By Dennis Norman, on February 21st, 2026

The St. Louis City real estate market has experienced notable shifts as of February 2026. Homes sold for a median price of $200,500 in January 2026, marking a 7.79% decrease from January 2025’s median of $217,450. This price also reflects a 14.68% decline from December 2025, when the median price was $235,000. The median list price in January 2026 stood at $199,700, down 15.02% from $235,000 a year earlier.

In terms of sales volume, there were 154 home sales in January 2026, representing an 8.33% decrease from the 168 homes sold in January 2025. These statistics, along with other key Continue Reading →

By Dennis Norman, on February 20th, 2026

In February 2026, the Franklin County real estate market experienced notable shifts in both home prices and sales activity. Homes sold for a median price of $260,000 in January 2026, marking a 9.57% decrease from January 2025’s median price of $287,500. This recent median price also represents a 7.64% decline compared to December 2025, when the median sold price was $281,500. Despite the drop in sold prices, the median list price saw a significant increase, reaching $310,000 in January 2026—a 16.54% rise from $266,000 in January 2025.

The number of home sales in Franklin County also saw an uptick, with Continue Reading →

By Dennis Norman, on February 19th, 2026

The St. Louis County real estate market has shown notable shifts as we enter February 2026. In January, homes sold for a median price of $250,500, marking an 8.68% increase from the $230,500 median price in January 2025. However, this figure represents a 4.39% decrease compared to December 2025, where the median sold price was $262,000.

The median list price in January 2026 was $209,950, significantly lower by 25.02% compared to $280,000 in January 2025. Additionally, there were 679 home sales recorded, a 7.99% decrease from the 738 sales in January of the previous year.

For a detailed visual representation Continue Reading →

By Dennis Norman, on February 17th, 2026

As of January 2026, the St. Louis metropolitan area, spanning counties in both Missouri and Illinois, has experienced a slight decline in home sales compared to the previous year. A total of 1,918 homes have been sold, marking a 2.59% decrease from the 1,969 homes sold during the same period in 2025. This subtle shift in the market indicates a potential opportunity for both buyers and sellers to reassess their strategies as the year progresses. Despite the dip, the market remains relatively stable, offering families and individuals a wide range of options to explore when considering a move within this Continue Reading →

By Dennis Norman, on February 16th, 2026

The Jefferson County real estate market saw notable shifts in January 2026, as homes sold for a median price of $280,000. This marks a slight decrease of 1.75% from January 2025, where the median price stood at $285,000. However, there was a modest increase of 0.92% compared to December 2025, when the median sold price was $277,450.

The median list price in Jefferson County surged to $334,900, a significant 16.69% rise from $287,000 in January 2025. This increase in listing prices indicates a competitive market environment. Additionally, the number of home sales in January 2026 climbed to 185, reflecting Continue Reading →

By Cathy Lirette, on February 13th, 2026

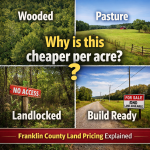

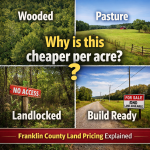

If you’ve been looking at land in Franklin County for any length of time, you’ve probably noticed something confusing. The price per acre can be wildly different from one listing to the next.

A common question from buyers is, “Why is this 20-acre parcel cheaper per acre than that 10 acre one?”

The short answer is simple. Land doesn’t price like houses do. In Franklin County especially, value depends far more on what the land can be used for than how many acres it has.

The First Mistake Buyers Make. Focusing Only Continue Reading →

By Dennis Norman, on February 9th, 2026

The metro east real estate market experienced a slight decline in home prices in January 2026, with homes selling for a median price of $180,000. This marks a 2.70% decrease from January 2025, when the median sold price was $185,000. Additionally, the January 2026 median price represents a 6.25% drop from December 2025, which saw a median sold price of $192,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $215,000, a 4.88% increase from $205,000 in January 2025. The number of home sales in the metro east also saw a modest increase, with Continue Reading →

By Dennis Norman, on February 8th, 2026

The St. Charles County real estate market experienced notable changes in January 2026. Homes sold for a median price of $344,900, marking a 2.19% increase from January 2025’s median of $337,500. However, this figure also reflects a 6.78% decrease from December 2025, when the median sold price was $370,000. The median list price in January 2026 was $446,345, a significant 23.98% rise from $360,000 in January 2025.

In terms of home sales, there were 270 transactions in January 2026, representing a 16.92% decrease from the 325 sales recorded in January 2025. The chart below, available exclusively from MORE, REALTORS®, provides Continue Reading →

By Dennis Norman, on February 7th, 2026

The St. Louis Metropolitan Statistical Area (MSA) experienced a notable shift in its real estate market as of February 2026. According to recent data, homes in the region sold for a median price of $255,000 in January 2026, marking a 1.92% decrease from the $260,000 median price recorded in January 2025. This decline is further emphasized by a 7.27% drop from December 2025, when the median sold price was $275,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $295,000, reflecting a 5.36% increase compared to $280,000 in January 2025. However, the number of Continue Reading →

By John Donati, on February 7th, 2026

We have been “debating” housing affordability for years now, but the conversation keeps circling the same drain. There are not enough smaller, attainable homes for first‑time buyers. Nobody disputes that. Everyone agrees it is a problem, most are willing to call it a crisis, and yet, after countless panels, policy papers, incentives, and task forces, the bottleneck is still right where we left it.

If demand for starter housing has been obvious for more than a decade, why does the market still fail to produce it? Is it land costs? Labor shortages? Interest rates? Zoning? Materials? Regulation? Capital? Or is Continue Reading →

By Karen Moeller, on February 6th, 2026

In my last article, we stepped back from the headlines and looked at what really drives affordability. Not political sound bites. Not whether prices should go up or down. Just the fundamentals. Supply, construction costs, financing, and whether the monthly math works for everyday families.

Once you see it that way, the next question becomes obvious. If those are the levers, how do we actually move them? Just “build more homes” sounds simple until you talk to a builder who cannot make the numbers work. There is no big red easy button, but the good Continue Reading →

By Dennis Norman, on January 21st, 2026

The St. Louis City real estate market experienced notable shifts in December 2025. Homes sold for a median price of $235,000, marking a 4.82% increase from December 2024’s median price of $224,200. However, this represents a 6.00% decrease from November 2025, when the median sold price was $250,000. The median list price in December 2025 was $200,000, a significant decrease of 14.89% compared to $235,000 in December 2024.

The number of home sales also saw a decline, with 239 homes sold in December 2025, down 9.47% from 264 sales in December 2024. These figures highlight a dynamic market environment, Continue Reading →

By Dennis Norman, on January 20th, 2026

The Franklin County real estate market has experienced notable growth as of January 2026, with December 2025 data revealing a substantial increase in home values and sales activity. Homes in Franklin County sold for a median price of $284,900 during December 2025, marking a 12.83% rise from December 2024’s median of $252,500. This figure also reflects a 13.51% increase compared to November 2025, when the median sold price was $251,000.

The upward trend extends to the listing prices as well, with the median list price reaching $311,900 in December 2025, up 16.42% from $267,900 in December 2024. Additionally, the market Continue Reading →

By Dennis Norman, on January 19th, 2026

The St. Louis County real estate market experienced notable changes as of December 2025. Homes sold for a median price of $262,000, marking a 2.75% increase from December 2024’s median of $255,000. This figure also reflects a slight rise of 0.77% from November 2025’s median price of $260,000. In contrast, the median list price decreased significantly to $224,900, down 19.39% from $279,000 in December 2024.

Home sales in St. Louis County totaled 1,043 in December 2025, a minor decrease of 2.07% compared to the 1,065 homes sold in December 2024. These statistics are illustrated in the chart below, available exclusively Continue Reading →

By Dennis Norman, on January 17th, 2026

The St. Louis metropolitan area has witnessed a subtle shift in its housing market dynamics this year, with a total of 34,383 homes sold through December 2025. This figure marks a slight decrease of 0.60% from the 34,590 homes sold during the same period last year. Despite this modest reduction, the market remains robust, reflecting a stable environment for both buyers and sellers. The consistency in sales figures over the past year suggests a balanced market, offering opportunities for families looking to settle in this vibrant region spanning counties in both Missouri and Illinois.

For those interested in the most Continue Reading →

By Dennis Norman, on January 15th, 2026

In December 2025, the Jefferson County real estate market saw notable activity, with homes selling at a median price of $277,450. This marks a 4.01% increase from December 2024, when the median price was $266,750. However, compared to November 2025, there was a slight decrease of 0.91% from the previous median price of $280,000. The market also experienced a significant rise in the median list price, reaching $334,100, which is a 16.11% increase from $287,750 in December 2024.

The number of home sales in December 2025 totaled 240, reflecting an 11.11% increase from the 216 homes sold in December 2024. Continue Reading →

By Dennis Norman, on January 9th, 2026

The Metro East real estate market experienced notable shifts as of January 2026, with homes selling for a median price of $191,500 in December 2025. This represents a 4.93% increase from the median price of $182,500 in December 2024. However, this figure also marks a 10.93% decrease from November 2025, when the median sold price was $215,000. The median list price for December 2025 was $215,000, showing a 4.88% rise from $205,000 in December 2024.

In terms of sales volume, there were 611 home sales in December 2025, a slight decrease of 0.33% from the 613 homes sold in Continue Reading →

By Dennis Norman, on January 8th, 2026

The St. Charles County real estate market continues its upward trajectory as of January 2026, with homes selling for a median price of $369,500 in December 2025. This marks a 5.59% increase compared to December 2024, when the median sold price was $349,950. Additionally, the December 2025 median sold price reflects a 2.64% rise from the previous month of November 2025, which had a median sold price of $360,000.

The median list price in December 2025 was $439,750, showcasing a significant 22.15% increase from $360,000 in December 2024. The market also experienced a boost in activity, with 474 homes sold Continue Reading →

By Dennis Norman, on January 7th, 2026

The St. Louis MSA real estate market demonstrated notable resilience as 2025 came to a close. In December 2025, homes in the region sold for a median price of $275,000, marking a 5.77% increase from December 2024, when the median price was $260,000. However, this figure represents a slight dip of 3.51% from November 2025, when the median sold price was $285,000. The median list price also saw a significant rise, reaching $299,000 in December 2025, up 6.41% from $281,000 the previous year.

The volume of home sales in December 2025 was 2,816, a 1.99% increase from the 2,761 homes Continue Reading →

By Dennis Norman, on December 25th, 2025 Wishing you and your family and loved ones a very Merry and Blessed Christmas!

“And so it was, that, while they were there, the days were accomplished that she should be delivered. And she brought forth her firstborn son, and wrapped him in swaddling clothes, and laid him in a manger; because there was no room for them in the inn.” Luke 2:6-7

By Dennis Norman, on December 21st, 2025

The St. Louis City real estate market saw a significant increase in home prices during November 2025, with homes selling for a median price of $250,000. This marks a 25.00% rise from November 2024, where the median sold price was $200,000. Additionally, last month’s median price reflects a 12.16% increase from October 2025’s median of $222,900. Despite the rising prices, the market experienced a decrease in the number of home sales, with 211 homes sold in November 2025, down 14.57% from 247 sales in November 2024.

Interestingly, while sale prices have surged, the median list price saw a decline. In Continue Reading →

By Dennis Norman, on December 20th, 2025

The Franklin County real estate market experienced notable changes in November 2025, as highlighted by the chart below, available exclusively from MORE, REALTORS®. Homes sold for a median price of $251,000, marking a 5.24% increase from the median price of $238,500 in November 2024. However, this figure also represents a 7.89% decrease from October 2025, when the median sold price was $272,500.

The median list price surged to $301,445, which is a 13.75% increase compared to $265,000 in November 2024. Despite the rise in prices, the number of home sales in Franklin County decreased to 85 in November 2025, down Continue Reading →

By Dennis Norman, on December 19th, 2025

The St. Louis County real estate market experienced notable shifts in November 2025, as reflected in the latest data. Homes sold for a median price of $260,000, marking a slight decrease of 0.10% from November 2024’s median of $260,263. This figure also represents a significant decline of 10.68% from October 2025, when the median sold price was $291,100.

In terms of listing prices, the median list price in November 2025 was $225,000, showing a substantial decrease of 18.92% compared to $277,500 in November 2024. Additionally, the number of home sales in St. Louis County stood at 955, a 6.65% drop Continue Reading →

By Dennis Norman, on December 17th, 2025

The St. Louis metropolitan area has experienced a slight dip in home sales this year, with a total of 31,498 homes sold through the end of November 2025. This marks a 1.04% decrease from the 31,829 homes sold during the same period last year. Despite this minor decline, the market shows remarkable stability when viewed over a longer timeline, as the number of homes sold this year remains unchanged from four years ago, when zero homes were sold by the end of November 2025. This consistency highlights the resilience of the St. Louis housing market amidst fluctuating economic conditions.

For Continue Reading →

By Dennis Norman, on December 15th, 2025

The Jefferson County real estate market shows a dynamic shift as of December 2025, with notable changes in home prices and sales activity. In November 2025, homes sold for a median price of $280,000, marking a 5.86% increase from November 2024’s median price of $264,500. However, this also represents a 3.45% decrease from October 2025, when the median sold price was $290,000. Despite these fluctuations, the market remains robust with 228 home sales in November 2025, maintaining the same number of transactions as November 2024.

The median list price in Jefferson County rose significantly, reaching $329,900 in November 2025, a Continue Reading →

By Dennis Norman, on December 9th, 2025

The Metro East real estate market experienced notable changes in November 2025, with the median home sale price reaching $214,500. This marks a 4.89% increase from November 2024, when the median price was $204,500. However, when compared to October 2025, this represents a slight decrease of 2.50% from $220,000. The median list price for homes in the area also rose to $225,000, a significant 9.76% increase from $205,000 in the previous year. Despite the rise in prices, the number of home sales in Metro East saw a decline, with 533 homes sold in November 2025, down 4.14% from 556 sales Continue Reading →

By Dennis Norman, on December 8th, 2025

The St. Charles County real estate market witnessed notable changes in November 2025. Homes sold for a median price of $360,000, marking a 3.23% increase from $348,750 in November 2024. However, this price reflects a slight decrease of 1.37% compared to October 2025’s median sold price of $365,000. The median list price in November 2025 was $440,900, showing a significant 22.47% rise from $360,000 in November 2024. Additionally, home sales totaled 422, a 4.95% decrease from the 444 homes sold in November 2024.

For a detailed visual representation of these statistics, refer to the chart below, available exclusively from MORE, Continue Reading →

By Dennis Norman, on December 7th, 2025

The St. Louis Metropolitan Statistical Area (MSA) real estate market saw notable changes in November 2025, with homes selling for a median price of $285,000. This represents a 7.18% increase compared to November 2024, when the median sold price was $265,900. However, this figure also marks a slight decrease of 1.72% from the previous month of October 2025, when the median sold price was $290,000.

The median list price for homes in the St. Louis MSA also experienced a rise, reaching $295,500 in November 2025. This is a 5.54% increase from the $280,000 recorded in November 2024. Despite the increase Continue Reading →

By Dennis Norman, on November 21st, 2025

The St Louis City real estate market showed a dynamic shift in October 2025, with homes selling for a median price of $223,000. This marks a 6.19% increase compared to October 2024’s median of $210,000. However, it also reflects an 8.98% decrease from September 2025, when the median sold price was $245,000. The median list price for homes in October 2025 was $205,000, representing a 10.87% drop from $230,000 in October 2024. Additionally, home sales totaled 255, down 16.12% from 304 sales in October 2024.

The chart below, available exclusively from MORE, REALTORS®, illustrates these market trends and provides further Continue Reading →

By Dennis Norman, on November 20th, 2025

The Franklin County real estate market continues to show robust growth as we move into November 2025. Homes in the area sold for a median price of $273,500 in October 2025, marking a 7.25% increase from the previous year when the median price was $255,000. This upward trend also reflects a 2.43% rise from September 2025’s median price of $267,000.

The median list price in October 2025 was $303,000, a significant 14.34% jump from $265,000 in October 2024. The number of home sales also saw a notable increase, with 133 homes sold in October 2025 compared to 112 in Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|