Definitely a philosophical question but here we are talking about Smart Homes. Indeed, the adoption and implementation of the Matter Protocol could end up having a substantial impact within the real estate industry and all its intertwined industries. Before I get into why that is let me tell you what Matter is. In the context of smart homes, a protocol like Matter would define the rules and specifications for how smart devices, such as lights, thermostats, door locks, and more, communicate with each other over a network within a single ecosystem. So, here’s why I think it could have a huge impact in real estate:

- Seamless Integration: This protocol ensures that devices from different manufacturers work harmoniously together. This simplifies the marketing of smart homes, assuring buyers that their devices will seamlessly integrate.

- Increased Property Value: Homes equipped with Matter Protocol devices can offer a competitive edge if marketed correctly. Buyers are drawn to properties with a unified and ready-to-use smart home system, potentially leading to higher property values and lower insurance rates.

- Efficient Transactions: Home inspectors and buyers should easily be able to evaluate integrated smart home systems, reducing some of the transactional complexities. In fact, an ASHI certified inspector should be able to understand 5 of the biggest Smart Home technologies.

- Futureproofing: Matter Protocol maintains compatibility as technology evolves. In other words, no planned obsolescence. Remember when Apple got fined over $300m for slowing down your device?? This reassures buyers that their smart home investments won’t quickly become outdated.

- Diverse Device Selection: The protocol encourages a wider range of devices adhering to the same standard. Smart Home Certified real estate professionals can offer a variety of devices that suit buyers’ preferences.

- Simplified Management: Property managers benefit from streamlined smart home system maintenance. A uniform protocol minimizes operational challenges across multiple properties.

- Sustainability Appeal: The protocol supports energy-efficient practices, attracting eco-conscious buyers and aligning with green trends.

This protocol is backed by some of the biggest players in the Smart Home industry. Amazon, Apple, Google, Samsung, et al. are all continually developing more products for this protocol. Even with these names involved, the rollout of the hardware has been slow and it’s still pretty much lighting, plugs and shades. Level Lock is the one smart lock with a little secret: it hides a Thread radio in its hardware that will support Matter. Huh? Yeah, exactly. There’s a lot to this Smart Home stuff so if you‚Äôre buying or selling a home with Smart Home integrations, hire an agent who understands what this all means to the overall transaction– the only Smart Home Certified CRS agent in the Greater St. Louis area, John Donati.*

John Donati, REALTOR®

Smart Home Certified

Accredited Buyer’s Representative (ABR¬Æ)

Military Relocation Professional (MRP)

JohnDonati.com

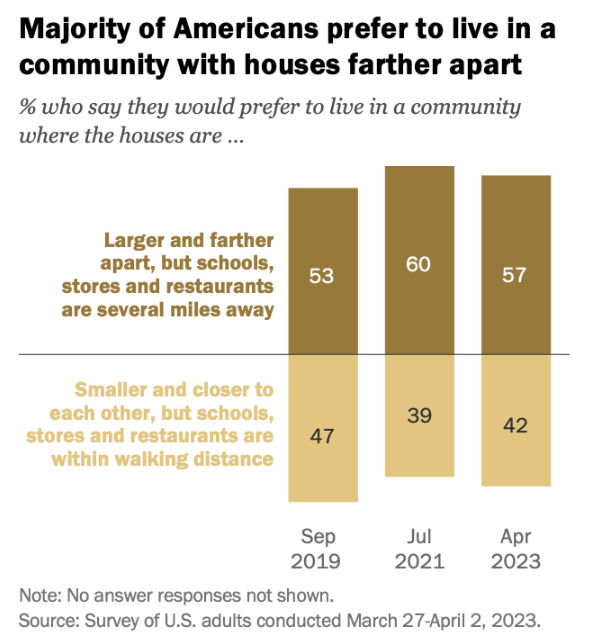

According to a recent survey by the Pew Research Center, 57% of Americans say they would prefer living in a community where the houses are larger and farther apart even though schools, stores and restaurants are several miles away.  This is down from 60% when the same survey was done in 2021 and up from 53% from the 2019 Survey.

Majority of Americans Prefer Big Houses Over Walkability

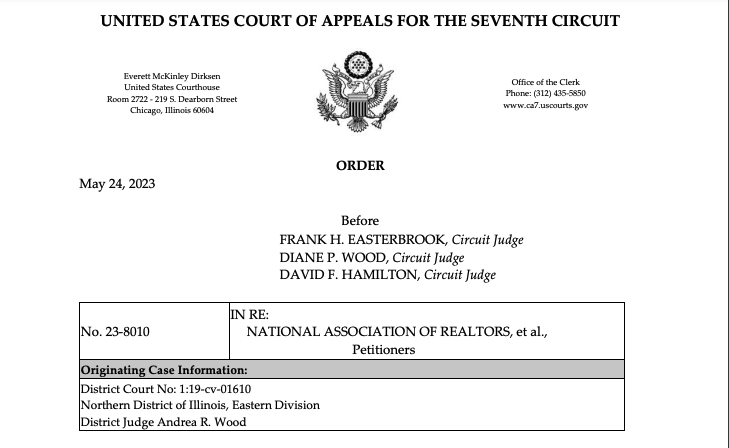

As I’ve previously discussed, the National Association of REALTORS¬Æ (NAR) is grappling with a myriad of challenges. These range from multiple class-action lawsuits to scrutiny from the Department of Justice (DOJ). This past week, the organization faced two more setbacks.

First, a scandal erupted involving NAR’s President, Kenny Parcell. Reports suggest that Parcell was accused of sexually harassing women within the organization. While this news began circulating about a week ago, it gained significant momentum when the New York Times published an expos√© last Saturday. The report prompted industry-wide calls for Parcell’s resignation. Consequently, Kenny Parcell stepped down as President of NAR yesterday. President-elect Tracy Kasper immediately assumed the role of President.

In another blow to NAR yesterday, the United States Court of Appeals for the Ninth Circuit overturned a lower court’s dismissal of a lawsuit. This lawsuit was filed by Top Agent Network, Inc., accusing NAR of violating the Sherman Antitrust Act through its “MLS Clear Cooperation Policy.”

Indeed, it’s been a challenging week for NAR, and it’s only Tuesday.”

Top Agent Network, Inc. v. National Association of REALTORS, et al Original Lawsuit

(click below for entire document)

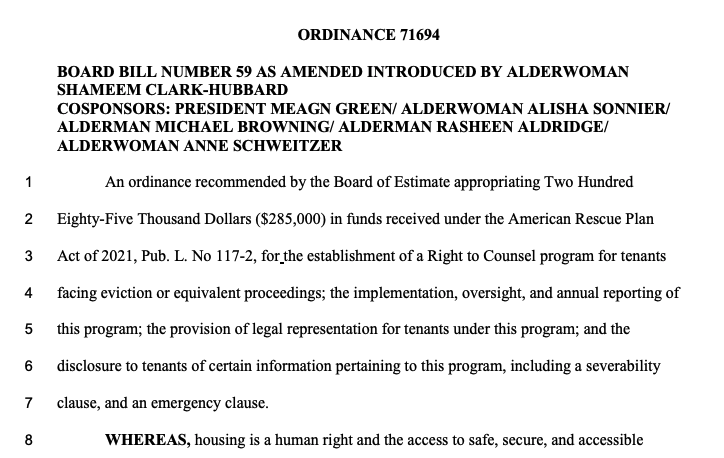

Last month, city of St Louis mayor, Tishaura Jones, signed into law a new ordinance which provides “access to legal representation for tenants facing eviction or equivalent proceedings”. Surprisingly, it does not appear that the tenant needs to show a final hardship or need for “full legal representation” to be provided at no cost as the bill defines a “covered individual” as “any residential tenant who occupies a dwelling located within the City under a claim of legal right, other than the legal property owner of the dwelling.” Another interesting thing in the ordinance is that it appears to include legal representation for not only in the case of an eviction but also in the case of a non-renewal of a lease as Section Four of the ordinance (General Provisions of Right To Counsel for Tenants In Covered Proceedings) states “A covered individual may access legal representation as provided in this ordinance as soon as a landlord provides notice to terminate or not renew a tenancy, or as soon thereafter as is practicable.”

Then, according to reports, yesterday, St. Louis Aldermanic President Megan Green announced that legislation was being drafted to require landlords in the City of St Louis to provide contact information as part of the City’s occupancy permit process. Aldermanic President Green stated “It will help the city better keep track of who is owning certain properties so if there’s issues with properties there’s a local agent requirement, instead of trying to track down a random person registered to an LLC, which is often a challenge,” Landlords will also be required to report the rental amount they are charging according to Green.

Green also announced that the Board of Aldermen plan to consider a “tenants bill of rights” as well.

Ordinance 71694 – Providing Legal Representation to Tenants Facing Eviction

(click on image below for entire ordinance)

Below is the St Louis Real Estate Market Report for July 2023 for the City and County of St Louis combined from MORE, REALTORS®, one of the most trusted sources for St Louis real estate market data and information. You can access the full infographic, containing data for St Charles, Jefferson and Franklin Counties as well by clicking on the image below.

The current St Louis real estate market leaves little room for errors…

The real estate market today is like a tough game where making wrong decisions based on poor information can cost you. With few homes listed and many eager buyers, there’s a rush to outbid others, leading some people to pay more than a home’s true value. It’s okay to pay a bit extra if you’re doing it for the right reasons and based on solid facts.

To make smart choices, you need accurate information and a great real estate agent who knows how to use it. I’m proud that our team at MORE, REALTORS® is comprised of such experts who can guide buyers and sellers to make rewarding decisions in this tricky market.

We work hard to gather and share the best market information to help our agents and clients make informed decisions. While no information is 100% perfect, getting as close to that as possible can help you make smarter choices.

Don’t all REALTORS® have this data?

You might think all agents have the same information, especially those under the REALTORS® banner. In St. Louis, for example, every REALTOR® can access the same vast data through the MARIS MLS system. But simply having access isn’t enough. It’s like the internet: the challenge is finding trustworthy information.

A lot of agents use general data given to them by others. Our agents, however, use special software to customize reports for their clients. They also double-check the information to spot any errors. This shows how serious they are about making sure you get only the best, even when the data comes from a trusted source like ours.

Continue reading “St Louis Real Estate Market Report for July 2023 with accurate data you can trust“

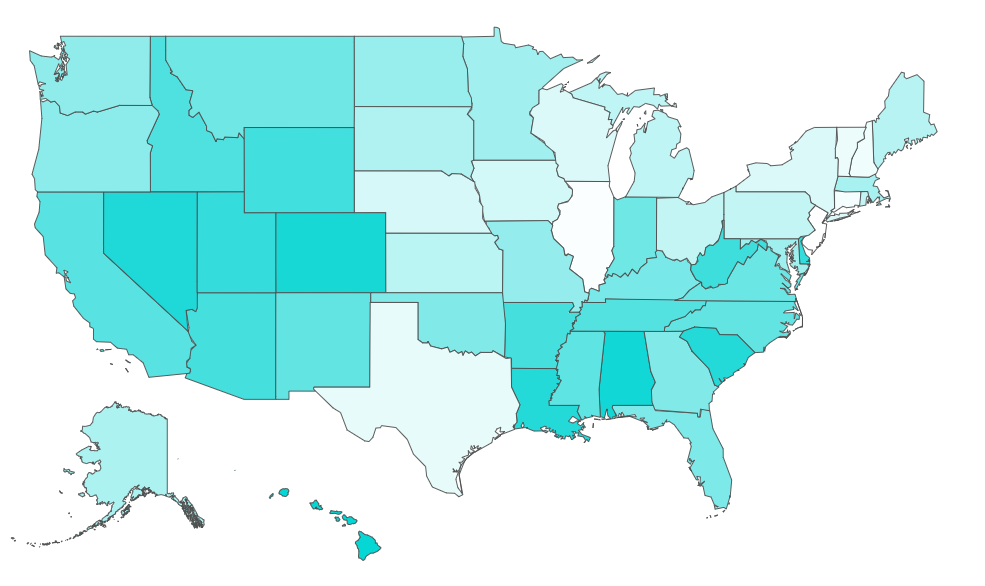

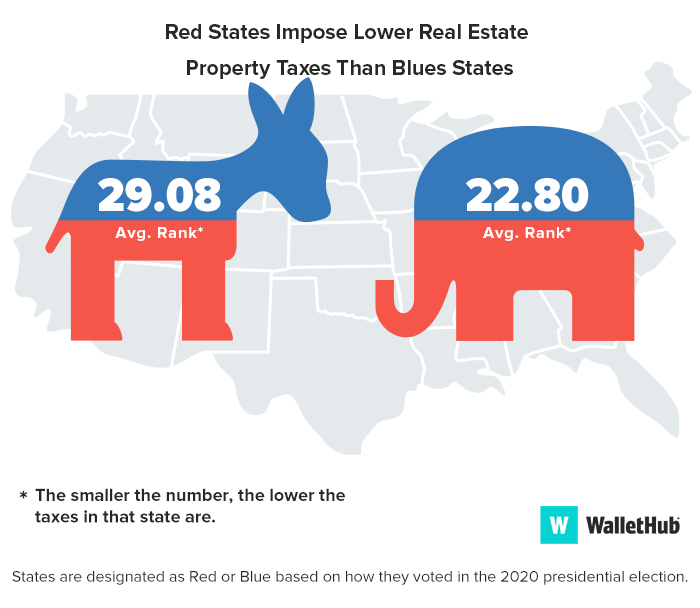

According to a study released earlier this year by WalletHub, Missouri property tax rates are the 29th lowest in the U.S. To determine the tax rates for this list, WalletHub took the median property tax payment for each state and divided it by the median property value to determine the effective tax rate. For Missouri, the median home price was $171,800 and median property tax was $1,676 resulting in an effective tax rate of 0.98%. Hawaii was the state with the lowest tax rate coming in at a scant 0.29% and New Jersey the highest at 2.47%.

WalletHub also compared “Blue States” with “Red States” and, as the infographic at the bottom shows, found that Red States impose lower real estate property taxes than Blue States.

Real Estate Property Tax Ranking By State

(click on map for interactive map showing ranking for each state)

Blue States vs Red States – Property Taxes

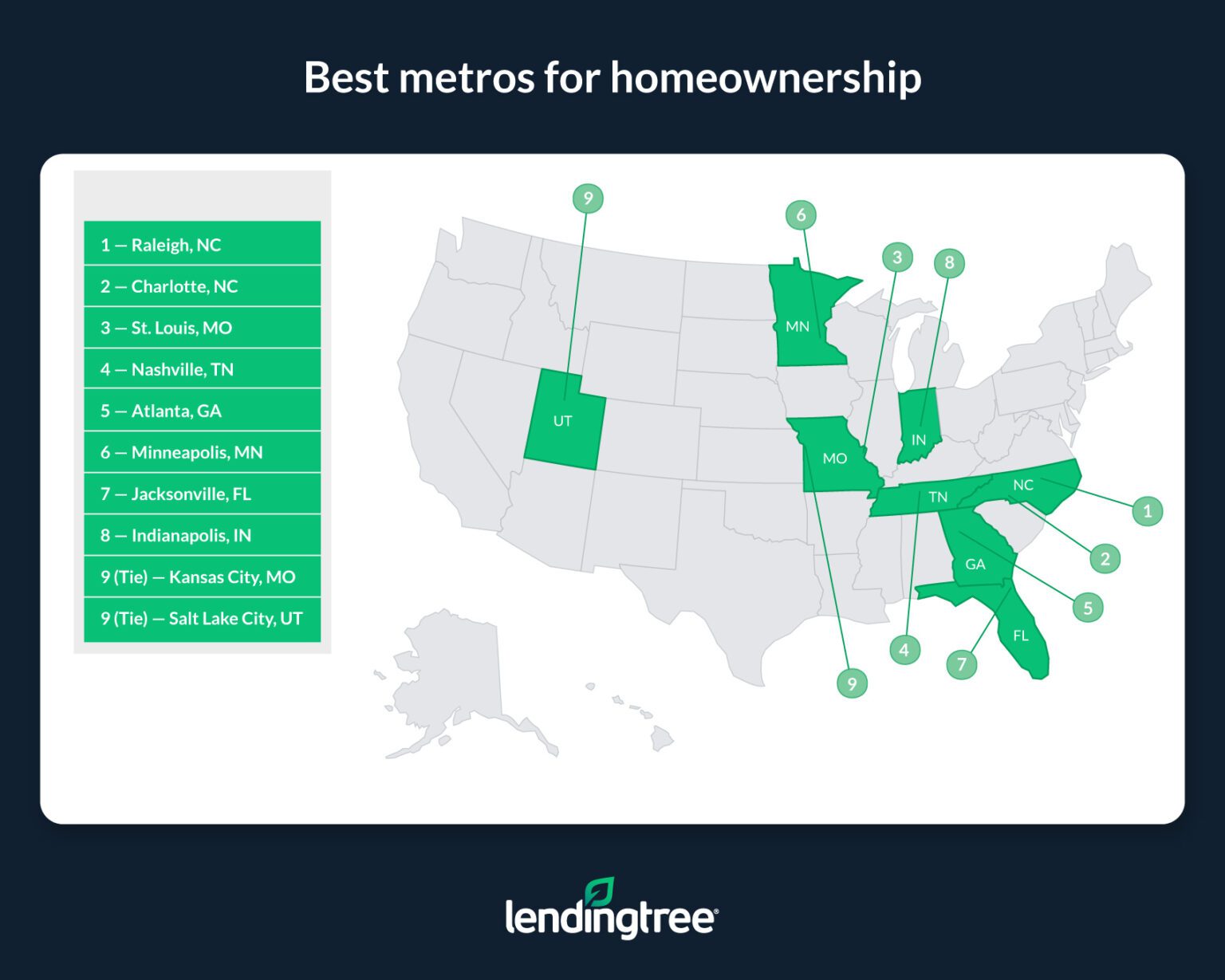

According to a newly released report by Lending Tree, St Louis is the third-best metro area in the U.S. for homeownership. The report ranks homeownership in metro areas based upon the Median ratio of housing costs to household income for owner-occupied homes.

Best Metro Areas In The U.S. For Homeownership

(click on infographic below for the complete list with details)

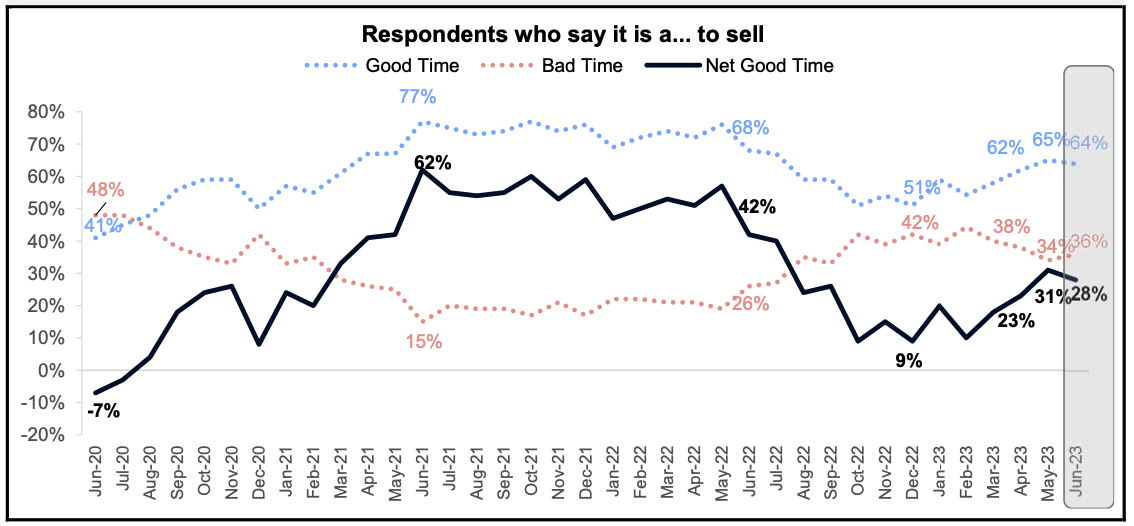

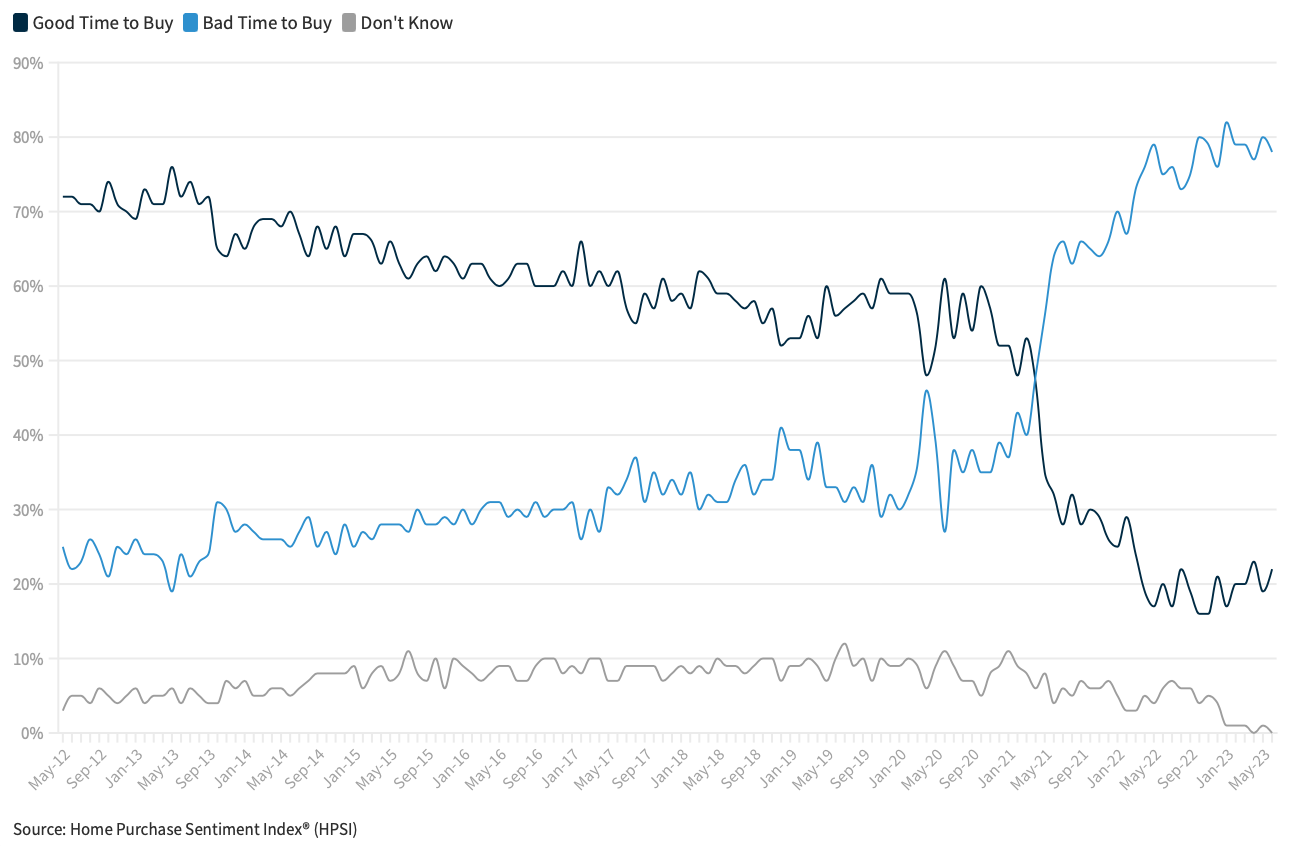

Every month Fannie Mae surveys consumers to gauge their sentiment toward whether its a good time to buy or sell a home and publishes the result in their Home Purchase Sentiment Index® (HPSI). In the most recent HPSI report, 78% of the people surveyed said they felt now was a bad time to buy a home, this is a decline from 80% in May. Conversely, 22% of consumers think now is a good time to buy a home up from 19% the month before. Interestingly enough, everyone had an opinion as the percentage of those that did not dropped to 0%, the first time it’s hit zero in the history of the survey.

Still a good time to sell..

Now is a good time to sell according to 64% of the consumers surveyed, which is down from 65% the month before and 36% think it’s a bad time to sell, up from 34% the month before.

[xyz-ips snippet=”Homes-For-Sale”]

Fannie Mae Home Purchase Sentiment Index Chart

(click on chart for live, interactive chart)

Is Now A Good Time To Sell?

(click on chart for the complete report)

[xyz-ips snippet=”Homes-For-Sale”]

Below is the St Louis Real Estate Market Report for May 2023 for the City and County of St Louis combined from St Louis Real Estate Search (the Official site). You can access the full infographic, containing data for St Charles, Jefferson and Franklin Counties as well by clicking on the image below.

In this competitive market don’t make decisions based upon bad data!

Today’s real estate market is unforgiving for homebuyers, driven by a scarcity of inventory and robust buyer demand. This, coupled with not just bidding wars but “terms wars”, has made it challenging for many. In an effort to stand out, homebuyers are waiving contingencies from their offers and pushing their budgets to the limit. Quite often, these buyers are willing to pay more than the actual worth of the property. As I previously addressed in my article, “Are Homebuyers Today Grossly Overpaying for Homes and Making Decisions They’ll Regret?“, this approach is acceptable, provided it’s a well-informed decision.

To make such decisions, you need accurate data and an experienced, professional agent who can interpret that data and apply it to your unique situation. This is why I take immense pride in our team at MORE, REALTORS®. Our agents are skilled professionals who can guide both buyers and sellers through the intricacies of the current market to a successful outcome.

To support our agents and clients, I invest considerable time in gathering, scrutinizing, and reporting on market information and data. I aim to provide the most precise data possible to empower smart, informed decision-making. While it’s true that no data can be 100% accurate in all respects, getting as close to that ideal as possible improves the odds of making sound decisions.

Don’t all agents have the same data?

It’s logical to think that all agents, especially those who are REALTORS®, have access to the same data. Indeed, in our area, all REALTORS® can access the most extensive and comprehensive source of information for the St Louis residential real estate market — MARIS, the REALTOR® Multiple Listing System (MLS). Yet, simply having access to this wealth of information is only the first step. It’s akin to the internet: while you can find nearly any information you seek online, the real challenge lies in knowing where to find it and determining the most accurate sources. The same principle applies to real estate market data available in the MLS.

While most agents aren’t data nerds and often depend on aggregated data provided by others, our agents, to some extent, do the same. However, a notable difference lies in their ability to define criteria and create their own reports for their clients using our proprietary software. Furthermore, they don’t simply accept the data we provide — they scrutinize it, cross-verify it, and highlight any errors they discover. This level of commitment, while humbling, is a testament to their dedication to accuracy, even when the data comes from a trusted source like our company.

Copy and Paste Culture Among Many Agents...

Contrary to the scrutiny that our agents apply to our data, many agents merely copy and paste infographics or reports they receive, without cross-checking the information. Take, for example, the infographic below showing the median sale price of homes in May 2023 for the city and county of St Louis combined as $255,000. Yet, numerous agents are sharing a report that states the median sale price for that market in May was $285,000. That’s nearly 12% higher than the actual figure, a discrepancy I deem significant. If you’re a buyer basing your offer, even partly, on market data, wouldn’t it be better to know the median price is actually $255,000 and not $285,000? Your next question might be, ‘How do you know your data is accurate?’ I’ve discussed this in detail in a previous article, which remains applicable today.”

Continue reading “St Louis Real Estate Market Report for May 2023 with accurate data you can trust“

As of April 1, 2023, the Federal Emergency Management Agency (FEMA) has put into action the National Flood Insurance Program’s (NFIP) Risk Rating 2.0, a newly devised pricing methodology. According to FEMA, this contemporary approach to flood risk assessment uses state-of-the-art technology and conforms to industry’s highest standards. The aim of this new model is to ensure that FEMA provides flood insurance rates that are not only actuarially justified, but also more equitable and comprehensible, and most importantly, they accurately represent the flood risk associated with a specific property.

There has been a fair amount of negative reports about the change in flood insurance pricing with 77% of the people with flood insurance seeing an increase in premiums as a result. For Missouri, 29.3% of homeowners with flood insurance will see a decrease in their flood insurance premium as a result with about 40% of these decreases being $50 per month or more. On the flip side, 62.4% will see an increase up to $10 per month, 6.1% with an increase from $11 to $20 per month and just 2.2% of the homeowners will see their flood insurance premiums increase by more than $20 per month.

Resources for more information on FEMA’s Risk Rating 2.0 as well as flood insurance:

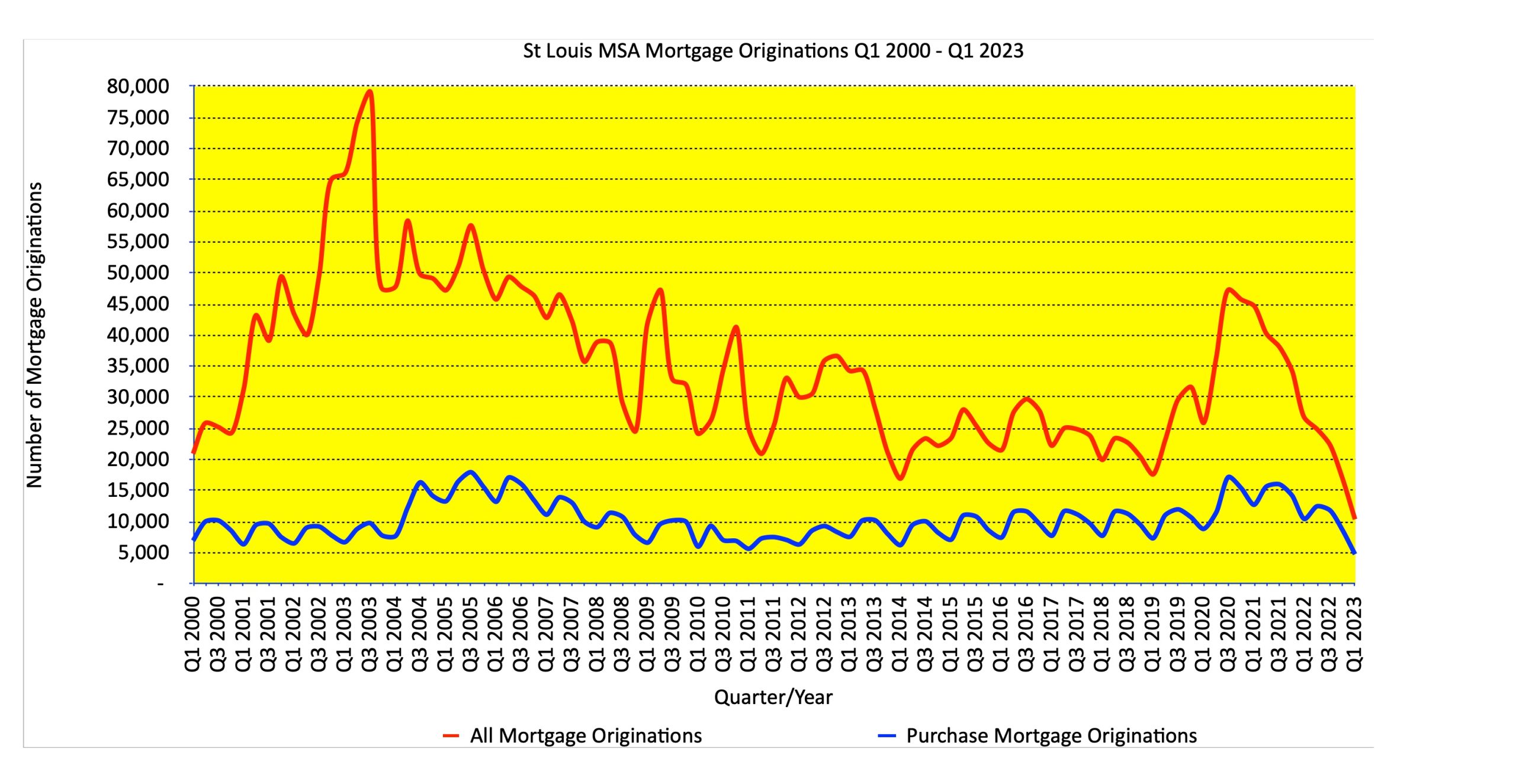

This might not come as a surprise, given that St. Louis home sales experienced a nearly 20% decline in the past 12 months compared to the previous year, coupled with 30-year fixed-rate loan interest rates approaching 7%. However, mortgage loan originations in St. Louis during the first quarter of this year have reached their lowest level since ATTOM Data began tracking them in the first quarter of 2000. As depicted in the chart below, both home purchase mortgages and total mortgage originations (including purchases and refinances) hit record lows in the first quarter of this year.

During the first quarter, the St. Louis MSA recorded 4,733 mortgage originations, marking a 45% decrease from the previous quarter’s 8,666 originations, and a 54% decrease compared to the same quarter in the previous year when 10,410 mortgages were originated for home purchases

St Louis MSA Mortgage Originations Q1 2000 – Q1 2023 (Chart)

Today, the U.S. Court of Appeals for the Seventh Circuit denied a motion by the National Association of REALTORS® (NAR) and other defendants in the Moehrl v. The National Association of Realtors lawsuit. The motion sought to appeal the decision certifying this case as a class action lawsuit. As a result of this denial, the lawsuit will be allowed to proceed.

Click here or on the image below to see the full ruling.

First and foremost, let me emphasize that home selling methods and practices are not a “one size fits all” approach. There are certainly situations where a different or unique strategy is required, including, in extreme cases, one that may not be in the seller’s best financial interest but favors a higher priority for the seller. For instance, I once handled a home sale for a woman with a stalker ex-husband who wanted her home sold discreetly – no sign, no ads, no MLS, etc. In her case, privacy and conducting the sale “under the radar” for her personal safety were more important than money. This article addresses the broader market and my opinion will apply to most sellers looking to sell their homes.

Now, let’s discuss an “office exclusive” listing.

Understanding this concept is a great starting point and highlights one of the reasons I’ve been writing articles about St. Louis real estate, St. Louis REALTORS®, and the St. Louis real estate industry. I believe that, in general, consumers lack sufficient knowledge about these matters to make the best choices for themselves when selecting agents to work with. As a result, I aim to share the insights I’ve gained from over 40 years in the industry. For example, most non-agent readers may not know what an “office exclusive” listing entails or whether it’s advantageous or disadvantageous for them as sellers. So, what is an office exclusive listing? In short, it’s a listing that the agent will “keep secret” to a large extent, only informing agents within their real estate brokerage and withholding your listing from the REALTOR® Multiple Listing System (MLS). Consequently, your listing will not be distributed to the thousands of websites that obtain listing information from the MLS (Zillow, Realtor.com and StLouisRealEstateSearch.com?agent_id=02107 to name a few).

Wait, my listing won’t be in the MLS??

What strange and confusing times we live in! Some seemingly credible predictions made by qualified experts suggest that our banking system could collapse, our currency may become worthless, and our country may face a significant downturn. Meanwhile, others claim that there is no cause for alarm. Here in St. Louis, the real estate market continues to thrive as if everything is great in our economy, despite the fact that interest rates have doubled in the past year. I have been in this business for 43 years, and although I have seen many ups and downs in the market, I have never seen anything quite like this before. It appears that there is a stark dichotomy between the economy and the St. Louis real estate market at present, as if they are two entirely separate entities. Could this be the result of the low inventory and high demand for housing, leading homeowners to throw caution to the wind? Or is it possible that the St. Louis economy is stronger than the national economy? Whatever the reason may be, despite talk at the national level of a looming housing market crash, the St. Louis real estate market continues to thrive.

Is the St Louis real estate market going to crash?

Now, onto the question of whether the St. Louis real estate market is going to crash. This is a fair question, given the current issues outlined above. However, so far, there are no clear signs of a crash. That’s not to say that there won’t be any changes to the market, as I believe we’ll see some, but nothing that indicates a crash is imminent at this point. Almost a year ago, I wrote an article in which I stated that “I don’t think St. Louis home prices will come crashing down, in fact, I don’t even think they are going to decline necessarily.” This prediction has proven to be accurate. However, I also said in that same article that “I think the premiums buyers have paid over and above the value of the home they were buying are going to quickly come to an end,” and this has proven to be inaccurate.

Despite my prediction, there are still bidding wars happening between buyers on new listings. The STL Market Chart table below shows that last month, the median price of homes sold was equal to 100% of the current list price at the time of sale. Given that the median is indicative of the midpoint of the frequency of values, if the midpoint is 100%, then it appears that plenty of homes are selling in excess of the list price.

The data for the St. Louis real estate market shows that there is a strong buyer demand. In addition, the market is facing the persistent issue of low inventory. These factors have contributed to the resilience of the St. Louis housing market, making it unlikely to succumb to a crash at this point. However, if there is increased economic uncertainty, inflation, and rising interest rates, we may reach a tipping point and see St. Louis home prices decrease. Despite this possibility, it is unlikely to happen anytime soon based on current data.

Continue reading “When will the St Louis real estate market crash?“

Recently I wrote a lengthy article about various current issues that are likely to bring significant changes to the real estate industry. These changes will also affect the process of buying or selling a home for consumers. Although I may be in the minority within the industry, I strongly believe that most, if not all, of the changes will benefit both consumers and real estate professionals.

One of the first changes that may happen is the elimination of the requirement for sellers to pay the commission to the buyer’s agent in order to list their property in the REALTOR® MLS system. Although sellers can still choose to pay buyers’ agents, the process will become more transparent for all parties involved.

One of the first changes that may happen is the elimination of the requirement for sellers to pay the commission to the buyer’s agent in order to list their property in the REALTOR® MLS system. Although sellers can still choose to pay buyers’ agents, the process will become more transparent for all parties involved.

Nearly two years ago, our brokerage, MORE, REALTORS® created an online real estate auction site called HomeAuctionMLS.com to provide an alternative for buyers and sellers that addresses many of the issues raised in class-action lawsuits and the investigation by the Department of Justice. The auction platform was designed to offer a transparent and fair process for both parties while ensuring that they still have the option to be represented by real estate professionals. Moreover, sellers do not have to pay the buyer’s agent’s commission, and they can even use the auction platform without paying any commission at all.

What are the benefits of selling your home on HomeAuctionMLS.com?

- Transparency: The auction process is transparent and open to all potential buyers, ensuring a fair market value for the property.

- Competitive bidding: Auctions generate competition among buyers, often resulting in higher sale prices than traditional listings.

- Control: The seller has more control over the sale process, including setting the reserve price and choosing the auction date.

- Reduced holding costs: Since the sale process is typically faster, the seller can avoid paying holding costs such as property taxes, utilities, and maintenance fees for an extended period of time.

- Convenience: Online auctions can be conducted from anywhere, allowing sellers to avoid the hassle of in-person showings and open houses.

- Increased exposure: Online auctions can attract a wider audience of potential buyers from all over the country, increasing the chances of a successful sale.

What are the benefits of buying a home on HomeAuctionMLS.com?

- Transparency is key in the auction process, as it ensures that all potential buyers have an equal opportunity to make a purchase. This means that you won’t lose out on a property simply because of the timing of your offer, or because you chose not to include a letter to the seller. Furthermore, the open and transparent nature of auctions ensures that you won’t be outbid by another purchaser who offers different terms than yours. Overall, the transparency of the auction process promotes fairness and equal access to all potential buyers.

- You’re the one in control during an auction. Unlike in a traditional real estate transaction where the listing agent or seller has the final say on which buyer to accept or which escalation clause to activate, the decision to purchase the property is entirely up to you. You have the power to keep bidding if you want to, and you also have the power to remove yourself from the equation if the bidding gets to a point where you are no longer interested. Essentially, you are in control of the entire process and can make decisions based on your own preferences and priorities. By taking control of the situation, you can feel confident that you are making the best decision for yourself and your future.

If you would like to learn more about buying or selling a home, condo, or other property at auction, please don’t hesitate to contact us by clicking the button below. Additionally, you can find additional resources and information below to help you get started.

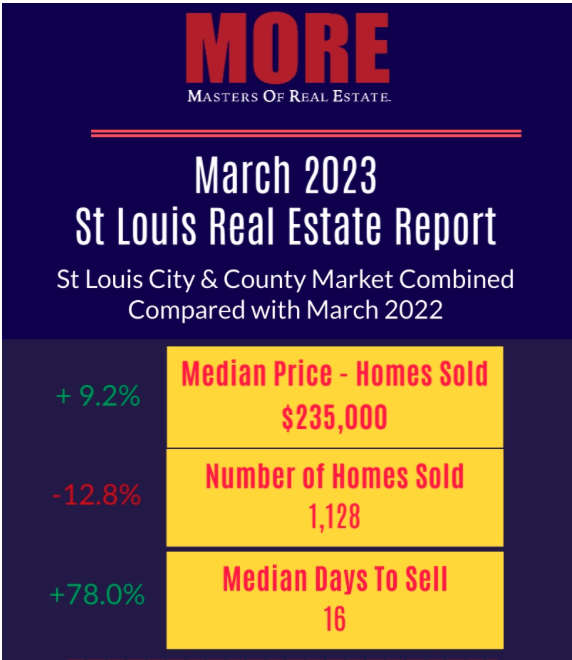

Below is our St Louis Real Estate Market Report for March 2023 for the City and County of St Louis combined. You can access the full infographic, containing data for St Charles, Jefferson and Franklin Counties as well by clicking on the image below.

St Louis Real Estate Report for March 2023

Let me begin by saying that I’m not a sensationalist, nor am I an advocate for everything I write about. Additionally, I am not an attorney, so this not a legal opinion. I am simply a real estate broker that has been very active in the profession and industry for over 40 years now. I strive to stay on top of industry and market changes so that the agents in our firm, MORE, REALTORS®, and their clients can avoid surprises and be prepared. Another reason I do this is to share what I have learned with consumers. I believe that by sharing good, relevant and accurate information to consumers, they will be equipped to make better decisions when it comes to buying or selling real estate, including how to choose an agent to best represent them.

So, what is going to turn the real estate industry upside down?

So, what is going to turn the real estate industry upside down?

Yes, I made a rather bold statement in my headline, but I believe it to be an accurate depiction of what is coming to the world of residential real estate, including right here in St Louis. The source of this disruption is not a single entity, but rather many. While there is a common theme to the multiple threats, they are coming from different sources. Over the past few months, I have written about all the issues I’m referring to, so below is a summary of them and links to the original articles:

- Moerhl v NAR Lawsuit. 3/22/2019 – This suit was filed against The National Association of REALTORS® (NAR), Realogy Holdings Corp, HomeServices of America, Inc, Re/Max Holdings, Inc and Keller Williams Realty, Inc. The suit alleges that the defendants were “conspiring to require home sellers to pay the broker representing the buyer of their homes, and to pay at an inflated amount, in violation of federal antitrust law.” At the heart of this claim is the NAR rule that requires sellers to offer compensation to the buyer’s agent in order to be eligible for listing in the MLS.

- Department of Justice (DOJ) Complaint against NAR. 12/01/2020. The DOJ filed a complaint against NAR, as well as a settlement agreement, focused on two primary issues; 1. Allowing buyer brokers to misrepresent to buyers that a buyer broker’s services are free; 2.Enabling buyer brokers to filter MLS listings based on the level of buyer broker commissions offered and to exclude homes with lower commissions from consideration by potential home buyers;

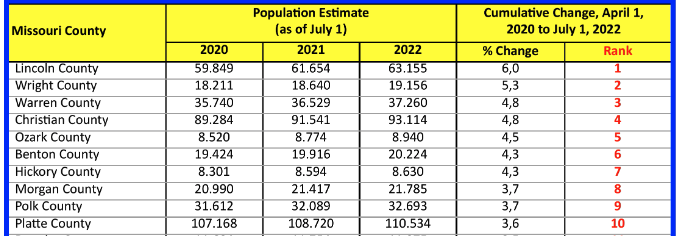

According to the U.S. Census Bureau’s 2022 estimates of population and components of change report released yesterday, Lincoln County was the Missouri county that experienced the highest percentage gain in population from 2020 – 2022. As the list below shows, Lincoln County saw a 6.0% increase in popular during the period from 2020 to 2022, with Wright County coming in 2nd at 5.3% and another St Louis MSA county, Warren County, coming in 3rd on the list with a 4.8% increase in population.

At the other end of the list was the City of St Louis which saw a 5.0% decline in population during the period giving it the rank of 113 of the 115 counties in Missouri that were ranked.

Missouri Population Change 2020-2022 By County

Top 10 Counties by Percentage Growth In Population

(click on list to see entire list showing all Missouri Counties)

Access the complete list HERE.

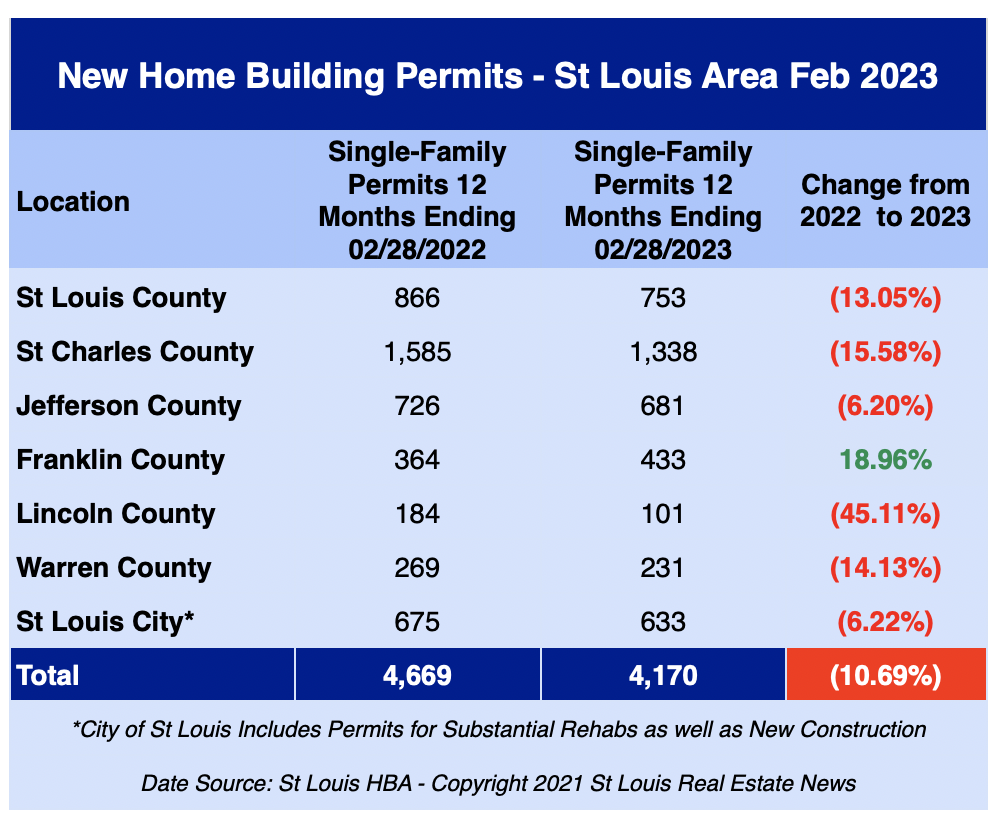

There were 4,170 building permits issued for new single-family homes in the St Louis area during the 12-month period ended February 28, 2023, a decrease of 10.69% from the same period a year ago when there were 4,669 permits issued, according to the latest data from the Home Builders Association of St. Louis & Eastern Missouri (St Louis HBA). Six of the seven counties covered in the report saw a decline in building permits from the same period a year ago with four of them experiencing double-digit declines. Franklin County, on the other hand, saw an increase of nearly 19%.

St Louis New Home Building Permits – February 2023

(click on table below for page with live charts showing additional permit data)

For the past several months there have been many reports anticipating the moves of the Federal Reserve regarding interest rates then followed by tons of articles, blog posts and videos analyzing then predicting the impact of the Fed’s decision on the economy. The other popular topic in this area is the “Money Supply”, usually M2 money supply and whether it’s increasing or decreasing as well as the impact on the economy.

Should St Louis homeowners and potential home buyers really care about the Fed Funds rate or M2 money supply?

First, let’s talk about the Fed Funds rate and what it is, what it is intended to do and the affect it can have on the real estate market. The Fed Funds rate is the interest rate at which banks lend to each other overnight to maintain their reserve requirements. This rate is set by the Federal Reserve, and changes to the rate can have a ripple effect throughout the economy, including the mortgage and housing markets. When the Fed lowers the Fed Funds rate, it can stimulate economic growth by making it cheaper for banks to borrow money, which can lead to lower mortgage interest rates. Lower mortgage rates make it more affordable for homebuyers to finance their purchases, which can increase demand for homes and drive up prices. Conversely, when the Fed raises the Fed Funds rate, it can lead to higher mortgage interest rates, which can slow down the housing market and lead to lower demand and prices.

Next, the the M2 money supply. The M2 money supply includes cash, checking accounts, savings accounts, and other liquid assets that can be easily converted into cash. When the M2 money supply increases, it can stimulate economic activity by making more money available for borrowing and spending. This can lead to lower mortgage interest rates as well, as banks have more funds available to lend out. However, if the M2 money supply increases too rapidly, it can lead to inflation, which can cause mortgage interest rates to rise.

So, as you can see, both the Fed Funds rate and M2 money supply can have a significant impact on the cost of a home mortgage as well as home prices so I would say the answer to the question I posed is “yes”. Granted, we don’t all need to become economists or stay up late at night pouring through spreadsheets and date, but to be aware of factors that affect the economy as a whole and as a result, the real estate market we’re in, would be wise.

How can knowledge of the Fed Funds rate and M2 money supply help me as a home seller or buyer?

The short answer is, it gives you a little insight into perhaps where things are headed which may help you make the decision to buy or sell sooner or later. For example, perhaps you are contemplating buying an home but anguishing over the fact the mortgage interest rates are double what they were a year or two ago and you’re thinking maybe you should wait until things settle down. Well, if you see the Fed Funds rate getting increased with talk of more increases while that is no guarantee mortgage interest rates will increase as well, as I explained above, it’s certainly an indicator that is a likelihood. Therefore, you may decide it’s better to make a move now than later.

What’s an easy way to track this stuff?

I have the answer for you. The charts below are two of the many charts and other information available on St Louis Real Estate Search as well as from MORE, REALTORS® . The first chart shows the relationship historically between St Louis home prices and the M2 Money Supply. Generally, they follow the same trend but, when the trend for one changes, like it did with St Louis home prices (the red line on the chart) beginning in the late 90’s through the housing market bubble burst after 2006, something happens to bring them back in line. As you can see, starting a little over 3 years ago the pace at which M2 was growing outpaced St Louis home prices, but St Louis home prices quickly caught up. Now it’s the opposite and it looks like both a making a downward correction.

The bottom chart shows the close relationship between the Fed Funds rate and mortgage interest rates. With little exception, when the Fed Funds rate increases or decreases, mortgage rates follow. For the past year, the Fed Funds rate has increased and the trend is upward so I wouldn’t expect to see falling mortgage interest rates anytime soon.

What happens when you pair up Ted Gottlieb, Certified Senior Advisor® (CSA®) that’s a real estate broker with a real estate broker (me) that’s Smart Home Certified? You end up with solutions for older adults that allow them to live more efficiently, for longer, in their current home by increasing safety, security, accessibility and independence. Before I get to the Smart Stuff, let me explain what a CSA® is and how rare it is for a REALTOR® to also be a CSA®. Ted is the first, and only as of this article, in Missouri to achieve this.

A Certified Senior Advisor® (CSA®) is a professional who has obtained a credential demonstrating expertise in the issues and concerns that affect seniors. These professionals are trained to provide guidance and support to seniors and their families in a variety of areas, including healthcare, financial and estate planning, and housing. This is rigorous training that allows the recipient to be well-versed in the complex issues that seniors face while avoiding conflicts of interest.

So how do we use Smart Home technology to better serve seniors? Here are a few of the numerous benefits for seniors:

Safety and security: Smart home devices such as smart locks, cameras, and motion sensors can help seniors feel more secure in their homes by alerting them to potential security risks and allowing them to monitor their home remotely.

Comfort and convenience: Smart thermostats, lighting, and other devices can be programmed to adjust automatically to the user’s preferences, making it easier for seniors to stay comfortable and maintain their daily routines.

Accessibility: Smart Home technology can make it easier for seniors with mobility or vision impairments to control their home environment, such as using voice commands to turn on lights or adjust the thermostat.

Health monitoring: Smart home devices can track seniors’ vital signs, remind them to take medications, and even alert caregivers or emergency services in case of a medical emergency. There are even devices that will automatically dispense medications at a preset time of day.

Independence: By enabling seniors to control their home environment more easily, Smart Home technology can help them maintain their independence and stay in their own homes for longer.

Overall, Smart Home technology can be a valuable tool for seniors to enhance their safety, comfort, and quality of life. Trust and peace of mind matter so consider allowing the region’s first and only two brokers, with the specialized knowledge necessary, help your senior live smarter and more efficiently. If you’re not a senior, we can still help you prepare your current home for when you become a senior or get you into the right home now so you can live out your days more conveniently. The sooner you learn this technology the better. None of us are getting any younger…

About the author…

John Donati, REALTOR®Smart Home CertifiedAccredited Buyer’s Representative (ABR®)Military Relocation Professional (MRP)

About Ted…

Ted Gottlieb, REALTOR®Certified Senior Advisor®Seniors Real Estate Specialist®Certified Seniors Housing Professional™Certified Seniors Downsizing Coach ™

Note: I’m generalizing ……..

Seniors don’t want to leave their homes. I can’t tell you how many times I’ve been told “I want to be carried out feet first”.

For most, the thought of selling the home is overwhelming – often paralyzing. Maybe it’s the memories, the years of accumulated “stuff”, lack of energy or the fear of what comes next. No matter the reason, just like you and me, older adults want to be where they feel safe. Enjoying their “independence” – when many times they are anything but.

So, it’s status quo until a life event happens – like the loss of a spouse, a fall, illness, a diagnosis. Still, many times the goal is to stay home, maybe with help (family member or paid companion) or not.

This took me a while to figure out. Frankly, when I decided to specialize in seniors real estate (2011), I didn’t know what I was getting myself into. I related well to older adults and wanted to differentiate myself from the thousands of other agents so this seemed like the right path. What I didn’t count on was overwhelming desire to stay put.

So I figured, if they are not ready to sell, why not help them stay put longer and safer. I earned an aging in place designation and promoted myself as the real estate agent who helped people stay in their homes longer. Brilliant! It didn’t help pay the bills, but boy did I sleep well at night. What I did come to appreciate was the seniors I met, helped, enjoyed, protected. I got paid in coffee, corn bread and good karma ….. and every so often I got to sell a home.

I learned some things along the way that you might find helpful: Older adults are chiefly concerned with maintaining control and their legacy (David Solie); Some family members are well intended while others are anything but; The equity in the home can be essential to someone’s care and legacy (so selling to that seemingly nice person who’s willing to pay cash and close fast rarely benefits the home owner or the neighbors); Not having an estate plan is more expensive than having one; Hiring a care manager is money well spent; Finding the right senior living community the first time matters, and so much more.

To the general public, I offer my older adult consulting and referral services without cost or obligation – really! To the licensed real estate professional, I offer my insight and mentorship, for the asking.

What I crave is that we honor our elders and treat them with the respect they so richly deserve. As the good books says, “love thy neighbor as thyself”.

About the author…

Ted Gottlieb, REALTOR®

Certified Senior Advisor®

Seniors Real Estate Specialist®

Certified Seniors Housing Professional™

Certified Seniors Downsizing Coach ™

314.956.9477

Ted@TrustInTed.com

TrustInTed.com

Licensed In Missouri since 2003 | MORE™, REALTORS® | 314.690.9922

Should I rent or buy a home in St Louis? This is a question St Louis REALTORS® are often asked, especially in the past few years while homes appeared to be increasing weekly, there were often more than a dozen offers on a listing and generally the market seemed out of control. Granted, some of that pandemonium has eased somewhat lately given the increase in interest rates and questions about the economy but the question still remains. While there are many non-financial reasons people choose to buy their own home or condo versus rent, we’ll just look at the cost today.

Home prices increased at more than double the rate of rents…

As the chart below, exclusively available from MORE, REALTORS®, shows, the median price of homes sold in St Louis during 2018 was $178,800 and increased to $240,000 in 2022 for an increase of over 34% during the 4-year period. The median rental rate of homes leased in St Louis during 2018 was $1,250 and increased to $1,450 in 2022 for an increase of 16% during the same 4-year period. During this 4-year period the rate at which the price of St Louis homes increased was more than double the rate at which the rental rates of St Louis homes increased.

Factor in interest rates and the cost of home ownership increase and monthly cost of home ownership

As the second chart below shows, mortgage interest rates during 2018 were in the mid-to upper 4’s and in the 6’s and even hit 7% during 2022 so this means in addition to home prices going up, payments went up even more. For the sake of this comparison, we’ll use 4.7% as the rate for 2018 and 6.7% for 2022. Therefore, the payment on a typical home in 2018 (principal and interest only based upon a 5% downpayment) would have been $881 per month and in 2022 increased by 67% to $1,471 per month. So, while the actual price of a home increased 34% during the period the monthly cost of it, in terms of house payment, increased at nearly double that rate, 67%. During the same period rents increased just 16% so the monthly cost of buying a home increased four-times as much.

Continue reading “St Louis Home Prices Increased At Twice The Rate Of Rental Rates From 2018-2022“

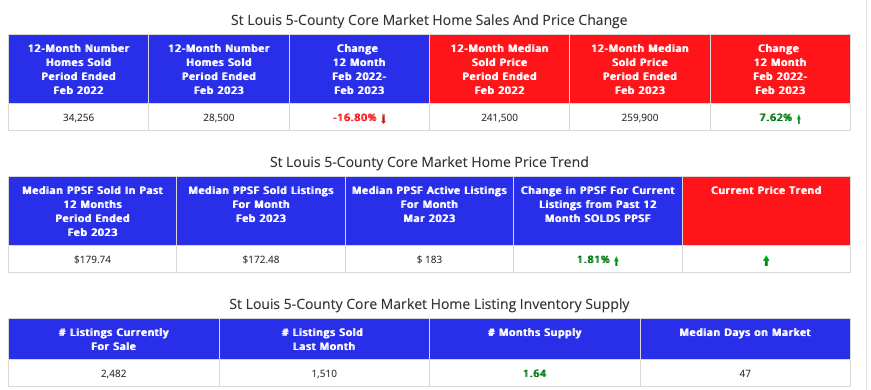

There were 28,500 homes sold in the St Louis 5-county core market during the 12-month period ended February, 28, 2023 a decline of 16.80% from the prior 12-months when 34,256 homes were sold according to MORE REALTORS® exclusive STL Market Report below. As the report below shows, the median price of homes sold in St Louis increased 7.62% during the same period.

While the supply of St Louis homes for sale is still historically very low, it has increased significantly over the past two years rising from under a 1-month supply to the current 1.64 month supply of homes currently active on the market in St Louis.

St Louis 5-County Core STL Market Report

(for the 12-month period ended February 28, 2023)

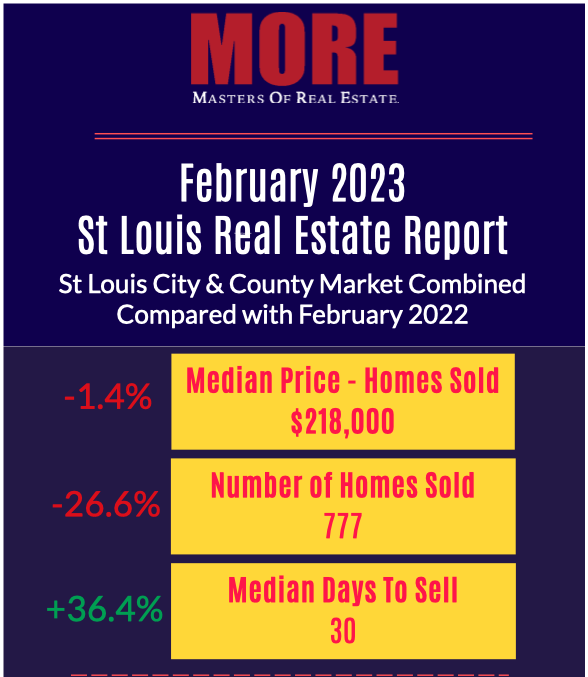

Below is our St Louis Real Estate Market Report for February 2023 for the City and County of St Louis combined. You can access the full infographic, containing data for St Charles, Jefferson and Franklin Counties as well by clicking on the image below.

St Louis Real Estate Report for February 2023

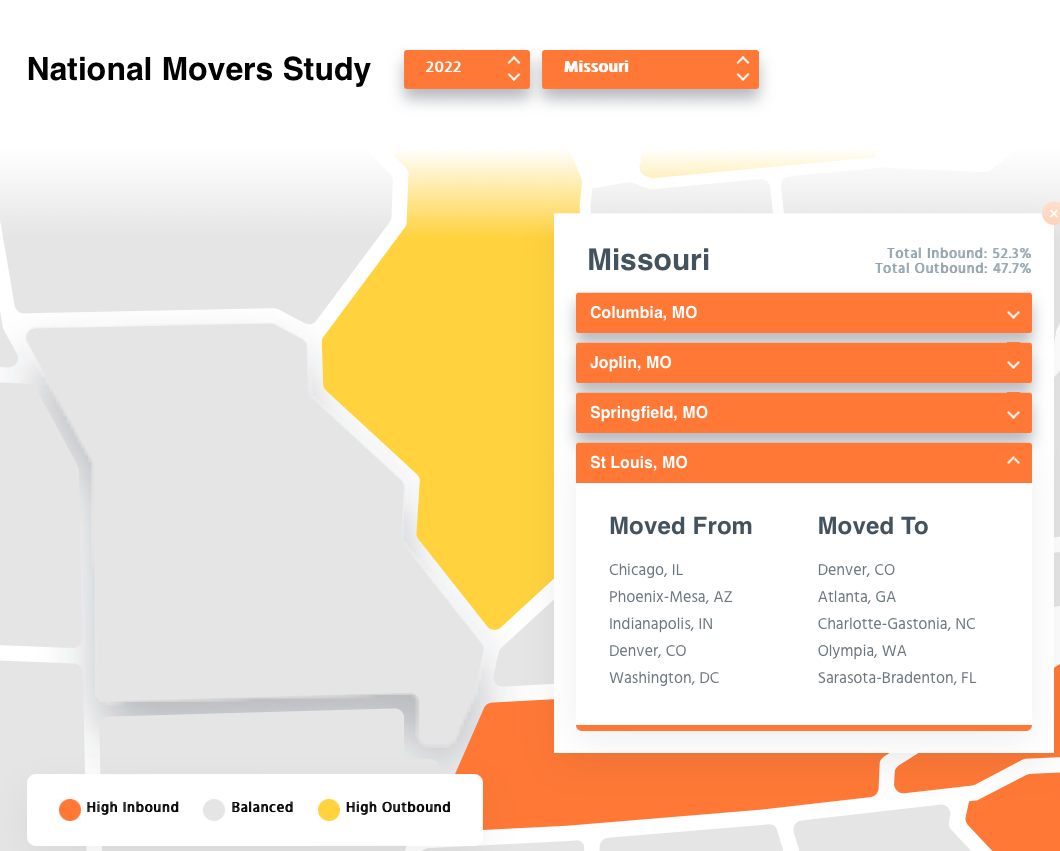

Allied Van Lines just released its Allied Magnet States Report which revealed that, across the U.S., fewer people moved in 2022 than in 2021. The report shows the number of people moving to or from a State as well as for the metropolitan areas located in that state. For last year, Missouri was considered a “balanced” state with the numbers of inbound and outbound movers being about the same at 52.3% and 47.7% respectively. Our neighbor to the east, Illinois, didn’t fair as well. Illinois was labeled as a “high outbound” state for 2022 with 66.1% of the moves being outbound and only 33.9% being inbound.

The most popular cities to move to St Louis from and the most popular cities to move to from St Louis.

According to the report, the city the largest number of inbound moves to St Louis were from was Chicago, IL and for the folks leaving St Louis and headed out of state the number one destination was Denver, CO. The table below shows the top 5 cities where people move to from St Louis as well a the top 5 they moved here from.

Top 5 Cities Inbound Movers to St Louis Come From and Top 5 Cities Attracting St Louis Residents

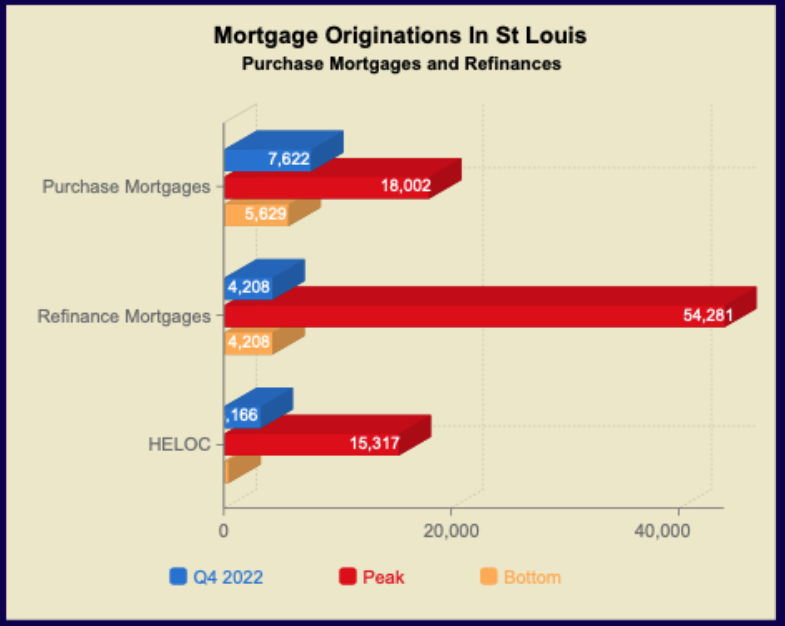

During the 4th quarter of 2022, 7,622 home buyers in St Louis applied for a home mortgage according to the latest report from ATTOM Data. According to the report, this is the lowest number of mortgage applications in a quarter from home buyers in St Louis since the 1st quarter of 2011 when there were just 5,629 applications. Mortgage applications to purchase a home peaked in St Louis in the 3rd quarter of 2005 when there were 18,002 applications.

As the chart below illustrates, the drop in St Louis homeowners refinancing their mortgage is even more dramatic. During the last quarter of 2022, 4,208 homeowners refinanced their existing mortgage marking the lowest number for a quarter in St Louis since AATOM began tracking the data back in 2000. The refinancing boom in St Louis was during the 3rd quarter of 2003 when 54,281 St Louis homeowners refinanced their mortgage.

HELOC’s (home-equity line of credit) are down in St Louis as well. During the 4th quarter of 2022, 3,166 St Louis homeowners took out a HELOC compared with 15,317 that did so during the HELOC peak in Q3 2003. HELOC’s hit their low point during the 3rd quarter of 2000 when just 356 were originated.

[xyz-ips snippet=”Interest-Rates-and-Traci-Everman-Promo”]

St Louis Mortgage Originations In St Louis – Q4- 2022

(click on chart for Live, Interactive chart)

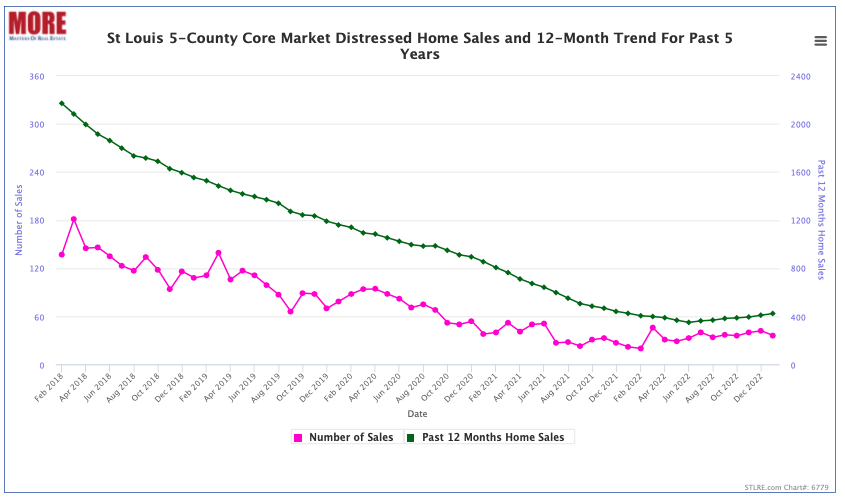

There have been a fair number of reports about the increase in distressed home sales in various markets around the country and on the national level. However, in St Louis, distressed home sales are on the rise, they are still at levels that are historically quite low.

Distressed home sales that involve some sort of distress or other condition that would typically result in the home not selling for a normal “retail” price like it would if it were a typical listing in market ready condition with normal marketing time allowed. The chart below shows distressed home sales in the St Lous 5-County core market over the past years and also shows the 12-month sales trend. For our purposes, we include probate sales, short-sales, foreclosures, and bank and government owned homes as distressed sales. As the chart illustrates, the 12-month sales trend has increased for 5 consecutive months but is still at a level that is significantly lower than it has been for the bulk of the 5-year period illustrated on the chart.

St Louis 5-County Core Market Distressed Home Sale and 12-Month Trend for Past 5 Years

(click on chart for live, interactive chart with the latest data)

Last week, there were 405 new listings of homes for sale in the St Louis 5-county core market, according to the STL Real Estate Trends Report from MORE, REALTORS®. During the same week, there were 365 new sale contracts written on homes for sale resulting in a new listing to new contract ratio of 1.11. As the tables below illustrate, the only county that had more new sales last week than new listings was Franklin County with 16 new sales and 15 new listings.

Listing supply remains low…

As the table at the bottom shows, as of today, there is just a 1.22 month supply of listings on the market for the St Louis 5-County Core market. While the current months supply is about double what it was a little over a year ago, it is still very low, historically speaking.

Last week, there were 350 new listings of homes for sale in the St Louis 5-county core market, according to the STL Real Estate Trends Report from MORE, REALTORS®. During the same week, there were 442 new sale contracts written on homes for sale resulting in a new listing to new contract ratio of 1.26. So while new contracts are still out numbering new listings, last weeks margin was much lower than a year ago during the same week. As the tables below show, last year during the same week there were only 266 new listings of homes for sale and 520 new sale contracts for a ratio of nearly two to 1 (1.95). Granted, this is just for a one-week period so I’ll be watching this weeks numbers to see if the pattern continues.

Continue reading “St Louis New Listings and New Contracts Trend Indicating an Easing in Demand“