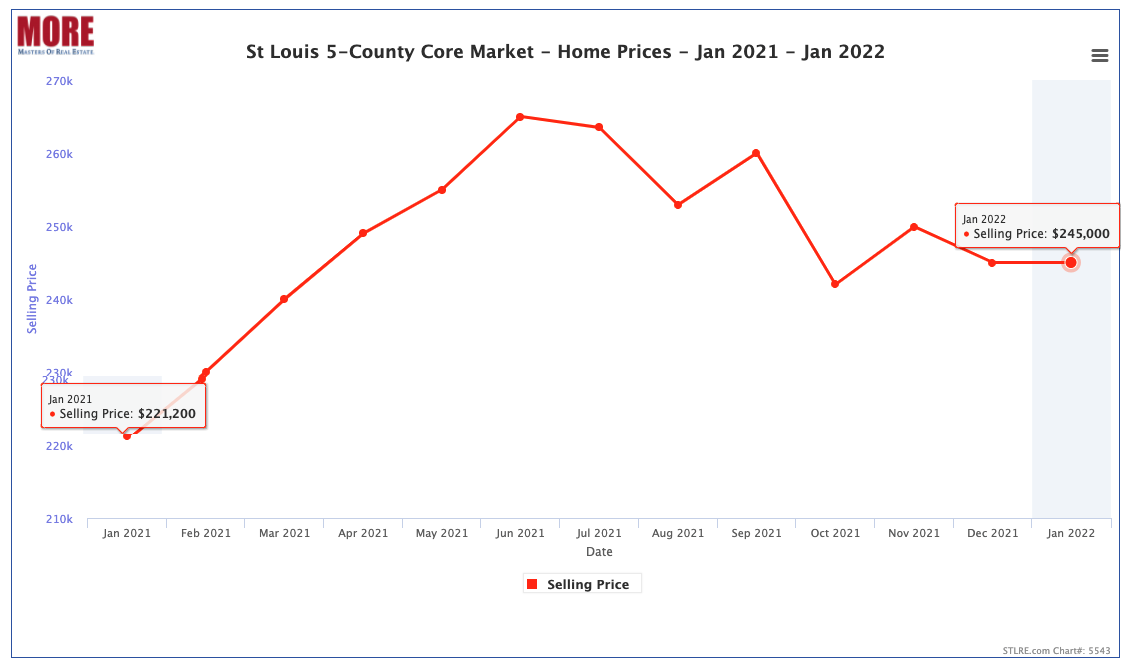

Most anyone that is interested in buying or selling a home is pretty much aware of two things: there is a low inventory of homes for sale and prices have increased a fair amount as a result. That part is likely largely a result of basic economics related to supply and demand. When the demand is greater than the supply, prices will increase. In St Louis, home prices have done just that. As the chart below (exclusively available from MORE, REALTORS®) illustrates, the median price of homes sold in January 2020 was $221, 200 and in January 2021 was $245,000, an increase of 10.8%.

Interest rates are the other part of the equation with regard to the “cost” of a home…

Since the overwhelming majority of home buyers that purchase a typical home in St Louis do so utilizing a mortgage or home loan, the interest rate on that home loan has a direct impact on what that home “costs” the homeowner in terms of the monthly payment. When buyers get pre-approved for a home loan, as well as consider how much they can afford to or want to, spend on a home, it all pretty much usually starts with the house payment. Therefore, we can’t underestimate the impact interest rates can have on home prices.

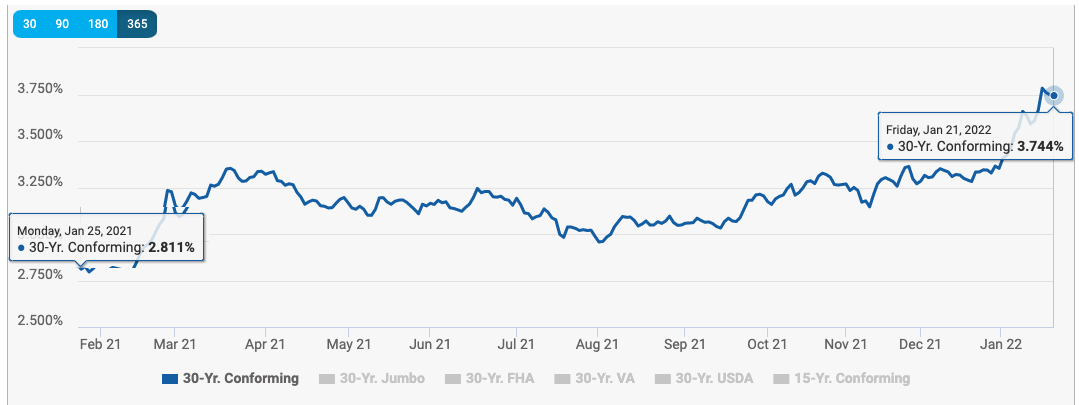

As the mortgage interest rate chart below shows, the average interest rate on a 30-year conforming conventional home loan in January 2021 was 2.811% and today has increased to 3.744%.

The change in the “cost” of a typical St Louis home in the past year…

So, if we look at the increase in the price of a typical St Louis home and then factor in the increase in the interest rates we find that the actual “cost” of a typical St Louis home (in terms of house payment) increased 25% n the past year. To keep things simple, I based this on a loan amount of 90% of the purchase price so the cost will vary depending upon downpayment of course and I’m only computing principal and interest so I’m not including escrows for property taxes or homeowners insurance.

- Typical payment on a typical St Louis home January 2021 – $ 805.00

- Typical payment on a typical St Louis home January 2022 – $ 1,009.00

Is it too late to buy since the cost has increased so much?

Obviously, each buyer must determine what they can afford and what timing makes sense for them but speaking generally, just based upon data, here are my thoughts as to whether a home buyer should buy now or wait based upon market conditions:

- Almost every report I’ve seen from economists and other folks smarter than me is predicting interest rates to increase more in the near term or, at minimum stay in the same range. Therefore, waiting for rates to come down is probably not a good strategy, in fact, the better strategy may be to try to buy before they get any higher.

- Since the interest rates are rising making the true cost of a home higher, it is possible that would drive down home prices a bit. However, given the low inventory of homes available for sale and the steady demand from buyers, this does not seem likely. Granted, at some point, home prices will not be able to continue to increase at the same rates they have been so a flattening may be possible but unless more happens in the economy or market than is happening now, I don’t see declining home prices. Therefore, the sooner you buy probably the better in this regard too. Not to mention, we are in the winter market now which, historically in good markets and bad, is a time when prices ease a bit due to the seasonality of the business.

St Louis 5-County Core Market- Home Prices – Jan 2021 – Jan 2022

(click on chart for live, interactive chart)

St Louis Morgage Interest Rates – 30 Year Conventional Loan- Jan 2021 – Jan 2022

(click on chart for live, interactive chart)