The Fannie Mae Fourth Quarter National Housing Survey polled homeowners and renters alike to assess their confidence in homeownership as an investment as well as their views on housing finance and the overall economy. The survey revealed that Americans are more confident about the stability of home prices than they were at the beginning of 2010, although they aren’t so confident about the strength of the overall US economy. Continue reading “Survey shows Americans gaining confidence in stability of home prices“

The Fannie Mae Fourth Quarter National Housing Survey polled homeowners and renters alike to assess their confidence in homeownership as an investment as well as their views on housing finance and the overall economy. The survey revealed that Americans are more confident about the stability of home prices than they were at the beginning of 2010, although they aren’t so confident about the strength of the overall US economy. Continue reading “Survey shows Americans gaining confidence in stability of home prices“

|

|||

|

When it comes to the meltdown in the housing market that has taken place over the past three years there has been no lack of finger pointing by many inside and outside the industry as to factors that either caused or contributed to the collapse of the housing market. Sub-prime lending, Wall Street, mortgage fraud, the mortgage industry, banks, community reinvestment act, real estate brokers and agents, fannie mae, freddie mac, federal government over-regulation, federal government under-regulation, appraisers, unemployment, the economy in general, “flipping”, sellers, buyers and more have been blamed in one way or another for the collapse. In my humble opinion and, based upon my 30+ years of experience in the industry, I would say all the aforementioned played a part in the collapse and certainly no one thing could have caused this mess on its own, it was a combination of several things that led up to the “perfect storm”. Continue reading “Making Appraisers the Scapegoat“ Great Desire to Own a Home by Growing Ethnic and Immigrant Populations Could Drive Future of the Housing Market

According to an economic outlook report just issued by Fannie Mae, our country’s economy should “kick into higher gear” by the second quarter of 2011. This positive outlook is the result of improvements in consumer spending, consumer confidence, increased demand for goods and services and falling unemployment claims. For 2011, Fannie Mae, in their December 2010 forecast, is forecasting growth of 3.4 percent which is an improvement from the 2.9 percent growth in 2011 they previously forecast. The big caveat is that this assumes “improving labor market conditions.” What this means for the real estate market, more specifically the housing market, is “despite rising mortgage rates, our (Fannie Mae) forecast for home sales is stronger than the previous forecast, given our brighter economic growth and labor market outlook,” said Fannie Mae Chief Economist Doug Duncan. Mr. Duncan goes on to say that his expectation of increased home sales is due in part to “modest additional declines in home prices” making homes even more affordable and tempting buyers as their”employment and income outlook brightens.” After the rather sad housing market in 2010 saying 2011 will improve probably isn’t saying a whole lot (sort of like celebrating on January 2nd that you have been able to stick to your new years resolution all year thus far) but hey, it’s a start and at least things are being forecast to go the right direction! Baby steps……

The National Association of REALTORS Pending Home Sales Index for October shows an increase of 10.4 percent in the index from the month before (seasonally adjusted), and a 20.5 percent decrease from a year ago. Continue reading “Pending home sales increase over 10 percent in October; Mortgage Interest Deduction vital to Recovery“ According the to the National Association of REALTORS® (NAR), the largest obstacles to the recovery of the housing market are job creation and the availability of credit. At their board meeting last week, NAR approved a credit polity to urge the mortgage lending industry to “reassess and amend their policies so more qualified home buyers can become home owners.” Continue reading “REALTORS’ Say Jobs and Access to Credit Needed for Housing Recovery“ The National Association of Realtors® announced that it “strongly supports” the proposed guidance from the Federal Housing Finance Agency to prevent government-sponsored enterprises Fannie Mae, Freddie Mac and the 12 Federal Home Loan Banks from investing in mortgages encumbered by private transfer fee covenants. In a letter sent to the Federal Housing Finance Agency (FHFA), NAR reiterated its opposition to these covenants, which developers often attach to a property to require payment of fees back to that developer each time the property is resold. These covenanted mandates are often extremely difficult to reverse once in place, and in many cases are attached to a deed for up to 99 years. Continue reading “REALTORS® Support Proposal to End Private Transfer Fees“  Dennis Norman Now that the controversial (to put it mildly) Home Valuation Code of Conduct (HVCC) has been put to rest as part of The Dodd-Frank Wall Street Reform, Fannie Mae has released their “Appraiser Independence Requirements“. Fannie Mae says the purpose of these requirements is to:

Dennis Norman In a letter to the Federal Housing Finance Agency, John A. Courson, the President and Chief Executive Officer of the Mortgage Bankers Association (MBA) said that the MBA “opposes the practice of private third parties, such as developers, builders, licensing companies and real estate brokers, imposing private transfer fee covenants on residential real estate for the purpose of extracting future income.” However, in his letter Mr. Courson goes on to say that the “MBA is concerned thatencumbering housing transactions with these types of PTFs will impede the marketability and affect the valuation of properties and thus the value of the loans and securities backed by such loans.” In addition, the MBA points out that “distinctions among PTFs (private transfer fees) are necessary” as they do not oppose private transfer fee covenants that are: Continue reading “Mortgage Bankers urge Feds not to ban all private transfer fees“ Surviving Spouses and Wounded Warriors Eligible for Special Forbearance At an event yesterday at the Pentagon, Fannie Mae and the U.S. Army announced new initiatives to help service members who are struggling with their mortgage payments avoid foreclosure. The effort includes a mortgage payment forbearance of up to six months where the death or injury of a service member on active duty causes a hardship for impacted military families with a mortgage obligation. Continue reading “Fannie Mae announces support for Military Homeowners“  Dennis Norman Fannie Mae is offering 3.5 percent in closing cost assistance and a $1,500 bonus to buyers’ real estate agent or broker for people purchasing a Fannie Mae-owned HomePath® property. Fannie Mae is trying to entice buyers to buy one of their Continue reading “New Incentives for Buyers of Fannie Mae Foreclosures; Over 700 Homes Available in St. Louis“  Dennis Norman Fannie Mae announced this week that it is expanding the Freddie Mac First Look Initiative so any home shopper can buy a HomeSteps® home as their primary residence during the first 15 days of the property’s listing without competition from investors. HomeSteps is the real estate sales unit of Freddie Mac and markets a nationwide selection of Freddie Mac-owned homes. Continue reading “Owner-occupants get first shot to buy Fannie Mae foreclosures; Investors must wait“  Dennis Norman Fannie Mae conducted a National Housing Survey poll between June 2010 and July 2010 to asses homeowners and renters’ confidence in home-ownership as an investment, the current state of their household finances and overall confidence in the economy. The finding from this survey were compared with a similar survey conducted by Fannie Mae from December 2009 to January 2010 as well as one conducted back in 2003. Continue reading “National Housing Survey shows 70 percent think it is a good time to buy a house“  Dennis Norman Today the Federal Housing Finance Agency announce proposed guidance that would prohibit Fannie Mae, Freddie Mac and the Federal Home Loan Banks from investing in mortgages with private transfer fee covenants. Considering that covers the lenders that originate, invest in or, or insure over 90 percent of the homes in the U.S. that pretty much puts the kibosh on financing a home with such a transfer fee. Continue reading “Private Transfer Fee Covenants Draw Fire From FHFA“  Dennis Norman Fannie Mae, after losing $59.8 Billion in 2008 and then $74.4 Billion in 2009, reported yesterday that things are looking up and they lost only $1.2 Billion in the 2nd quarter of this year. This “good” news comes on the heels of documents being released two weeks ago showing that Countrywide made, what appears to be, some “below-market” mortgages to employees of Fannie Mae under a VIP loan program. There have been allegations that perhaps this was done in exchange for favors. Continue reading “Countrywide VIP Loans To Fannie Mae Execs Are Under Investigation“ Fannie Mae Rolls out New Loan Quality Initiative (LQI) Program – Tightens underwriting requirements and aims to reduce borrower fraud. These rules could derail some closings for buyers who rack up purchases or even take out new store credit cards before their home sales have closed. Continue reading “Fannie Mae Tightens Rules; St. Louis Mortgage Watch“ Last month I said that I expected to see some elevated numbers in the existing home sales report for May and June since this report would reflect the actual closing of the home purchases from buyers that raced to buy before the April 30th home-buyer tax credit deadline. Even though Congress has extended the deadline to close on these purchases until August 31st, the majority of the tax-credit induced sales will have closed by June 30th and therefore be reflected in today’s report which I would say has happened. Today’s existing home sales report from theNational Association of REALTORS(R) shows existing home sales in June were at at a seasonally adjusted-annual rate of 5.37 million units which is a decline of 5.1 percent from May but is 9.8 percent higher than a year ago.. Prices on the rise for fourth consecutive month – The median home price in the U.S. in June was $183,700 an increase of 5.2 percent from May and an increase of 1.0 percent from a year ago when the median price was $181,800. Inventory levels increase- Inventories decreased in May after being on the rise three consecutive months but were back on the rise again in June as the number of existing homes for sale in June finally increased to 3,992,000, an increase of 2.5 percent from May and an increase of 4.7 percent from a year ago. The number of months “supply” this inventory represented in June, based upon current sales levels, increased to 8.9 months making it the highest level since August 2009. Metro Home Sales and Prices – NAR publishes existing home sales for 20 major metropolitan areas of the U.S. Highlights from that report include:

Lawrence Yun, NAR chief economist,said the market shows uncharacteristic yet understandable swings as buyers responded to the tax credits. “June home sales still reflect a tax credit impact with some sales not closed due to delays, which will show up in the next two months,” he said. “Broadly speaking, sales closed after the home buyer tax credit will be significantly lower compared to the credit-induced spring surge. Only when jobs are created at a sufficient pace will home sales return to sustainable healthy levels.” (hey, I’ve been saying this for months :) I don’t like “seasonally adjusted rates of sales”: If you have been reading my posts for a while you know by now I don’t like “seasonally adjusted” numbers when artificial stimuli, such as homebuyer tax-credits, can cause an unseasonal spike in sales activity. I much prefer to see the actual numbers and try to garner from them what is going on in the housing market. The following are the ACTUAL Existing Home sales reported by NAR without any adjustment or fluff:

Other highlights of the NAR Report:

My Take On the Numbers: We have clearly seen a boost to the housing market as a result of the home-buyer tax credit and continue to get a little support as the deals close. Unfortunately the economy still has major issues….Fannie Mae’s housing forecast in June took a sharp turn downward (which I will be writing about in the next day), unemployment increased today and there is still much political unrest in the country. I think the best we can hope for at this point is for some stabilization in the housing market which we are seeing some glimpses of. It will be quite a while before I will be using the “R” word though (recovery).  Dennis Norman Last month I wrote about a new policy implemented by Fannie Mae that would “lock-out” borrowers from getting a Fannie-Mae insured loan for 7 years if they did a “strategic default” or otherwise did not act in good faith and were foreclosed upon. In a nut shell, the borrower that Fannie Mae is targeting here is the borrower that has the financial ability to make their payments, accept a loan modification or other “work-out” from Fannie Mae but instead chooses just to walk away from their home and letting the lender foreclose. In addition to locking out borrowers from a new loan for 7 years Fannie Mae has also made it clear in a recent announcement that they will “take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans“. Obviously, they can only do this in those States that allow a lender to sue a borrower for a deficiency but if you live in one of those states are are thinking of doing a strategic default on a Fannie Mae insured loan, you may want to think twice. Or at least be sure you get appropriate legal advice first and explore other options that are available to you. Fannie Mae said that this month (July) they will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

According to a report issued by Radar Logic Incorporated government-sponsored enterprises (GSEs) and Federal agencies involved in housing finance currently have an inventory of over 200,000 repossessed homes. Being the largest owner of foreclosed homes in the U.S. gives the government a lot of power and influence over the housing market for years to come as they will generate significant pressure on home prices as they sell off foreclosed homes in the coming years. Foreclosed homes currently sell at significant discounts to the unpaid balances of the mortgages they back, generating a loss for the seller (i.e., the lender, mortgage investor or government agency) at every sale. As Fannie Mae, Freddie Mac, the Department of Housing and Urban Development (HUD) and the Department of Veterans Affairs (VA) sell their REO (“real estate owned”) inventories for less than the book value on their loans, they generate billions in losses for taxpayers. When the huge numbers of government-insured mortgages in the intermediate stages of default or foreclosure are taken into account, losses from future government REO sales could reach hundreds of billions of dollars. “For over a year now we have been saying that the GSEs and other Federal agencies will play a critical role in the success or failure of the housing recovery due to their huge holdings of foreclosed homes,” said Michael Feder, President and CEO of Radar Logic. “Now their role is more critical than ever before. The potential cost to taxpayers resulting from the government’s current policies is enormous. We can’t help but wonder if there isn’t a better approach.” Highlights from the report:

Recent reports have shown that mortgage delinquencies may be leveling off, albeit at almost record levels, but this is the first step to the foreclosure rate declining which will help the housing market stabilize. Unfortunately with the number of current foreclosures as well as the gloomy projections for future foreclosures, it will be a while before this happens. So, you have the money to pay on your ‘underwater’ mortgage, or to afford the reduced payment amount offered to you under the HAMP program, but think, rather than throw good money after bad you’ll just do like so many borrowers are doing and ‘walk-away‘? Well, if you have any plans to buy a house again in, say the next seven years, particularly with a Fannie Mae loan, think again. Today Fannie Mae announced policy changes to “encourage borrowers to work with their servicers”. These policy changes include, a seven-year “lock-out” period for borrowers that default that had the capacity to pay, or did not complete a workout alternative offered to them in good faith. Those borrowers will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure. Borrowers that in fact do have extenuating circumstances may be eligible for a new home loan in a shorter period. “We’re taking these steps to highlight the importance of working with your servicer,” said Terence Edwards, executive vice president for credit portfolio management. “Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time.” Thinking about a “Strategic Default”? There has been a lot of talk lately about borrower’s that “strategically default”; for example, borrowers that have the ability to pay their mortgage payments but stop doing so in the hopes they can get out from under their home in an easier method than selling it in a down market, particularly if they are underwater on their mortgage. Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstances. These policy changes were announced in April, in Fannie Mae’s Selling Guide Announcement SEL-2010-05.

The inventory of Fannie and Freddie continue to increase, but their inventory is only a portion of the total foreclosures. The worst loans were made outside of Fannie and Freddie by banks, thrifts or other private label institutions. Most foreclosures are heavily concentrated in a few key states: Florida, Arizona, Nevada, California and Michigan. With unemployment hovering near 10%, the economic recovery so far is too fragile to expect mortgage rates to rise in the near future. St. Louis Mortgage Interest Rates – June 23, 2010 *

For more information or if you have questions on mortgage rates in St. Louis you may contact me by phone at my direct line, (314) 372-4319, email at rfishel@paramountmortgage.com or you can visit our company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower. This information is provided by this author and this site for informative purposes only and is not warranted or guarteed in any way.

Dennis Norman UPDATE June 21, 2010- I said I would update this post after the proposed rules were published on the Federal Register with info on how to submit a comment -If you would like to comment, see the comment instructions in the Federal Register (I highlighted them) by clicking here -end of update. June 4, 2010Are they really going to repeat the same mistakes that helped cause this housing recession?I say this because of a release I received from the Federal Housing Finance Agency (FHFA) last week announcing that the FHFA “has sent to the Federal Register a proposed rule implementing provisions of the Housing and Economic Recovery Act of 2008 (HERA) that establish a duty for Fannie Mae and Freddie Mac (the Enterprises) to serve very low-, low- and moderate-income families in three specified underserved markets — manufactured housing, affordable housing preservation, and rural markets.” While the statement is a little ambiguous on the surface it sounds like a nice thought, “serve the underserved.” However, as I read on I couldn’t believe my eyes as I read other aspects of the proposed rule. The “Enterprises” (Fannie and Freddie) would be required to take actions to “improve the distribution of investment capital available for mortgage financing for underserved markets” and are expected to continue their support for affordable housing (again, something that sounds great, just depends how you plan to go about supporting “affordable housing”). The rule would establish a method to evaluate the Enterprises performance in these underserved markets for 2010 and subsequent years. Of the four criteria the enterprises are to be evaluated under, one really got my attention; “the development of loan products, more flexible underwriting guidelines, and other innovative approaches to providing financing“. WHAT?? More FLEXIBLE underwriting, INNOVATIVE approaches to provide financing? Isn’t this the stuff that got Fannie Mae and Freddie Mac (not to mention thousands of homeowners) in trouble to start with? Now, I don’t claim to be an economist or even that smart for that matter, but this sure appears to me to be the Federal Government putting pressure on Fannie Mae and Freddie Mac to make loans they shouldn’t be making….again. I’m not saying that the pressure on Fannie Mae and Freddie Mac to make loans to borrowers that weren’t really qualified is the only cause of the housing bust as there were many contributors to it, but this was certainly one of them and definitely a large part of what led to their financial demise and need for a tax-payer bailout. A book I’ve read that I think has the most complete and thorough analysis of what caused the housing market to have it’s longest positive run only to be followed by a collapse is Thomas Sowells’ “The Housing Boom and Bust“. In his book Mr. Sowell says this about the housing bust and the demise of Fannie Mae and Freddie Mac; “in reality, government agencies not only approved the more lax standards for mortgage loan applicants, government officials were in fact the driving force behind the loosening of mortgage loan requirements.” So is this deja vu or what? Mr. Sowell goes on to say “the development of lax lending standards, both by banks and by Fannie Mae and Freddie Mac standing behind the banks, came not from a lack of government regulation and oversight, but precisely as a result of government regulation and oversight, directed toward the politically popular goal of more ‘home ownership’ through “affordable housing,” especially for low-income home buyers. These lax lending standards were the foundation for a house of cards that was ready to collapse with a relatively small nudge.” Correct me if I’m wrong, but it appears to me the government has opened the deck of cards and begun construction again. There will be a 45 day period for public comments once the proposed rule is published in the Federal Register. I just tried to access the website site and it is down so I don’t know if it’s published yet but will check again and update this post with info on how to comment on the rule if you like.

The mortgage market has benefited from the “flight to quality” mentality since the news of the uncertainty of debt defaults in Europe over the last few weeks. As the perception of these uncertainties diminish, mortgage rates should hold steady if not rise. St. Louis Mortgage Interest Rates – June 16, 2010 *

For more information or if you have questions on mortgage rates in St. Louis you may contact me by phone at my direct line, (314) 372-4319, email at rfishel@paramountmortgage.com or you can visit our company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower. This information is provided by this author and this site for informative purposes only and is not warranted or guarteed in any way.

Will the Bears or Bulls prevail in 2010? As the real estate market is beginning to show signs that we are “bottoming out” and that the down-slide is leveling off the discussion has become what the rest of 2010 holds in store. Some say we are entering a Bull market and expect prices to increase from the depressed levels they have reached citing the greatly increased affordability of homes and record low interest rates; others say we are entering a Bear market and that over-supply in the market, largely a result of record foreclosures, will continue to beat prices down. Here’s what the “Bulls” say:

Here’s what the “Bears” say:

So what it is, a Bull or a Bear coming our way? Remember, I’m in the real estate business, I WANT it to be a bull. But….here’s what I see coming…

Dennis Norman What is HAFA? In a nutshell it gives qualifying homeowners the opportunity to do a short-sale or deed-in-lieu rather than face foreclosure: The Home Affordable Foreclosure Alternatives Program provides financial incentives to loan servicers as well as borrowers who do a short-sale or a deed-in-lieu to avoid foreclosure on an eligible loan under HAMP. Both of these foreclosure alternatives help the lender out by avoiding the potentially lengthy and expensive foreclosure proceedings and also by protecting the property by minimizing the time it is vacant and subject to vandalism and deterioration. These options help out the borrower by avoiding the foreclosure process and the uncertainty that comes with it and allows the borrower to negotiate when they will give up possession of their home as well as, under the HAFA program be released from any further liability from the loan including short-fall and deficiencies. Highlights of the guidelines given to mortgage servicers by Fannie-Mae:

Borrower Eligibility for HAFA Consideration:

Financial Requirements of Borrower for HAFA: The lender, prior to deciding if the borrower is eligible for HAFA, must determine if the borrower has:

So the bottom line here is, if you have a bunch of assets, money in the bank or high income relative to you debt, Fannie Mae is not going to be interested in letting you walk away from your deficiency after a short-sale, or DIL. On question that has come up on other posts I’ve written about this, is the effect of bankruptcy on eligibility for HAFA….Here’s the answer from Fannie Mae:

Lenders must, upon determination of eligibility for a HAFA Short-Sale or DIL, determine the fair market value of the property:

Allowable Fees on Short-Sale: Fannie-Mae will allow:

In addition, Fannie Mae will allow;

Short-Sale Approval Should be Faster: One of the major hindrances to short-sales has been the amount of time it takes for a lender or servicer to respond to an offer to purchaser, many times taking several months. Under these new guidelines that should not be a problem because, provided the Seller’s Agent has submitted all the required document to Fannie Mae (they only have 3 business days to submit) then the servicer must respond to the offer within 10 business days indicating acceptance or rejection of the offer. This is huge and should really help facilitate short-sales. Deed-in-Lieu Eligibility: Generally, for a borrower to be eligible for a Fannie Mae HAFA DIL, the mortgaged property must have been listed for sale at market value for 120 days or more. A servicer may waive the requirement that the property securing the mortgage loan previously be listed for sale in cases involving:

This is simply an overview of the Fannie-Mae guidelines and the HAFA program…there is much more, but this gives you the idea. For starters, this is nothing that a homeowner would want to take on alone in my opinion. I think you need a qualified real estate broker or agent, that has in-depth knowledge about HAMP and HAFA and the short-sale process. To get more information I suggest your read my post from March, you can access that by clicking here, or if you really want to have some fun, you can read the complete Fannie-Mae guidelines by clicking here.

Dennis Norman Talk about the housing market not being able to catch a break….it seems every time something positive happens to give us a little encouragement, something else pops up to give the market another black eye. Here we are less than a month after the home-buyer tax credit deadline has passed and we are seeing reports of home prices dropping again as well as the volume of sales, and now, the National Flood Insurance Program (NFIP) is set to expire on May 31st. Of course Congress could extend the program prior to the expiration, but the word I hear from the National Association of REALTORS is that is not going to happen. So what happens after May 31st? The NFIP will no longer have the authority to issue new flood insurance policies nor renew existing policies until Congress reauthorizes the program. This will not affect existing policies however, nor policies purchased prior to the May 31st expiration. Obviously for sellers with homes in flood plains, this will not help them sell their homes, and for those homeowners that have existing flood insurance policies expiring (particularly with hurricane season approaching) it’s probably going to put them a little on edge. There is some help and alternatives… FEMA will allow buyers to assume existing flood insurance policies on homes they are buying, so if you are purchasing a home in a flood plain and the current homeowner has flood insurance you can assume it….now, if the expiration date of the policy is not far off that may make a buyer hesitate for fear that their insurance could lapse before Congress takes care of things. An alternative is to purchase private flood insurance from a company such as Lloyd’s of London, Chubb or AIG….get ready for premium shock though as flood, when not subsidized through a government program like NFIP, is expensive. Hopefully when Congress gets back to work after the Memorial Day break they will get the program extended before too much time lapses. For more information you can check out the following web sites:  Dennis Norman Today the S&P/Case-Shiller Index report for the first quarter of 2010 was released showing that the U.S. National Home Price Index fell 3.2 percent in the first quarter of 2010, but remains above it’s level from a year-earlier. In March, 13 of the 20 MSA’s covered by the Case-Shiller report, as well as both the 10-city and 20-city composites, were down for the month however both the composites as well as 10 of the 20 MSA’s showed year-over-year gains. The report cites the end of the tax incentives and the increasing foreclosure rate as reasons the housing market is seeing some “renewed weakness“.

Other highlights from the report –

“The housing market may be in better shape than this time last year; but, when you look at recent trends there are signs of some renewed weakening in home prices,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “In the past several months we have seen some relatively weak reports across many of the markets we cover. Thirteen MSAs and the two Composites saw their prices drop in March over February. Boston was flat. The National Composite fell by 3.2% compared to the previous quarter and the two Composites are down for the sixth consecutive month. “While year-over-year results for the National Composite, 18 of the 20 MSAs and the two Composites improved, the most recent monthly data are not as encouraging. It is especially disappointing that the improvement we saw in sales and starts in March did not find its way to home prices. Now that the tax incentive ended on April 30th, we don’t expect to see a boost in relative demand.”

The Federal Housing Finance Agency (FHFA) released their report on first quarter home prices today as well. The FHFA report data and methodology differs from NAR and Case-Shiller, in that the FHFA home price index is based only on the sale prices of homes that are financed with a conforming loan (by Fannie Mae and Freddie Mac’s standards). The FHFA report for the first quarter of 2010 shows home prices fell 1.9 percent from the quarter before, so not terribly far off from the 3.2 percent decline the Case-Shiller report showed. In contrast to the Case-Shiller report however, the FHFA report showed March’s home prices rose 0.3 percent from February. Also, the FHFA report shows home prices for this quarter fell 3.1 percent from a year ago.

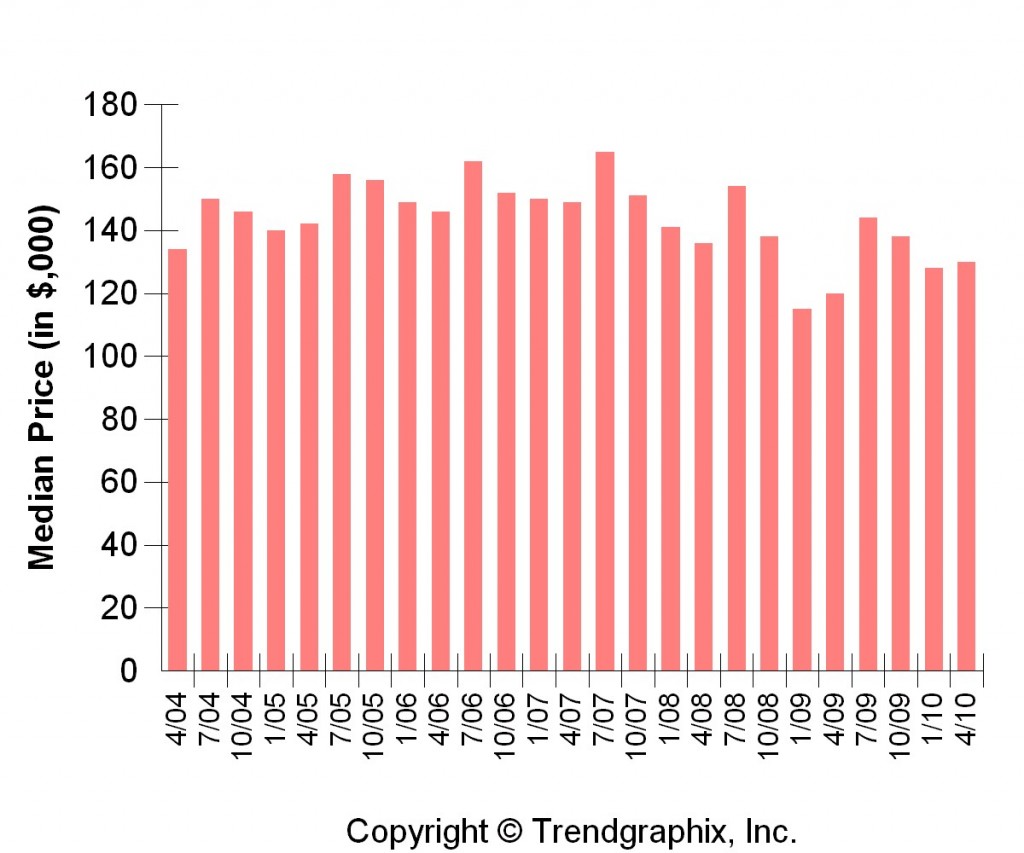

St. Louis Home Prices Doing Better: For the St. Louis metro and surrounding areas, the median home price for the quarter ended April 30, 2010 was $130,000 an increase of 1.6 percent from the prior quarter’s median price of $128,000 and an increase of 8.3 percent from a year ago when the median home price was $120,000. In case you are wondering, the median home price for the St. Louis area has dropped 3.0 percent in the past six years.  Median Home Prices in St. Louis Metro and Surrounding Areas for Past Six Years - Source: Mid America Regional Information Systems (MARIS)

Comparison of St. Louis Median Home Prices to Prior Periods - Source: Mid America Regional Information Systems (MARIS)

Where are home prices headed? As we are frequently reminded, “all real estate is local”, so there will be markets that do better than others, but in general I think we are in store for soft home prices for a while. I think after the “sugar-rush” of the tax credit incentive wears off as the deals close over the next couple of months, and the next wave of foreclosures hit the market we will see prices regress again in many markets, enough so to bring overall home prices in the US down modestly in the coming months.

Dennis Norman In an effort to “support overall market stability and reinforce the importance of borrowers working with their lenders when they have difficulty paying their mortgages”, Fannie Mae has eased their policies with regard to the eligibility of borrowers to obtain a new mortgage loan after having a short-sale or deed-in-lieu of foreclosure. The “waiting period” that someone must wait before getting a new mortgage after a short-sale or deed-in-lieu has been shortened in certain situations. Changes to the Waiting Period After a Short-Sale or Deed-in-Lieu of Foreclosure:

If you had “extenuating circumstances” that caused the need for the short-sale or deed-in-lieu there are different guidelines for your waiting period and Fannie Mae has made changes to them as follows:

I would say most borrowers that have had to do short-sales and deeds-in-lieu have had extenuating circumstances that caused it, so these changes I would think give them some hope. With a ten percent down payment they can obtain a mortgage again as soon as two years…maybe by then the market will be looking a little better.

Housing is stabilizing but excess inventory and shadow supply are hindering recovery according to the April 2010 Economic Outlook released today by Fannie Mae’s Economics & Mortgage Market Analysis Group. The report projects that new home sales (which are at record lows) will be slow to recover until inventory of existing homes and the foreclosure overhang are worked off. The comments about existing home sales were more optimistic saying key indicators for existing home sales, including pending home sales and purchase applications, are showing good signs of a pickup.

Jobs, a driving force for housing, are now moving in the right direction according to the report. Fundamentals of the labor market appear to be improving as layoffs have slowed and hiring is showing signs of life. March payroll employment increased by 162,000, the largest gain in three years; temp employment posted a sixth consecutive monthly gain; and the average workweek increased. On the downside, unemployment will remain elevated for some time, despite the peak unemployment rate of 10.1 percent likely having occurred in October 2009. Highlights of the housing forecast contained in the report:

|

|||

|

St Louis Real Estate Search® St Louis Home Values St. Louis Real Estate News Contact Us Copyright © 2024 Missouri Online Real Estate, Inc. - All Rights Reserved St Louis Real Estate News is a Trademark of Missouri Online Real Estate, Inc. Missouri Online Real Estate, Inc. 3636 South Geyer Road - Suite 100, St Louis, MO 63127 314-414-6000 - Licensed Real Estate Broker in Missouri The owner and authors this site are providing the information on this web site for general informational purposes only and make no representations, warranties (expressed or implied) or guarantees of any kind whatsoever, as to the accuracy or completeness of any information on this site or of any information found by following any link on this site. Furthermore, the owner and authors of this site will not be liable in any manner whatsoever for any errors or omissions in information on this site, nor for the availability of this information. Additionally the owner and authors of this site will not be liable for for any losses, injuries or damages in any way from the display or use of this information or as the result of following external links displayed on this site, or by responding to advertisements displayed, or contained, on this site

In using this site, users acknowledge and agree that the information on this site does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind nor should it be construed as such. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action on this information, you should consult a qualified professional adviser to whom you have provided all of the facts applicable to your particular situation or question. None of the tax information on this web site is intended to be used nor can it be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer. |

|||

FHFA Shows Lower Home Prices in First Quarter Also:

FHFA Shows Lower Home Prices in First Quarter Also: