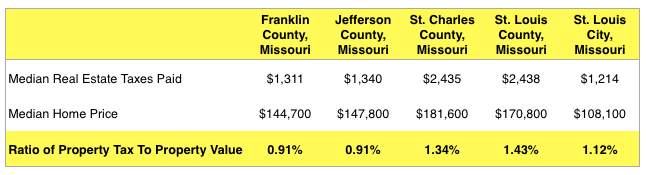

Real property tax rates in St Louis County effectively cost homeowners in that county about 1.43 percent of the value of the home which is 57 percent higher than Jefferson and Franklin counties were property taxes cost homeowners about .91 percent of their homes value. In St Charles County, property taxes are about 1.34 percent of the homes value.

Effective Real Property Tax Rates In St Louis*

*Median real estate taxes paid and median home price based upon U.S. Census Data from the 2013 ACS Estimates

*Median real estate taxes paid and median home price based upon U.S. Census Data from the 2013 ACS Estimates