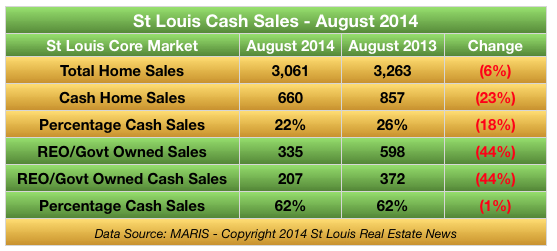

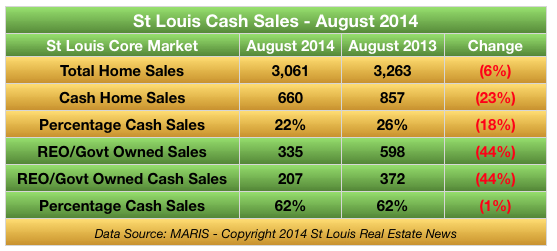

By Dennis Norman, on September 9th, 2014 The number of St Louis Foreclosures (bank and government owned) continues to decline resulting in just 335 St Louis Foreclosures being sold during the month of August 2014 in the St Louis Core market, a decline of 44% from August 2013 when there were 598 St Louis Foreclosures sold. What hasn’t changed though is the fact that nearly two-thirds (62%) of the foreclosures sold were cash sales for both periods. For the St Louis real estate market as a whole, cash sales made up for fewer of the home sales in August 2014 with just 22% of all homes being sold on a cash sale, down from 26% a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on August 21st, 2014 Property flipping, which is basically buying a property and then reselling it immediately, or shortly thereafter, is occurring less frequently now in St Louis than it was, according to a report released today by RealtyTrac. According to the report, there were 289 houses flipped in the St Louis metro area during the 2nd quarter, down 44% from the first quarter and down 17% from the 2nd quarter of 2013. During the 2nd quarter of this year, 3.3% of all St Louis home sales were “flip” deals which, for the purpose of this report, were homes that were bought, then resold within a 12 month period.

The average gross profit on the properties flipped during the 2nd quarter of 2014 was $20,122, down significantly from the same period a year ago when the average gross profit was $36,858. Before you get too excited, I should point out, this is just the gross margin, the difference between the initial price paid and the resale price and does not take into account any repairs, improvements or other expenses related to that property or the transaction.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip

By Dennis Norman, on August 19th, 2014 Today, the owners and operators of the Alger Meadows Apartments in Grand Rapids, Michigan, agreed to pay $550,000 in damages as well as terminate their property manager to settle a sexual harassment lawsuit that was filed against them by the U.S. Department of Justice.

With the increasing popularity of rental property as an investment, there are many new investors and landlords getting into the business and they need to realize the importance of being familiar with the laws and regulations that may affect them and their business in order to avoid problems. Even though, according to the press release issued by the DOJ, the property manager is the one that was alleged to have committed the sexual harassment, the DOJ also included the owners of the complex and alleged they were liable for the property managers actions. So, just because you, as a landlord, may use a property manager, that does not necessarily mean that you are in the clear or not liable for what goes on in your behalf. Therefore, the better informed you are as an investor and landlord, they better off you will be!

I have bought and sold 2,000 homes and have owned and managed apartments and rental homes and enjoy using this experience to help new, as well as seasoned, investors not only find good deals to invest in, but get educated on the things they need to know about such as Federal Fair Housing Laws. If I can help you, please contact me.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

By Dennis Norman, on August 14th, 2014 St Louis foreclosure activity was on the decline again in July with a total of 485 foreclosure actions taking place in the St Louis MSA during the month which equates to foreclosure activity on 1 of every 2,573 housing units, according to data released this morning by RealtyTrac. This represents a decline in St Louis foreclosure activity of 19.57% from the month before and a decline of 59.0% from July 2013. As the table below shows, with the exception of Franklin County, all of the major Missouri counties of the St Louis MSA saw a decline in foreclosure activity from both the month before as well as a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

(see a slideshow of all foreclosures for sale below)

Continue reading “St Louis Foreclosure Activity Down Fifty-Nine Percent In Past Year“

By Dennis Norman, on July 30th, 2014 The rental vacancy rate in the U.S. was at 7.5% for the 2nd quarter of 2014, down from 8.3% the quarter before and at the lowest level in 20 years, according to data just released by the U.S. Census Bureau. The U.S. rental vacancy rate has not been this low since the 4th quarter of 1994 when the rate was 7.4%.

Here in the Midwest region of the U.S., the rental vacancy rate was 7.5% during the 2nd quarter of 2014, the lowest rate in 16 years! The last time the Midwest Region of the U.S. saw rental vacancy rates as low as this was back in the 2nd quarter of 1998 when the vacancy rate fell to 7.3%.

Perhaps it’s time to expand your rental portfolio or, begin building your portfolio?

(We work hard on this and sure would appreciate a “Like”) Continue reading “Rental Vacancy Rate Falls To Lowest Level In 20 Years“

By Dennis Norman, on July 24th, 2014 Even though, for a while now, foreclosures have been on the decline in St Louis as well as in most parts of the country, there are still many St Louis neighborhoods that are being impacted significantly by foreclosure activity. While after the housing bubble burst in 2008 we foreclosures appeared in most every neighborhood in St Louis from areas with the lowest values to areas with the highest, there has been a concentration of foreclosure activity in a few areas of St Louis. The city of Florissant, for one, is an area that has had more than it’s fair share of foreclosure activity and has seen pretty severe impact on home values there as a result.

Which St Louis Neighborhoods Have The Highest Foreclosure Rates?

As I mentioned previously, Florissant has been pounded with foreclosures, however, as the table below shows, there are many areas throughout the St Louis area, including areas in St Louis City as well as the counties of St Louis, St Charles, Jefferson and Franklin, that are on the list of the 19 highest foreclosure rate areas of St Louis. Below the table is an interactive foreclosure map for Missouri where you can find foreclosure rates for any county in Missouri or, click on the county and find foreclosure rates for any area within that county.

See ALL Foreclosures for sale in St Louis

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Areas With Highest Foreclosure Rates In St Louis“

By Dennis Norman, on July 17th, 2014 St Louis Foreclosure activity dropped in June to a rate of 1 foreclosure action on every 2,070 units, a decline of nearly 50 percent (49.58%) from June 2013, and down 13.11% from the month before, according to a report just released this morning by RealtyTrac. The table below shows the numbers for the St Louis metro area as a whole as well as a breakdown by county and, as the table shows, all the counties in the St Louis, Missouri core market saw declines of nearly 50% or better in the past year and all, except the city of St Louis, saw double-digit declines from May 2014.

On the national level there is good news as well as foreclosure activity declined in June 2014 to the lowest level since July 2006, before the housing market meltdown.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Activity Drops Nearly 50 Percent In Past Year“

By Dennis Norman, on July 7th, 2014 St Louis’ Most Expensive Foreclosures currently for sale includes homes in St Louis, St Charles and Franklin counties and top out at $1,700,000 at the time of this article. While buying a foreclosure does generally involve more risk than buying a privately owned home that is being sold under “non-distress” conditions, the added risk is usually rewarded in a much better price and therefore a better deal. The main risks with buying a foreclosure have to do with the condition of the property both in that the property is normally being sold as is, there is not a sellers disclosure available from the former owner and, if the former owner had financial trouble it is safe to say that some maintenance and repairs needed may have been foregone.

St. Louis Most Expensive Foreclosures For Sale – $300,000+

See ALL Foreclosures for sale in St Louis

Get More Information on St Louis Foreclosures

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis’ Most Expensive Foreclosures – Slide Show“

By Dennis Norman, on July 3rd, 2014 I’ll begin with a disclaimer. I realize this is a VERY subjective topic and there are about a hundred different criteria one may use to determine the best area to invest in rental property however, having said that, I attempted to do a broad brush analysis from 30,000 feet. I decided to look at which area, in general, offers the best return on investment when it comes to rental property. For the sake of my analysis, I looked at single family homes as rental properties since they are the most common investment by individual investors.

To determine the best rate of return I looked at the median rent for the area as well as median vacancy rate of rentals and median home price. I then determined a rent/value ratio and the area with the highest ratio determines the area with the best potential return on investment. In computing the ratio I multiplied the median rent by 12 to get the annual rate, then reduced that amount by the vacancy rate and divided the result into the median property value.

As the table below shows, the city of St Louis came out on top with the highest rent to value ratio, 6.48% followed by St Louis County with a 5.45%.

Foreclosure Properties For Sale – Click HERE

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “The Best Place In St Louis To Buy Rental Property“

By Dennis Norman, on July 2nd, 2014 As I wrote about recently, lofts in St Louis are making a comeback and the loft market is heating up. Lofts come in a lot of shapes and sizes and, given the challenge presented to developers to create great residential spaces in old buildings original built to be warehouses or for other commercial uses, not all are created equal. Below are 3 of what I think are the coolest loftscurrently on the market. (click the image to see all photos and complete details).

(click the image to see all photos and complete details)

See ALL St Louis Lofts for sale

Piqued your interest? If you would like more information on any of these lofts or for a private viewing, click here.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on June 26th, 2014 Zombie Foreclosures, while fewer, are still quite prevalent in the St Louis area. So, what is a zombie foreclosure? Good question. It’s yet another term that has come out of the real estate bubble burst of 2008 and refers to homes that are in the foreclosure process and the owner has vacated the home prior to actually losing it as the foreclosure is not complete. These properties often become an eyesore and burden on the neighbors, and the city they are in, as they are sort of in “no man’s land” as the owner has left the property and typically does not continue to maintain it as they are losing it however, it is not yet foreclosed upon so the lender does not own it yet (and if it sells at the foreclosure to a third party won’t own it) therefore they normally do not maintain it. Therefore, until the foreclosure is actually final, the property often sits and deteriorates without attention.

Where in St Louis can you find Zombies?

As the table below shows, zombie foreclosures are concentrated, to a large extent, in the North St Louis County area with 5 of the top ten zombie locations being in North County. The 63136 zip, which encompasses all of Jennings as well as some areas around Jennings including part of north St Louis, is at the top of the list with 16 “zombies“, following by the 63031 zip area of Florissant with 13, and then the 63135 zip area, which is predominately Ferguson, with 11.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Get More Information on Foreclosures Continue reading “Zombie Foreclosures In St Louis“

By Dennis Norman, on June 24th, 2014 St Louis Foreclosures, and short sales, in May 2014 accounted for just 8.5% of all home sales in the St Louis core market (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin), according to data released just this morning from RealtyTrac. This is a decline of 26.7% from May 2013 when foreclosures and short sales in St Louis accounted for 11.6% of all home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures and Short Sales Fall By Over 25 Percent“

By Dennis Norman, on June 13th, 2014 The inventory of homes for sale in several St Louis neighborhoods is down to the lowest level we have seen in years. It would be great if that was the result of skyrocketing home sales however, it’s really a combination of home sales and a lack of sellers. While there are many different reasons people are not choosing to sell right now, I believe it is a lack of equity that is holding back many homeowners from selling, particularly in the lower price ranges. Last month I did an article about the fact that 40 percent of St Louis homeowners in the bottom 1/4 of the market were underwater, and, overall, 44% of St Louis homeowners had too little equity to sell their homes, hence the lack of inventory.

As the table below shows, the top 3 St Louis neighborhoods all have just a 1 month inventory of homes for sale, and the rest of the areas making up the top ten list just have 2 months. For homeowners in these areas that have thought about selling, and have the equity to do so, now would be the time to hit the market!

Find the value of your home online in under a minute!

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “St Louis Inventory of Homes For Sale Drying Up In Many Areas“

By Dennis Norman, on June 10th, 2014 New home construction is not keeping up with demand in most of the U.S. and could even lead to “persistent housing shortages and affordability issues unless housing starts increase to match up with local job creation”, according to a newly released analysis by the National Association of REALTORS® (NAR).

Lawrence Yun, NAR’s chief economist, discussed in the report the relationship between new jobs and increased demand for housing saying “Historically, there’s one new home construction for every one-and-a-half new jobs,”. Yun goes on to say “Our analysis found that a majority of states are constructing too few homes in relation to local job market conditions. This lack of construction has hamstrung supply and slowed home sales.”

Missouri is not one of the states the NAR report cites as having the biggest disparity between job creation and new homes, instead listing Florida, Utah, California, Montana and Indiana as the states where this issue is most prevalent, but I think we are going to see this, on a reduced scale, in St Louis as well.

See St Louis New Homes For Sale – Click HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “New Home Construction Needs to Increase to Match Job Growth According to REALTORS®“

By Dennis Norman, on May 29th, 2014 Distressed home sales in St Louis accounted for just under eleven percent (10.7%) of all home sales in the St Louis MSA in April 2014, according to data released just this morning from RealtyTrac. This is a decline of 29.1% from April 2013 when distressed home sales in St Louis were responsible for 15.1% of all home sales. Distressed home sales include short-sales (when sellers sell for less than they owe with the agreement of their lender), REO’s (bank-owned real estate acquired through foreclosure and now being resold) and foreclosure auction sales (when homes are actually sold at foreclosure).

Since a big chunk of the St Louis MSA lies across the Mississippi river in Illinois, I like to focus on the 5-county area that makes up the bulk of the St Louis real estate market on the Missouri side of the river. These counties include St Louis, St Charles, Jefferson, Franklin as well as the city of St Louis. As the table below shows, distressed home sales in April 2014 were down from a year ago in all of the counties. For the 5 county core as a whole, on median, 10.1% of all home sales in April 2014 were distressed home sales, down 41.4% from a year ago when distressed sales accounted for 14.7% of the goal home sales in the 5-county core St Louis market.

Distressed home sales put a lot of downward pressure on home prices in St Louis, so this continued trend of fewer distressed sales is very much a positive for the St Louis housing market and should help the St Louis market sustain home prices as well as support home price increases when supported by market demand.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Distressed Home Sales in St Louis Metro Area Fall Almost 30 Percent From A Year Ago“

By Dennis Norman, on May 20th, 2014 While the St Louis housing market is improving, unfortunately the homeowners that can afford it the least are the ones that are still the hardest hit with 41.5% of all homeowners with a mortgage on a home in the bottom price tier (the 25% lowest valued homes in St Louis) being underwater on their mortgage, meaning they owe more than their homes are worth. This is according to the newly released Zillow Negative Equity report which shows that, at the opposite end of the spectrum, in the top tier, only 11% of St Louis homeowners are underwater, or in a negative equity position, on their homes.

For the overall market, 22.9% of St Louis homeowners are underwater on their mortgage as of the first quarter of 2014 and 44% are in a “effective” negative equity position, meaning while they are not technically “underwater” they don’t have enough equity to pay the normal cost of selling their home and are therefore locked into their home unless they have cash to bring to the closing table. For the nation as a whole, 18.8% of homeowners with a mortgage were in a negative equity position during the 1st quarter of 2014 and 36.9% were in an “effective” negative equity position.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on May 16th, 2014 St. Louis Metro Foreclosure Activity declined in April with 1 of every 1,013 housing units in the St Louis metro area having a foreclosure action on it during the month, a decline of 16.56 percent from the month before and a decline of 20.36% from April 2014, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) had decreased foreclosure activity in April from the month before. Three of the five counties saw double digit decreases from a year about however, St Louis city and county both saw increases.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading "St. Louis Metro Foreclosure Activity Down 20 Percent From Year Ago"

By Dennis Norman, on May 1st, 2014 Last month I wrote an article about a residential rental property licensing ordinance that was proposed in St Louis County by Councilman Michael O’Mara which I felt was a bad piece of legislation and an egregious violation of the private property rights of property owners. I heard from many readers that felt the same way I did and in fact, many of you turned out at the County Council meeting earlier this week to voice your opposition to the bill. I’m happy to say that the ordinance, which was on the agenda to be perfected, was in fact not voted upon by the council and therefore did not become law, yet. Hopefully, the outcry of opposition from the public as well as from organizations such as the St Louis Association of REALTORS and the Metropolitan St. Louis Equal Housing Opportunity Council, has convinced the members of the council to no longer pursue passage of bill 73.

See below for public comments that were made at the council meeting in opposition to the ordinance, as recorded in the St Louis County Council journal for the meeting of April.

(We work hard on this and sure would appreciate a “Like”) Continue reading “Update on St Louis County Residential Rental Property Licensing Ordinance“

By Dennis Norman, on April 24th, 2014 St Louis distressed home sales declined during the first quarter of this year with distressed home sales (foreclosures, REO’s and short sales) in the 5-county core St Louis market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) accounting for 15.0% of all home sales, This is down 18.5% from the first quarter of 2013 when St Louis distressed home sales accounted for 18.4% of all home sales, according to newly released data from RealtyTrac. As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw short sales and REO’s decrease in the first quarter of 2014 from a year ago with the exception of REO sales in St Charles that increased 5% during the period. All counties saw an increase in foreclosure auction activity from the first quarter of 2013 to the first quarter of 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Distressed Home Sales Down From a Year Ago“

By Dennis Norman, on April 22nd, 2014 Mortgage delinquency and foreclosure rates both declined in March to the lowest levels since October 2007 and 2008, respectively, according to data just released by Black Knight Financial Services (formerly LPS). The U.S. mortgage delinquency rate (30+ days delinquent) in March 2014 was 5.52%, a 7.57% decline from the month before and a 16.29% decline from a year ago. The U.S. foreclosure pre-sale inventory rate in March 2014 was 2.13%, a decline of 4.23% from the month before and a drop of 36.69% from March 2013.

There are still several states with double-digit mortgage delinquencies, Mississippi being the one with the highest rate with 13.39% of all mortgages being 30+ days delinquent. Below is the list of the top 5 states for the highest mortgage delinquency rates as well as the top 5 states for the lowest rates.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Mortgage Delinquency and Foreclosure Rates Drop to Lowest Level In 6 Years“

By Dennis Norman, on April 17th, 2014 Almost 1 of every 4 St Louis homeowners with a mortgage (23%) are seriously underwater, meaning their mortgage(s) total at least 125% of their homes current value, according to a report for the 1st quarter of 2014 just released this morning by RealtyTrac. According to the report, there are 161, 310 St Louis homeowners that are underwater while 138,492 homeowners (19%) have “resurfacing equity” meaning their mortgage totals are 90% – 110% of their homes current value, allowing them to see the light at the end of the tunnel. Throughout the state of Missouri, 22% of homeowners with a mortgage are seriously underwater and 20% have resurfacing equity.

At the opposite end of the spectrum, 13% of St Louis homeowners with a mortgage are “equity rich” with more than 50% equity in their homes.

St Charles County Has Lowest Rate of Underwater Homeowners

Of the five counties that make up the bulk of the St Louis market on the Missouri side of the Mississippi, St Charles county has the lowest percentage of underwater homeowners at just 11%. The table below shows complete data for all 5 counties.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Nearly 1 in 4 St Louis Homeowners with a mortgage are underwater“

By Dennis Norman, on April 10th, 2014 St Louis foreclosures increased during the first quarter of this year in the main areas of our St. Louis metro area market located on the Missouri side of the Mississippi with St Louis city foreclosures, St Louis County foreclosures and St Charles county foreclosures all increasing from the 4th quarter of 2013, according to information real eased this morning by RealtyTrac.

St Louis foreclosures for the MSA were down during the first quarter of 2013 1.6% from the 4th quarter of 2013 with a foreclosure action occurring on 1 out of every 452 housing units in the St Louis metro area. Foreclosures in the St Louis metro area, including all 5 counties that make up the core of the market on the Missouri side of the river, St Louis City and County, St Charles County, Jefferson county and Franklin County, decreased double digits from a year ago. Complete details are in the table below.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In First Quarter 2014“

By Dennis Norman, on April 7th, 2014 A residential rental property licensing ordinance has been proposed in St Louis County by Councilman Michael O’Mara which would prohibit an owner of residential property in unincorporated St. Louis County from renting or leasing their property without first paying a fee and obtaining a residential rental license. The bill, which has been kept relatively quiet and is impossible to find on the website for the St Louis County Council other than listed on the agenda, will most likely be passed at the meeting of the St Louis County Council tomorrow evening.

While there are several municipalities in the St Louis area that currently require some sort of licensing or registration of rental property, and the issue of whether that is an infringement of property rights or not, is a topic I’m not going to address today. Instead, I will just focus on some of the things in this proposed legislation that I feel, in my humble opinion, are egregious violations of property owner’s private property rights. The bill, a draft of which can be read here, is bad in many ways, however below are the parts that violate private property rights the most. followed by my comments on each section: (We work hard on this and sure would appreciate a “Like”) Continue reading “St Louis County Residential Rental Property Licensing Ordinance Tramples Property Rights“

By Dennis Norman, on April 4th, 2014  Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000. Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.

Who is the typical real estate investor?

According to the NAR report, the typical home investor in 2013 was a median age of 42 years, had a median household income of $111,400 and more than half (59%) were in a two income household.

What type of property do investors buy?

(We work hard on this and sure would appreciate a “Like”) Continue reading “Investment Property Sales Fall in 2013“

By Dennis Norman, on March 13th, 2014 St Louis foreclosures were on the rise in February with 1 of every 1,328 housing units in the St Louis metro area having a foreclosure action on it during the month, 24.17 percent higher than the month before, however still down 33.14% from February 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw an increase in foreclosure activity in February from the month before with the exception of Jefferson county that had relatively little foreclosure activity but more than a year ago. All the counties saw a decrease in foreclosures from a year ago however.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Rise in February-Still Down From Last Year“

By Dennis Norman, on March 10th, 2014 Rising rents in St Louis now has the attention of Apartments.com which just released a report showing why $1,000 a month rent will get you throughout the U.S. and listed St Louis on the “Rents on the Rise” list. While this is good news for investors and landlords, who can expect better returns from their St Louis apartments and rental properties, tenants would prefer to find St Louis on the “Small Rents in Big Cities” or “Enormous Deals” list in the Apartments.com report. (See below for all cities on the lists)

See St Louis Homes Currently For Rent

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Rising Rents Puts St Louis On Apartment.coms’ Bad List“

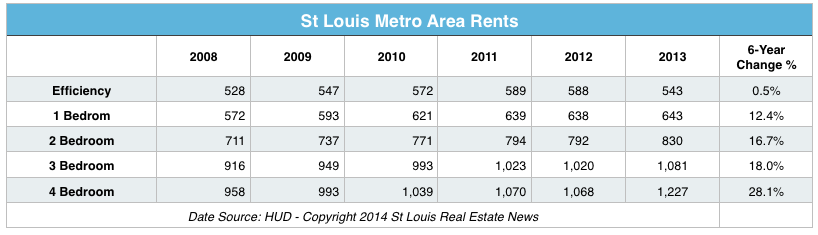

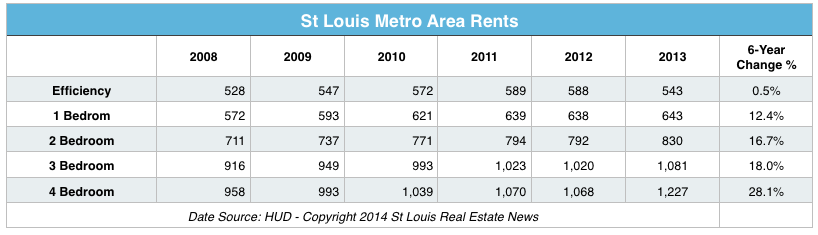

By Dennis Norman, on March 6th, 2014 St Louis rents have risen 18% since the real estate bubble burst (based upon HUD fair market rents for 3 bedrooms) while median home prices have fallen 12% during the same period. Part of the reason behind has been the increased demand for rentals as a result of many homeowners who, after the real estate bubble burst, lost their homes in foreclosure or were forced to do a short sale and then had to seek a rental while they rebuild their credit. This, couple with almost no new apartment construction for several years has created the right environment for increasing rents.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rents Rose While Home Prices Declined Post Boom“

By Dennis Norman, on March 1st, 2014 Not long ago distressed home sales (foreclosures, short sales, REO’s, etc) were a dominant force in the St Louis real estate market, accounting for a good portion of St Louis area home sales. Today, however, with a few exceptions, they have all but left the St Louis real estate market. As far as the St Louis housing market is concerned, this is a good thing, for home buyers and investors looking for what are often bargain prices as a result, they may have different thoughts.

As the table below for the five St Louis counties that make up the bulk of our market, short sales, REO’s (foreclosed homes being sold by banks) and foreclosure sales percentage of St Louis home sales was very slight in January 2014, and down significantly from a year ago. In fact, there were virtually no short sales or foreclosure auction sales in January and REO’s accounted for just over 5% of all St Louis home sales for the month. The only year-over-year increase seen in any of these sales was in REO sales in St Charles county that increased from 5.7% of home sales in January 2013 to 8% of home sales in January 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on February 13th, 2014 St Louis foreclosures increased in January to the point where 1 of every 1,649 housing units in the St Louis metro area had a foreclosure action on it during the month, an increase of 21.70 percent from the rate in December 2013, however a decline of almost 50% (47.06%) from January 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw declines in foreclosure activity from a year ago with the exception of Jefferson County which saw foreclosure activity spike in January, increasing 128% from the month before and over 13% from a year ago. Jefferson County also had the dubious distinction as having the highest rate of foreclosure activity during January 2014 of any county in Missouri.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In January But Down Almost 50 Percent From Year Ago“

By Dennis Norman, on February 3rd, 2014 The St Louis rental vacancy rate for the 4th quarter of 2013 was 10.1 percent, the lowest rate since the 3rd quarter of 2012 when the rate was 8.2 percent, according to the latest dates just released by the Census Bureau.

See the table below for quarterly vacancy rates from 2010 through 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rental Vacancy Rate Falls To Lowest Level In Over A Year“

|

Recent Articles

|

Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.

Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.