Federal Reserve Governor Elizabeth A. Duke, while speaking at the Federal Reserve Board Policy Forum last week, discussed the effect on the housing market that properties acquired by banks and lenders through foreclosure (REO’s) and suggested that if some of this inventory was converted to rental property by the lenders, this may have a positive effect on the housing market. Continue reading “Converting REO’s to rentals could help housing recovery according to Fed Official“

Federal Reserve Governor Elizabeth A. Duke, while speaking at the Federal Reserve Board Policy Forum last week, discussed the effect on the housing market that properties acquired by banks and lenders through foreclosure (REO’s) and suggested that if some of this inventory was converted to rental property by the lenders, this may have a positive effect on the housing market. Continue reading “Converting REO’s to rentals could help housing recovery according to Fed Official“

|

|||

|

Dennis Norman Today, Trulia released it’s “Rent vs. Buy Index” which established a price-to-rent ratio for the 50 largest cities in America (by population), then, based upon that ratio, determined which cities it makes more sense (financially) to rent versus buy. Continue reading “Cities where home ownership is more affordable than rental“ The Internet Crime Complaint Center (IC3) and the Federal Bureau of Investigation have published a report about common real estate scams and rental scams they are finding and how to avoid them. Like most scams there are warning signs and red flags that can help you avoid falling victim; knowing what to look for is key. The IC3 reminds people to be cautious when using the internet to either advertise real estate for sale or rent or to find a property to rent or buy. For Landlords and Sellers of Property: Look out for: Rental scams occur when the victim has property advertised and is contacted by an interested party. Once the rental price is agreed upon, the scammer sends a check for the deposit. The check covers housing expenses and is either written in excess of the amount required, with the scammer asking for the remainder to be remitted back, or for the correct amount, but the scammer backs out of the rental agreement and asks for a refund. Because banks do not usually place a hold on the funds, the victim has immediate access to them and believes the check has cleared. In the end, the check is found to be counterfeit and the victim is held responsible by the bank for all losses. For Renters and Home Buyers: Look out for: The scammer duplicates postings from legitimate real estate sites, alters them, and reposts them. Often, the scammers use the broker’s real name to create a fake e-mail address, which gives the fraud more legitimacy. When the victim sends an e-mail through the website inquiring about the home, they receive a response from someone claiming to be the owner. The “owner” typically says he and his wife are doing missionary work in a foreign country and need someone to rent their home while they are away. If the victim is interested, he or she is asked to send money to the “owner” in a foreign country. These funds go directly to the scammer, and the would-be renter loses his or her money. Suggestions from the IC3 and FBI on how to protect yourself from schemes:

The following requests can be indicators of fraudulent activity:

If you feel you have been a victim of an Internet real estate scheme, you can file a complaint with the IC3 by clicking here. By: Dennis Norman Yesterday, on a post I did earlier on rental scams, I received a comment from Dan with RentalScams.org. I visited RentalScams.org and saw their site is a wealth of information to help tenants avoid falling victim to a rental scam. I am going to post one of their helpful posts here today but invite you to visit their site and check out all the useful information they have available. The Property “Owner” Rental ScamHere is how the scam works. Continue reading “Tenants-Be on the lookout for rental scams“ The FBI has issued a consumer alert warning of phony online rental ads. According to the alert, the scam goes like this: You can’t believe your good fortune-you find a rental home in a nice area through a Craigslist classified ad at an unbelievably low rate. The landlord-who had to leave the country and travel to Nigeria-asks that you wire him two months worth of rent. You arrive at the home on the agreed-upon date, but there is just one small problem- the house is not actually for rent and its owners know nothing about your agreement. This latest scam is being perpetrated by Nigerian criminals located halfway aroudn the world and has been seen in a number of U.S. states, perhaps in response to the current housing market- with fewer people buying, more people are renting. The FBI offers these tips to avoid being victimized:

According to the latest Independent Landlord Rental Performance Report by Chandan Economics, April 2024 witnessed a decline in on-time rental payments in independently operated rental units nationwide, dropping to 85.2%. As illustrated by the chart below, this marks a decrease from 87.0% the prior month and 87.8% a year ago. Western states, notably Utah, Alaska, and Colorado, continue to lead the nation with the highest on-time payment rates. However, it’s worth noting that here in Missouri, only 82% of tenants paid their rent on time in April, resulting in Missouri ranking 43rd in the country for on-time rent payments.

Whether you’re looking to buy or rent a home, your credit score is more than just a number—it’s a gateway to your future residence. A recent survey by LendingTree has shed light on the significant role credit scores play in Americans’ access to financial products, including those crucial for securing a home. Here’s a recap of the findings and their implications for the St. Louis real estate market. Key Findings:

Implications for St. Louis Real Estate:

In St. Louis, as in the rest of the country, a strong credit score is more than just a number—it’s a key that unlocks the door to future housing opportunities. The recent LendingTree survey provides a basis for understanding the challenges and strategies related to credit scores in the real estate market. By focusing on credit education and management, St. Louis residents can navigate these challenges more effectively, making the dream of buying or renting a home more attainable.

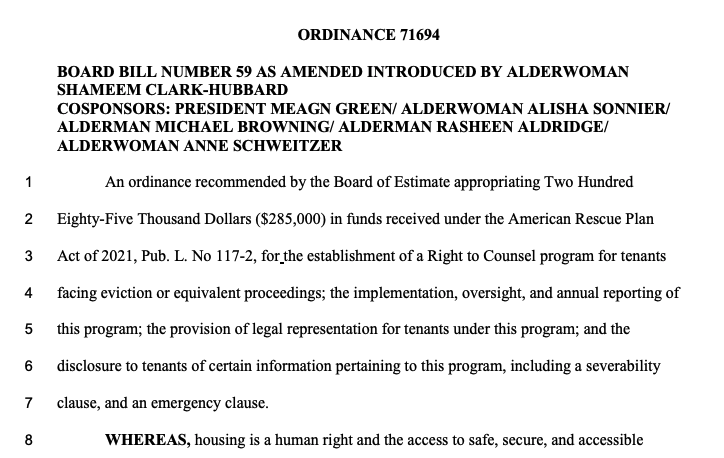

With changing regulations, subdivision restrictions, municipal ordinances, state and federal laws, landlords certainly have a lot to keep up with today to make sure they stay compliant in their rental business. I’ve been in the business over 40 years, have an interest-and a fair understanding of- laws that affect real estate, yet still find it challenging to stay updated. Given this, I can only imagine the challenge faced by someone with a full-time career who also owns rental properties as an investment. Perhaps, this might be a compelling reason to consider hiring a professional property manager for your rentals. However, that decision brings its own complexities, which I’ll delve into in a future article. A recurring issue for landlords, which prompts many questions from agents in our firm, clients, and other landlords, revolves around service animals. The question is usually framed something like, “I don’t want any pets in my rental properties, so I have a strict no-pet policy but am I obligated to allow dogs or other pets if the tenant claims it’s a ‘service animal’?” Before I go further, let me remind you, I am not an attorney, this isn’t legal advice—in fact, it’s not advice at all. I’m merely sharing what I’ve learned on the topic to heighten awareness of the issue and to encourage those that are not familiar with it to learn what they need to learn or to seek out proper legal guidance to avoid problems. Last month, city of St Louis mayor, Tishaura Jones, signed into law a new ordinance which provides “access to legal representation for tenants facing eviction or equivalent proceedings”. Surprisingly, it does not appear that the tenant needs to show a final hardship or need for “full legal representation” to be provided at no cost as the bill defines a “covered individual” as “any residential tenant who occupies a dwelling located within the City under a claim of legal right, other than the legal property owner of the dwelling.” Another interesting thing in the ordinance is that it appears to include legal representation for not only in the case of an eviction but also in the case of a non-renewal of a lease as Section Four of the ordinance (General Provisions of Right To Counsel for Tenants In Covered Proceedings) states “A covered individual may access legal representation as provided in this ordinance as soon as a landlord provides notice to terminate or not renew a tenancy, or as soon thereafter as is practicable.” Then, according to reports, yesterday, St. Louis Aldermanic President Megan Green announced that legislation was being drafted to require landlords in the City of St Louis to provide contact information as part of the City’s occupancy permit process. Aldermanic President Green stated “It will help the city better keep track of who is owning certain properties so if there’s issues with properties there’s a local agent requirement, instead of trying to track down a random person registered to an LLC, which is often a challenge,” Landlords will also be required to report the rental amount they are charging according to Green. Green also announced that the Board of Aldermen plan to consider a “tenants bill of rights” as well. Ordinance 71694 – Providing Legal Representation to Tenants Facing Eviction(click on image below for entire ordinance) A little over two weeks ago I wrote my most recent article addressing St Louis home prices titled “Will St Louis Home Prices Decline?” in which my short answer was “yes”, but kind of tongue in cheek and based upon the seasonality of home prices, but my longer answer was more vague. I mentioned that there certainly is a correction coming but pointed out that there are so many variables that will affect prices that it is hard to say to what extent this correction will be. While this is still true, a lot has happened in the short time period since that article that has caused me to become more bearish on the St Louis real estate market to the point where I’m confident St Louis home prices will decline. What has changed in the last 16 days…

Market data pointing to lower St Louis home prices…

Continue reading “Why St Louis Home Prices Are Going To Decline“ UPDATE: After the decision by to overturn the eviction moratorium was decided upon by Judge Dabney L. Friedrich on May 5th, at 6:54pm that evening the U.S. Government filed a notice of appeal as well as a motion for an emergency stay to not have the eviction moratorium lifted until after the appeal. Judge Dabney L. Friedrich through a Minute Order, granted the stay, thereby leaving the eviction moratorium in place for now but noting that “This Minute Order should not be construed in any way as a ruling on the merits of the defendants’ motion.” The judge allowed the plaintiff’s until May 12th to file opposition to the motion to stay and then the U.S. government 4 days to respond to the plaintiff’s opposition. So, for now, the eviction moratorium stands…

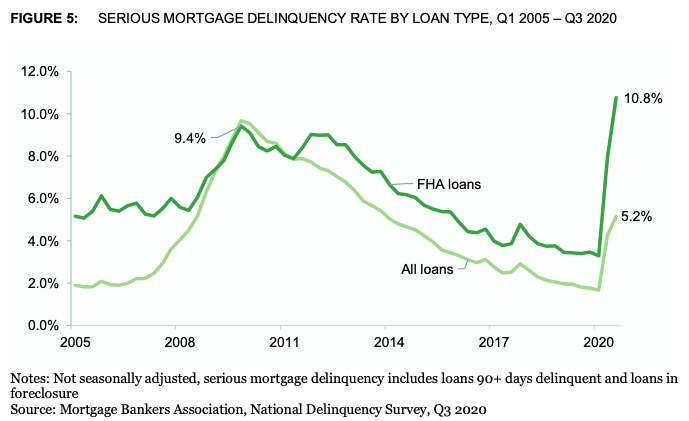

Today, United States District Judge Dabney L. Friedrich issued an oder setting aside the CDC Ordered nationwide eviction moratorium that, prior to this order, was in effect until June 30, 2021. For the entire opinion from the court, click “>HERE and then scroll down to the first big red button titled “Court Order Lifting Rental Eviction Moratorium May 5, 2021”. [xyz-ips snippet=”Foreclosures-For-Sale-and-Homes-For-Sale”] According to a report just released by the Consumer Financial Protection Bureau (CFPB), titled “Housing insecurity and the COVID-19 pandemic“, there are over 2 million homeowners that have fallen behind at least three months on their mortgage payments. This represents a 250% increase from pre-Covid-19 levels and is now at a level we haven’t seen since the height of the Great Recession in 2010. Homeowners with an FHA mortgage delinquency rates double rate for all loans: As the chart below shows, homeowners with an FHA mortgage hit a serious mortgage delinquency rate of 10.8% during the 3rd quarter of 2020, with the rate for all mortgages was just under half that at 5.2%. Serious Mortgage Delinquency Rate By Loan Type- Q1 2005 – Q3 2020

[xyz-ips snippet=”Homes-For-Sale”]

What is an IRA and what does a “self-directed” IRA mean? This is an Individual Retirement Account. There are two options:

During the 2020 year, you can contribute $6k a year and add $1k if you are over 50. There are income limits for contributions for the Roth IRA and the tax-deductible traditional. However, you can always contribute to the traditional but the income limit determines if the IRA is tax-deductible or not. All traditional IRA’s are tax-deferred. The Roth IRA is the only tax-free growth IRA. [xyz-ips snippet=”Homes-For-Sale”] Continue reading “Control your investments with self-directed IRA investing“ Today, as we celebrate the life of Dr. Martin Luther King, Jr. who is best known as a leader in the Civil Rights movement, I wanted to look at how his efforts also ultimately resulted in the Fair Housing Act, which sought to end discrimination in housing. Through the efforts of the civil rights movement, Dr. King and others were able to get the attention of our nation resulting in President John F. Kennedy, in a nationally televised address on June 6, 1963, urging the nation to ” take action toward guaranteeing equal treatment of every American regardless of race.” Shortly after his address to the nation, President Kennedy proposed that Congress consider civil rights legislation that would address rights in many areas such as voting, public accommodations, school desegregation but not housing at the time. Even though President Kennedy was assassinated on November 22, 1963, his efforts beforehand still resulted in the Civil Rights Act of 1964 when, then President, Lyndon Johnson, signed into law on July 2, 1964. The Civil Rights Act of 1964 prohibited discrimination in public places, provided for integration of schools, and made employment discrimination illegal, however, it did not address housing. Four years later came the Civil Rights Act of 1968, which is also referred to, and more commonly known, as the “Fair Housing Act of 1968″, which expanded the original civil rights act to include prohibiting discrimination concerning the sale, rental, and financing of housing based on race, religion, national origin or sex. President Lyndon Johnson signed the Fair Housing Act into law on April 11, 1968, one week after Dr. Martin Luther King, Jr. was assassinated. Fair Housing Resources: Yesterday, the Centers For Disease Control and Prevention (CDC) announced the issuance of an order temporarily halting all residential evictions in the United States through December 31, 2020. The CDC indicated this action was being taken “to prevent further spread of COVID-19”. Details of the order…. Under the order, a landlord or other owner of residential property, “shall not evict any covered person from any residential property in any jurisdiction to which this Order applies during the effective period of the Order.” So, it’s pretty simple, if you own a residential property in the U.S. that has a tenant in it, this order applies to you. The only exception is the American Samoa, which, at the time of the order, had not cases of COVID-19 reported. Tenants are still obligated for rental payments… The order makes it clear that it does not remove the tenant’s obligations to pay rent, nor the landlord’s ability to charge late fees, penalties, etc. Specifically, the order states: “This order does not relieve any individual of any obligation to pay rent, make a housing payment, or comply with any other obligation that the individual may have under a tenancy, lease, or similar contract. Nothing in this Order precludes the charging or collecting of fees, penalties, or interest as a result of the failure to pay rent or other housing payment on a timely basis, under the terms of any applicable contract.” Tenants must submit a declaration form to take advantage of this protection… According to the order, for a tenant to receive the protection under this order, an executed copy of a Declaration form must be submitted to their landlord, owner, or property manager. See the entire order here. Download the Declaration Form for tenants here. Not only has it become common today for homes to sell as soon as they hit the market but receiving offers from multiple buyers and at prices that equal or even exceed the asking price is common as well. While this is an illustration of Economics 101, the rule and supply and demand, when the demand exceeds the supply (such as in the housing market in many price ranges and areas), prices increase this can also be a reminder of times past when home prices rose quickly for several years, then retreated rather abruptly. The most recent example of this, and arguably the worst during my 40 years in the real estate business, was the housing bubble that burst in 2008 sending home prices into a downward trend that lasted about 3 years. So, are we headed to another housing bubble? My focus is primarily on the St Louis housing market so I will focus on that but I will point out what I see with regard home prices, St Louis has a better outlook than at the national level. [xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”] Continue reading “Have Home Prices Increased Too Much Too Fast? Is A Correction Coming?“ Today, as we celebrate the life of Dr. Martin Luther King, Jr. who is best known as a leader in the Civil Rights movement, I wanted to look at how his efforts also ultimately resulted in the Fair Housing Act, which sought to end discrimination in housing. Through the efforts of the civil rights movement, Dr. King and others were able to get the attention of our nation resulting in President John F. Kennedy, in a nationally televised address on June 6, 1963, urging the nation to ” take action toward guaranteeing equal treatment of every American regardless of race.” Shortly after his address to the nation, President Kennedy proposed that Congress consider civil rights legislation that would address rights in many areas such as voting, public accommodations, school desegregation but not housing at the time. Even though President Kennedy was assassinated on November 22, 1963, his efforts beforehand still resulted in the Civil Rights Act of 1964 when, then President, Lyndon Johnson, signed into law on July 2, 1964. The Civil Rights Act of 1964 prohibited discrimination in public places, provided for integration of schools and made employment discrimination illegal, however, it did not address housing. Four years later came the Civil Rights Act of 1968, which is also referred to, and more commonly known, as the “Fair Housing Act of 1968″, which expanded the original civil rights act to include prohibiting discrimination concerning the sale, rental, and financing of housing based on race, religion, national origin or sex. President Lyndon Johnson signed the Fair Housing Act into law on April 11, 1968, one week after Dr. Martin Luther King, Jr. was assassinated. Fair Housing Resources: Dr. Martin Luther King, Jr. resources and information… St Louis is the top marketing for flipping homes, according to an article published yesterday on Realtor.com. It’s not all just flipping activity however in the article a very notable and credible St Louis industry source (unabashed self-promotion) stated that “flipping is more common in homes in the $175,000-plus range, while many of those listed for $125,000 and less are being turned into rentals, says Norman.” The Realtor.com article gave an overview of the market data I produced for them so I wanted to share the market data behind the overview. St Louis Neighborhoods With Large Investor Presence:

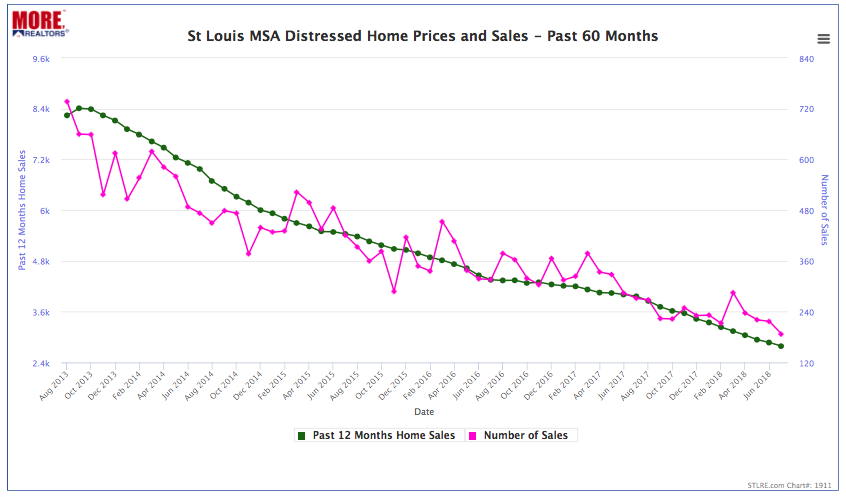

Home Prices In St Louis’ Active Investor Markets: Continue reading “St Louis Is Number One Market For Flipping Homes“ A bill introduced by St Louis County Councilmember Lisa Clancy would require landlords in unincorporated St Louis County to participate in the Section 8 program as well as pretty much any other rental subsidy program. St Louis County bill number 102 (see complete bill at bottom of article), introduced by Councilmember Clancy, if passed, would amend the existing St Louis County “Fair Housing Code” ordinance adding “lawful source of income” to the list of things that a landlord cannot discriminate based upon. The St Louis County Fair Housing Ordinance (section 717.020) currently makes it unlawful for landlords to discriminate on the basis of race, color, religion, national origin, gender, disability, sexual orientation, gender identity, or familial status. Currently included in the protected classes under St Louis County law, which are not included in the Federal Fair Housing Act, are “sexual orientation” and “gender identity”. In addition, St Louis County has “gender” as a class instead of “sex” as is in the Federal Fair Housing Act. If St Louis County Council bill 102 passes and becomes an ordinance, then “lawful source of income” will be an additional protected class and will be another one that is not in the Federal Fair Housing Act. There are other municipalities, counties, and states around the country that have passed similar legislation as well. As to be expected, legislation like this has been met with a mixed response. Is it discriminatory for a landlord to refuse to accept Section 8, Vouchers and the like? Continue reading “Proposed St Louis County Ordinance Would Require Landlords To Accept Section 8“ As the interest in investing in real estate in St Louis continues to increase, whether to buy, fix and flip or to buy and hold for rental, the number of opportunities to do so continues to decline. The primary source of “deals” for investors is typically “distressed” sales; property that has been foreclosed on and being resold, short sales or property in poor condition needing work. However, as our chart for St Louis MSA below reveals, the number of distressed home sales in St Louis has been steadily declining over the past 5 years. The chart shows both the number of distressed sales for each month (the pink line) as well as the 12-month trend (green line) and both are on the decline. During the month of July 2018, there were 187 distressed home sales in St Louis, down 14% from 217 the month before and down 31% from last July when there were 272 distressed homes sold. For the 12-month period ended July 31, 2018, there were 2,787 distressed home sales, down 30% from the prior 12-month period when there were 3,965 distressed homes sold in the St Louis MSA. [xyz-ips snippet=”Foreclosures-For-Sale-and-Homes-For-Sale”] St Louis MSA Distressed Home Sales – Past 60 Months(Click on Chart For Live, Interactive Chart)

Dr. Martin Luther King, Jr. is a name synonymous with civil rights who, along with his followers, led to the passage of the Civil Rights Act. Through the efforts of the civil rights movement, Dr. King and others were able to get the attention of our nation resulting in President John F. Kennedy, in a nationally televised address on June 6, 1963, urging the nation to ” take action toward guaranteeing equal treatment of every American regardless of race.” Shortly after his address to the nation, President Kennedy proposed that Congress consider civil rights legislation that would address rights in many areas such as voting, public accommodations, school desegregation but not housing at the time. Even though President Kennedy was assassinated on November 22, 1963, his efforts beforehand still resulted in the Civil Rights Act of 1964 when, then President, Lyndon Johnson, signed into law on July 2, 1964. The Civil Rights Act of 1964 prohibited discrimination in public places, provided for integration of schools and made employment discrimination illegal, however, it did not address housing. Four years later came the Civil Rights Act of 1968, which is also referred to, and more commonly known, as the “Fair Housing Act of 1968″, which expanded the original civil rights act to include prohibiting discrimination concerning the sale, rental, and financing of housing based on race, religion, national origin or sex. President Lyndon Johnson signed the Fair Housing Act into law on April 11, 1968, one week after Dr. Martin Luther King, Jr. was assassinated.

Dr. Martin Luther King, Jr. resources and information…

There are several ways to look at home prices and home affordability as well as to argue the merits of homeownership versus renting, however, one my favorite metrics to consider along these lines is the relationship between home prices and rental rates. Most home buyers, that are seeking a home to live in, never consider what the home they are considering purchasing would rent for, since that is not their intended use. However, there is a relationship between home values the potential rental income in that there is a tipping point reached when the cost of owning a home exceeds the cost of renting a comparable home in the same neighborhood by too much, there becomes an incentive to rent rather than buy. Along the same lines, if rental rates get so high that, for about the same money, or even less, one could buy the home they are renting, there exists a strong incentive to buy a home. With this in mind, when you look at the chart below from the St Louis Federal Reserve, which shows the St Louis home price index, the blue line, and the Consumer Price Index for Rent, the red line, you can see there is a pretty significant gap between the two. The chart goes back to 1975 and, as you can see, historically the home price index and CPI for rents have increase at relatively similar rates, with home prices lagging slightly behind from about 1980 through around 2004 but, even then, there was a pretty similar trend. As the housing bubble in 2006 approached, you can see the home price trend shot upward and past rents only to fall sharply around 2008 after the housing bubble burst. Since hitting bottom around late 2011, home prices have been trending upward, but, as illustrated, there is a much larger gap between home prices and rents then is the historic norm which is a good thing with regard to home prices. Based upon what I see on the chart (you can click on the chart to be taken to our live, current version which is interactive) I would expect the gap between rents and home prices to close at some point in the near future. This can be accomplished in one of two ways: home prices can rise at a greater rate than rents rise, or rents can fall or remain flat, or, of course, some combination of the two. In either event I think this is good data to support sustained home prices and also shows that buying a home could well be a better investment than renting. Search St Louis Homes For Sale HERE On June 2, 2017, in a victory for landlords, St Louis County Circuit Court Judge Gloria Clark Reno declared St Louis County’s landlord license ordinance unconstitutional. The landlord license ordinance was passed by the St Louis County Council, with a surprise vote at the Council meeting on October 18, 2015 while the council members ignored the outcries from many private property rights advocates, including the St Louis Association of REALTORS, who questioned, among other things, the constitutionality of the ordinance. The ordinance went into effect on December 31, 2015 however, as a result of a lawsuit filed by the St Louis Association of REALTORS on December 29, 2015, Judge Reno issued a temporary restraining order on January 7, 2016 prohibiting St Louis County from enforcing the ordinance. The St Louis County landlord license ordinance, landlords were required to obtain a license annually before renting out property in St Louis County. Many aspects of the ordinance appeared to be unconstitutional and to infringe upon the private property rights of landlords causing many groups to speak out against the ordinance. The complete order by Judge Reno is below. Search St Louis Homes For Sale HERE The homeownership rate for the St Louis MSA during the 1st quarter of 2017 was 61.6% according to recently released data from the U.S. Census Bureau. As our table below shows, the current homeownership rate for St Louis is at the lowest level in our records. On the table I also compute a rolling 12 month average which helps smooth out seasonal variations in the data and it shows an average homeownership rate of 64.8% over the past 12 months, down from 68.8% for the prior 12-month period and, like the percentage for the quarter, the lowest level in our records. This is not gloom and doom news for the real estate market. It may just be indicative of a change in lifestyle today versus the past with a smaller percentage of the population being married to the idea of homeownership and more receptive to being a tenant. As the second table below illustrates the total of occupied housing units in the midwest region of the US has only grown from about 25,500 units 10 years ago to 26,500 units now, an increase of just 3.9%. However, during that period, the total number of rental units increased 21% while the total number of owner occupied units declined 2% clearly marking a shift from home ownership to rental but a segment of the population. Search St Louis Homes For Sale HERE My headline is a rhetorical question and I personally don’t think landlords and tenants are bad people but, after seeing so many municipalities work so hard over the past few years passing ordinances that, in many cases, in my humble opinion, tramples the property rights of landlords as well as the rights of tenants, one would have to believe that landlords and tenants must be some pretty bad people. After all, if not, why would some municipalities work so hard to discourage them from entering their cities and work hard to chase them out? For example, the most recent egregious example of this comes from the north-county city of Berkeley, where, last September, the city council passed an ordinance (#4320-bill can be seen at bottom) that put a “30-percent limitation of single-family rental homes per residential block“. Bill number 4456, which was the bill introduced that became the ordinance, gave the purpose of the new ordinance to be:

Since the city of Berkeley seems to equate “a good quality of life” with a “limitation of single family rental homes‘ I think, by negative inference, we can come to the conclusion that Berkeley is saying rental homes, and I would guess either the people that own them, or the tenants that live in them, must negatively impact, or run counter to, “a good quality of life” in their neighborhoods which now brings us back to my initial question, are landlords and tenants bad people? Search St Louis Homes For Sale HERE On October 10th (well, technically October 11th since the final vote was not taken until reportedly 1:00 am) the city of Florissant dealt it’s latest blow to landlords and tenants. The blow by way of Crime Free Bill No. 9226 which was introduced by the Florissant City Council as a whole and was passed unanimously by the council in spite of opposition to the bill expressed by the St Louis Association of REALTORS, EHOC and others. I have provided below a complete copy of Article XVII: Residential Real Estate of the city of Florissant ordinances as this was the section that was changed by the bill. Highlights of changes as a result of Crime-Free Bill No. 9226: Get Live St Louis Real Estate Market Data By City, Zip or County HERE Yes, it is October and yes, home sales, and prices, do tend to soften around this time of year as we head into the winter months, but, having said that, it can still be a great time to sell a home, especially if you are in one of the areas I’ve identified below! Why? Well, for one, there is VERY LITTLE COMPETITION but good demand from buyers. So, even though the St Louis housing market, including home prices, can be following suit with the weather and cooling off, when you are in a market with good demand and no competition, you can sell your home for more than you could under normal conditions this time of year. Plus, it’s a lot easier to please a buyer and motivate a buyer to act when there aren’t many homes to choose from and the buyer feel’s they’ll miss out if they don’t act quick enough. The St Louis markets where NOW is the time to sell your home! Search St Louis Homes For Sale HERE Continue reading “If You Live In One Of These Areas NOW Is A Good Time To Sell Your Home!“ UPDATE February 3, 2017 – Representative Gary Cross has introduced HB 705 which would repeal this legislation. Ironically, Rep Cross is the representative that first introduced the original legislation, HB 1862. I’m guessing he has come to realize the problems this legislation has caused, which I believe were unintended consequences, and has chosen to fix the issue which I praise him for! ## This legislative session, the Missouri State Legislature passed HB. 1862, which modifies provisions relating to the existing landlord-tenant law in Missouri, specifically, it repeals sections 534.350, 534.360, 535.030, 535.110, 535.160 and 535.300 of the Revised Statutes of Missouri and replaces them with five new sections as described in the bill. The bill has been delivered to Governor Nixon and, if signed by him, will go into effect August 28th of this year. Why This New Law May Force Landlords (even licensed real estate agents) To Use Property Managers: While this bill has some good things in it, such as establishing some reasonable procedures and time lines for a landlord regaining possession of a property as well as doing a little housekeeping with regard to what can be deducted from a security deposit, the bill also makes, what I believe to be, a very damaging change to the law with regard to security deposits. With regard to security deposits held by landlords, the bill changes section 535.300 (2) to read (emphasis is mine): Search St Louis Homes For Sale HERE For those that have been reading my articles for a while, you know I am not a Pollyanna when it comes to the real estate market, opting instead to tell it like it is, even when the news is not so encouraging. For that reason, as well as the data behind my opinion, I think my suggestion that now is a good time to buy a home in St Louis should be considered to be a credible opinion from an industry insider. So, why buy a home in St Louis now?

St Louis Home Price Trends By City/Municipality Continue reading “4 Reasons Why You Should Buy A Home Now In St Louis“ |

|||

|

St Louis Real Estate Search® St Louis Home Values St. Louis Real Estate News Contact Us Copyright © 2024 Missouri Online Real Estate, Inc. - All Rights Reserved St Louis Real Estate News is a Trademark of Missouri Online Real Estate, Inc. Missouri Online Real Estate, Inc. 3636 South Geyer Road - Suite 100, St Louis, MO 63127 314-414-6000 - Licensed Real Estate Broker in Missouri The owner and authors this site are providing the information on this web site for general informational purposes only and make no representations, warranties (expressed or implied) or guarantees of any kind whatsoever, as to the accuracy or completeness of any information on this site or of any information found by following any link on this site. Furthermore, the owner and authors of this site will not be liable in any manner whatsoever for any errors or omissions in information on this site, nor for the availability of this information. Additionally the owner and authors of this site will not be liable for for any losses, injuries or damages in any way from the display or use of this information or as the result of following external links displayed on this site, or by responding to advertisements displayed, or contained, on this site

In using this site, users acknowledge and agree that the information on this site does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind nor should it be construed as such. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action on this information, you should consult a qualified professional adviser to whom you have provided all of the facts applicable to your particular situation or question. None of the tax information on this web site is intended to be used nor can it be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer. |

|||