan area during the past 12 months as reported by MORE, REALTORS. Of those, as the chart below illustrates, conventional financing made up the lion’s share of the sales. Conventional mortgages accounted for 18,967 home sales (50.3%), followed by cash transactions with no financing that accounted for 7,109 sales (18.9%), then 6,353 (16.8%) sales with FHA loans, 2,333 (6.2%) with VA loans, and 770 (2.0%) sales financed with USDA financing. The remaining 5.8% of the home sales were financed with one of roughly 30 other lessor popular financing methods.

St Louis MSA Home Sales By Financing Type – Past 12 Months

(Click on chart for live, interactive chart)

Date source: MARIS

Mortgage interest rates have been on the rise and hit their highest level in seven years toward the end of May, however, the higher rates don’t appear to be having an effect on the number of people in St Louis obtaining home loans yet. The table below is based upon the latest data from ATTOM Data Research, just released yesterday, and shows that there were 6,830 home purchase mortgage loans obtained in the St Louis metro area during the 1st quarter of this year. This represents an increase of nearly 10% from the number of home purchase mortgage loans that were obtained in St Louis a year ago. Even if we go back to the first quarter of 2016, when the average 30-year fixed rate mortgage rate was below 4%, there were just 6,093 home purchase loan originations, 12.1% fewer than the most recent quarter.

The number of St Louis homeowners refinancing their home mortgages during the first quarter of this year dropped over 10% from a year ago and was down over 15% from the first quarter of 2016.

The housing bubble that led to the housing bubble burst in 2008 started a decline in the value of homes, including those in St Louis, for the following 3 to 4 years. This resulted in a much larger number of homeowners facing financial struggles including late payments, foreclosures, short sales, bankruptcy and the like, than was the historic norm. As a result, while maybe not a new concept but certainly one that had been more obscure in the past, credit repair, became a lucrative and growing business as consumers sought to repair the damage done and position themselves to buy a home.

In St Louis, there are many companies offering credit repair services, with many making some pretty enticing sounding claims with regard to removal of negative items from your credit, improving your credit score in a short time period and so on. While there are reputable companies out there doing a good job for St Louis homebuyers looking to improve their credit no doubt, there are also some that are probably not doing much more for the consumer than they could easily do on their own or, worse yet, perhaps very little at all for the fee paid.

How do you find a good credit repair company in St Louis?

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Get Home Prices and Sale Charts For ANY Area- STLMarketCharts.com

Get Home Prices and Sale Tables and Data For ANY Area- STLMarketReports.com Continue reading “What To Look Out For In Credit Repair Companies“

According to a report just released by Corelogic, the 30-59 day mortgage delinquency rate in March (the most recent month reported) fell to just 1.7%, the lowest level since January 2000. The “seriously delinquency” rate (30+ days late) fell to 4.4% in March, the lowest level sine November 2007, according to Corelogic.

In addition, the “transition rates” all improved as well from a year ago. Transition rates show which way the borrowers are moving, from slightly delinquent to more delinquent, or from slightly delinquent to current for example. Below are the transition rates for March 2017, according to the Corelogic report:

- Borrowers going from current to 30 days late – 0.6% for March 2017, down from 0.7% in March 2016

- Borrowers going from 30 days late to 60 days late – 11.6% for March 2017, down from 13.2% in March 2016

- Borrowers going from 60 days late to 90 days late – 20.8% for March 2017, down from 23.1% in March 2016

All of this is good news for the real estate industry as the trends are positive and are is a good “leading indicator” of what is to come. As mortgage delinquencies decrease, foreclosures, short sales and other distressed home sales decline, putting less downward pricing pressure on the housing market and providing sustainability to the improving housing market.

Speaking of mortgages, if you are considering refinancing, want to know what current rates and terms are, or would like to get pre-approved for a mortgage, I would highly recommend speaking with Ryan Derryberry, a mortgage loan professional with Movement Mortgage. Ryan is a great guy, is honest and knows his stuff. Movement is a great company, founded and operated on great principals and offer some mortgage products you won’t find anywhere else….More information on Ryan, including his contact info, can be found here.

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find The Value Of Your Home In Under A Minute!

Before I begin, I should point out that what I’m about to tell you runs contrary to what the National Association of REALTORS® (NAR), the largest trade association in the country and one I belong to and support, will tell you. The NAR position on the mortgage interest deduction (MID) is, quoting from their website, “the mortgage interest deduction (MID) is a remarkably effective tool that facilitates homeownership.” Many St Louis REALTORS® will echo the message of NAR but I think if more people took the time to look into the MID, and do a little simple math, they would see that the mortgage interest deduction does not appear to offer any real benefit to the ordinary, typical homebuyer in St Louis.

What brought this to mind this morning was a friend of mine on Facebook (who is a loan officer for a St Louis mortgage company) posted a link to an article written by an owner of a Chicago real estate company outlining the benefits of the MID and, while I think he did an excellent job of laying out the potential tax savings of deducting mortgage interest and property taxes on a home, I think he left out a key component, namely, the Standard Deduction.

Why the MID doesn’t help the normal home buyer in St Louis:

Search St Louis Homes For Sale HERE

Find Your Home’s Value Online NOW!

See ALL Homes That Will Be Open In St Louis This Weekend

Get The Latest LIVE St Louis Home Prices, Sales and Other Market Data HERE

Continue reading “The Truth About The Mortgage Interest Deduction“

St Louis Mortgage companies were not making many 30-year, fixed-rate jumbo mortgages a year ago, but now many St Louis Mortgage companies are offering fixed jumbos – with very competitive rates, including my firm, Paramount Mortgage.

As interest rates start to rise, homeowners are thinking they may not see rates this low in the future and if their ARM is maturing a couple of years from now, they could be in a tough spot.

Continue reading “St Louis Mortgage Companies Seeing Fixed Rate Jumbo Mortgages Make Comeback“

Continue reading “St Louis Mortgage Companies Seeing Fixed Rate Jumbo Mortgages Make Comeback“

One-third of Homebuyers Surveyed Are Ill-prepared to Get a Mortgage

According to a survey recently conducted by Zillow, many homebuyers are really not armed with the information they should have before attempting to obtain a mortgage. For example, over one-third (34 percent) of the prospective homebuyers surveyed did not know that a qualified borrower can obtain a home loan today with less than a five percent downpayment.

In addition, many homebuyers have misinformation that can prevent them from obtaining the best possible mortgage interest rate. For example, 26 percent of the homebuyers said they thought they were obligated to obtain their home loan with the lender that pre-approved them, and 24 percent believed that all lenders are required to charge the same amount for credit reports and appraisals.

Continue reading “Survey Shows One-Third Of Homebuyers Lack Info Needed To Get Mortgage“

“The (real estate) recovery has been much more like the tortoise than the hare,” said Stephen Blank, a senior resident fellow of the Washington-based Urban Land Institute. “We’ve become used to slow relief. But we have finally turned the corner.”

Real estate markets on both coasts in places like; New York, San Francisco, Los Angeles and Boston were the first to emerge from recession and will pick up their pace of recovery through 2013, said Blank, a principal researcher for Emerging Trends. He was the main speaker at the annual outlook presented by ULI’s St. Louis chapter.

Big investors scared away by the high prices in coastal cities will look more closely at properties in secondary markets, including St. Louis, experts predict. David Griege, executive vice president at Paramount Mortgage, believes home sales will be much stronger this spring and summer than in past years. Continue reading “Real Estate Recovery "On Its Way"“

It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.

It is more important now than ever, as a result of increasing regulation and scrutiny of the mortgage industry, to plan ahead when you are planning on obtaining a mortgage loan to buy a house or refinance an existing loan to ensure that the process will go smoothly and as expected. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.

By following the simple guidelines below, you are assured a smooth and error-free closing.

Continue reading “How to make getting a home loan easier; St Louis Mortgage Interest Rate Update“

Continue reading “How to make getting a home loan easier; St Louis Mortgage Interest Rate Update“

After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include:

After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include:

Continue reading “Changes in the Mortgage Industry; St Louis Mortgage Interest Rate Update“

Continue reading “Changes in the Mortgage Industry; St Louis Mortgage Interest Rate Update“

Qualified first-time home buyers can receive a forgivable 3% cash assistance loan for down payment and closing costs on a home. The Missouri Housing Development Commission (MHDC) provides a competitive interest rate on a safe 30-year fixed rate 1st mortgage. Your 3% advance loan is treated as a 2nd mortgage completely forgivable after five years of continuous occupancy. New, Constant Funding means MHDC will have the monies available for the borrowers regardless of bond issuance.

For more information about this program,contact me by clicking below.

The new legislation is titled: Honoring America’s Veterans and Caring for Camp Lejeune Families Act (H.R. 1627) and has been signed into law on August 6, 2012.

Congress expanded the scope of the legislation and specifically mandated improvements in VA home loan benefits through the VA Home Loan Guaranty Program. Realtors and lenders will now be able to help more veterans and their families become homeowners. A portion of the new law makes VA loans available to more surviving spouses, provides easier funding fee waivers for disabled vets and helps single and dual-duty parents with occupancy hurdles. Continue reading “New Law Improves VA Loan Benefits; St. Louis Mortgage Interest Rate Update“

Every borrower’s situation is different. My goal is to provide various options/loan programs that are available to meet the borrower’s needs. When considering a refinance, the following are typical situations borrowers face:

Every borrower’s situation is different. My goal is to provide various options/loan programs that are available to meet the borrower’s needs. When considering a refinance, the following are typical situations borrowers face:

Are you refinancing primarily to lower your rate and monthly payments? Your best option might be a low fixed-rate loan. Maybe you have a fixed-rate mortgage now with a higher rate, or maybe you have an ARM — adjustable rate mortgage — where the interest rate varies. Even if it’s low now, unlike your ARM, when you qualify for a fixed-rate mortgage you lock that low rate in for the life of your loan. This is especially a good idea if you don’t think you’ll be moving within the next five years or so. On the other hand, if you do see yourself moving within the next few years, an ARM with a low initial rate might be the best way to lower your monthly payment. Continue reading “St. Louis Mortgage Rates Drop Even Further; Which refinancing option is best for you?“

Recently, I heard a radio commercial about “special” financing for certain veterans implying this “special” loan is available for a “limited time only.” The good news is that the Veterans Administration (VA) offers an ongoing mortgage loan program to benefit members of the armed forces who have generally served for two years in peace time, or 90 days during conflict. Members of the National Guard or Reserves who have served for six years are eligible along with widows of veterans if the veteran died in a service-related incident. The VA offers loans to: Purchase a New or Existing Home, Rate Reduction Refinance, and Cash-Out Refinance. Borrowers are evaluated by their credit worthiness and their ability to show stable and sufficient income to cover the costs of owning a home, cover other obligations and expenses and have enough left for family support. Traditional credit scoring is not used by the VA in underwriting. Non-married co-borrowers are not permitted. VA loans must be the borrowers’ primary residence. Continue reading “The truth about VA loans; St. Louis Mortgage rate update“

Interest rates have been strong all year, last week however, we saw mortgage backed securities rally each day and with the release of unemployment figures on Friday we are now officially sitting at historic lows! If you have not taken advantage of these rates…what are you waiting for? Maybe you have been told that you don’t have enough equity in your home due to the housing market trending down over the past few years?

Well there is something here for you too! The Home Affordable Refinance Program (HARP) is a program developed by Fannie Mae and Freddie Mac that helps folks with little or no equity in their homes take advantage of today’s fantastic mortgage rates. Continue reading “Historic low mortgage interest rates, Refinancing Options & New HUD program“

A common complaint that consumers have regarding today’s mortgage loan origination process has to do with all of the hoops they have to jump through in order to get a loan.

A common complaint that consumers have regarding today’s mortgage loan origination process has to do with all of the hoops they have to jump through in order to get a loan.

Personally, as a loan officer, I try to be as thorough as possible going into the application to avoid “the last minute chase” for additional documentation. I will be the first to admit, I am not perfect. Best intentions. After each deal is closed, I review the loan and how the process went; did I prepare and ask my clients for all that the documentation needed. Did I take a good loan application? Continue reading “St. Louis Mortgage Rate Update; Jumping through hoops to get a mortgage“

With interest rates at all time lows, it is worth the few minutes to do a mortgage check up and determine if a refinance would be beneficial to your situation. Since there are many reasons a homeowner may choose to refinance, we’ll take a look at the few most common reasons to consider a refinance. Continue reading “St. Louis Mortgage Rate Update; Why Refinance?“

Freddie Mac recently released their fourth-quarter refinance analysis and it shows that 85 percent of homeowners who refinanced their mortgages during the fourth quarter of 2011 maintained or reduced their principal balance by paying-in additional money at the closing table. Frank Nothaft, Freddie Mac’s vice president and chief economist, said savvy homeowners are taking advantage of some of the lowest fixed-rates in more than 60 years to lock in interest savings.

Freddie Mac recently released their fourth-quarter refinance analysis and it shows that 85 percent of homeowners who refinanced their mortgages during the fourth quarter of 2011 maintained or reduced their principal balance by paying-in additional money at the closing table. Frank Nothaft, Freddie Mac’s vice president and chief economist, said savvy homeowners are taking advantage of some of the lowest fixed-rates in more than 60 years to lock in interest savings.

According to Nothaft, the typical borrower who refinanced during the fourth quarter reduced their interest rate by approximately 1.4 percentage points. During the fourth quarter, 37 percent of homeowners who refinanced their mortgage maintained about the same loan amount and 49 percent reduced their principal balance. The percentage of cash-in borrowers was the highest in the 26-year history of the analysis. Continue reading “St. Louis Mortgage Rate Update; Refinancing Homeowners Reduced Debt In Fourth Quarter“

For many military members, there is no greater joy than completely service and finally being able to lay some roots, and the first order of business for many is to purchase a home. However, in recent years, purchasing a home hasn’t been as easy as it once was. Conventional lenders have increased their lending requirements sometimes making it nearly impossible for the average borrower to secure financing.

For many military members, there is no greater joy than completely service and finally being able to lay some roots, and the first order of business for many is to purchase a home. However, in recent years, purchasing a home hasn’t been as easy as it once was. Conventional lenders have increased their lending requirements sometimes making it nearly impossible for the average borrower to secure financing.

However, the large down payments and high credit requirements of conventional lending don’t have to mean the end of the road for military Continue reading “VA Home Loans for Missouri Veterans“

“Ballparking” mortgage rates just is not the same anymore. Home buyers who obtain online quotes from popular websites and “shopping” mortgage rates on the phone are receiving nothing more than a starting point for what their final mortgage rate will be. This is due to a government-led pricing scheme called loan-level pricing adjustments or LLPAs.”

The government has taken the example of risk-based pricing from the auto insurance industry. “Riskier” car owners pay higher rates for insurance, e.g. a driver with a few accidents and speeding tickets in their past will pay a higher premium than the driver with a clean driving record. Continue reading “St. Louis Mortgage Rate Update; What are "loan-level" price adjustments?“

As the mortgage industry continues to adjust to new financial regulations, it is more important than ever to ensure that the financing (or refinancing) of your home goes smoothly. Your loan approval is subject to the financial information you provide at the time of your loan approval. Any subsequent changes in your financial situation before the actual date of closing could jeopardize your loan approval and delay your closing.

By following the simple guidelines below, you are assured a smooth and error-free closing. Continue reading “St. Louis Mortgage Rate Update; The Do’s and Dont’s when financing your home“

The National Association of Realtors’ research staff recently released its comprehensive annual report: Profile of Home Buyers and Sellers for 2011.

Market researcher, Paul C. Bishop, Ph. D., Vice President and Jessica Lautz, Manager of Consumer Survey Research state that they’ve identified “trends that have not been seen in the last 10 years,” which will affect the housing market as we enter 2012. Continue reading “St. Louis Mortgage Rate Update; Trends that will affect the housing market in 2012“

The characteristics of home buyers has changed fairly significantly in the past year, according to the National Association of REALTORS (NAR) annual Profile of Home Buyers and Sellers. Last year, first-time home-buyers made up 50 percent of the market and in 2011 made up only 37 percent of the market. Continue reading “St. Louis Mortgage Rate Update; Who are the home-buyers?“

A common complaint that consumers have regarding today’s mortgage loan origination process has to do with all of the hoops they have to jump through in order to get a loan.

Personally, as a loan officer, I try to be as thorough as possible going into the application as possible to avoid the last minute chase. After each deal closed, I review the process and question whether I prepared my clients for all that they needed to have or do in order to get the loan approved and closed. I will be the first to admit, I am not perfect. Continue reading “St Louis Mortgage Interest Rate Update; How to make getting a home loan go smoother“

The top five mistakes consumers make when refinancing their home loan were revealed by LendingTree Network’s newly released “Monthly Lender Marketplace Survey”. According to the survey, the top 5 mistakes made by consumers refinancing their home loans are:

The top five mistakes consumers make when refinancing their home loan were revealed by LendingTree Network’s newly released “Monthly Lender Marketplace Survey”. According to the survey, the top 5 mistakes made by consumers refinancing their home loans are:

- Over-estimating the value of the home: With home values dropping in today’s market, borrowers typically over-value their home, causing borrowers to receive higher-than-expected loan offers. Continue reading “Mistakes borrowers make when refinancing their home loan“