Dennis Norman

Today the S&P/Case-Shiller Index report for the first quarter of 2010 was released showing that the U.S. National Home Price Index fell 3.2 percent in the first quarter of 2010, but remains above it’s level from a year-earlier.

In March, 13 of the 20 MSA’s covered by the Case-Shiller report, as well as both the 10-city and 20-city composites, were down for the month however both the composites as well as 10 of the 20 MSA’s showed year-over-year gains. The report cites the end of the tax incentives and the increasing foreclosure rate as reasons the housing market is seeing some “renewed weakness“.

Other highlights from the report –

- The S&P/Case-Shiller U.S. National Home Price Index for first quarter 2010 is up 2.0 percent from the first quarter of 2009.

- In March the 10-City Composite was up 3.1 percent from the first quarter of 2009, and the 20-City Composite was up 2.3 percent for the same period.

- These two indices are reported monthly and have seen improvements in their annual rates of return every month for the past year.

“The housing market may be in better shape than this time last year; but, when you look at recent trends there are signs of some renewed weakening in home prices,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “In the past several months we have seen some relatively weak reports across many of the markets we cover. Thirteen MSAs and the two Composites saw their prices drop in March over February. Boston was flat. The National Composite fell by 3.2% compared to the previous quarter and the two Composites are down for the sixth consecutive month.

“While year-over-year results for the National Composite, 18 of the 20 MSAs and the two Composites improved, the most recent monthly data are not as encouraging. It is especially disappointing that the improvement we saw in sales and starts in March did not find its way to home prices. Now that the tax incentive ended on April 30th, we don’t expect to see a boost in relative demand.”

FHFA Shows Lower Home Prices in First Quarter Also:

FHFA Shows Lower Home Prices in First Quarter Also:

The Federal Housing Finance Agency (FHFA) released their report on first quarter home prices today as well. The FHFA report data and methodology differs from NAR and Case-Shiller, in that the FHFA home price index is based only on the sale prices of homes that are financed with a conforming loan (by Fannie Mae and Freddie Mac’s standards).

The FHFA report for the first quarter of 2010 shows home prices fell 1.9 percent from the quarter before, so not terribly far off from the 3.2 percent decline the Case-Shiller report showed. In contrast to the Case-Shiller report however, the FHFA report showed March’s home prices rose 0.3 percent from February. Also, the FHFA report shows home prices for this quarter fell 3.1 percent from a year ago.

St. Louis Home Prices Doing Better:

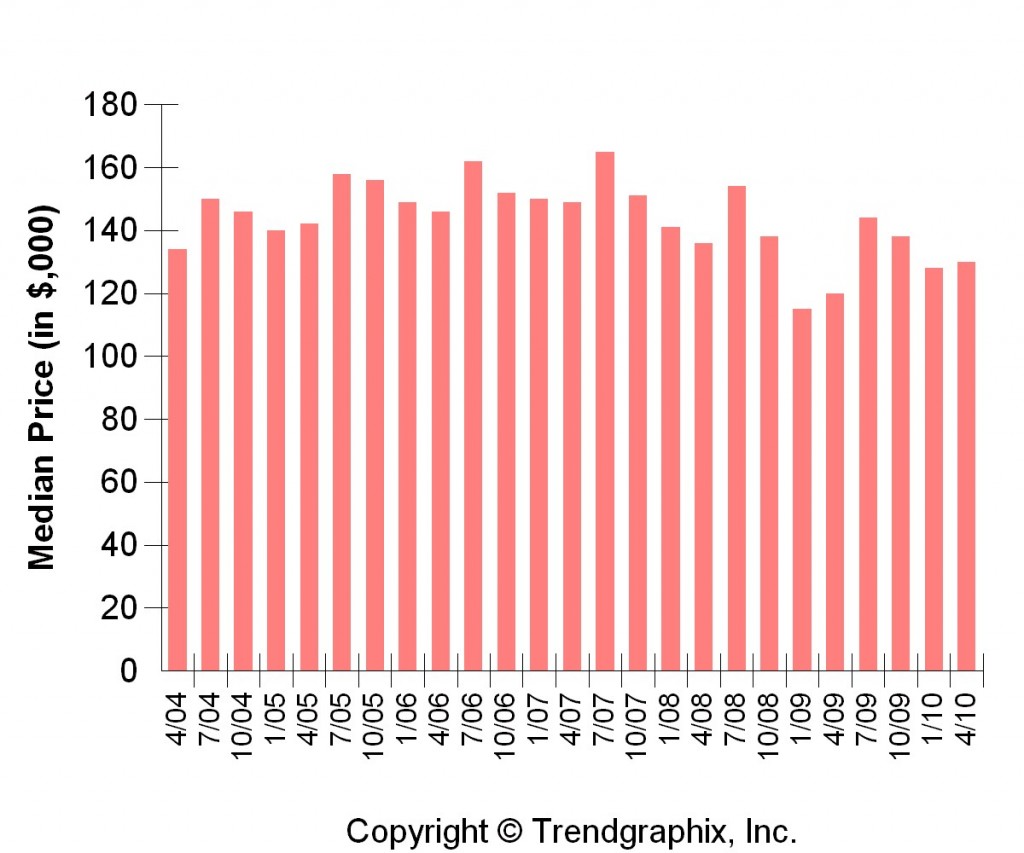

For the St. Louis metro and surrounding areas, the median home price for the quarter ended April 30, 2010 was $130,000 an increase of 1.6 percent from the prior quarter’s median price of $128,000 and an increase of 8.3 percent from a year ago when the median home price was $120,000. In case you are wondering, the median home price for the St. Louis area has dropped 3.0 percent in the past six years.

Median Home Prices in St. Louis Metro and Surrounding Areas for Past Six Years - Source: Mid America Regional Information Systems (MARIS)

Comparison of St. Louis Median Home Prices to Prior Periods - Source: Mid America Regional Information Systems (MARIS)

Where are home prices headed?

As we are frequently reminded, “all real estate is local”, so there will be markets that do better than others, but in general I think we are in store for soft home prices for a while. I think after the “sugar-rush” of the tax credit incentive wears off as the deals close over the next couple of months, and the next wave of foreclosures hit the market we will see prices regress again in many markets, enough so to bring overall home prices in the US down modestly in the coming months.

Leave a Reply

You must be logged in to post a comment.