So…you are looking to buy a home in 2013 and are considering using a FHA mortgage for financing…don’t delay, because that FHA mortgage could end up costing more very soon.

HR 4264 or The Fiscal Solvency Act of 2012 is a bill that has overwhelmingly passed the House and is on its way to the Senate. This bill among other things grants FHA the power to raise its mortgage insurance premiums to as high as 2.05% annually — nearly twice the 1.20% rate most FHA-Insured homeowners pay today.

FHA mortgages traditionally have been used by First Time Buyers as it allows a lower down-payment and usually more liberal underwriting standards than other traditional loan programs. If this bill passes all borrowers that use a FHA insured mortgage will have to pay higher mortgage insurance premiums. That could have a significant impact on folks looking to buy their first home and the recovery of the housing market in general. It also could impact those that currently have a FHA insured mortgage that want to look at refinancing to today’s historic low mortgage rates.

FHA mortgages traditionally have been used by First Time Buyers as it allows a lower down-payment and usually more liberal underwriting standards than other traditional loan programs. If this bill passes all borrowers that use a FHA insured mortgage will have to pay higher mortgage insurance premiums. That could have a significant impact on folks looking to buy their first home and the recovery of the housing market in general. It also could impact those that currently have a FHA insured mortgage that want to look at refinancing to today’s historic low mortgage rates.

Mortgage rates may be dropping, but they’re not dropping as fast as FHA mortgage insurance premiums may rise!

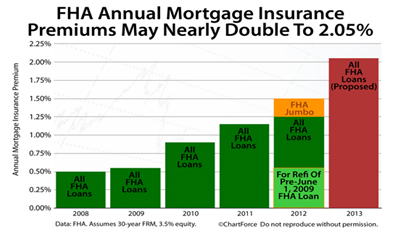

In 2008, FHA charged just 0.50% in annual MIP to home buyers. Since then, those rates have increased.

- In 2009 FHA charged 0.55 percent

- In 2010 FHA charged 0.90 percent

- In 2011 FHA charged 1.10 percent

- In 2012 FHA charged 1.25 percent

If this new increase to 2.05 percent is approved it would be the highest annual MIP in FHA history.

Another very important aspect to FHA Increasing the MIP is the fact that they are considering charging these premiums for the “life of the loan”

Currently the MIP premiums can be eliminated in certain circumstances after five years, having MIP for the life of the loan will have a huge impact on the overall cost of a FHA-Insured mortgage.

FHA uses these mortgage insurance premiums as a reserve for defaulted loans. However these premiums have not been accumulating at the same rate at which FHA-Insured loans defaulted over the past few years. This has lowered the FHA’s “reserves” to record low levels and as a result another increase appears to be on the way.

So if you are looking to buy a home – don’t sit on the fence – act now before these insurance premiums increase again and ultimately cost homebuyers more money.

If you know someone that currently has a FHA mortgage…did you know that you can streamline these loans to today’s great mortgage rates without an Appraisal, without Value and without Income Verification?

The clock is ticking….act now before these new premiums kick in.

Peter can be reached by phone at (314) 722-2332 or on his cell phone at (314) 753-7155 by email at pwright@erezllc.com or you can visit his website at RoosterReview.com.

Leave a Reply

You must be logged in to post a comment.