By Karen Moeller, on February 14th, 2026

How to tell if the Delmar Divine redevelopment truly works

When a new housing project is announced in St. Louis, most people do not start by reading the details. In a city where redevelopment projects have often carried big expectations, reactions tend to start with comparison rather than celebration. They start by remembering. This region has seen ambitious redevelopment before. Some helped. Some faded. So when a project like Delmar Divine is introduced, the real reaction is not excitement or negativity. It is evaluation. The question is not whether St. Louis has tried to stabilize neighborhoods before. The question is Continue Reading →

By Cathy Lirette, on February 13th, 2026

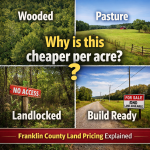

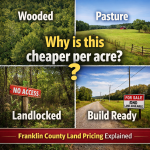

If you’ve been looking at land in Franklin County for any length of time, you’ve probably noticed something confusing. The price per acre can be wildly different from one listing to the next.

A common question from buyers is, “Why is this 20-acre parcel cheaper per acre than that 10 acre one?”

The short answer is simple. Land doesn’t price like houses do. In Franklin County especially, value depends far more on what the land can be used for than how many acres it has.

The First Mistake Buyers Make. Focusing Only Continue Reading →

By Dennis Norman, on February 12th, 2026

February 12, 2026 – Homebuyers and sellers in the St. Louis area are seeing continued upward movement in mortgage rates as the 30-year fixed rate reaches 6.14%, marking an increase of 0.03% from previous figures. This trend reflects a broader rise in mortgage rates across various loan types, including the 15-year fixed rate which has edged up to 5.71%, and the 30-year jumbo rate now at 6.30%.

For St. Louis buyers, these rate increases mean potentially higher monthly payments, influencing the affordability of homes in the area. Sellers may also feel the impact, as rising rates could temper buyer Continue Reading →

By Dennis Norman, on February 12th, 2026

In the competitive St. Louis real estate market, understanding which school districts are in high demand can be crucial for both home buyers and sellers. Currently, the Columbia DIST 4 in Monroe and St Clair Counties, Illinois, leads the pack as the fastest selling school district. With only 8 listings on the market for an average of 36 days and an average list price of $454,963, this area is attracting families looking for quick transactions and desirable homes. Columbia DIST 4’s appeal is evident in its swift market movement, making it a prime location for those looking to buy or Continue Reading →

By Dennis Norman, on February 9th, 2026

The metro east real estate market experienced a slight decline in home prices in January 2026, with homes selling for a median price of $180,000. This marks a 2.70% decrease from January 2025, when the median sold price was $185,000. Additionally, the January 2026 median price represents a 6.25% drop from December 2025, which saw a median sold price of $192,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $215,000, a 4.88% increase from $205,000 in January 2025. The number of home sales in the metro east also saw a modest increase, with Continue Reading →

By Dennis Norman, on February 8th, 2026

There is a limited window for St. Louis area residents to seek federal compensation for serious illnesses tied to historic radiation exposure, and time is not on their side. The Radiation Exposure Compensation Act, commonly known as RECA, was reauthorized in July 2025 and the deadline to file a claim is December 31, 2027. For many families in North County and surrounding areas impacted by Manhattan Project waste, this program may finally provide long overdue financial relief.

RECA is a federal law administered by the U.S. Department of Justice Radiation Exposure Compensation Program. It was created as a non adversarial Continue Reading →

By Dennis Norman, on February 8th, 2026

The St. Charles County real estate market experienced notable changes in January 2026. Homes sold for a median price of $344,900, marking a 2.19% increase from January 2025’s median of $337,500. However, this figure also reflects a 6.78% decrease from December 2025, when the median sold price was $370,000. The median list price in January 2026 was $446,345, a significant 23.98% rise from $360,000 in January 2025.

In terms of home sales, there were 270 transactions in January 2026, representing a 16.92% decrease from the 325 sales recorded in January 2025. The chart below, available exclusively from MORE, REALTORS®, provides Continue Reading →

By Karen Moeller, on February 8th, 2026

There’s a moment almost every first-time landlord has. It usually happens right after the first rent check clears. They lean back and think, This is great. Why didn’t I do this sooner?

Fast forward a few months and they’re in the basement with a flashlight in their mouth, halfway through a YouTube video titled “Easy 5-Minute Pipe Fix,” wondering how a tiny drip just turned into a much bigger problem.

Rental ownership is often sold as passive income. In reality, it’s a small business with safety rules, maintenance standards, inspections, permits, and real liability. Collecting rent is the fun part. Continue Reading →

By Dennis Norman, on February 7th, 2026

The St. Louis Metropolitan Statistical Area (MSA) experienced a notable shift in its real estate market as of February 2026. According to recent data, homes in the region sold for a median price of $255,000 in January 2026, marking a 1.92% decrease from the $260,000 median price recorded in January 2025. This decline is further emphasized by a 7.27% drop from December 2025, when the median sold price was $275,000.

Despite the decrease in sold prices, the median list price in January 2026 rose to $295,000, reflecting a 5.36% increase compared to $280,000 in January 2025. However, the number of Continue Reading →

By John Donati, on February 7th, 2026

We have been “debating” housing affordability for years now, but the conversation keeps circling the same drain. There are not enough smaller, attainable homes for first‑time buyers. Nobody disputes that. Everyone agrees it is a problem, most are willing to call it a crisis, and yet, after countless panels, policy papers, incentives, and task forces, the bottleneck is still right where we left it.

If demand for starter housing has been obvious for more than a decade, why does the market still fail to produce it? Is it land costs? Labor shortages? Interest rates? Zoning? Materials? Regulation? Capital? Or is Continue Reading →

By Karen Moeller, on February 6th, 2026

In my last article, we stepped back from the headlines and looked at what really drives affordability. Not political sound bites. Not whether prices should go up or down. Just the fundamentals. Supply, construction costs, financing, and whether the monthly math works for everyday families.

Once you see it that way, the next question becomes obvious. If those are the levers, how do we actually move them? Just “build more homes” sounds simple until you talk to a builder who cannot make the numbers work. There is no big red easy button, but the good Continue Reading →

By Dennis Norman, on February 5th, 2026

As of February 5, 2026, St. Louis homebuyers are facing a steady climb in mortgage rates, with the 30-year fixed rate holding firm at 6.20%. This rate stability, despite the overall rising trend, indicates that the market is maintaining moderate levels just above the 6% mark. Meanwhile, the 15-year fixed rate remains unchanged at 5.76%, offering a slightly more affordable option for those looking to pay off their loans more quickly. In contrast, the 30-year Jumbo and FHA rates have seen increases, now at 6.36% and 5.84% respectively. The adjustable 7/6 SOFR ARM also rose, now sitting at 5.64%.

For Continue Reading →

By Karen Moeller, on February 5th, 2026

Spend five minutes with housing headlines lately and you’ll see the same debate on repeat. Prices are too high. Prices need to stay high. Protect homeowners. Help buyers. Every side sounds urgent, and every side sounds certain. It makes for good sound bites. It doesn’t make for very helpful answers.

Because for most families, housing isn’t a political talking point. It’s deeply personal. It’s whether they can finally stop renting. Whether their kids get their own bedrooms. Whether retirement feels secure. Whether a move across town is possible without blowing up the monthly budget. And when Continue Reading →

By Karen Moeller, on February 4th, 2026

A recent federal case shows how ownership can be challenged on paper and why a few simple safeguards matter more than most people realize.

Here’s something I didn’t expect to see in a federal indictment this year: 17 St. Louis homes allegedly transferred using fake deeds. Not sold. Not foreclosed. Just reassigned on paper through forged documents. If you’re wondering how that could even happen, you’re not alone. I had the same question. So I dug into how our recording system actually works, where the gaps are, and what homeowners should know.

According to prosecutors, stolen Continue Reading →

By Karen Moeller, on February 3rd, 2026

Every morning I walk past 751 North Taylor. Most days it looks the same. Quiet. Steady. Like it has been there forever. In a way, it has. It is not the largest house on the block. It does not have the newest finishes or the sharpest curb appeal. At first glance, it simply looks like an older home that has quietly watched the neighborhood grow up around it.

But look a little closer and you are looking at something rare. The house is believed to date back to around 1858, making it one of the oldest surviving Continue Reading →

By Karen Moeller, on February 3rd, 2026

When two incomes make one mortgage possible

For years, the path to homeownership followed a predictable script. You finished school, settled into a job, maybe got married, and then you bought a house together. Lately, though, I’m watching buyers in St. Louis rewrite that story.

More often, I’m working with people who aren’t couples at all. They’re friends who have rented together for years, siblings who get along well enough to share a kitchen, or longtime roommates who are simply tired of watching rent checks disappear every month. Instead of waiting for the “traditional” setup, they’re Continue Reading →

By Dennis Norman, on January 29th, 2026

As of January 29, 2026, mortgage rates in St. Louis reflect a rising trend, with the 30-year fixed rate inching up to 6.16%, marking an increase of 0.01% from the previous rate. Despite the modest change, this movement keeps rates at moderate levels above 6%, which may influence homebuyers to act sooner rather than later. Meanwhile, the 15-year fixed rate remains steady at 5.75%, providing an alternative for those looking to minimize interest payments over a shorter term.

For St. Louis area buyers and sellers, these rate changes may have significant implications. Buyers might face slightly higher monthly payments, which Continue Reading →

By John Donati, on January 26th, 2026

Most consumers assume real estate agents build their business through relationships, local knowledge, and referrals. Many do. Others operate very differently.

For years, scores of agents have relied heavily on purchased leads from third-party companies like Zillow, Trulia, etc., often at significant monthly cost. The consumer rarely sees this distinction and likely doesn’t know they are being sold to the highest bidder, yet it quietly shapes how the business operates. Is that approach inherently wrong? Or is it simply a reflection of how the business is structured? And, if structure drives behavior, who is actually in control?

Over time, most Continue Reading →

By Cathy Lirette, on January 26th, 2026

I don’t just work in Gray Summit, I live here. Like many of my neighbors, I chose this area for the open land, quiet setting, and small-community feel. That’s why the proposed data center off Robertsville Road has sparked so many conversations, both personally and professionally.

As a local resident and real estate broker, I’ve been hearing the same questions from homeowners and buyers alike: What does this mean for our community? And how could it affect home values? Unlike a factory or corporate campus, a data center doesn’t bring a large permanent workforce once construction is complete. That means Continue Reading →

By Karen Moeller, on January 26th, 2026

When a real estate transaction slows down, most buyers and sellers assume the issue is the inspection. A roof concern, an aging system, or something else visible and measurable that everyone can point to. Inspections are tangible. Buyers attend them, reports are long, and repair negotiations can get emotional. When momentum slows, it feels logical to look there first.

But that assumption does not always hold up. Sometimes a closing stalls for a reason no one saw coming, and the problem has nothing to do with the condition of the house itself. Instead, it has everything Continue Reading →

By Dennis Norman, on January 25th, 2026

Homeowners researching how to sell their house today will quickly run into a wave of articles and websites promising savings through FSBO or so-called “discount” and “low-commission” broker models. Sites like Clever Real Estate, Houzeo, and others publish polished guides comparing traditional agents, flat-fee MLS services, and selling without representation altogether. The message is consistent: full-service agents are expensive, FSBO is risky, and the smart middle ground is a reduced-fee agent matched to you by a national platform. It sounds reasonable, and it is presented as consumer advocacy. But the economics behind those promises deserve a closer look.

Continue Reading →

By Karen Moeller, on January 24th, 2026

What Buyers Should Watch for When a Home Looks “Updated”

Walking into a freshly renovated home can feel like a deep exhale. New floors. Fresh paint. Updated fixtures. Someone already did the hard work, right?

Maybe.

For many buyers, especially first-time buyers, excitement plus staging is a powerful distraction. The house smells clean. The furniture is perfectly placed. The lighting is flattering. And before you know it, your brain quietly clocks out while your heart starts imagining Thanksgiving in the dining room.

That is usually when the house starts telling on itself.

Continue Reading →

By Karen Moeller, on January 23rd, 2026

Dual agency is legal in Missouri, but it is frequently misunderstood. At first glance, it can sound efficient. One agent. One transaction. Fewer moving parts. What is often overlooked is the trade-off. When dual agency is established, the agent must step back from full advocacy for both the buyer and the seller.That limitation is significant, and it fundamentally changes the agent’s role in the transaction.

Understanding that shift is essential before agreeing to dual agency.

What dual agency means in Missouri

In Missouri, dual agency occurs when the same brokerage represents both the buyer Continue Reading →

By Karen Moeller, on January 22nd, 2026

Few phrases in real estate create more confusion than “As-Is.”

Buyers often see it as a warning label.Sellers sometimes view it as a shield.In reality, it is neither.

I regularly hear buyers say they will not even consider a home once they see “As-Is” in the listing. I also frequently hear buyers assume that “As-Is” means the seller is desperate or that the property can be purchased for pennies on the dollar. That expectation rarely aligns with reality. In most cases, the seller has already considered the condition of the home and priced it Continue Reading →

By Dennis Norman, on January 22nd, 2026

The St. Louis real estate market is experiencing mixed movements in mortgage rates as of January 22, 2026. The 30-year fixed-rate mortgage has seen a slight decrease, now standing at 6.20%, down by 0.01%. In contrast, the 15-year fixed rate has edged up to 5.76%, reflecting a minor increase of 0.01%. These subtle shifts in rates can influence the decision-making process for both homebuyers and sellers in the region.

For prospective buyers in St. Louis, the marginal drop in the 30-year fixed rate presents a slight relief, potentially lowering monthly payments and overall interest costs. However, those considering a 15-year Continue Reading →

By Karen Moeller, on January 22nd, 2026

For many years, homeowners insurance followed a predictable script. The house itself mattered most. Age of the roof. Square footage. Replacement cost. Claims history.

That is changing.

Across the St. Louis region, insurance underwriting is becoming increasingly location-specific, meaning where a home sits now plays a larger role in coverage terms and pricing than many buyers and sellers expect. This shift is not universal across all insurers, but it is widespread enough to be affecting real estate transactions in noticeable ways.

Communities like Eureka often feel this change sooner, not because something Continue Reading →

By Dennis Norman, on January 21st, 2026

The St. Louis City real estate market experienced notable shifts in December 2025. Homes sold for a median price of $235,000, marking a 4.82% increase from December 2024’s median price of $224,200. However, this represents a 6.00% decrease from November 2025, when the median sold price was $250,000. The median list price in December 2025 was $200,000, a significant decrease of 14.89% compared to $235,000 in December 2024.

The number of home sales also saw a decline, with 239 homes sold in December 2025, down 9.47% from 264 sales in December 2024. These figures highlight a dynamic market environment, Continue Reading →

By Dennis Norman, on January 20th, 2026

The Franklin County real estate market has experienced notable growth as of January 2026, with December 2025 data revealing a substantial increase in home values and sales activity. Homes in Franklin County sold for a median price of $284,900 during December 2025, marking a 12.83% rise from December 2024’s median of $252,500. This figure also reflects a 13.51% increase compared to November 2025, when the median sold price was $251,000.

The upward trend extends to the listing prices as well, with the median list price reaching $311,900 in December 2025, up 16.42% from $267,900 in December 2024. Additionally, the market Continue Reading →

By Dennis Norman, on January 19th, 2026

The St. Louis County real estate market experienced notable changes as of December 2025. Homes sold for a median price of $262,000, marking a 2.75% increase from December 2024’s median of $255,000. This figure also reflects a slight rise of 0.77% from November 2025’s median price of $260,000. In contrast, the median list price decreased significantly to $224,900, down 19.39% from $279,000 in December 2024.

Home sales in St. Louis County totaled 1,043 in December 2025, a minor decrease of 2.07% compared to the 1,065 homes sold in December 2024. These statistics are illustrated in the chart below, available exclusively Continue Reading →

By Dennis Norman, on January 19th, 2026 Seventeen years ago, on the day we celebrated the life of Dr. Martin Luther King, Jr., I wrote the article below on a personal blog. This morning, while reflecting on Dr. King’s legacy, I revisited it and felt it was still as relevant and meaningful today as it was then. While a few of the statistics are now outdated, the message and intent remain important and timely. So, in honor of Dr. King’s birthday today, I’m republishing it with some updates and perspective for 2026.

Originally published January 19, 2009…

Today we celebrate the life of Dr. Martin Luther King, Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|