By Dennis Norman, on February 27th, 2026

St. Louis homebuyers are witnessing a gradual climb in mortgage rates this February 2026, as the 30-year fixed rate ticks up to 6.00%, marking a modest 0.01% increase from the previous rate. This rise is part of a broader upward trend affecting various mortgage products in the region. The 15-year fixed rate has also seen an uptick, now standing at 5.62%, a 0.04% increase that could influence the decision-making process for potential buyers looking at shorter loan terms. Other products, including the 30-year FHA and Jumbo loans, as well as the 7/6 SOFR adjustable-rate mortgage, have similarly experienced rate increases.

Continue Reading →

By Dennis Norman, on February 21st, 2026

The St. Louis City real estate market has experienced notable shifts as of February 2026. Homes sold for a median price of $200,500 in January 2026, marking a 7.79% decrease from January 2025’s median of $217,450. This price also reflects a 14.68% decline from December 2025, when the median price was $235,000. The median list price in January 2026 stood at $199,700, down 15.02% from $235,000 a year earlier.

In terms of sales volume, there were 154 home sales in January 2026, representing an 8.33% decrease from the 168 homes sold in January 2025. These statistics, along with other key Continue Reading →

By Dennis Norman, on February 20th, 2026

In February 2026, the Franklin County real estate market experienced notable shifts in both home prices and sales activity. Homes sold for a median price of $260,000 in January 2026, marking a 9.57% decrease from January 2025’s median price of $287,500. This recent median price also represents a 7.64% decline compared to December 2025, when the median sold price was $281,500. Despite the drop in sold prices, the median list price saw a significant increase, reaching $310,000 in January 2026—a 16.54% rise from $266,000 in January 2025.

The number of home sales in Franklin County also saw an uptick, with Continue Reading →

By Dennis Norman, on February 19th, 2026

A newly filed federal class action lawsuit in Missouri is taking aim at Columbia, Missouri based Veterans United Home Loans, alleging illegal steering practices, undisclosed kickbacks, and violations of federal consumer protection laws. Because the company is headquartered in Missouri and operates nationwide, this case could have meaningful implications for home buyers, agents, and lenders right here in the St. Louis area.

The lawsuit, filed in the U.S. District Court for the Western District of Missouri, claims Veterans United and related entities engaged in practices that allegedly steered VA borrowers to affiliated real estate agents and back to Veterans United Continue Reading →

By Dennis Norman, on February 19th, 2026

February 2026 brings with it a slight rise in mortgage rates for the St. Louis area, with the 30-year fixed rate now standing at 6.05%, marking a 0.01% increase from previous levels. This upward movement is mirrored in the 15-year fixed rate, which also experienced a 0.01% uptick, now at 5.62%. These increases indicate a steady climb in borrowing costs, reflecting broader market trends and economic conditions.

For potential homebuyers in St. Louis, the gradual rise in rates means higher monthly payments, which could impact affordability and purchasing decisions. Sellers may also feel the effects, as rising rates could dampen Continue Reading →

By Dennis Norman, on February 19th, 2026

The St. Louis County real estate market has shown notable shifts as we enter February 2026. In January, homes sold for a median price of $250,500, marking an 8.68% increase from the $230,500 median price in January 2025. However, this figure represents a 4.39% decrease compared to December 2025, where the median sold price was $262,000.

The median list price in January 2026 was $209,950, significantly lower by 25.02% compared to $280,000 in January 2025. Additionally, there were 679 home sales recorded, a 7.99% decrease from the 738 sales in January of the previous year.

For a detailed visual representation Continue Reading →

By Dennis Norman, on February 18th, 2026

The Missouri Department of Commerce and Insurance is encouraging homeowners across the state to review their preparedness plans and consider earthquake insurance as more coverage options become available statewide. February is Earthquake Awareness Month, and according to DCI, insurers are expanding their presence, even in higher risk areas such as the New Madrid Seismic Zone.

In a recent news release, DCI Director Angela Nelson emphasized the importance of preparation, stating, “It’s not something we like to think about, but Missouri has a significant risk for another major earthquake. Being prepared means having a plan for how you will recover when Continue Reading →

By Dennis Norman, on February 17th, 2026

As of January 2026, the St. Louis metropolitan area, spanning counties in both Missouri and Illinois, has experienced a slight decline in home sales compared to the previous year. A total of 1,918 homes have been sold, marking a 2.59% decrease from the 1,969 homes sold during the same period in 2025. This subtle shift in the market indicates a potential opportunity for both buyers and sellers to reassess their strategies as the year progresses. Despite the dip, the market remains relatively stable, offering families and individuals a wide range of options to explore when considering a move within this Continue Reading →

By Dennis Norman, on February 16th, 2026

The St. Louis metropolitan area, spanning both Missouri and Illinois, is experiencing a dynamic real estate market, with certain zip codes standing out for their rapid sales. Leading the pack is a zip code in St. Clair County, IL, where homes are selling at lightning speed, averaging just -19 days on the market. This area offers affordability with an average listing price of $43,113, making it an attractive option for budget-conscious buyers and investors alike.

Following closely is a zip code in Jefferson County, MO, where listings average 24 days on the market, and another in Madison County, IL, with Continue Reading →

By Dennis Norman, on February 16th, 2026

The Jefferson County real estate market saw notable shifts in January 2026, as homes sold for a median price of $280,000. This marks a slight decrease of 1.75% from January 2025, where the median price stood at $285,000. However, there was a modest increase of 0.92% compared to December 2025, when the median sold price was $277,450.

The median list price in Jefferson County surged to $334,900, a significant 16.69% rise from $287,000 in January 2025. This increase in listing prices indicates a competitive market environment. Additionally, the number of home sales in January 2026 climbed to 185, reflecting Continue Reading →

By Dennis Norman, on February 12th, 2026

February 12, 2026 – Homebuyers and sellers in the St. Louis area are seeing continued upward movement in mortgage rates as the 30-year fixed rate reaches 6.14%, marking an increase of 0.03% from previous figures. This trend reflects a broader rise in mortgage rates across various loan types, including the 15-year fixed rate which has edged up to 5.71%, and the 30-year jumbo rate now at 6.30%.

For St. Louis buyers, these rate increases mean potentially higher monthly payments, influencing the affordability of homes in the area. Sellers may also feel the impact, as rising rates could temper buyer Continue Reading →

By Dennis Norman, on February 12th, 2026

In the competitive St. Louis real estate market, understanding which school districts are in high demand can be crucial for both home buyers and sellers. Currently, the Columbia DIST 4 in Monroe and St Clair Counties, Illinois, leads the pack as the fastest selling school district. With only 8 listings on the market for an average of 36 days and an average list price of $454,963, this area is attracting families looking for quick transactions and desirable homes. Columbia DIST 4’s appeal is evident in its swift market movement, making it a prime location for those looking to buy or Continue Reading →

By Dennis Norman, on February 9th, 2026

The metro east real estate market experienced a slight decline in home prices in January 2026, with homes selling for a median price of $180,000. This marks a 2.70% decrease from January 2025, when the median sold price was $185,000. Additionally, the January 2026 median price represents a 6.25% drop from December 2025, which saw a median sold price of $192,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $215,000, a 4.88% increase from $205,000 in January 2025. The number of home sales in the metro east also saw a modest increase, with Continue Reading →

By Dennis Norman, on February 8th, 2026

There is a limited window for St. Louis area residents to seek federal compensation for serious illnesses tied to historic radiation exposure, and time is not on their side. The Radiation Exposure Compensation Act, commonly known as RECA, was reauthorized in July 2025 and the deadline to file a claim is December 31, 2027. For many families in North County and surrounding areas impacted by Manhattan Project waste, this program may finally provide long overdue financial relief.

RECA is a federal law administered by the U.S. Department of Justice Radiation Exposure Compensation Program. It was created as a non adversarial Continue Reading →

By Dennis Norman, on February 8th, 2026

The St. Charles County real estate market experienced notable changes in January 2026. Homes sold for a median price of $344,900, marking a 2.19% increase from January 2025’s median of $337,500. However, this figure also reflects a 6.78% decrease from December 2025, when the median sold price was $370,000. The median list price in January 2026 was $446,345, a significant 23.98% rise from $360,000 in January 2025.

In terms of home sales, there were 270 transactions in January 2026, representing a 16.92% decrease from the 325 sales recorded in January 2025. The chart below, available exclusively from MORE, REALTORS®, provides Continue Reading →

By Dennis Norman, on February 7th, 2026

The St. Louis Metropolitan Statistical Area (MSA) experienced a notable shift in its real estate market as of February 2026. According to recent data, homes in the region sold for a median price of $255,000 in January 2026, marking a 1.92% decrease from the $260,000 median price recorded in January 2025. This decline is further emphasized by a 7.27% drop from December 2025, when the median sold price was $275,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $295,000, reflecting a 5.36% increase compared to $280,000 in January 2025. However, the number of Continue Reading →

By Dennis Norman, on February 5th, 2026

As of February 5, 2026, St. Louis homebuyers are facing a steady climb in mortgage rates, with the 30-year fixed rate holding firm at 6.20%. This rate stability, despite the overall rising trend, indicates that the market is maintaining moderate levels just above the 6% mark. Meanwhile, the 15-year fixed rate remains unchanged at 5.76%, offering a slightly more affordable option for those looking to pay off their loans more quickly. In contrast, the 30-year Jumbo and FHA rates have seen increases, now at 6.36% and 5.84% respectively. The adjustable 7/6 SOFR ARM also rose, now sitting at 5.64%.

For Continue Reading →

By Dennis Norman, on January 29th, 2026

As of January 29, 2026, mortgage rates in St. Louis reflect a rising trend, with the 30-year fixed rate inching up to 6.16%, marking an increase of 0.01% from the previous rate. Despite the modest change, this movement keeps rates at moderate levels above 6%, which may influence homebuyers to act sooner rather than later. Meanwhile, the 15-year fixed rate remains steady at 5.75%, providing an alternative for those looking to minimize interest payments over a shorter term.

For St. Louis area buyers and sellers, these rate changes may have significant implications. Buyers might face slightly higher monthly payments, which Continue Reading →

By Dennis Norman, on January 25th, 2026

Homeowners researching how to sell their house today will quickly run into a wave of articles and websites promising savings through FSBO or so-called “discount” and “low-commission” broker models. Sites like Clever Real Estate, Houzeo, and others publish polished guides comparing traditional agents, flat-fee MLS services, and selling without representation altogether. The message is consistent: full-service agents are expensive, FSBO is risky, and the smart middle ground is a reduced-fee agent matched to you by a national platform. It sounds reasonable, and it is presented as consumer advocacy. But the economics behind those promises deserve a closer look.

Continue Reading →

By Dennis Norman, on January 22nd, 2026

The St. Louis real estate market is experiencing mixed movements in mortgage rates as of January 22, 2026. The 30-year fixed-rate mortgage has seen a slight decrease, now standing at 6.20%, down by 0.01%. In contrast, the 15-year fixed rate has edged up to 5.76%, reflecting a minor increase of 0.01%. These subtle shifts in rates can influence the decision-making process for both homebuyers and sellers in the region.

For prospective buyers in St. Louis, the marginal drop in the 30-year fixed rate presents a slight relief, potentially lowering monthly payments and overall interest costs. However, those considering a 15-year Continue Reading →

By Dennis Norman, on January 21st, 2026

The St. Louis City real estate market experienced notable shifts in December 2025. Homes sold for a median price of $235,000, marking a 4.82% increase from December 2024’s median price of $224,200. However, this represents a 6.00% decrease from November 2025, when the median sold price was $250,000. The median list price in December 2025 was $200,000, a significant decrease of 14.89% compared to $235,000 in December 2024.

The number of home sales also saw a decline, with 239 homes sold in December 2025, down 9.47% from 264 sales in December 2024. These figures highlight a dynamic market environment, Continue Reading →

By Dennis Norman, on January 20th, 2026

The Franklin County real estate market has experienced notable growth as of January 2026, with December 2025 data revealing a substantial increase in home values and sales activity. Homes in Franklin County sold for a median price of $284,900 during December 2025, marking a 12.83% rise from December 2024’s median of $252,500. This figure also reflects a 13.51% increase compared to November 2025, when the median sold price was $251,000.

The upward trend extends to the listing prices as well, with the median list price reaching $311,900 in December 2025, up 16.42% from $267,900 in December 2024. Additionally, the market Continue Reading →

By Dennis Norman, on January 19th, 2026

The St. Louis County real estate market experienced notable changes as of December 2025. Homes sold for a median price of $262,000, marking a 2.75% increase from December 2024’s median of $255,000. This figure also reflects a slight rise of 0.77% from November 2025’s median price of $260,000. In contrast, the median list price decreased significantly to $224,900, down 19.39% from $279,000 in December 2024.

Home sales in St. Louis County totaled 1,043 in December 2025, a minor decrease of 2.07% compared to the 1,065 homes sold in December 2024. These statistics are illustrated in the chart below, available exclusively Continue Reading →

By Dennis Norman, on January 19th, 2026 Seventeen years ago, on the day we celebrated the life of Dr. Martin Luther King, Jr., I wrote the article below on a personal blog. This morning, while reflecting on Dr. King’s legacy, I revisited it and felt it was still as relevant and meaningful today as it was then. While a few of the statistics are now outdated, the message and intent remain important and timely. So, in honor of Dr. King’s birthday today, I’m republishing it with some updates and perspective for 2026.

Originally published January 19, 2009…

Today we celebrate the life of Dr. Martin Luther King, Continue Reading →

By Dennis Norman, on January 17th, 2026

The St. Louis metropolitan area has witnessed a subtle shift in its housing market dynamics this year, with a total of 34,383 homes sold through December 2025. This figure marks a slight decrease of 0.60% from the 34,590 homes sold during the same period last year. Despite this modest reduction, the market remains robust, reflecting a stable environment for both buyers and sellers. The consistency in sales figures over the past year suggests a balanced market, offering opportunities for families looking to settle in this vibrant region spanning counties in both Missouri and Illinois.

For those interested in the most Continue Reading →

By Dennis Norman, on January 17th, 2026

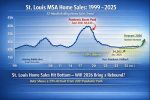

The SLT Market Chart below, available exclusively from MORE, REALTORS®, shows a full monthly history of St. Louis MSA home sales since 1999, and if you’re a data geek (like me) or just trying to get a real read on where this market is going, this chart is gold.

Here’s what stands out immediately: 2021 was the peak, no debate. In September 2021, the 12-month rolling total for home sales in the St. Louis metro hit 48,633 homes, an all-time high. For the calendar year 2021, sales totaled 48,328. Nothing before or after even comes close.

Continue Reading →

By Dennis Norman, on January 16th, 2026

In the dynamic real estate market of the St. Louis metropolitan area, certain zip codes are experiencing rapid sales, making them hotspots for both buyers and sellers. Leading the pack is a zip code in St. Clair, Illinois, where homes are flying off the market in just 19 days on average. With five active listings, the average list price stands at an attractive $54,580, presenting a unique opportunity for families looking to settle in a vibrant community.

Close behind is a zip code in Clinton, Illinois, where properties spend an average of 37 days on the market, followed by a Continue Reading →

By Dennis Norman, on January 15th, 2026

In the St. Louis real estate market, mortgage rates showcase a mixed yet predominantly falling trend as of January 2026. The 30-year fixed mortgage rate remains stable at 6.07%, maintaining its position slightly above the 6% mark. Meanwhile, the 15-year fixed mortgage rate has seen a slight decrease, now sitting at 5.58%. This subtle shift may provide some relief for prospective homebuyers looking to finance their homes over a shorter term.

The current market dynamics present both opportunities and challenges for St. Louis area buyers and sellers. While the stability of the 30-year fixed rate suggests a level of predictability Continue Reading →

By Dennis Norman, on January 15th, 2026

In December 2025, the Jefferson County real estate market saw notable activity, with homes selling at a median price of $277,450. This marks a 4.01% increase from December 2024, when the median price was $266,750. However, compared to November 2025, there was a slight decrease of 0.91% from the previous median price of $280,000. The market also experienced a significant rise in the median list price, reaching $334,100, which is a 16.11% increase from $287,750 in December 2024.

The number of home sales in December 2025 totaled 240, reflecting an 11.11% increase from the 216 homes sold in December 2024. Continue Reading →

By Dennis Norman, on January 12th, 2026

Home buyers and sellers in the St. Louis metropolitan area, encompassing both Missouri and Illinois, are witnessing a dynamic real estate market, particularly in school districts where homes are selling rapidly. Leading the charge is the Bayless School District in St. Louis, boasting 14 active listings that typically spend just 38 days on the market, with an average list price of $209,571. This district’s swift turnover highlights its appeal to families seeking a vibrant community with accessible amenities.

Following closely is the Wolf Branch DIST 113 in St. Clair, Illinois, where properties average 42 days on the market, reflecting strong Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|