The bursting of the real estate market bubble back in 2008 led to opportunities for investors to buy up homes at attractive prices throughout the country and even attracted some large firms backed by Wall Street such as Blackstone, American Homes 4 Rent, Colony American Homes and Fundamental REO. While institutional ownership of commercial real estate, apartments and land has been very common, and in fact, predominant, since entering the business in 1979, firms like this investing in single family homes has not. The best I can tell, St Louis has not attracted any of the four largest institutional investors (although it is hard to tell because they could own property in LLC’s not easily identified to be them) however, there has been plenty of investor activity here, including some by institutional investors.

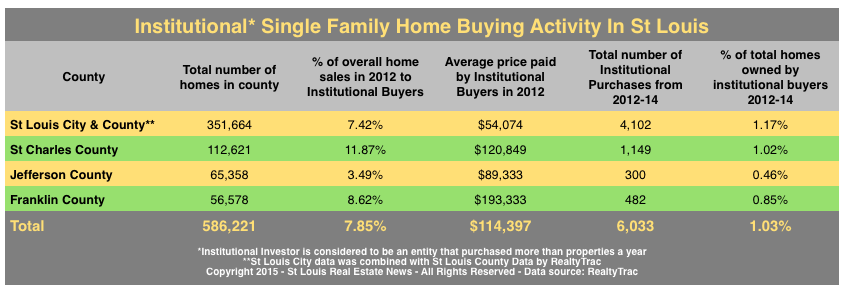

So, what is an “institutional investor”? Well, for the purposes of this article, and the data below, we’ll consider it to be an entity that buys at least 10 homes a year thereby separating them out from the small and/or occasional investor. One such investor that has been active in St Louis is BLT (Building Land & Technology out of Connecticut) which, at this time, appears to own around 700 single family homes in the St Louis area. However, as the table below shows, ownership of homes in St Louis by institutional investors is pretty minimal, with those types of investors having acquired over the past 3 years (the most active period for this type of investment) at total of just over 6,000 homes or, just over 1 percent of the total housing stock in the five-county core St Louis market.

Search St Louis Foreclosures For Sale

With regard to whether the institutional investor activity has been a good thing or a bad thing is subject to debate as there are differing opinions within the real estate community, but it seems the majority feels it helped the market through a rough period by removing much of the depressed sale inventory from the market. As the impact of those depressed home sales lessened, it opened up the door for the market to begin healing and recovering in the opinion of yours truly as well as of many in the industry. Now the concern is, what happens when these large investors decide to sell off the homes and claim their profits? Will they overload the market to the point with inventory that they then cause a negative impact on the market and subsequently cause the market to lose some of the ground it gained toward recovery? This is a good question and, for many markets one to keep a close eye on. Fortunately, here in St Louis, I think this type of ownership is limited enough that overall it won’t have an effect on the market, although, since the majority of the ownership by institutional investors here is in north county, it certainly could have a negative impact on North County if they chose to dump a large number of homes on the market at once.