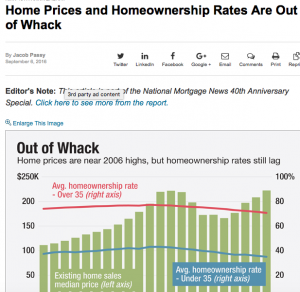

Last week, National Mortgage News, published an article on a report which indicated home prices and homeownership rates are “out of whack”. While the article never actually said home prices were too high, per se, it pointed out that when home prices peaked in 2006, homeownership rates began to decline as a result, implying that home prices caused home ownership to slow. It goes on to state that, while home prices have recovered to the levels they peaked at in 2006, the homeownership rate, on the other hand, has continued to decline.

Last week, National Mortgage News, published an article on a report which indicated home prices and homeownership rates are “out of whack”. While the article never actually said home prices were too high, per se, it pointed out that when home prices peaked in 2006, homeownership rates began to decline as a result, implying that home prices caused home ownership to slow. It goes on to state that, while home prices have recovered to the levels they peaked at in 2006, the homeownership rate, on the other hand, has continued to decline.

Are home prices to blame on the decline homeownership rates?

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Is the decline in the homeownership rate a result of millennials not being that interested in owning a home, or that they (millennials) are saddled with too much student loan debt? Or, maybe it’s the economy or tougher standards for home loans, or have home prices increased to the point of discouraging homeownership? For the sake of this article, I’m going to stick with the latter issue, home prices.

In looking at the home price issue, I think there are several different different things to look at that would indicate whether home prices are too high, or “out of whack”, so to speak. Very briefly, here are some of the best in my opinion as well as my thoughts on each:

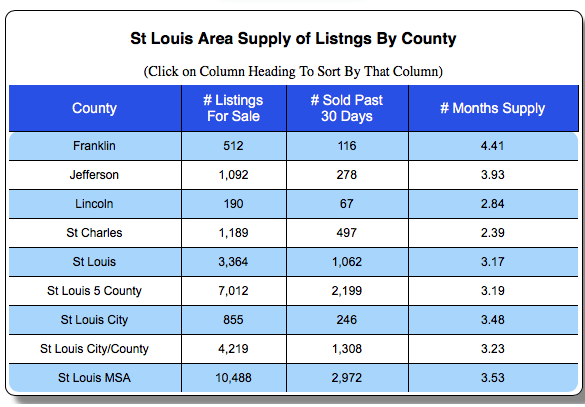

- Supply vs Demand – As the table below shows, the St Louis MSA has just a 3.5 month supply of homes at this point, and all of the St Louis area counties have an inventory of under 4 months with the exception of Franklin County with a 4.41 month supply, but all are under the historical “norm” of 6 months. Therefore, low supply would indicate there is demand and prices are not rising to the point where the supply is growing too much.

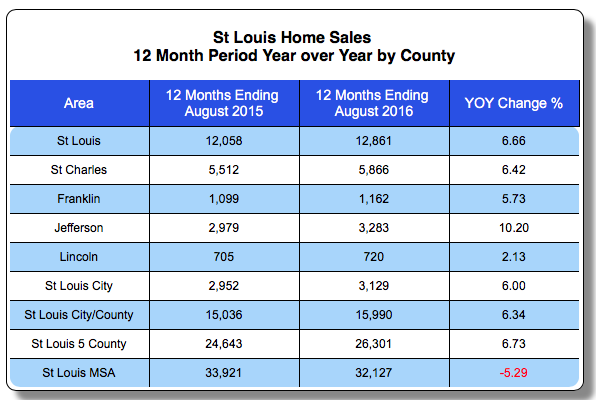

- Home Sales – As the table below shows, for the 12 month period ended last month, sales were up from the prior 12 month period in all St Louis area counties. The St Louis MSA, as a whole, saw home sales fall a little over 5%, but it must have been primarily counties in Illinois. This doesn’t show any resistance to home prices.

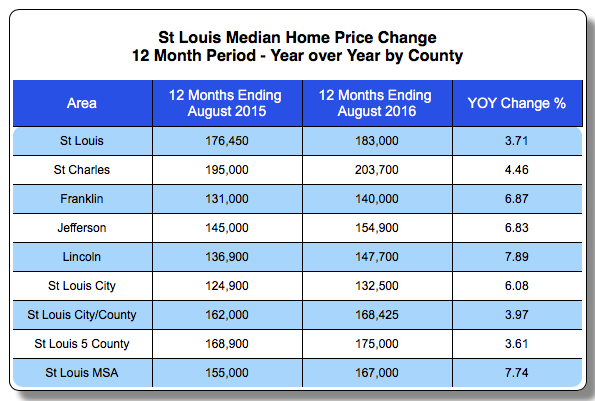

- Home Prices – As the table below shows, all St Louis area counties, and the St Louis MAS as a whole, she home prices increase in the most recent 12 month period from the prior period. Additionally, for the most part, all of the rates of increase seem reasonable so nothing here indicates price resistance.

In summary, while real estate is all very local and could vary from zip to zip, city to city and even block to block, in looking at the “big picture” for St Louis, as I did above, I see nothing that indicates that home prices are too high at this time or the blame for the decline in homeownership rate. Of course, pricing adjustments we see as a normal course of business, such as seasonal adjustments or “corrections” along the way, help keep things in check and we will see that but nothing here causes me concern…for now.