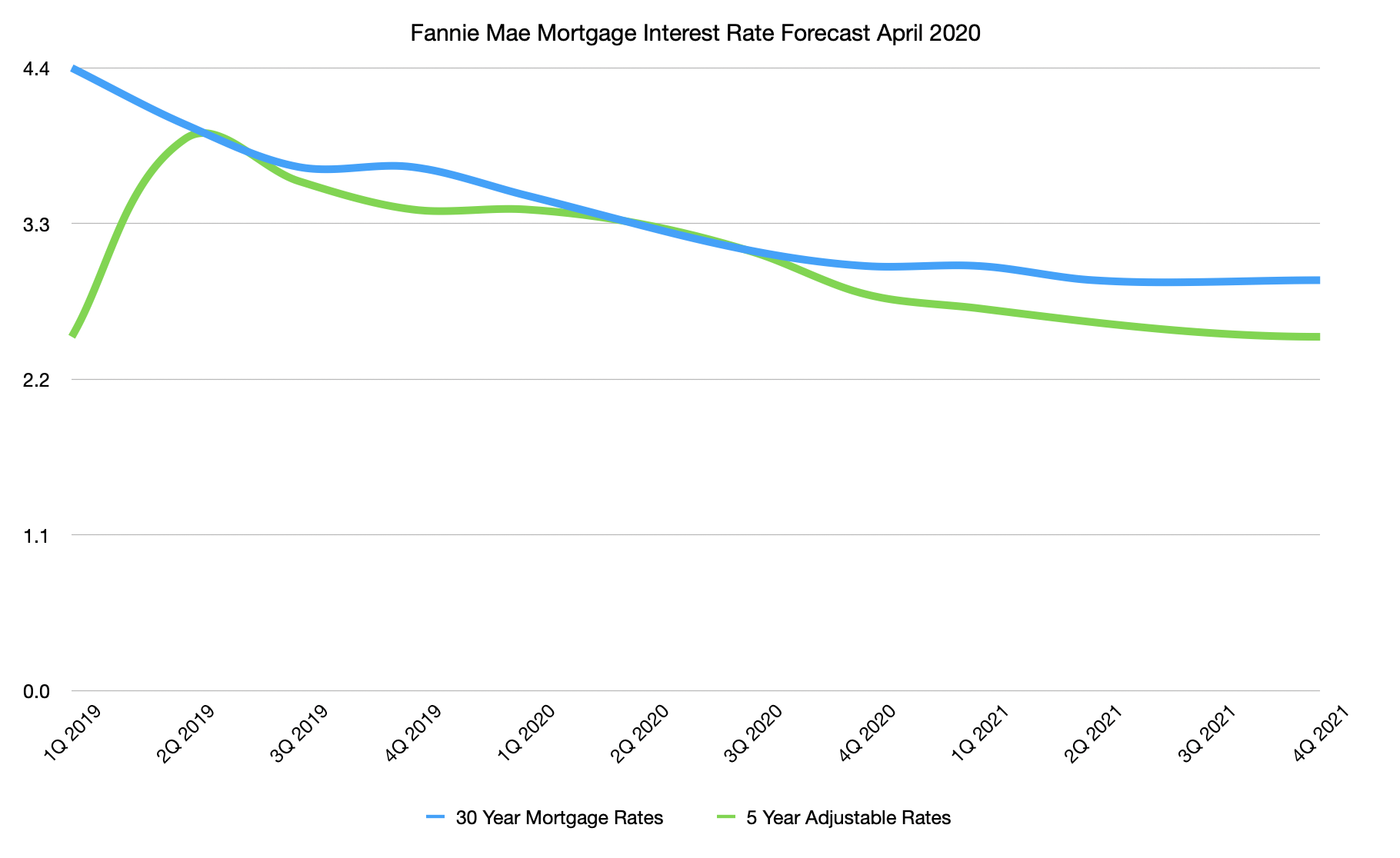

Fannie Mae issued their monthly housing forecast for April which includes, among other data, a forecast of what mortgage interest rates will be in the coming months. Last months forecast had projected that mortgage rates would continue to decline moving forward but only to a low of 3.1% before the end of 2021 while the April forecast predicted the interest rate on a 30-year fixed-rate mortgage would fall to 2.9% in the 2nd quarter of 2021 and stay there through the balance of the year.

If you’re able, now’s the time to buy!

While the effects of the COVID-19 pandemic, such as job loss, is going to take some would-be home buyers out of the market, for those that are still able to buy, now is a great time to buy a home. There are many factors that play in favor of buyers today, such as the fact that there are about 1/3 fewer of them (buyers in the market) now than this time last year, sellers that want to have fewer people coming through their homes and interest rates. As our chart below shows, not only are rates low now, they are projected to go much lower even.

Why not wait until next year when the rates hit their lowest?

Good question, but there are several reasons not to wait. First off, the rates shown on my chart are “projections”, or to put it another way “an educated guess”, so there is no guarantee rates will actually come down as predicted. In addition, once the stay at home orders go away and we start moving back to something closer to normal, I anticipate there will be a flood of buyers to the market which, along with lower interest rates (if that happens) will likely drive home prices up. So, for buyers that are able, they may get a better buy today, with less competition, still get a good interest rate and then if rates do fall as predicted can easily refinance to take advantage of lower rates.

[xyz-ips snippet=”Homes-For-Sale”]

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

Fannie Mae Mortgage Interest Rate Forecast April 2020 (Chart)

Data source: Fannie Mae – Copyright ©2020 St Louis Real Estate News, all rights reserved