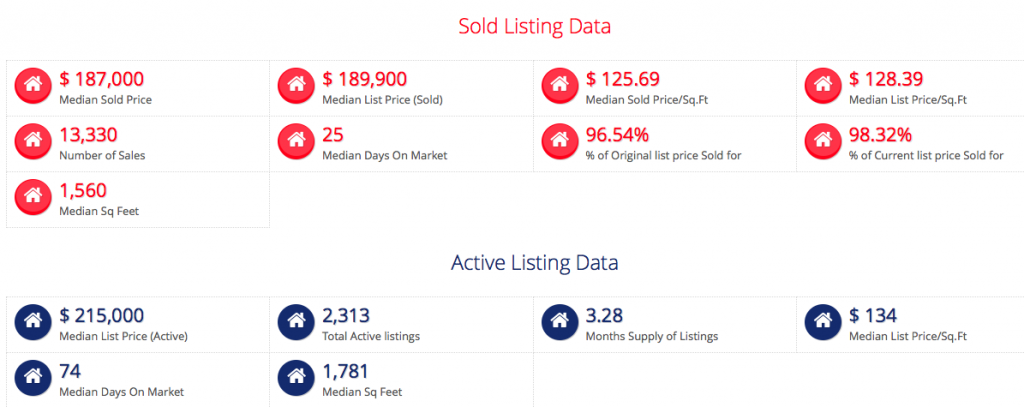

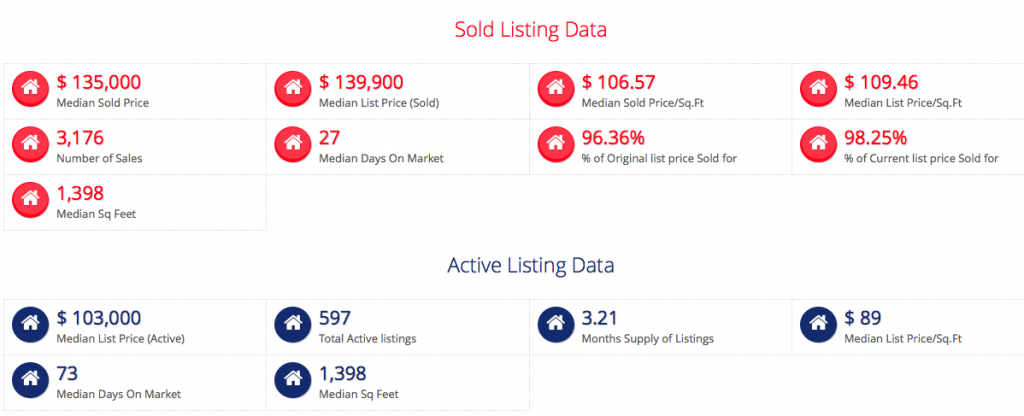

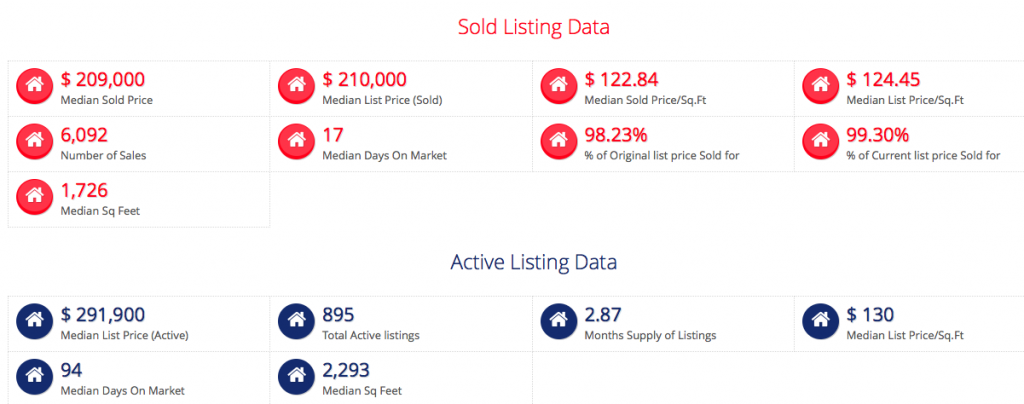

Investors that rental property may find their best returns, relative to the price of the homes they buy, in the City of St Louis, according to some county-level rental data compiled by MORE, REALTORS. As the tables below illustrate, over the past 12 months the median price of homes sold in the City of St Louis was $106.57 per square foot and the median annualized price per foot homes lease for was $11.04 which works out to a gross annual return on investment of 10.4% in the City of St Louis, the highest of the four St Louis area counties we looked at. The next best return is found in Jefferson County with a 9.8% return, followed by St Charles County at 9.3% and finally, St Louis County, at 9.1%.

Data limitations…

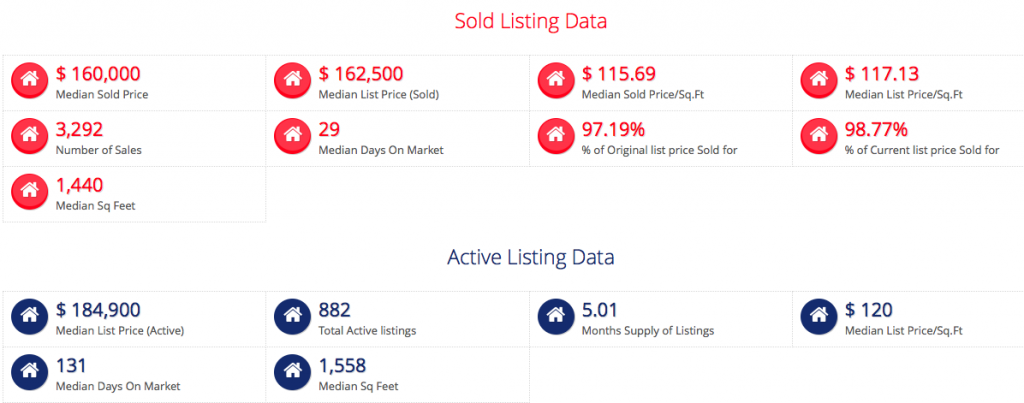

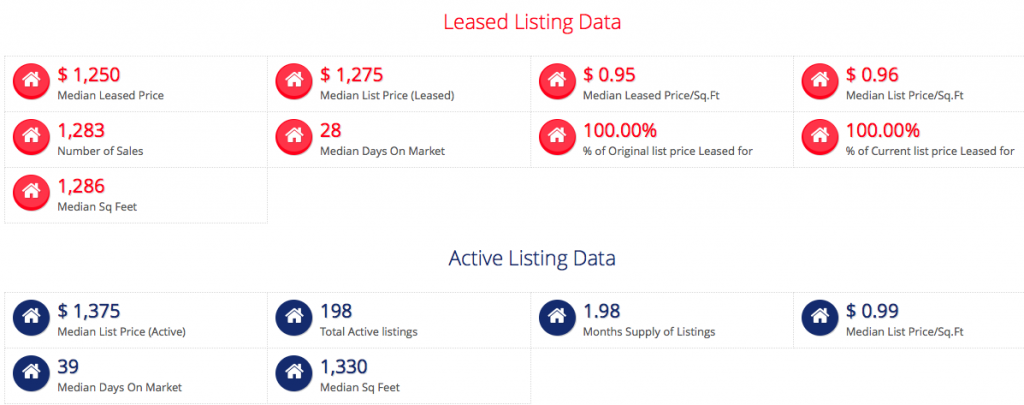

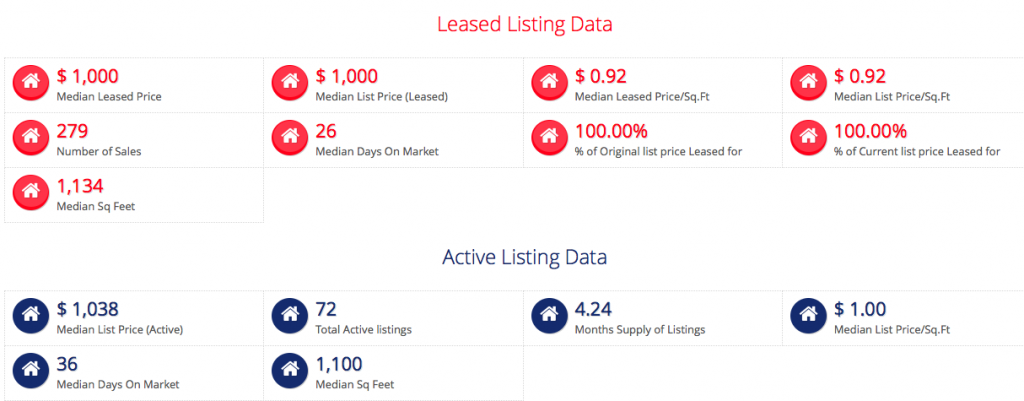

There is an excellent source of very accurate market data available with regard to prices of homes sold, that being the REALTOR MLS which is where our sold data comes from. One of the reasons this data is so accurate is because the lions share of homes sold in St Louis are done through REALTORS and the data that is reported on those sales to the MLS is subject to strict guidelines and rules to insure accuracy. When it comes to rental and lease data however, the data is much harder to assimilate. This is because the majority of rentals are leased without the assistance of REALTORS and therefore the lease data does not make it’s way to the MLS and there really is no other reputable data source available for it. When it comes to rental data for larger apartment complexes and the like, there is such data available, but not for single family homes. Therefore, we have worked to produce rental data from the leases that are handled by REALTORS. As you can see from the tables below, the number of leases reported in the MLS is much smaller than sales (1,283 vs 13,330 for St Louis County for example) however, there are enough reported I believe to make the data statistically significant.

We can drill it down more…

We can drill down the data to a more local level, such as at the school district, city or zip level, and do this for our investor clients, but what I’ve compiled here gives an overall view of the market at the county level. Another thing I suggest investors evaluate as well before investing their money, is the appreciation rate of homes in that area. This is data we also compile and, when you put the rental return rate data next to the price appreciation data you get a pretty good picture of the areas that make the most overall sense to invest in.

Search St Louis Homes For Sale HERE

How to Buy Foreclosures – Advice From a 2,000+ Home Investor

Find The Value Of Any Home In Under A Minute!

St Louis County Home Prices – Past 12 Months St Louis County Lease Data – Past 12 Months

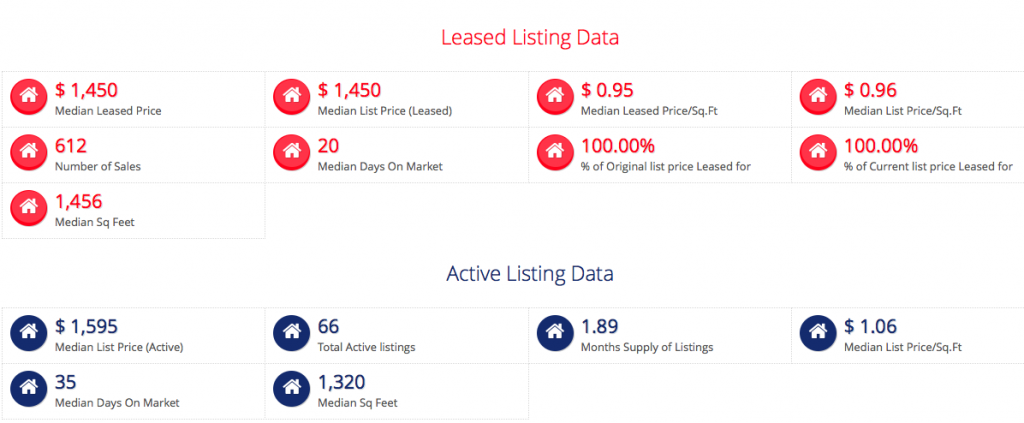

St Louis County Lease Data – Past 12 Months

St Louis City Home Prices – Past 12 Months

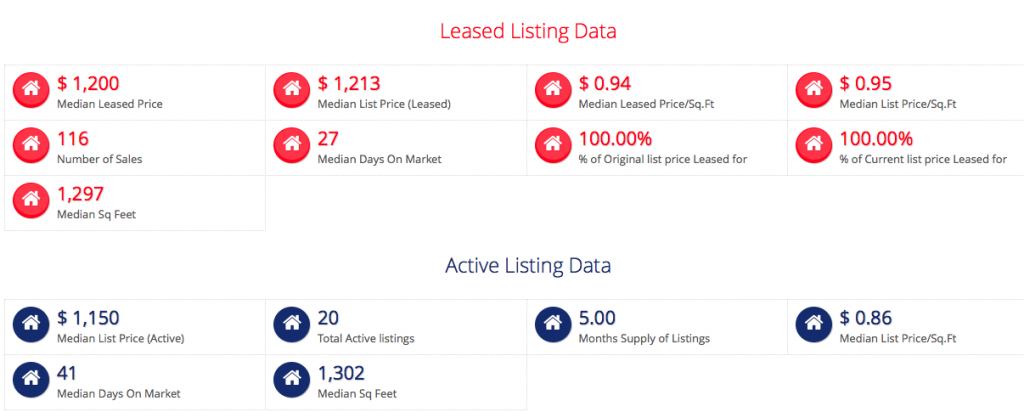

St Louis City Lease Data – Past 12 Months

St Charles County Home Prices – Past 12 Months

St Charles County Lease Data – Past 12 Months