The Federal Reserve Bank of New York just released it’s Quarterly Report on Household Debt and Credit for the 2nd quarter of 2015 in which some encouraging facts were revealed with regard to the home mortgage market, including:

- New home loan originations during the quarter increased to $466 billion…this marks the fourth consecutive quarterly increase since originations hit a 14-year low a year ago

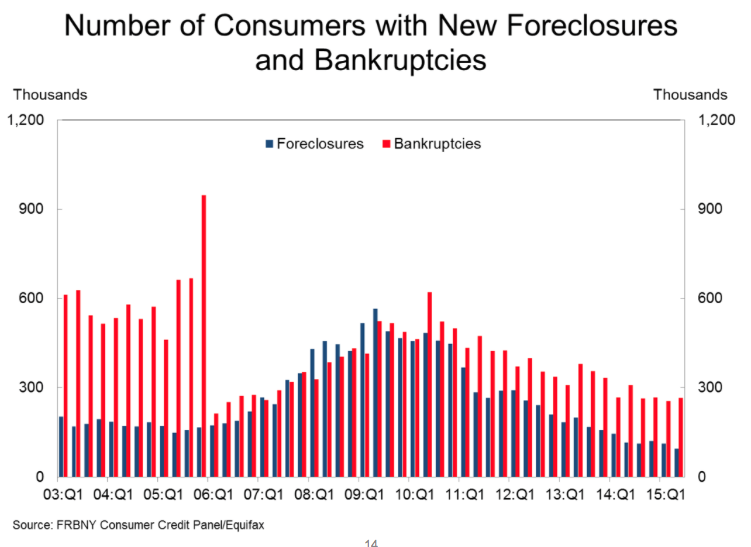

- As the chart below illustrates, roughly 95,000 individuals had a new foreclosure add to their credit report during the quarter, marking the lowest number of new foreclosures since the data was first tracked 16 years ago.

- Mortgage delinquencies improved with the share of seriously delinquent mortgages (90+ days) dropping to 2.5% from 3.0% during the prior quarter.

- Mortgage delinquencies improved again, with the share of mortgage balances 90 or more days delinquent decreasing slightly;

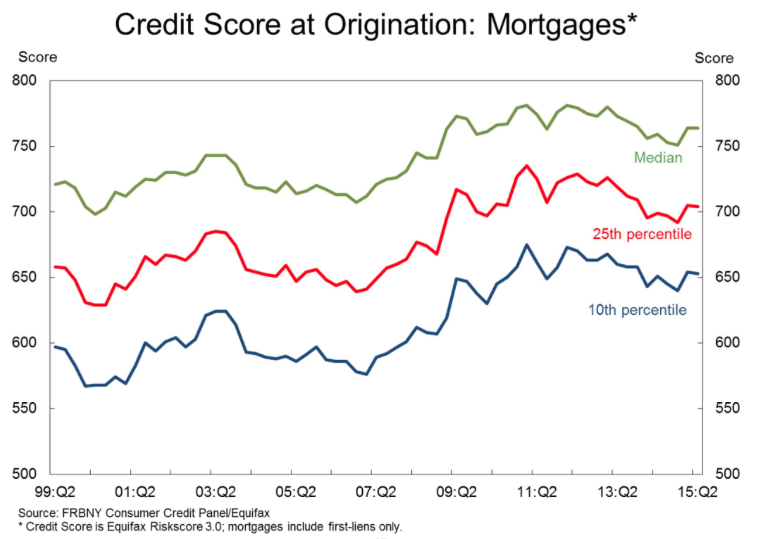

- The median credit score for borrowers obtaining a home mortgage during the 2nd quarter, as the chart below shows, rose to above 750, while the bottom 10th percentile of borrowers, also known as “sub-prime”, rose to 650. As the chart illustrates, back in 2000 the median was around 700 and the lowest percentile was barely above the 550 mark.

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price