For quite a while now we have enjoyed the positive effects on the real estate market from low mortgage rates but it looks like it’s going to get even better! Yesterday’s announcement by the Fed of the emergency step of lowering the benchmark U.S. interest rate by one-half of one percent, in an effort to offset the negative effect tot eh financial markets from the coronavirus will likely lead to even lower mortgage interest rates.

What’s the connection between the federal funds rate and mortgage interest rates? This is something often asked not only by homebuyers but is even within the real estate community as since the Federal Reserve doesn’t “set” mortgage rates, the connection is not always clear. I’m not an expert in this area by no means, but I have a decent understanding of it and will share it from the perspective of the most popular home mortgage, the 30-year fixed-rate mortgage. First, we have to understand where the money for those mortgages comes from. It comes from investors, investors that compare an investment in 30-year mortgages to other comparable investments. One of those comparable investments would be the 30-year treasury.

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

The 30-year treasury is backed by the U.S. government so it is about as safe of an investment as you can get so, while mortgage-backed investments are a pretty safe investment as well, they still have more risk than a treasury so they need to deliver a higher return to the investor. So, in order to keep enticing investors to invest in mortgages, the rates have to be higher than a similar treasury hence when treasury rates go down mortgage rates follow and when treasury rates rise so do mortgages to preserve the gap between the two and to provide the return incentive investors need to keep pumping money into mortgages.

The impact of the action by the Fed Reserve yesterday lowers the treasury rate which now, as we all know thanks to that little 45-second finance lesson above, will likely cause mortgage rates to fall even lower than they currently are. Speaking of mortgages and low-interest rates, if you are considering refinancing your mortgage (you should) or considering buying a home, I would suggest talking with Michael McCarthy with Flat Branch Home Loans…he’s great and our firm does a lot of business with him. You can find his info at STLBestLender.com.

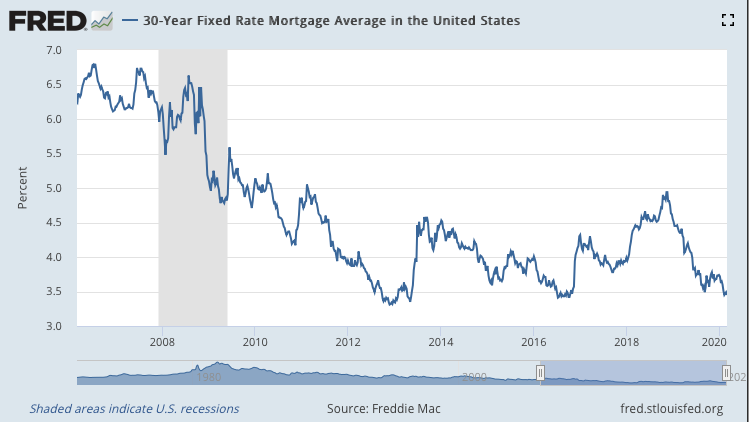

Below is a chart showing the rates on 30-year treasury’s for the past 14-years and below that is one showing the 30-year fixed mortgage rates for the same period. You’ll be able to see the relationship between the two. If you click on the charts you can access the interactive charts on our site with live data to watch what happens to rates in the days ahead.

30-Year Treasury Constant Maturity Rate Chart

(click on chart for live, interactive chart)

Mortgage Interest Rates – 30 Year Fixed-Rate

(click on chart for live, interactive chart)

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]