By Dennis Norman, on January 16th, 2015 Missouri foreclosure filings during 2014 occurred on a total of 9.762 properties in Missouri which is down over 70% from 2010 when foreclosure activity in Missouri hit an all-time record high with foreclosure filings occurring that year on 33,120 properties, according to data just released by RealtyTrac. Below is a complete table showing Missouri foreclosure filings for each year, from the real estate “boom” year of 2006 through 2014, for all counties in Missouri which reveals that in most counties in Missouri foreclosure activity peaked during 2010.

Foreclosure filings in the Missouri counties that make up the St Louis MSA occurred on a total of 5,310 properties during 2014, down 68% from 2010 when foreclosure activity hit a record high in the Missouri counties of the St Louis MSA with foreclosure filings taking place on 16,588 properties that year.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “Missouri Foreclosure Filings For 2014 Down Seventy Percent From Peak in 2010“

By Dennis Norman, on December 11th, 2014 St Louis foreclosure activity continued to decline in November with the number of foreclosure actions decreasing in all of the St Louis core counties from the month before, according to a report just released this morning from RealtyTrac. The St Louis MSA as well as the core counties that make up the bulk of the St Louis market in Missouri, also saw double digit declines in foreclosure activity in November from the year before with the exception being Jefferson County which, as the table below shows, saw an increase of almost 90%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Foreclosure Activity Continues Downward Trend“

By Dennis Norman, on November 14th, 2014 St Louis Foreclosure Activity was on the rise during the month of October with a big spike in foreclosure activity from the month before in St Charles and Franklin Counties as well as the St Louis MSA as a whole, according to newly released data from RealtyTrac. As the table below shows, St Charles County saw an increase of over 3,000% in foreclosure activity during the month of October from September, and over a 400% increase in activity from October 2013, however, this is the result of a large influx of REO property in October. When you look at the second table below, showing year-to-date foreclosure activity, you will see that St Charles County foreclosure activity is actually down 13.6% in 2014 from the same time period in 2013.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Foreclosure Activity Increases In October But Down Overall“

By Dennis Norman, on November 13th, 2014 Yesterday, the Missouri Supreme Court handed down it’s decision in the case “Missouri Bankers Association, Inc., and Jonesburg State Bank v. St. Louis County, Missouri, and Charlie A. Dooley” ruling in favor of the Appellants (Missouri Bankers Association and Jonesburg State Bank) and against the Respondents (St Louis County and Charlie A. Dooley) by reversing an lower courts decision that ruled the Banker’s suit was moot. The original suit was filed after St Louis county enacted its “Mortgage Foreclosure Intervention Code” which, among other things, required mediation prior to a bank or other lender proceeding with a foreclosure on a deed a trust.

In it’s decision, the Missouri Supreme Court ruled that the ordinance passed by St Louis County known as the “Mortgage Foreclosure Intervention Code” was “void and unenforceable” because the county exceeded its charter authority when enacting the ordinance.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 16th, 2014 Foreclosures in the St Louis area fell dramatically during the 3rd quarter of this year with 1,529 total foreclosure actions on property in the St Louis MSA, a decline of 28.05 percent from the prior quarter and a decline of 53.04 percent from the same quarter a year ago, according to the latest data from RealtyTrac. As our table below shows, during the 3rd quarter of this year all the counties in the core area of the St Louis market saw double digit declines in foreclosure activity from both the quarter before as well as the same period a year ago with the exception of Franklin County. Franklin County saw foreclosure activity increase over 300 percent from the quarter before and almost 50 percent (48%) from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Area Foreclosures Plummet In 3rd Quarter Except in Franklin County“

By Dennis Norman, on September 30th, 2014 The St Louis Foreclosure rate in July 2014 was 0.78 percent, down almost 30 percent from the same time last year when the St Louis foreclosure rate was 1.08 percent, according to data just released by Corelogic. The foreclosure rate for the state of Missouri in July 2014 was .64%, down from .89% a year ago.

On another good note, the serious mortgage delinquency rate (90+ days) for St Louis in July 2014 was 3.33%, down from 3.85% in July 2013. On the state level, the Missouri serious mortgage delinquency rate for July 2014 was 3.06% down from 3.52% the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Foreclosures & Serious Delinquencies Fall In Past Year“

By Dennis Norman, on September 11th, 2014 For the first time in a long time, there was an increase in St Louis Foreclosures with 497 foreclosure actions in August, equivalent to 1 foreclosure action for every 2,511 housing units, an increase of 2.47 percent from the month before. While up from the month before, St Louis Foreclosures in August 2014 were down 58.41% from August 2013. As the table below shows, St Charles County had a big decline in foreclosure activity in August and the city of St Louis a modest decline, but Jefferson County and Franklin County both saw increases in foreclosures over over 100% from the month before. With the exception of Franklin County, all the counties listed had a double digit decline in foreclosure activity from the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

(see a slideshow of all foreclosures for sale below)

Continue reading “St Louis Foreclosures Rise Slightly In August; Up over 100 Percent In Outlying Areas“

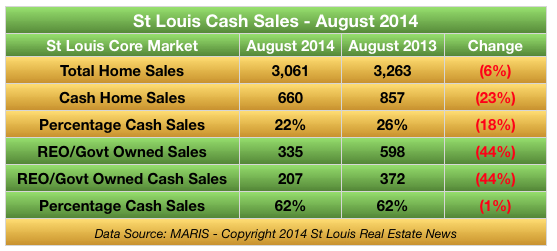

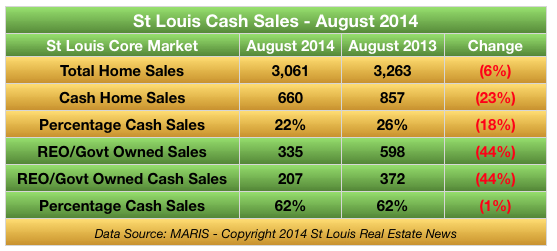

By Dennis Norman, on September 9th, 2014 The number of St Louis Foreclosures (bank and government owned) continues to decline resulting in just 335 St Louis Foreclosures being sold during the month of August 2014 in the St Louis Core market, a decline of 44% from August 2013 when there were 598 St Louis Foreclosures sold. What hasn’t changed though is the fact that nearly two-thirds (62%) of the foreclosures sold were cash sales for both periods. For the St Louis real estate market as a whole, cash sales made up for fewer of the home sales in August 2014 with just 22% of all homes being sold on a cash sale, down from 26% a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on August 14th, 2014 St Louis foreclosure activity was on the decline again in July with a total of 485 foreclosure actions taking place in the St Louis MSA during the month which equates to foreclosure activity on 1 of every 2,573 housing units, according to data released this morning by RealtyTrac. This represents a decline in St Louis foreclosure activity of 19.57% from the month before and a decline of 59.0% from July 2013. As the table below shows, with the exception of Franklin County, all of the major Missouri counties of the St Louis MSA saw a decline in foreclosure activity from both the month before as well as a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

(see a slideshow of all foreclosures for sale below)

Continue reading “St Louis Foreclosure Activity Down Fifty-Nine Percent In Past Year“

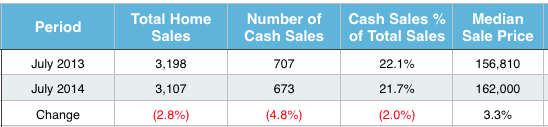

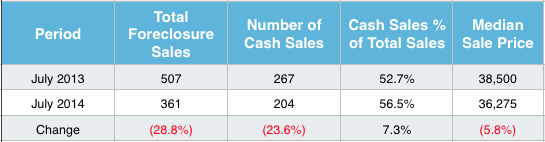

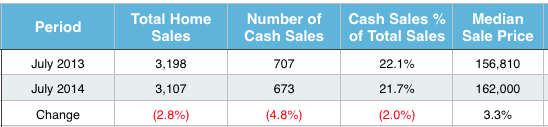

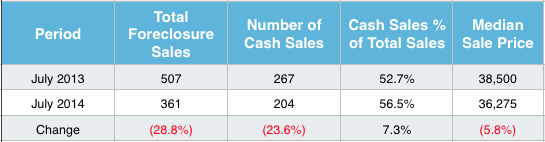

By Dennis Norman, on August 13th, 2014 Cash sales accounted for more than 1 in 5 (21.7%) St Louis home sales in July 2014, a slight decrease from a year ago when cash sales accounted for 22.1% of home sales. The median price of these cash home sales in July 2014 was $162,000, 3.3% higher than a year ago when the median price was $156,810. St Louis foreclosures sold during the month of July 2014 were cash sales more than half the time (56.5%), an increase of 7.3% from a year ago when cash sales accounted for 52.7% of St Louis foreclosure sales. The median price of cash sales on foreclosures was $36,275 in July 2014, a drop of 5.8% from a year ago when it was $38,500.

See ALL Foreclosures for sale in St Louis

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Source: MORE, REALTORS  Source: MORE, REALTORS

By Dennis Norman, on July 24th, 2014 Even though, for a while now, foreclosures have been on the decline in St Louis as well as in most parts of the country, there are still many St Louis neighborhoods that are being impacted significantly by foreclosure activity. While after the housing bubble burst in 2008 we foreclosures appeared in most every neighborhood in St Louis from areas with the lowest values to areas with the highest, there has been a concentration of foreclosure activity in a few areas of St Louis. The city of Florissant, for one, is an area that has had more than it’s fair share of foreclosure activity and has seen pretty severe impact on home values there as a result.

Which St Louis Neighborhoods Have The Highest Foreclosure Rates?

As I mentioned previously, Florissant has been pounded with foreclosures, however, as the table below shows, there are many areas throughout the St Louis area, including areas in St Louis City as well as the counties of St Louis, St Charles, Jefferson and Franklin, that are on the list of the 19 highest foreclosure rate areas of St Louis. Below the table is an interactive foreclosure map for Missouri where you can find foreclosure rates for any county in Missouri or, click on the county and find foreclosure rates for any area within that county.

See ALL Foreclosures for sale in St Louis

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Areas With Highest Foreclosure Rates In St Louis“

By Dennis Norman, on July 17th, 2014 St Louis Foreclosure activity dropped in June to a rate of 1 foreclosure action on every 2,070 units, a decline of nearly 50 percent (49.58%) from June 2013, and down 13.11% from the month before, according to a report just released this morning by RealtyTrac. The table below shows the numbers for the St Louis metro area as a whole as well as a breakdown by county and, as the table shows, all the counties in the St Louis, Missouri core market saw declines of nearly 50% or better in the past year and all, except the city of St Louis, saw double-digit declines from May 2014.

On the national level there is good news as well as foreclosure activity declined in June 2014 to the lowest level since July 2006, before the housing market meltdown.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Activity Drops Nearly 50 Percent In Past Year“

By Dennis Norman, on July 7th, 2014 St Louis’ Most Expensive Foreclosures currently for sale includes homes in St Louis, St Charles and Franklin counties and top out at $1,700,000 at the time of this article. While buying a foreclosure does generally involve more risk than buying a privately owned home that is being sold under “non-distress” conditions, the added risk is usually rewarded in a much better price and therefore a better deal. The main risks with buying a foreclosure have to do with the condition of the property both in that the property is normally being sold as is, there is not a sellers disclosure available from the former owner and, if the former owner had financial trouble it is safe to say that some maintenance and repairs needed may have been foregone.

St. Louis Most Expensive Foreclosures For Sale – $300,000+

See ALL Foreclosures for sale in St Louis

Get More Information on St Louis Foreclosures

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis’ Most Expensive Foreclosures – Slide Show“

By Dennis Norman, on June 26th, 2014 Zombie Foreclosures, while fewer, are still quite prevalent in the St Louis area. So, what is a zombie foreclosure? Good question. It’s yet another term that has come out of the real estate bubble burst of 2008 and refers to homes that are in the foreclosure process and the owner has vacated the home prior to actually losing it as the foreclosure is not complete. These properties often become an eyesore and burden on the neighbors, and the city they are in, as they are sort of in “no man’s land” as the owner has left the property and typically does not continue to maintain it as they are losing it however, it is not yet foreclosed upon so the lender does not own it yet (and if it sells at the foreclosure to a third party won’t own it) therefore they normally do not maintain it. Therefore, until the foreclosure is actually final, the property often sits and deteriorates without attention.

Where in St Louis can you find Zombies?

As the table below shows, zombie foreclosures are concentrated, to a large extent, in the North St Louis County area with 5 of the top ten zombie locations being in North County. The 63136 zip, which encompasses all of Jennings as well as some areas around Jennings including part of north St Louis, is at the top of the list with 16 “zombies“, following by the 63031 zip area of Florissant with 13, and then the 63135 zip area, which is predominately Ferguson, with 11.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Get More Information on Foreclosures Continue reading “Zombie Foreclosures In St Louis“

By Dennis Norman, on June 24th, 2014 St Louis Foreclosures, and short sales, in May 2014 accounted for just 8.5% of all home sales in the St Louis core market (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin), according to data released just this morning from RealtyTrac. This is a decline of 26.7% from May 2013 when foreclosures and short sales in St Louis accounted for 11.6% of all home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures and Short Sales Fall By Over 25 Percent“

By Dennis Norman, on May 16th, 2014 St. Louis Metro Foreclosure Activity declined in April with 1 of every 1,013 housing units in the St Louis metro area having a foreclosure action on it during the month, a decline of 16.56 percent from the month before and a decline of 20.36% from April 2014, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) had decreased foreclosure activity in April from the month before. Three of the five counties saw double digit decreases from a year about however, St Louis city and county both saw increases.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading "St. Louis Metro Foreclosure Activity Down 20 Percent From Year Ago"

By Dennis Norman, on April 22nd, 2014 Mortgage delinquency and foreclosure rates both declined in March to the lowest levels since October 2007 and 2008, respectively, according to data just released by Black Knight Financial Services (formerly LPS). The U.S. mortgage delinquency rate (30+ days delinquent) in March 2014 was 5.52%, a 7.57% decline from the month before and a 16.29% decline from a year ago. The U.S. foreclosure pre-sale inventory rate in March 2014 was 2.13%, a decline of 4.23% from the month before and a drop of 36.69% from March 2013.

There are still several states with double-digit mortgage delinquencies, Mississippi being the one with the highest rate with 13.39% of all mortgages being 30+ days delinquent. Below is the list of the top 5 states for the highest mortgage delinquency rates as well as the top 5 states for the lowest rates.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Mortgage Delinquency and Foreclosure Rates Drop to Lowest Level In 6 Years“

By Dennis Norman, on April 10th, 2014 St Louis foreclosures increased during the first quarter of this year in the main areas of our St. Louis metro area market located on the Missouri side of the Mississippi with St Louis city foreclosures, St Louis County foreclosures and St Charles county foreclosures all increasing from the 4th quarter of 2013, according to information real eased this morning by RealtyTrac.

St Louis foreclosures for the MSA were down during the first quarter of 2013 1.6% from the 4th quarter of 2013 with a foreclosure action occurring on 1 out of every 452 housing units in the St Louis metro area. Foreclosures in the St Louis metro area, including all 5 counties that make up the core of the market on the Missouri side of the river, St Louis City and County, St Charles County, Jefferson county and Franklin County, decreased double digits from a year ago. Complete details are in the table below.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In First Quarter 2014“

By Dennis Norman, on March 13th, 2014 St Louis foreclosures were on the rise in February with 1 of every 1,328 housing units in the St Louis metro area having a foreclosure action on it during the month, 24.17 percent higher than the month before, however still down 33.14% from February 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw an increase in foreclosure activity in February from the month before with the exception of Jefferson county that had relatively little foreclosure activity but more than a year ago. All the counties saw a decrease in foreclosures from a year ago however.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Rise in February-Still Down From Last Year“

By Dennis Norman, on February 13th, 2014 St Louis foreclosures increased in January to the point where 1 of every 1,649 housing units in the St Louis metro area had a foreclosure action on it during the month, an increase of 21.70 percent from the rate in December 2013, however a decline of almost 50% (47.06%) from January 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw declines in foreclosure activity from a year ago with the exception of Jefferson County which saw foreclosure activity spike in January, increasing 128% from the month before and over 13% from a year ago. Jefferson County also had the dubious distinction as having the highest rate of foreclosure activity during January 2014 of any county in Missouri.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In January But Down Almost 50 Percent From Year Ago“

By Dennis Norman, on January 16th, 2014 Foreclosures in the St Louis metro area during the 4th quarter of 2013 were down 13.79% from the prior quarter and down 40.64% from the 4th quarter of 2012, according to a report released today by RealtyTrac. As the table below shows, the foreclosure rate for 3 of the 5 core St Louis counties declined in the 4th quarter from the prior quarter and all declined from the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Foreclosures in St Louis Metro Area Down Over 40 Percent From Year Ago“

By Dennis Norman, on January 13th, 2014  St Louis foreclosures are on the decline, however there are still some “deals” out there for buyers on homes that were previously foreclosed upon. Presently, there are 714 bank-owned or government owned homes in the St Louis 5-county core area (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin) listed for sale in the St. Louis area MLS. St Louis foreclosures typically sell at a discount of 25% – 40% off retail, and sometimes even more, however you can bank on the fact that the better the price is the more work the home is going to need though. For the right buyer though, foreclosures can be a great opportunity to buy a home with instant equity! St Louis foreclosures are on the decline, however there are still some “deals” out there for buyers on homes that were previously foreclosed upon. Presently, there are 714 bank-owned or government owned homes in the St Louis 5-county core area (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin) listed for sale in the St. Louis area MLS. St Louis foreclosures typically sell at a discount of 25% – 40% off retail, and sometimes even more, however you can bank on the fact that the better the price is the more work the home is going to need though. For the right buyer though, foreclosures can be a great opportunity to buy a home with instant equity!

In the slideshow below, you can see the wide variety of homes, and prices, of bank and government owned homes for sale in the St Louis area.

For Advice on How to Buy St Louis Foreclosures From An Investor that has bought and sold over 2,000 St Louis homes click here.

Piqued your interest? If you would like more information on any of these homes or for a private viewing, click here.

Disclaimer: The information herein is believed to be accurate and timely, but no warranty whatsoever, whether expressed or implied, is given. Information from third parties is deemed reliable but not verified and should be independently verified. MORE, REALTORS does not display the entire IDX database of Mid America Regional Information Systems, Inc. (MARIS MLS) on this website.

By Dennis Norman, on December 12th, 2013 St. Louis foreclosures have declined roughly 50 percent from a year ago, according to the latest data from RealtyTrac. As the table below shows, the foreclosure rate for the 3 main counties of St Louis (city of St Louis, St Louis County and St Charles county) was down from the month before (or about the same for the city), however Franklin and Jefferson county saw an increase from the month before. All five counties have seen a significant drop in foreclosure rate from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Down About 50 Percent From A Year Ago“

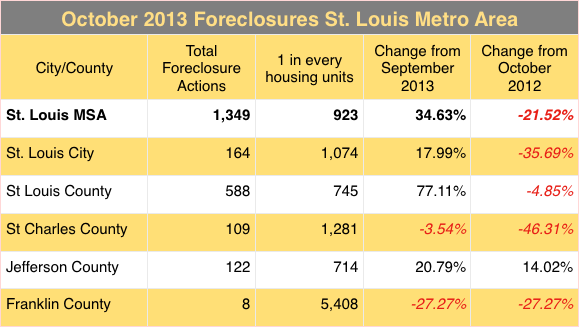

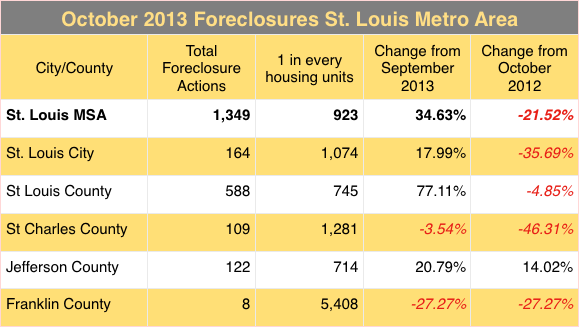

By Dennis Norman, on November 15th, 2013 St. Louis foreclosure activity shot up in October from the month before for the metro area as a whole with foreclosure actions occurring on 1 of every 923 housing units, according to the latest data from RealtyTrac. Even with the increase, October’s foreclosure activity rate for the St Louis metro area was down over 20% from a year ago. Foreclosure activity varied widely across the St Louis metro area with St Louis county seeing a 77% month over month increase and St. Charles and Franklin county both seeing declines in month over month as well as year over year rates.

Data Source: Realty/Trac – Copyright 2013 St Louis Real Estate News

By Dennis Norman, on October 21st, 2013  The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent. The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Rate Declines“

By Dennis Norman, on October 10th, 2013

St Louis foreclosure activity during the 3rd quarter of this year was down 35.70 percent from a year ago, according to a report just released this morning from RealtyTrac. There was foreclosure activity of some kind (notice of trustee sale published, foreclosure auction or new REO property) on 3,256 properties in the St Louis metro area during 3rd quarter of this year. This works out to foreclosure activity on one of every 382 properties in the St Louis metro area. St Louis’ foreclosure activity rate ranks 98th of the large metro areas (200,000+ population) in the U.S. St Louis foreclosure activity during the 3rd quarter of this year was down 35.70 percent from a year ago, according to a report just released this morning from RealtyTrac. There was foreclosure activity of some kind (notice of trustee sale published, foreclosure auction or new REO property) on 3,256 properties in the St Louis metro area during 3rd quarter of this year. This works out to foreclosure activity on one of every 382 properties in the St Louis metro area. St Louis’ foreclosure activity rate ranks 98th of the large metro areas (200,000+ population) in the U.S.

Nationally, foreclosure activity during the 3rd quarter was down 27 percent from a year ago and the rate of activity his a seven-year low. (see chart below)

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Foreclosure Activity Down Almost 36 Percent From Year Ago“

By Dennis Norman, on September 13th, 2013

There were 1,198 St Louis foreclosure filings in August 2013, down 1.27 percent from 1,213 in July and down over 40 percent (40.58%) from August 2012 when there were 2,016 foreclosure filings, according to RealtyTrac.

Of the 20 largest metro areas in the U.S. covered by the report (see below), St. Louis had the 7th lowest foreclosure rate for August with 1 foreclosure filing for every 1,039 housing units. Boston had the lowest rate with 1 foreclosure for every 2,669 housing units and Miami the highest with 1 foreclosure for every 324 housing units.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Foreclosure Filings In August Down 40 Percent From Year Ago“

By Dennis Norman, on August 15th, 2013

The number of St Louis homeowners with a foreclosure filing in July was 1,183 homeowners, a decline of 1.09 percent from June and a whopping decline of 36.4 percent from a year ago when 1,860 properties had a foreclosure filing, according to a report just released this morning by RealtyTrac. This works out to one in every 1,052 St Louis properties receiving a foreclosure filing, slightly lower than the national rate of one in every 1,001 properties and well below the 1 in every 250 rate in Miami, the metro area with the highest foreclosure rate in the U.S. in July.

Search St Louis Foreclosures For Sale

By Dennis Norman, on July 23rd, 2013

The St Louis foreclosure rate fell in May to 1.16 percent, down 33 percent from a year ago when the St Louis foreclosure rate was 1.75 percent, according to newly released data from Corelogic. More good news in the data is the fact that the St Louis mortgage delinquency rate declined in May as well, falling to 3.88 percent of all mortgage loans, down 17 percent from a year ago when the St Louis mortgage delinquency rate was 4.7 percent.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?) [iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “St Louis Foreclosure Rate Declined By One-Third In Past Year“

By Dennis Norman, on July 10th, 2013  Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes. Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes.

Mortgage delinquencies are improving as well with less than 2.3 million mortgages (5.6 percent of total mortgages) being seriously delinquent as of the end of May. This is the lowest level for mortgage delinquencies since December 2008. Continue reading “Foreclosures and Shadow Inventory Decline By Double Digits“

|

Recent Articles

|

St Louis

St Louis