Apparently a lot of consumers are concerned about the housing market crashing or at least concerned enough to be online searching for answers. According to Google Trends the search phrase “Will The Housing Market Crash?” has hit it’s 5-year peak in terms of interest level during the last 4-5 months. In addition, according to Google Adwords tools, there are 10,000 – 100,000 searches for month for the phrase “Will The Housing Market Crash?” and 100,000 – 1,000, 000 monthly searches for “housing market crash“.

Apparently a lot of consumers are concerned about the housing market crashing or at least concerned enough to be online searching for answers. According to Google Trends the search phrase “Will The Housing Market Crash?” has hit it’s 5-year peak in terms of interest level during the last 4-5 months. In addition, according to Google Adwords tools, there are 10,000 – 100,000 searches for month for the phrase “Will The Housing Market Crash?” and 100,000 – 1,000, 000 monthly searches for “housing market crash“.

Will there actually be a housing market crash in St Louis?

I guess first we should define “crash” as the word itself sounds rather harsh. But if we agree that a market crash would be less severe than the housing market bubble burst we witnessed in 2008, then I would say a “crash” is more likely than a bubble burst. However, what may seem like a crash in the St Louis housing market may in fact not be as much of a crash as well as a correction. Given that the St Louis real estate market has been flying high for a few years now and many seller’s have felt like they died and went to heaven and buyer’s just felt like they died from the competition and difficulty in buying a home, a correction is really needed.

How bad will the St Louis housing market correction be?

With everything we have going on in the economy, our country and in society, I think it’s impossible for anyone to predict with certainty what a correction or crash for the housing market will actually entail. Having said that, I will say that, if nothing dramatic changes in the aforementioned, I think the St Louis real estate housing market will see a correction that St Louis home prices are not going to come crashing down. Granted, it’s not going to be as fun being a seller as it was when you could expect buyers to be tripping over themselves to get through your home the first weekend and you received a dozen or two offers, most if not all for above your asking price, but lets face it, that’s not really the recipe for a healthy or sustainable market. For the same reasons that I just gave for seller’s not having as much fun, being a buyer will be a much better experience. Overall, I think we’ll see a healthier and more balanced market.

Remember, home prices came back after the housing bubble burst in 2008…

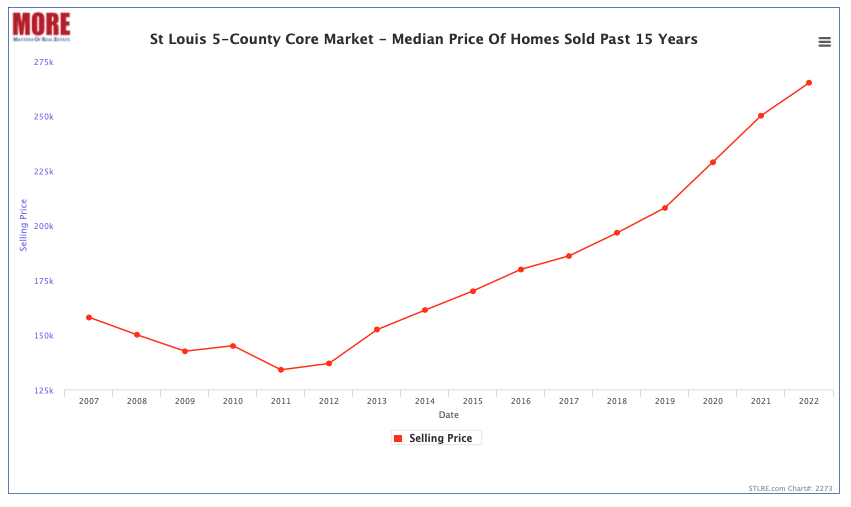

Just in case I’m wrong, or things change dramatically in our economy and home prices do come crashing down, or St Louis faces another housing bubble burst like in 2008, we can find solace in realizing that home prices will come back. The beauty of real estate as an investment is time almost always fixes everything. For example, in the chart below, you can see that when the housing bubble burst in St Louis in 2007 home prices began falling and they continued coming down, more or less, until bottoming out in 2011. However, by 2014, 3 years after hitting bottom, St Louis median home prices had recovered the value lost after the bubble burst and then continued to rise. The catch is, of course, if you buy a home at the peak and then have to sell it in a downturn, it can be ugly, but provided you can wait it out, it’s a safe bet the value will come back.

St Louis 5-County Core Market Median Home Prices -Past 15 Years

(click on chart for live-interactive chart)