By Dennis Norman, on December 30th, 2014 St Louis home sales fell to 2,065 homes in November 2014 for the St Louis 5-County Core Market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin), a decline of 3.3% from from 2,136 homes sold in November 2013. St Louis home prices, on the other hand, rose 7.26 percent in November 2014 from a year ago bringing the median home price for the 5-county St Louis core market to $149,300. As the table below shows, results varied between the counties with 2 of the 5 seeing an increase in home sales and only one (the city of St Louis) a decline in home prices.

Distressed home sales (foreclosures, short sales and REO’s) still make up a significant share of the market (about 30 percent of the home sales in November 2014) and therefore have a fairly big impact on home sales and prices. The second table below shows the home sale data without distressed home sales being included and reveals quite a different result. For starters, home sales (non-distressed) actually increased in November 2014 from a year ago and home prices fell a little, the exact opposite of the data with the distressed home sales included. As the second table shows, there were significant differences in the data between the counties as well.

More proof why now, more than ever, you really need a professional and competent real estate broker or agent to assist you in buying or selling a home. There is a lot more to the market than just what appears on the surface. If I can help you in this regard, please contact me.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “St Louis Home Sales Fall While Prices Rise In November“

By Dennis Norman, on December 17th, 2014 Yesterday, the U.S. Senate passed H.R. 5771, the “Tax Increase Prevention Act of 2014”, which had been passed by U.S. House of Representatives on December 3, 2014 and is now headed to President Obama’s desk for his approval. Assuming President Obama signs the act into law, it will be good news for homeowners that sold their homes in a short sale in 2014 or in some other way was forgiven on mortgage debt during this year. The Tax Increase Prevention Act of 2014 extends the Mortgage Forgiveness Debt Relief Act of 2007 through December 31, 2014 and makes it retroactive to January 1, 2014 so there is no gap in coverage from when the last extension expired.

This falls short of the two year extension the National Association of REALTORS (NAR), among other groups, pushed for which would have covered next year as well, but is at least some relief for those affected this year. Read the complete article on the extension from last month here.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

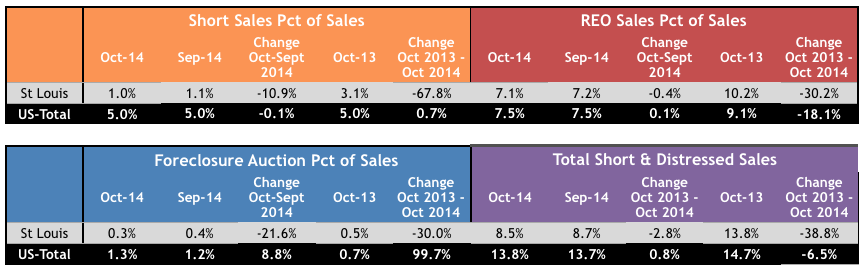

By Dennis Norman, on November 28th, 2014 St Louis Distressed Home Sales continue to have less impact on the St Louis real estate market paving the way for sustainable home appreciation, according to the latest data available from RealtyTrac. According to the chart below, short sales in St Louis accounted for just 1% of the overall home sales last month, a 10% decrease from the month before and a decrease of almost 68% from a year ago. Nationally, short sales accounted for 5% of all home sales last month.

St Louis REO’s (bank-owned properties obtained through foreclosure) declined slightly in October from the month before and dropped over 30% from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on November 20th, 2014 UPDATE December 17, 2014 – Congress has passed an extension of the Mortgage Forgiveness Debt Relief Act of 2007 through December 31, 2014 – It is part of a bill that has been sent to President Obama for his approval. This falls short of the two year extension the National Association of REALTORS (NAR), among other groups, was pushing for which would have covered next year as well, but is at least some relief for those affected this year.

The Mortgage Forgiveness Debt Relief Act of 2007 provided relief for homeowners that receive forgiveness on some of their mortgage debt (such as is the case on a short-sale) in the form of removing their obligation to pay income tax on the amount of their debt that was forgiven by their lender. Originally, the Mortgage Forgiveness Debt Relief Act, was to expire at the end of 2012 but was later extended through the end of 2013 and on April 3rd of this year the Senate Finance Committee approved a bill that, if passed, would reinstate a bunch of tax provisions that expired at the end of 2013, including the Mortgage Forgiveness Debt Relief Act of 2007 , through December 31, 2015. Thus far, the bill has not passed and now many are concerned that it may not which will leave all the people that did short sales this year, or had debt relieved in some other manner, possibly owing income tax on the forgiven debt.

The National Association of REALTORS (NAR) have issued a call to action to it’s 1 million plus members asking them to urge their Member of Congress and Senators to act on “The Mortgage Forgiveness Tax Relief Act” before the end of 2014. Apparently, the stumbling block to getting this extended has been politics…shocker, right? The Democratic Majority Leader of the Senate, Harry Reid, according to the NAR website, “refused to allow an open amendment process” which then, in turn, the Republicans “exercised their rights to prevent the bill from moving to a vote.”

Should the Mortgage Forgiveness Debt Relief Act of 2007 be extended?

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “Will The Mortgage Forgiveness Debt Relief Act of 2007 Be Extended?“

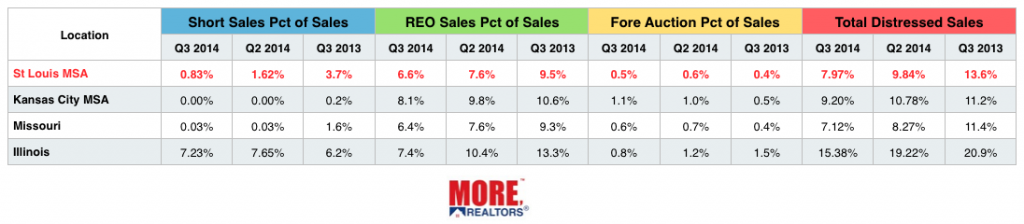

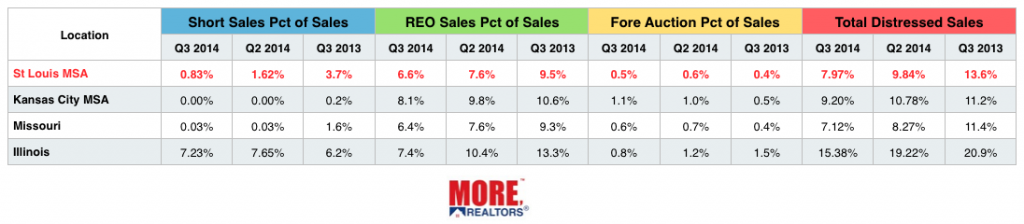

By Dennis Norman, on October 28th, 2014 Distressed home sales in St Louis accounted for 7.97 percent of all home sales during the 3rd quarter, down from 9.84 percent the quarter before and down a whopping 40 percent from a year ago when distressed sales accounted for 13.6 percent of all homes sold in the St Louis MSA, according to the latest data from RealtyTrac. State-wide for Missouri, distressed home sales made up 7.12 percent of home sales during 3rd quarter, lower than the rate for St Louis however, at the other side of our state, in Kansas City, distressed home sales share of home sales was 9.2% for 3rd quarter, about 15% higher than St Louis. The table below shows the breakdown of distressed sales by short sales, REO’s and foreclosure auction.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 9th, 2014 Today, the U.S. Department of Housing and Urban Development (HUD) released it’s Fair Market Rent amounts for 2015 which are used for several purposes including computation of section 8 rents in a given area. The table below shows the fair market rents for 2015 for all Missouri Counties as well as Missouri Metropolitan Areas.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “HUD Releases Fair Market Rent Amounts for 2015 For Missouri“

By Dennis Norman, on October 3rd, 2014 St Louis short sales are definitely fewer and farther between than they were a couple of years back however, they are still out there and still often offer a great opportunity to a buyer. A short sale is where a home is being sold by it’s owner at a price less than the current mortgage on it in the hope that the lender will agree to accept the proceeds from the sale and release the loan since the equity is simply not there to sell the home and pay off the loan. Of course, there has to be some hardship with it as well and the owners have to prove they are in no position to pay the loan off in full otherwise it would not make sense for the lender to accept less than the full balance of the loan.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on June 24th, 2014 St Louis Foreclosures, and short sales, in May 2014 accounted for just 8.5% of all home sales in the St Louis core market (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin), according to data released just this morning from RealtyTrac. This is a decline of 26.7% from May 2013 when foreclosures and short sales in St Louis accounted for 11.6% of all home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures and Short Sales Fall By Over 25 Percent“

By Dennis Norman, on April 24th, 2014 St Louis distressed home sales declined during the first quarter of this year with distressed home sales (foreclosures, REO’s and short sales) in the 5-county core St Louis market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) accounting for 15.0% of all home sales, This is down 18.5% from the first quarter of 2013 when St Louis distressed home sales accounted for 18.4% of all home sales, according to newly released data from RealtyTrac. As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw short sales and REO’s decrease in the first quarter of 2014 from a year ago with the exception of REO sales in St Charles that increased 5% during the period. All counties saw an increase in foreclosure auction activity from the first quarter of 2013 to the first quarter of 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Distressed Home Sales Down From a Year Ago“

By Dennis Norman, on April 4th, 2014  Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000. Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.

Who is the typical real estate investor?

According to the NAR report, the typical home investor in 2013 was a median age of 42 years, had a median household income of $111,400 and more than half (59%) were in a two income household.

What type of property do investors buy?

(We work hard on this and sure would appreciate a “Like”) Continue reading “Investment Property Sales Fall in 2013“

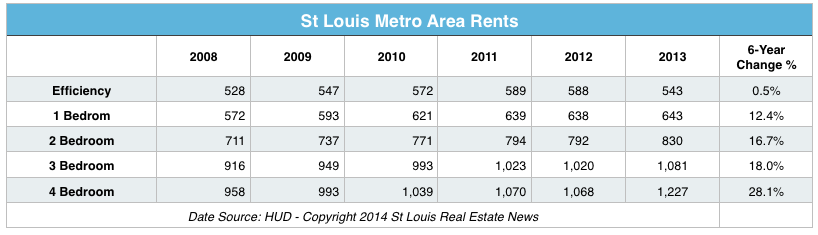

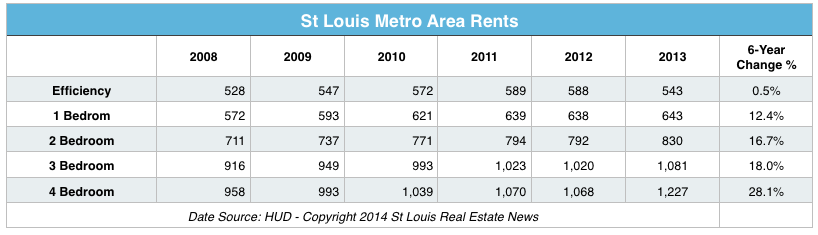

By Dennis Norman, on March 6th, 2014 St Louis rents have risen 18% since the real estate bubble burst (based upon HUD fair market rents for 3 bedrooms) while median home prices have fallen 12% during the same period. Part of the reason behind has been the increased demand for rentals as a result of many homeowners who, after the real estate bubble burst, lost their homes in foreclosure or were forced to do a short sale and then had to seek a rental while they rebuild their credit. This, couple with almost no new apartment construction for several years has created the right environment for increasing rents.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rents Rose While Home Prices Declined Post Boom“

By Dennis Norman, on March 1st, 2014 Not long ago distressed home sales (foreclosures, short sales, REO’s, etc) were a dominant force in the St Louis real estate market, accounting for a good portion of St Louis area home sales. Today, however, with a few exceptions, they have all but left the St Louis real estate market. As far as the St Louis housing market is concerned, this is a good thing, for home buyers and investors looking for what are often bargain prices as a result, they may have different thoughts.

As the table below for the five St Louis counties that make up the bulk of our market, short sales, REO’s (foreclosed homes being sold by banks) and foreclosure sales percentage of St Louis home sales was very slight in January 2014, and down significantly from a year ago. In fact, there were virtually no short sales or foreclosure auction sales in January and REO’s accounted for just over 5% of all St Louis home sales for the month. The only year-over-year increase seen in any of these sales was in REO sales in St Charles county that increased from 5.7% of home sales in January 2013 to 8% of home sales in January 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on January 22nd, 2014

St Louis distressed home sales continue to fall, according to a report published by MORE, REALTORS based upon data released by RealtyTrac. This report supports other market data that indicates the St Louis real estate market is recovering from the devastation brought on it when the real estate market bubble burst back in 2008.

The market crash brought many institutional buyers into the market, buying up homes as prices fell, but the recovery of the St Louis real estate market has slowed this activity as well. Home sales fueled by institutional investors fell 23.6% in December 2013 from the year before, according to the report.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on December 20th, 2013 St Louis homes sales (the 5-county core market*) for the 12 month period ending November 30, 2013 increased 4 percent from the same period a year ago, in contrast to national home sales which are down 1.2 percent from a year ago. As the table below shows, St Louis distressed home sales (foreclosures, bank-owned and short sales) have declined by more than a third and are currently responsible for just 5 percent of the overall home sales.

St Louis home prices are increasing too with the median home price for the past year coming in at $149,600, an increase of 10.81 percent from a year ago when the median price was $135,000. St Louis home prices have increased more than the national rate of of 9.4 percent for the past year.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Home Sales Increase In Past Year; Buck National Trend“

By Dennis Norman, on December 6th, 2013  “Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal. “Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal.

If you are one of those buyers wanting to snag a deal, you may have missed the boat as the volume of short sales in St Louis has fallen dramatically. While, overall, this is good news as it indicates the health of the real estate market is improving and will help to stabilize prices, it does remove some of the opportunities for bargains to buyers willing to go through the short-sale process. As the chart below shows, the number of short sale listings in St Louis hitting the market peaked around January 2012, when around 230 new short sale listings came on the market, and then the trend has been downward ever since. The blue line on the chart shows the number of short sale listings sold which peaked in July 2012 around 90 sales for the month and has fallen to less than 25 a month for the past couple of months.

Search St Louis Short Sales HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Short-Sales Dwindling“

By Dennis Norman, on November 26th, 2013 St. Louis short sales accounted for just 1 percent of the overall home sales activity during October in the core market of St. Louis (the city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin), according to the latest data from RealtyTrac. As the table below shows, Jefferson County had the largest percentage of short sales in October at 7% and St Charles and Franklin both the lowest at 0%. REO sales (prior foreclosures that are now bank owned) on the other hand, made up 7 percent of St Louis area home sales in October, an increase of 33.3% from a year ago.

St Louis has historically not seen much in the way of institutional investors buying homes in the area, however this has changed of late and, in fact, made up 10% of the overall area home sales a year ago. In St Charles County, 25% of home sales in October 2012 were sales involving institutional investors but this has fallen to 13% last month, a decline of almost 50%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Short Sales Plummet While REO’s on the Rise“

By Dennis Norman, on November 20th, 2013 St Louis homes sales (the 5-county core market*) increased slightly in October 2013 to 2,211 sales from 2,207 sales the month before. However, as the table below shows, a couple of key things worth noting are that October home sales increased 6.76 percent from October 2012 and, in October 2013, distressed sales (foreclosures, short sales, REO’s) accounted for just a little over 20% of total home sales, down from almost 31% a year ago.

St Louis home prices, as the chart below shows, have steadily risen in the past year from a median price of $130,000 in October 2012 to $148,000 in October 2013. The median price for distressed sales was much lower at $52,914.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Home Sales Increase Slightly In October…Distressed Sales Share Drops By Third In Past Year“

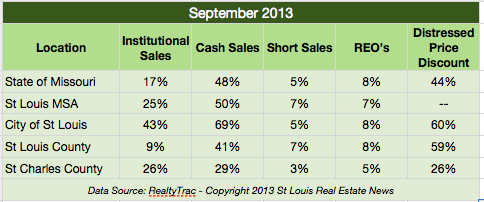

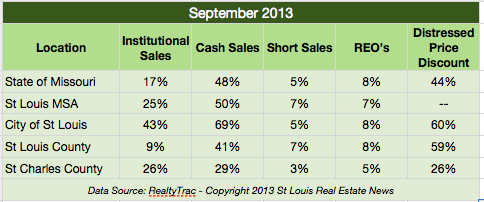

By Dennis Norman, on October 24th, 2013  Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales. Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales.

Cash sales are often associated with investors and, as the table shows, there is no lack of investor activity in the St. Louis metro area. In fact, institutional sales in September were over 50 percent higher in the St Louis metro area than for the state of Missouri as a whole.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?)

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 3rd, 2013

Agency relationships between a buyer or seller of a home and the real estate agent are probably one of the most confusing aspects of the real estate transaction for consumers and for many real estate agents as well for that matter. Dual agency takes the confusion to a whole new level though for the parties involved as the issue gets quite complex. At the very basic level, dual agency exists when the same real estate agent represents both the buyer and seller in the same real estate transaction (a bad idea in my humble opinion). At a more complicated level, state law states that dual agency also exists if the agent representing the buyer is with the same firm as the agent representing the seller then dual agency exists as well.

The point of this article is not actually to explain all the nuances of agency relationships, it’s really about a “dual” going on presently between the National Association of REALTORS (NAR) and the The National Association of Exclusive Continue reading “The Dual Agency Dual“

By Dennis Norman, on September 6th, 2013

Nearly one of every 4 St Louis homeowners with a mortgage are seriously underwater, meaning their mortgage exceeds the current value of their home by 25 percent or more, according to a report just released by RealtyTrac. As the table below shows, the city of St. Louis has the highest percentage of seriously underwater homeowners at 31 percent and Franklin county the lowest at 14 percent. In addition, there are another 104,000 St Louis homeowners in a “near-equity” or “resurfacing equity” position, meaning their loan equals 90 to 110 percent of the current value of their home. As long as home prices continue to rise, these homeowners will hopefully come out of their negative equity position soon.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Over 123,000 St Louis Homeowners Are Seriously Underwater“

By Dennis Norman, on July 25th, 2013

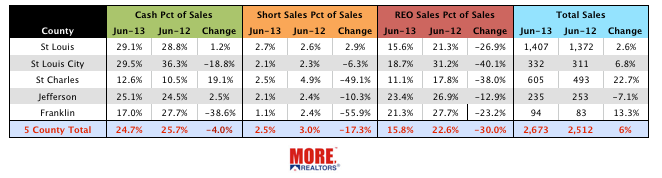

St Louis distressed home sales have fallen substantially in the past year with distressed home sales in June making up less than 1 in 5 home sales (18.3 percent) for the 5 county core area of the St Louis MO market (St Louis City and County, St Charles, Jefferson and Franklin Counties), according to the latest data from MORE, REALTORS. REO sales (bank and government-owned properties) accounted for just 15.8 percent of St Louis home sales in June (5 county core), down from 22.6 percent in June 2012. Short sales (where sellers sell for less than they owe) accounted for just 2.5 percent of home sales in June 2013, down from 3 percent in June 2012.

Cash home buyers (both investors and owner occupants) remain a strong force in the market with almost 1 in 4 (24.7 percent) home purchases in June 2013 being a cash purchase, down just slightly from 25.7 percent a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on June 12th, 2013  There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage. There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage.

For the State of Missouri as a whole, there were 120,056 homeowners, or 15.3 percent of all homeowners with a mortgage, with negative equity during the first quarter of this year. On a national level, there were 9.7 million, or 19.8 percent of all homeowners with a mortgage, with negative equity, or underwater, during the quarter.

If you are an underwater homeowner and want to know what your options are, please contact me by clicking here.

Many underwater homeowners turn to a short sale to get out from under their mortgage-to see all St Louis short sales currently listed click here.

Continue reading “St Louis Homeowners With Negative Equity Falls 10 Percent“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Since the real estate market crash, millions of homeowners have lost their homes in a foreclosure, been forced to do a short sale to get out from a home they were underwater on or file bankruptcy as a result of financial hardship as a result of the the market crash and general economic downturn. Many of these homeowners have resorted to renting or living with relatives but, as time passes and the financial wounds heal, are now wanting to buy a home again prompting the question, “how long do I have to wait after a foreclosure, short-sale, deed-in-lieu or bankruptcy before I can get a home loan again?”.

Fortunately, it is possible for former homeowners who have faced financial hardships to obtain a home loan again, but it does take time and effort on their part. Before obtaining a home loan after a foreclosure, short-sale or bankruptcy, the borrower will have to reestablish credit and establish a stable income that will support the home loan they wish to obtain. In addition, time will have to pass as (see the chart below), no matter how well the borrowers situation has improved, there are still some minimum timeframes that will have had to pass in order to be eligible for most types of home loans. There is no “one size fits all” answer though, so I highly suggest if you are in this situation and want to know what your options are, to use the form below to contact me, I’ll be happy to help. Continue reading “How Long Do You Have To Wait To Get A Home Loan After Foreclosure, Short Sale or Bankruptcy?“

One-third of Homebuyers Surveyed Are Ill-prepared to Get a Mortgage

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 According to a survey recently conducted by Zillow, many homebuyers are really not armed with the information they should have before attempting to obtain a mortgage. For example, over one-third (34 percent) of the prospective homebuyers surveyed did not know that a qualified borrower can obtain a home loan today with less than a five percent downpayment.

In addition, many homebuyers have misinformation that can prevent them from obtaining the best possible mortgage interest rate. For example, 26 percent of the homebuyers said they thought they were obligated to obtain their home loan with the lender that pre-approved them, and 24 percent believed that all lenders are required to charge the same amount for credit reports and appraisals.

Continue reading “Survey Shows One-Third Of Homebuyers Lack Info Needed To Get Mortgage“

By Dennis Norman, on March 6th, 2013  If you are a homeowner then it is probably good that St. Louis did not make the list of best markets for buying short sales, but if you are a buyer hoping to get a good deal on a home then it may be a disappointment not to see St. Louis on the list. While we do have plenty of short sale opportunities here in St. Louis, our city did not make RealtyTrac’s list of the top 15 markets in the U.S. for buying short sales, but the top 15 are listed in the chart below: If you are a homeowner then it is probably good that St. Louis did not make the list of best markets for buying short sales, but if you are a buyer hoping to get a good deal on a home then it may be a disappointment not to see St. Louis on the list. While we do have plenty of short sale opportunities here in St. Louis, our city did not make RealtyTrac’s list of the top 15 markets in the U.S. for buying short sales, but the top 15 are listed in the chart below:

Continue reading “Where Are The Best Short Sale Deals?“

By Dennis Norman, on February 8th, 2013  Missourians have received more than $112 million of mortgage relief as a result of the National Mortgage Settlement reached a year ago with the nations largest lenders, according to Missouri Attorney General Chris Koster. Koster, along with Attorney General’s from other states, sent a letter to Congress last November urging them to extend a measure that was due to expire at the end of 2012 that would provide tax relief for some people receiving mortgage relief in the form of principal reduction and short sales. January 1, 2013, Congress passed the extension as part of the American Taxpayer Relief Act of 2012. Continue reading “Mortgage relief received in 2012 may not be taxable“ Missourians have received more than $112 million of mortgage relief as a result of the National Mortgage Settlement reached a year ago with the nations largest lenders, according to Missouri Attorney General Chris Koster. Koster, along with Attorney General’s from other states, sent a letter to Congress last November urging them to extend a measure that was due to expire at the end of 2012 that would provide tax relief for some people receiving mortgage relief in the form of principal reduction and short sales. January 1, 2013, Congress passed the extension as part of the American Taxpayer Relief Act of 2012. Continue reading “Mortgage relief received in 2012 may not be taxable“

By Robert Fishel, on January 23rd, 2013  As part of the fiscal cliff deal, Congress extended the cancellation of mortgage debt relief provision for 1 year, through the end of 2013. As part of the fiscal cliff deal, Congress extended the cancellation of mortgage debt relief provision for 1 year, through the end of 2013.

It seems there is little focus on the importance of this law, it is crucial to foreclosure mitigation efforts such as principal forgiveness and short sales.

Normally, when a lender forgives all or a portion of a borrower’s debt, U.S. law decrees that the forgiven amount is considered taxable income to the borrower. This “forgiveness” is also known as Cancellation of Debt (COD) Income. COD must be included in a taxpayer’s gross income. The Mortgage Forgiveness Debt Relief Act allows homeowners who received principal reductions or other forms of debt forgiveness not to pay taxes on the amount forgiven.

Consult your tax adviser to determine whether the Mortgage Forgiveness Debt Relief Act is relevant to your particular situation.

Continue reading “Cancellation of Debt; St Louis Mortgage Interest Rate Update“ Continue reading “Cancellation of Debt; St Louis Mortgage Interest Rate Update“

By Dennis Norman, on December 21st, 2012

Lately we have seen several reports on the housing market that show the housing market is improving and may even be headed toward a recovery however some experts, including Cliff Rossi, Tyser Teaching Fellow and executive-in-residence for the University of Maryland’s Robert H. Smith School of Business, say it may be premature to call this a “real recovery.” Rossi is not entirely negative on the housing market and does admit that home prices are stabilizing and inventories are declining, however he has concerns as a result of the “fiscal cliff”, regulatory reform and tightness of credit. Continue reading “Is it premature to say the housing market is in recovery?“

By Dennis Norman, on November 1st, 2012  For anyone that has been through the short sale process, or knows someone that has, they will attest to the fact that short sales are not “short” but, instead, are typically long, drawn out processes with many layers of approvals and much red tape. Good news! Beginning today, Fannie Mae and Freddie Mac took steps to shorten the short sale process as well as reduce the amount of red tape, by no longer requiring approved private mortgage insurance companies to come to them (Fannie and Freddie) for approvals on short sales or deeds in lieu of foreclosure. This is a significant change from the current policy and should definitely make the short sale process less drawn out going forward. For anyone that has been through the short sale process, or knows someone that has, they will attest to the fact that short sales are not “short” but, instead, are typically long, drawn out processes with many layers of approvals and much red tape. Good news! Beginning today, Fannie Mae and Freddie Mac took steps to shorten the short sale process as well as reduce the amount of red tape, by no longer requiring approved private mortgage insurance companies to come to them (Fannie and Freddie) for approvals on short sales or deeds in lieu of foreclosure. This is a significant change from the current policy and should definitely make the short sale process less drawn out going forward.

If you are looking to buy a short sale and would like to search all the short sales available in the St. Louis, click here.

By Dennis Norman, on October 28th, 2012  The St. Louis area has seen a fairly dramatic change in the make-up of the housing occupants with a shift from home-owners to renters over the past six years. After the crash of the real estate market we have experienced, as well as massive unemployment and a weak economy, this is not surprising, but is something that I think needs to be recognized. The five-county St Louis core market (St Louis County, St. Louis City, St Charles County, Jefferson County and Franklin County) as a whole saw owner-occupied units drop almost 3.5 percent during the period while, at the same time, renter-occupied units increased almost 15 percent resulting in renter’s making up almost 31 percent of all the occupied housing units in 2011, up 13.14 percent from 2005 when they accounted for 27.29 percent. The St. Louis area has seen a fairly dramatic change in the make-up of the housing occupants with a shift from home-owners to renters over the past six years. After the crash of the real estate market we have experienced, as well as massive unemployment and a weak economy, this is not surprising, but is something that I think needs to be recognized. The five-county St Louis core market (St Louis County, St. Louis City, St Charles County, Jefferson County and Franklin County) as a whole saw owner-occupied units drop almost 3.5 percent during the period while, at the same time, renter-occupied units increased almost 15 percent resulting in renter’s making up almost 31 percent of all the occupied housing units in 2011, up 13.14 percent from 2005 when they accounted for 27.29 percent.

As we drill-down to the county level, we can see that the results vary fairly significantly by county. For example, Jefferson County saw the largest increase in renter-occupied housing units with a 35.38 percent increase during the six-year period, while Franklin County had a decrease of almost 9 percent in renter occupied units during the period. Continue reading “St. Louis Area Renter Occupied Housing On the Rise While Owner Occupied Housing Declines“

|

Recent Articles

|

Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.

Investment property sales in 2013 fell to 1,104,000 properties, down 8.5 percent from 2012 when there were 1,2o7,000 investment properties sold, according to a report just released by the National Association of REALTORS. The median sale price of investment homes purchased during 2013 was $130,000, a 13% increase from 2012 when the median price was $115,000.

“Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal.

“Short-sale” is a term that was relatively unknown until the real estate market bubble burst in 2008. After the bubble burst the term quickly became a common topic of conversation among homeowners that found themselves “underwater” in their homes, meaning they owed more on their homes than they were worth, and also among potential home buyers and investors looking to snag a good deal.

There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage.

There were 88,367 St Louis homeowners with negative equity during the first quarter of this year, according to a report just released by CoreLogic. This represents 15.7 percent of the St. Louis homeowners with a mortgage and is a decline of 10 percent from the prior quarter when there were 98,365 St Louis homeowners with negative equity, or 17.5 percent of all St Louis homeowners with a mortgage.

If you are a homeowner then it is probably good that St. Louis did not make the list of best markets for buying short sales, but if you are a buyer hoping to get a good deal on a home then it may be a disappointment not to see St. Louis on the list. While we do have plenty of short sale opportunities here in St. Louis, our city did not make RealtyTrac’s list of the top 15 markets in the U.S. for buying short sales, but the top 15 are listed in the chart below:

If you are a homeowner then it is probably good that St. Louis did not make the list of best markets for buying short sales, but if you are a buyer hoping to get a good deal on a home then it may be a disappointment not to see St. Louis on the list. While we do have plenty of short sale opportunities here in St. Louis, our city did not make RealtyTrac’s list of the top 15 markets in the U.S. for buying short sales, but the top 15 are listed in the chart below:

Missourians have received more than $112 million of mortgage relief as a result of the National Mortgage Settlement reached a year ago with the nations largest lenders, according to Missouri Attorney General Chris Koster. Koster, along with Attorney General’s from other states, sent a letter to Congress last November urging them to extend a measure that was due to expire at the end of 2012 that would provide tax relief for some people receiving mortgage relief in the form of principal reduction and short sales. January 1, 2013, Congress passed the extension as part of the American Taxpayer Relief Act of 2012.

Missourians have received more than $112 million of mortgage relief as a result of the National Mortgage Settlement reached a year ago with the nations largest lenders, according to Missouri Attorney General Chris Koster. Koster, along with Attorney General’s from other states, sent a letter to Congress last November urging them to extend a measure that was due to expire at the end of 2012 that would provide tax relief for some people receiving mortgage relief in the form of principal reduction and short sales. January 1, 2013, Congress passed the extension as part of the American Taxpayer Relief Act of 2012.  As part of the fiscal cliff deal, Congress extended the cancellation of mortgage debt relief provision for 1 year, through the end of 2013.

As part of the fiscal cliff deal, Congress extended the cancellation of mortgage debt relief provision for 1 year, through the end of 2013.