The headline of this article is not clickbait nor sensationalism. In fact, it’s based on something that’s about to happen. Fannie Mae, which, along with Freddie-Mac, is involved in almost two-thirds of the home loans in the United States, is set to release a new Loan Level Price Adjustment Matrix (LLPA) on May 1, 2023. The LLPA is used by lenders to determine the cost (interest rate) of a loan for a borrower, and it’s not entirely new, as there’s an existing one already in effect. The new LLPA is similar to the current one, as it also charges varying amounts based on the loan to value (LTV) and credit score.

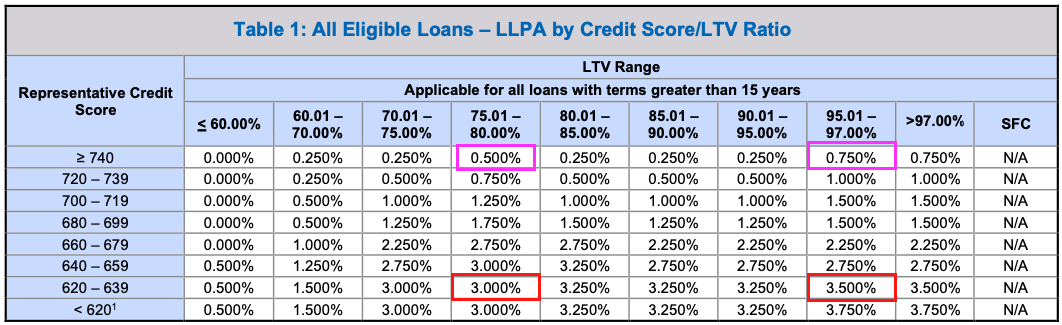

What’s different in the new LLPA is that the cost is going up for borrowers with better credit and going down for borrowers with a lower credit score. To explain briefly how LLPA works, the higher the percentage of the purchase price a borrower is borrowing, the higher the fee. This percentage is known as the “LTV.” It makes sense that a loan where the borrower made a smaller down payment (e.g., 3%) has more risk associated with it than a loan where the borrower made a 20% down payment. Furthermore, the higher the credit score a borrower has, the lower the fee will be. This is because credit scores are based on past payment performance, and it’s logical that there’s less risk to a lender for a mortgage where the borrower has a higher credit score.

Borrowers with a higher credit score will still get better rates:

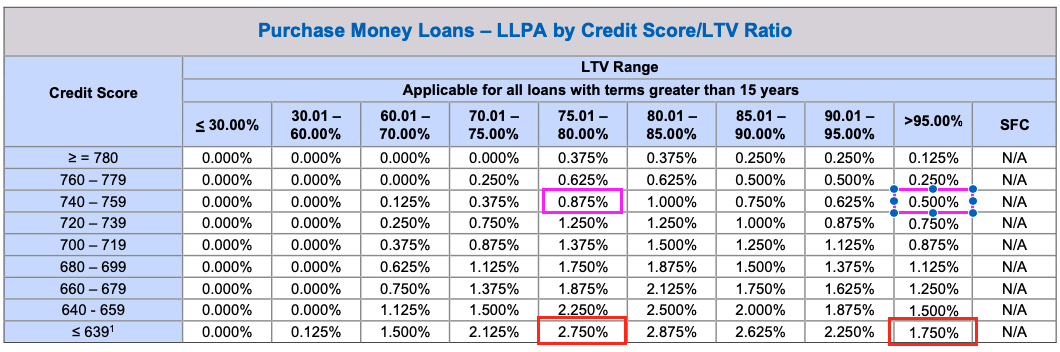

It’s essential to point out that Fannie Mae hasn’t entirely lost its mind by charging higher-risk borrowers less than it’s charging lower risk borrowers. For instance, a borrower with a 740 credit score borrowing 95% or more of the purchase price will be charged a 0.125% LLPA fee come May 1st, while a borrower with a 630 credit score borrowing the same amount will pay a cost of 1.75%. So, the borrower with the worst credit score will pay an LLPA fee approximately 14 times higher than a borrower with the best credit score.

So what’s the big deal then, what’s different?

The headlines surrounding this change relate to how Fannie Mae has adjusted its current pricing. The change appears to punish better credit risk borrowers and reward higher risk borrowers. For example, a borrower making a 20% down payment with a high credit score will be charged higher rates come May 1st. In contrast, a borrower with the same down-payment but a lower credit score will get charged a lower rate than the current one. Currently, a borrower with a 740 credit score is charged a 0.50% LLPA fee, but beginning May 1st, that charge will go up to 0.875%. However, a borrower with a credit score of 639 currently is charged 3.0%, and on May 1st, that will drop to 2.75%.

Some high credit, strong borrowers will benefit, but overall the winners are borrowers with the worst credit scores…

I must admit that it took me a while to determine whether the media was exaggerating the impact of the recent pricing changes on Fannie Mae loans. Specifically, I wanted to understand whether these changes were penalizing borrowers with better credit scores while rewarding those with higher risk. The reason for this confusion is that there are certain credit score and LTV combinations that actually benefit stronger borrowers under the new plan. For instance, a borrower with a credit score of 780 or above who borrows 75% of the purchase price currently pays a LLPA fee of 0.25%. However, starting May 1st, this same borrower will pay no fee, and if they borrow 80%, they will only pay a 0.375% fee. However, these exceptions for stronger borrowers are few and far between, and for the most part, the costs either remain the same or increase for most borrowers with a credit score of 740 or higher. On the other hand, borrowers with lower credit scores see a significant reduction in costs at nearly every LTV level.

What’s the overall real impact?

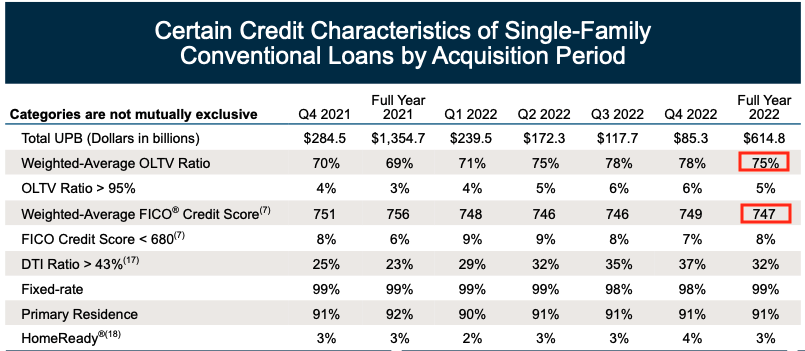

Overall, it is challenging to determine the real impact of these changes since there are numerous credit score and LTV combinations, and the pricing changes are inconsistent (except for the lowest credit score levels). To gain a better understanding, I referred to the Fannie Mae 2022 report, which provides a table illustrating the “typical” borrower for 2022. As the table shows, the average Fannie Mae borrower in 2022 had a credit score of 747 and an LTV of 75%. Under the current pricing, Fannie Mae’s average borrower pays a LLPA fee of 0.25%. However, starting May 1st, this same borrower will pay a fee of 0.375%, which is a 50% increase. While there is no information available on the net impact expected to Fannie Mae, it appears that this increase for the average borrower (and the best credit risk borrowers mentioned above) works as a subsidy to lower the loan costs for borrowers with lower credit scores and higher LTVs.

Fannie Mae Loan-Level Price Adjustment Matrix For Loans AFTER May 1, 2023

(click on image below to access entire Fannie Mae LLPA)

Fannie Mae Loan-Level Price Adjustment Matrix For Loans PRIOR to May 1, 2023

(click on image below to access entire Fannie Mae LLPA)

Fannie Mae 2022 Report

(click on image below to access entire report)