By Dennis Norman, on February 3rd, 2014 The St Louis rental vacancy rate for the 4th quarter of 2013 was 10.1 percent, the lowest rate since the 3rd quarter of 2012 when the rate was 8.2 percent, according to the latest dates just released by the Census Bureau.

See the table below for quarterly vacancy rates from 2010 through 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rental Vacancy Rate Falls To Lowest Level In Over A Year“

By Dennis Norman, on January 28th, 2014

The St Louis housing market bubble of 2006 was followed by the bursting of the bubble shortly thereafter and, even though many of us tried to convince ourselves it would not happen, reality set back in. The reality was, when it came to home prices, the “greater fool theory” would only work so long until the reality of the underlying fundamentals of what makes up the value of a home would rear it’s ugly head and bring everyone down from their real estate high.

So, now that several years have passed, and many market prognosticators (including yours truly) say the St Louis housing market is in a recovery, I thought I would take a look at which St Louis area county (of the 5 county core market I frequently talk about) is recovering the best from the housing market bubble burst. As the table below shows, St Louis County has recovered the best, with a median home sales price of $156,000 during the bubble year of 2006 and a median home price of $151,500 in 2013 for a decline of only 2.88%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on January 22nd, 2014

St Louis distressed home sales continue to fall, according to a report published by MORE, REALTORS based upon data released by RealtyTrac. This report supports other market data that indicates the St Louis real estate market is recovering from the devastation brought on it when the real estate market bubble burst back in 2008.

The market crash brought many institutional buyers into the market, buying up homes as prices fell, but the recovery of the St Louis real estate market has slowed this activity as well. Home sales fueled by institutional investors fell 23.6% in December 2013 from the year before, according to the report.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on January 16th, 2014 Foreclosures in the St Louis metro area during the 4th quarter of 2013 were down 13.79% from the prior quarter and down 40.64% from the 4th quarter of 2012, according to a report released today by RealtyTrac. As the table below shows, the foreclosure rate for 3 of the 5 core St Louis counties declined in the 4th quarter from the prior quarter and all declined from the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Foreclosures in St Louis Metro Area Down Over 40 Percent From Year Ago“

By Dennis Norman, on January 13th, 2014  St Louis foreclosures are on the decline, however there are still some “deals” out there for buyers on homes that were previously foreclosed upon. Presently, there are 714 bank-owned or government owned homes in the St Louis 5-county core area (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin) listed for sale in the St. Louis area MLS. St Louis foreclosures typically sell at a discount of 25% – 40% off retail, and sometimes even more, however you can bank on the fact that the better the price is the more work the home is going to need though. For the right buyer though, foreclosures can be a great opportunity to buy a home with instant equity! St Louis foreclosures are on the decline, however there are still some “deals” out there for buyers on homes that were previously foreclosed upon. Presently, there are 714 bank-owned or government owned homes in the St Louis 5-county core area (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin) listed for sale in the St. Louis area MLS. St Louis foreclosures typically sell at a discount of 25% – 40% off retail, and sometimes even more, however you can bank on the fact that the better the price is the more work the home is going to need though. For the right buyer though, foreclosures can be a great opportunity to buy a home with instant equity!

In the slideshow below, you can see the wide variety of homes, and prices, of bank and government owned homes for sale in the St Louis area.

For Advice on How to Buy St Louis Foreclosures From An Investor that has bought and sold over 2,000 St Louis homes click here.

Piqued your interest? If you would like more information on any of these homes or for a private viewing, click here.

Disclaimer: The information herein is believed to be accurate and timely, but no warranty whatsoever, whether expressed or implied, is given. Information from third parties is deemed reliable but not verified and should be independently verified. MORE, REALTORS does not display the entire IDX database of Mid America Regional Information Systems, Inc. (MARIS MLS) on this website.

By Dennis Norman, on December 20th, 2013 St Louis homes sales (the 5-county core market*) for the 12 month period ending November 30, 2013 increased 4 percent from the same period a year ago, in contrast to national home sales which are down 1.2 percent from a year ago. As the table below shows, St Louis distressed home sales (foreclosures, bank-owned and short sales) have declined by more than a third and are currently responsible for just 5 percent of the overall home sales.

St Louis home prices are increasing too with the median home price for the past year coming in at $149,600, an increase of 10.81 percent from a year ago when the median price was $135,000. St Louis home prices have increased more than the national rate of of 9.4 percent for the past year.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Home Sales Increase In Past Year; Buck National Trend“

By Dennis Norman, on December 12th, 2013 St. Louis foreclosures have declined roughly 50 percent from a year ago, according to the latest data from RealtyTrac. As the table below shows, the foreclosure rate for the 3 main counties of St Louis (city of St Louis, St Louis County and St Charles county) was down from the month before (or about the same for the city), however Franklin and Jefferson county saw an increase from the month before. All five counties have seen a significant drop in foreclosure rate from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Down About 50 Percent From A Year Ago“

By Dennis Norman, on December 6th, 2013  “Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal. “Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal.

If you are one of those buyers wanting to snag a deal, you may have missed the boat as the volume of short sales in St Louis has fallen dramatically. While, overall, this is good news as it indicates the health of the real estate market is improving and will help to stabilize prices, it does remove some of the opportunities for bargains to buyers willing to go through the short-sale process. As the chart below shows, the number of short sale listings in St Louis hitting the market peaked around January 2012, when around 230 new short sale listings came on the market, and then the trend has been downward ever since. The blue line on the chart shows the number of short sale listings sold which peaked in July 2012 around 90 sales for the month and has fallen to less than 25 a month for the past couple of months.

Search St Louis Short Sales HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Short-Sales Dwindling“

By Dennis Norman, on November 26th, 2013 St. Louis short sales accounted for just 1 percent of the overall home sales activity during October in the core market of St. Louis (the city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin), according to the latest data from RealtyTrac. As the table below shows, Jefferson County had the largest percentage of short sales in October at 7% and St Charles and Franklin both the lowest at 0%. REO sales (prior foreclosures that are now bank owned) on the other hand, made up 7 percent of St Louis area home sales in October, an increase of 33.3% from a year ago.

St Louis has historically not seen much in the way of institutional investors buying homes in the area, however this has changed of late and, in fact, made up 10% of the overall area home sales a year ago. In St Charles County, 25% of home sales in October 2012 were sales involving institutional investors but this has fallen to 13% last month, a decline of almost 50%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Short Sales Plummet While REO’s on the Rise“

By Dennis Norman, on November 20th, 2013 St Louis homes sales (the 5-county core market*) increased slightly in October 2013 to 2,211 sales from 2,207 sales the month before. However, as the table below shows, a couple of key things worth noting are that October home sales increased 6.76 percent from October 2012 and, in October 2013, distressed sales (foreclosures, short sales, REO’s) accounted for just a little over 20% of total home sales, down from almost 31% a year ago.

St Louis home prices, as the chart below shows, have steadily risen in the past year from a median price of $130,000 in October 2012 to $148,000 in October 2013. The median price for distressed sales was much lower at $52,914.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Home Sales Increase Slightly In October…Distressed Sales Share Drops By Third In Past Year“

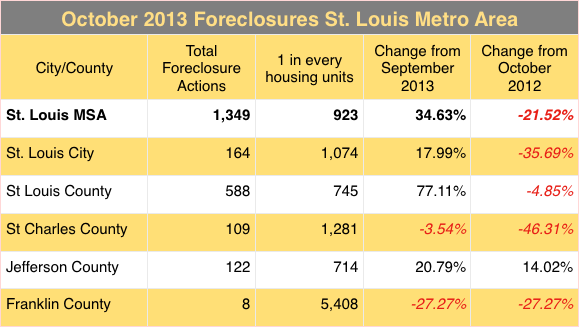

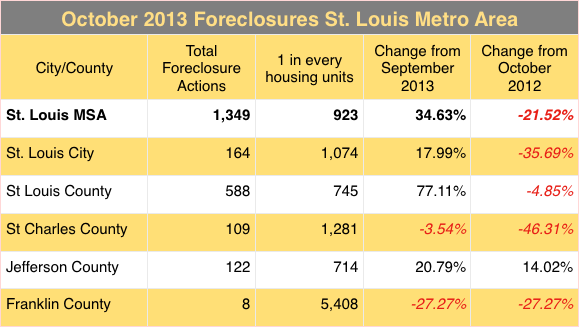

By Dennis Norman, on November 15th, 2013 St. Louis foreclosure activity shot up in October from the month before for the metro area as a whole with foreclosure actions occurring on 1 of every 923 housing units, according to the latest data from RealtyTrac. Even with the increase, October’s foreclosure activity rate for the St Louis metro area was down over 20% from a year ago. Foreclosure activity varied widely across the St Louis metro area with St Louis county seeing a 77% month over month increase and St. Charles and Franklin county both seeing declines in month over month as well as year over year rates.

Data Source: Realty/Trac – Copyright 2013 St Louis Real Estate News

By Dennis Norman, on November 8th, 2013 The St Louis rental vacancy rate dropped to the lowest level of 2013 in the 3rd quarter coming in at 13.1 percent for the St. Louis metro area, according to the latest data available from the U.S. Census Bureau. This year started off with a vacancy rate of 15.6 percent for the first quarter, the same rate 2012 started out with as well, however, in 2012 the vacancy rate fell to just 8.2 percent during the 3rd quarter. Due to holidays and weather, the 4th quarter usually sees a significant increase in vacancy rates from the 3rd quarter so we could easily see the highest vacancy rates next quarter we have seen in years if the trend continues.

See the table below for quarterly vacancy rates from 2011 through 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rental Vacancy Rate For 3rd Quarter Hits Lowest Level Of The Year“

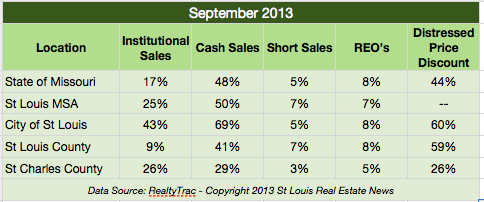

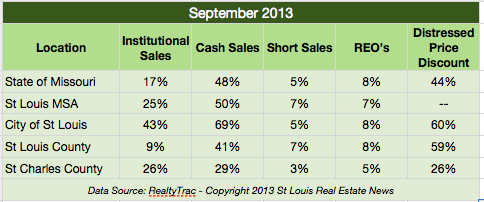

By Dennis Norman, on October 24th, 2013  Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales. Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales.

Cash sales are often associated with investors and, as the table shows, there is no lack of investor activity in the St. Louis metro area. In fact, institutional sales in September were over 50 percent higher in the St Louis metro area than for the state of Missouri as a whole.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?)

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 21st, 2013  The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent. The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Rate Declines“

By Dennis Norman, on October 10th, 2013

St Louis foreclosure activity during the 3rd quarter of this year was down 35.70 percent from a year ago, according to a report just released this morning from RealtyTrac. There was foreclosure activity of some kind (notice of trustee sale published, foreclosure auction or new REO property) on 3,256 properties in the St Louis metro area during 3rd quarter of this year. This works out to foreclosure activity on one of every 382 properties in the St Louis metro area. St Louis’ foreclosure activity rate ranks 98th of the large metro areas (200,000+ population) in the U.S. St Louis foreclosure activity during the 3rd quarter of this year was down 35.70 percent from a year ago, according to a report just released this morning from RealtyTrac. There was foreclosure activity of some kind (notice of trustee sale published, foreclosure auction or new REO property) on 3,256 properties in the St Louis metro area during 3rd quarter of this year. This works out to foreclosure activity on one of every 382 properties in the St Louis metro area. St Louis’ foreclosure activity rate ranks 98th of the large metro areas (200,000+ population) in the U.S.

Nationally, foreclosure activity during the 3rd quarter was down 27 percent from a year ago and the rate of activity his a seven-year low. (see chart below)

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Foreclosure Activity Down Almost 36 Percent From Year Ago“

By Dennis Norman, on October 3rd, 2013

Agency relationships between a buyer or seller of a home and the real estate agent are probably one of the most confusing aspects of the real estate transaction for consumers and for many real estate agents as well for that matter. Dual agency takes the confusion to a whole new level though for the parties involved as the issue gets quite complex. At the very basic level, dual agency exists when the same real estate agent represents both the buyer and seller in the same real estate transaction (a bad idea in my humble opinion). At a more complicated level, state law states that dual agency also exists if the agent representing the buyer is with the same firm as the agent representing the seller then dual agency exists as well.

The point of this article is not actually to explain all the nuances of agency relationships, it’s really about a “dual” going on presently between the National Association of REALTORS (NAR) and the The National Association of Exclusive Continue reading “The Dual Agency Dual“

By Dennis Norman, on September 13th, 2013

There were 1,198 St Louis foreclosure filings in August 2013, down 1.27 percent from 1,213 in July and down over 40 percent (40.58%) from August 2012 when there were 2,016 foreclosure filings, according to RealtyTrac.

Of the 20 largest metro areas in the U.S. covered by the report (see below), St. Louis had the 7th lowest foreclosure rate for August with 1 foreclosure filing for every 1,039 housing units. Boston had the lowest rate with 1 foreclosure for every 2,669 housing units and Miami the highest with 1 foreclosure for every 324 housing units.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Foreclosure Filings In August Down 40 Percent From Year Ago“

By Dennis Norman, on September 6th, 2013

Nearly one of every 4 St Louis homeowners with a mortgage are seriously underwater, meaning their mortgage exceeds the current value of their home by 25 percent or more, according to a report just released by RealtyTrac. As the table below shows, the city of St. Louis has the highest percentage of seriously underwater homeowners at 31 percent and Franklin county the lowest at 14 percent. In addition, there are another 104,000 St Louis homeowners in a “near-equity” or “resurfacing equity” position, meaning their loan equals 90 to 110 percent of the current value of their home. As long as home prices continue to rise, these homeowners will hopefully come out of their negative equity position soon.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Over 123,000 St Louis Homeowners Are Seriously Underwater“

By Dennis Norman, on August 15th, 2013

The number of St Louis homeowners with a foreclosure filing in July was 1,183 homeowners, a decline of 1.09 percent from June and a whopping decline of 36.4 percent from a year ago when 1,860 properties had a foreclosure filing, according to a report just released this morning by RealtyTrac. This works out to one in every 1,052 St Louis properties receiving a foreclosure filing, slightly lower than the national rate of one in every 1,001 properties and well below the 1 in every 250 rate in Miami, the metro area with the highest foreclosure rate in the U.S. in July.

Search St Louis Foreclosures For Sale

By Dennis Norman, on July 25th, 2013

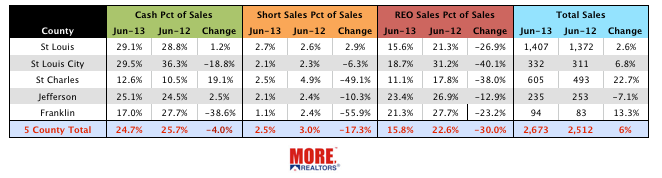

St Louis distressed home sales have fallen substantially in the past year with distressed home sales in June making up less than 1 in 5 home sales (18.3 percent) for the 5 county core area of the St Louis MO market (St Louis City and County, St Charles, Jefferson and Franklin Counties), according to the latest data from MORE, REALTORS. REO sales (bank and government-owned properties) accounted for just 15.8 percent of St Louis home sales in June (5 county core), down from 22.6 percent in June 2012. Short sales (where sellers sell for less than they owe) accounted for just 2.5 percent of home sales in June 2013, down from 3 percent in June 2012.

Cash home buyers (both investors and owner occupants) remain a strong force in the market with almost 1 in 4 (24.7 percent) home purchases in June 2013 being a cash purchase, down just slightly from 25.7 percent a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on July 23rd, 2013

The St Louis foreclosure rate fell in May to 1.16 percent, down 33 percent from a year ago when the St Louis foreclosure rate was 1.75 percent, according to newly released data from Corelogic. More good news in the data is the fact that the St Louis mortgage delinquency rate declined in May as well, falling to 3.88 percent of all mortgage loans, down 17 percent from a year ago when the St Louis mortgage delinquency rate was 4.7 percent.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?) [iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “St Louis Foreclosure Rate Declined By One-Third In Past Year“

By Dennis Norman, on July 10th, 2013  Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes. Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes.

Mortgage delinquencies are improving as well with less than 2.3 million mortgages (5.6 percent of total mortgages) being seriously delinquent as of the end of May. This is the lowest level for mortgage delinquencies since December 2008. Continue reading “Foreclosures and Shadow Inventory Decline By Double Digits“

By Dennis Norman, on June 25th, 2013

St Louis Foreclosures fell in April to 1.2 percent of all St Louis homes with a mortgage, a decline of 33 percent from a year ago when the rate was 1.78 percent and is now at the lowest rate in well over 3 years, according to a report just released by CoreLogic. This puts St Louis foreclosures less than half the national rate for April of 2.65 percent.

In addition, the report reveals that St Louis mortgage delinquencies are also down significantly for April 2013 which 3.96 percent of St Louis mortgage being 90 days or more delinquent, a decline of 16 percent from a year ago when the St Louis mortgage delinquency rate was 4.74 percent.

By Dennis Norman, on June 13th, 2013  If you want to buy a St Louis foreclosure, you will have to be prepared to move quick, and pay up to be successful! Over the past 60 days, there were 929 new foreclosure listings (bank and government owned homes) in the St Louis core market area (St Louis City & County, St Charles, Jefferson and Franklin Counties). These new St Louis foreclosures for sale have an average listing price of $84,467 and almost 50 percent of them are already sold (48%), selling in a median time of 11 days and for an average of 106 percent of the list price. Clearly, if you want to buy a foreclosure in St Louis you need to be prepared to act quickly! If you want to buy a St Louis foreclosure, you will have to be prepared to move quick, and pay up to be successful! Over the past 60 days, there were 929 new foreclosure listings (bank and government owned homes) in the St Louis core market area (St Louis City & County, St Charles, Jefferson and Franklin Counties). These new St Louis foreclosures for sale have an average listing price of $84,467 and almost 50 percent of them are already sold (48%), selling in a median time of 11 days and for an average of 106 percent of the list price. Clearly, if you want to buy a foreclosure in St Louis you need to be prepared to act quickly!

If you Would Like To Buy a St Louis Forelcosure-Click HERE To See All That Are For Sale

For Advice on How to Buy St Louis Foreclosures From An Investor that has bought and sold over 2,000 St Louis homes click here.

By Dennis Norman, on June 12th, 2013  There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage. There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage.

For the State of Missouri as a whole, there were 120,056 homeowners, or 15.3 percent of all homeowners with a mortgage, with negative equity during the first quarter of this year. On a national level, there were 9.7 million, or 19.8 percent of all homeowners with a mortgage, with negative equity, or underwater, during the quarter.

If you are an underwater homeowner and want to know what your options are, please contact me by clicking here.

Many underwater homeowners turn to a short sale to get out from under their mortgage-to see all St Louis short sales currently listed click here.

Continue reading “St Louis Homeowners With Negative Equity Falls 10 Percent“

By Dennis Norman, on May 30th, 2013  St Louis foreclosures rose during the 1st quarter of this year to 2,505 foreclosure sales in the St Louis metro area during the quarter, an increase of 18.83 percent from the year before, according to a newly released report from RealtyTrac. The average sales price of St Louis foreclosures during the quarter was $89,229 and, on average, St Louis foreclosures sold at a 37.95 percent discount from non-distressed sales. St Louis foreclosures rose during the 1st quarter of this year to 2,505 foreclosure sales in the St Louis metro area during the quarter, an increase of 18.83 percent from the year before, according to a newly released report from RealtyTrac. The average sales price of St Louis foreclosures during the quarter was $89,229 and, on average, St Louis foreclosures sold at a 37.95 percent discount from non-distressed sales.

Continue reading “St Louis Foreclosures Up Almost 19 Percent From Year Ago“ Continue reading “St Louis Foreclosures Up Almost 19 Percent From Year Ago“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Since the real estate market crash, millions of homeowners have lost their homes in a foreclosure, been forced to do a short sale to get out from a home they were underwater on or file bankruptcy as a result of financial hardship as a result of the the market crash and general economic downturn. Many of these homeowners have resorted to renting or living with relatives but, as time passes and the financial wounds heal, are now wanting to buy a home again prompting the question, “how long do I have to wait after a foreclosure, short-sale, deed-in-lieu or bankruptcy before I can get a home loan again?”.

Fortunately, it is possible for former homeowners who have faced financial hardships to obtain a home loan again, but it does take time and effort on their part. Before obtaining a home loan after a foreclosure, short-sale or bankruptcy, the borrower will have to reestablish credit and establish a stable income that will support the home loan they wish to obtain. In addition, time will have to pass as (see the chart below), no matter how well the borrowers situation has improved, there are still some minimum timeframes that will have had to pass in order to be eligible for most types of home loans. There is no “one size fits all” answer though, so I highly suggest if you are in this situation and want to know what your options are, to use the form below to contact me, I’ll be happy to help. Continue reading “How Long Do You Have To Wait To Get A Home Loan After Foreclosure, Short Sale or Bankruptcy?“

By Dennis Norman, on May 9th, 2013  As of April 2013, there were 182,678 homeowners in Missouri (26.68 percent) that were underwater on their mortgage meaning that their loan balances exceeds 125 percent of the current value of their home, according to a report just released by RealtyTrac. As a comparison, Illinois’ underwater homeowner rate is 34.79, Florida 41.24, Nevada 52.07 and California 25.07 As of April 2013, there were 182,678 homeowners in Missouri (26.68 percent) that were underwater on their mortgage meaning that their loan balances exceeds 125 percent of the current value of their home, according to a report just released by RealtyTrac. As a comparison, Illinois’ underwater homeowner rate is 34.79, Florida 41.24, Nevada 52.07 and California 25.07

In a little more upbeat news, the RealtyTrac report also revealed that foreclosure filings (default notices, scheduled foreclosure auctions and bank repossessions) in April affected 144,790 properties in the U.S. which is a decline of 5 percent from the month before and a decline of 23 percent from a year ago and the lowest level of foreclosure activity in over 6 years (74 months).

By Dennis Norman, on April 30th, 2013  Foreclosures were completed on 55,000 properties in the U.S. in March 2013, an increase of 6 percent from the month before but a decline of 16 percent from March 2012. Foreclosure activity has decreased over 50 percent (52) from when the number of foreclosures peaked back in 2010. Foreclosures were completed on 55,000 properties in the U.S. in March 2013, an increase of 6 percent from the month before but a decline of 16 percent from March 2012. Foreclosure activity has decreased over 50 percent (52) from when the number of foreclosures peaked back in 2010.

Looking to buy a foreclosure? Click here for current list of St Louis foreclosures for sale

Highlights of the Corelogic Foreclosure Report for March 2013:

Continue reading “Completed Foreclosures In U.S. Down 16 Percent From A Year Ago“

By News Desk, on April 30th, 2013 The FDIC filed suit yesterday against 10 directors and officers of Champion Bank alleging “negligence, gross negligence, and breach of fiduciary duty in the underwriting, recommendation, and approval of seven high-risk out-of-territory commercial real estate (“CRE”) loan participations and two business lines of credit (collectively, the “Loss Transactions”), resulting in damages of at least $15.56 million,” according to court documents filed.

4:13-cv-00816 Federal Deposit Insurance Corporation as Receiver for Champion Bank et al v. DiMaria et al –

Defendants: Continue reading “FDIC Sues Champion Bank Directors“

|

Recent Articles

|

St Louis

St Louis

If you want to buy a St Louis foreclosure, you will have to be prepared to move quick, and pay up to be successful!

If you want to buy a St Louis foreclosure, you will have to be prepared to move quick, and pay up to be successful!