By Dennis Norman, on December 19th, 2025

The St. Louis County real estate market experienced notable shifts in November 2025, as reflected in the latest data. Homes sold for a median price of $260,000, marking a slight decrease of 0.10% from November 2024’s median of $260,263. This figure also represents a significant decline of 10.68% from October 2025, when the median sold price was $291,100.

In terms of listing prices, the median list price in November 2025 was $225,000, showing a substantial decrease of 18.92% compared to $277,500 in November 2024. Additionally, the number of home sales in St. Louis County stood at 955, a 6.65% drop Continue Reading →

By Karen Moeller, on December 19th, 2025

*A new federal reporting requirement affects certain entity and cash transactions nationwide, including St. Louis.*

Not every change in real estate shows up in market statistics or price charts. Some changes are procedural, happening quietly behind the scenes, and only become noticeable when a transaction suddenly feels more complicated than expected.

A new federal reporting rule from the U.S. Treasury Department’s Financial Crimes Enforcement Network, commonly referred to as FinCEN, falls squarely into that category. While it has been discussed for some time at the national level, it is now close enough to implementation Continue Reading →

By Dennis Norman, on December 18th, 2025

In December 2025, the St. Louis real estate market is witnessing a period of mixed movements in mortgage rates, with the 30-year fixed rate holding steady at 6.27%. Although this rate remains unchanged, the slight increase of 0.01% in the 15-year fixed rate to 5.76% indicates subtle upward pressure in the market. Meanwhile, the 30-year jumbo rate has climbed to 6.42%, reflecting a trend that may affect high-value property buyers. In contrast, the 30-year FHA rate has decreased to 5.87%, providing a slight relief for first-time homebuyers or those seeking government-backed loans.

For potential homebuyers and sellers in St. Louis, Continue Reading →

By Dennis Norman, on December 17th, 2025

The St. Louis metropolitan area has experienced a slight dip in home sales this year, with a total of 31,498 homes sold through the end of November 2025. This marks a 1.04% decrease from the 31,829 homes sold during the same period last year. Despite this minor decline, the market shows remarkable stability when viewed over a longer timeline, as the number of homes sold this year remains unchanged from four years ago, when zero homes were sold by the end of November 2025. This consistency highlights the resilience of the St. Louis housing market amidst fluctuating economic conditions.

For Continue Reading →

By Dennis Norman, on December 16th, 2025

The St. Louis metropolitan area is witnessing a dynamic real estate market, with certain zip codes emerging as hotspots for quick sales. Leading the pack is a zip code in St. Clair County, Illinois, where homes are flying off the market in an average of just 26 days. This area currently has 7 active listings, with an average list price of $70,286, making it an attractive option for budget-conscious buyers seeking swift transactions.

Following closely is a zip code spanning Monroe and St. Clair Counties in Illinois, where the average time on the market is 31 days across 14 listings. Continue Reading →

By Dennis Norman, on December 15th, 2025

The Jefferson County real estate market shows a dynamic shift as of December 2025, with notable changes in home prices and sales activity. In November 2025, homes sold for a median price of $280,000, marking a 5.86% increase from November 2024’s median price of $264,500. However, this also represents a 3.45% decrease from October 2025, when the median sold price was $290,000. Despite these fluctuations, the market remains robust with 228 home sales in November 2025, maintaining the same number of transactions as November 2024.

The median list price in Jefferson County rose significantly, reaching $329,900 in November 2025, a Continue Reading →

By Dennis Norman, on December 12th, 2025

In the dynamic St. Louis metropolitan real estate market, certain school districts are standing out for their rapid home sales. Leading the charge is the Bayless School District in St. Louis, where homes are selling at an impressive pace. With 14 active listings, properties here spend an average of just 30 days on the market, boasting an attractive average list price of $213,914. This makes Bayless a hot spot for families looking to move quickly into their new homes.

Following closely is the Wood River-Hartford DIST 15 in Madison County, Illinois, where the average days on the market is 34, Continue Reading →

By Dennis Norman, on December 12th, 2025

As December 2025 unfolds, the St. Louis mortgage market is experiencing a mixed bag of rate movements, providing both opportunities and challenges for prospective homeowners and sellers. The 30-year fixed mortgage rate has slightly eased by 0.05%, now settling at 6.30%. This slight decrease offers a glimmer of relief for those looking to lock in rates for their long-term home financing. Meanwhile, the 15-year fixed rate saw a marginal increase, rising by 0.01% to 5.80%, reflecting a modest upward pressure in the shorter-term borrowing market.

For St. Louis homebuyers, these rate changes emphasize the importance of staying informed and agile. Continue Reading →

By Dennis Norman, on December 9th, 2025

The Metro East real estate market experienced notable changes in November 2025, with the median home sale price reaching $214,500. This marks a 4.89% increase from November 2024, when the median price was $204,500. However, when compared to October 2025, this represents a slight decrease of 2.50% from $220,000. The median list price for homes in the area also rose to $225,000, a significant 9.76% increase from $205,000 in the previous year. Despite the rise in prices, the number of home sales in Metro East saw a decline, with 533 homes sold in November 2025, down 4.14% from 556 sales Continue Reading →

By Dennis Norman, on December 8th, 2025

The St. Charles County real estate market witnessed notable changes in November 2025. Homes sold for a median price of $360,000, marking a 3.23% increase from $348,750 in November 2024. However, this price reflects a slight decrease of 1.37% compared to October 2025’s median sold price of $365,000. The median list price in November 2025 was $440,900, showing a significant 22.47% rise from $360,000 in November 2024. Additionally, home sales totaled 422, a 4.95% decrease from the 444 homes sold in November 2024.

For a detailed visual representation of these statistics, refer to the chart below, available exclusively from MORE, Continue Reading →

By Dennis Norman, on December 7th, 2025

The St. Louis Metropolitan Statistical Area (MSA) real estate market saw notable changes in November 2025, with homes selling for a median price of $285,000. This represents a 7.18% increase compared to November 2024, when the median sold price was $265,900. However, this figure also marks a slight decrease of 1.72% from the previous month of October 2025, when the median sold price was $290,000.

The median list price for homes in the St. Louis MSA also experienced a rise, reaching $295,500 in November 2025. This is a 5.54% increase from the $280,000 recorded in November 2024. Despite the increase Continue Reading →

By Dennis Norman, on December 6th, 2025

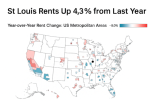

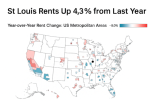

While rents have declined nationally over the past year, St. Louis is one of the exceptions. According to the December 2025 National Rent Report from Apartment List, the St. Louis metro saw a 4.3% year-over-year increase in rent prices, placing it among the top ten large U.S. metro areas for rent growth.

The national picture looks very different. Rents fell by 1.0% in November alone and are now down 1.1% compared to the same time last year. This marks the fourth straight month of nationwide rent declines. In fact, national median rent has dropped 5.2% from its August 2022 peak Continue Reading →

By Dennis Norman, on December 6th, 2025

Real estate investors accounted for a record-high 33% of all single-family home purchases in the U.S. during the second quarter of 2025, according to the latest Investor Pulse™ Report from BatchData. This marks the highest share in five years and reflects a growing trend of investor activity in the housing market, particularly from “mom-and-pop” buyers who now own over 90% of all investor-held homes. In contrast, large institutional investors have been net sellers for six straight quarters. Despite this national trend, Missouri’s investor footprint remains relatively modest, coming in just under the national average, based on visual analysis of the Continue Reading →

By Dennis Norman, on December 4th, 2025

St. Louis homebuyers received a bit of relief this December as mortgage rates saw a slight decline across the board, reflecting a favorable trend for those in the market for a new home. The 30-year fixed mortgage rate has fallen to 6.23%, down 0.07% from the previous rates, while the 15-year fixed rate also saw a decrease, now standing at 5.75%. This drop in rates provides a much-needed breather for potential buyers who have been facing the pressure of high borrowing costs in recent months.

The slight dip in rates is expected to invigorate the St. Louis housing market as Continue Reading →

By Karen Moeller, on December 3rd, 2025

Showing homes in St. Louis is a little like speed dating. You walk in, take one lap through the room, get a feel for the energy and decide very quickly if this relationship has potential or if you should politely run.

After hundreds of showings across the metro, I have noticed certain patterns. Consider this your completely serious, absolutely scientific guide to the subtle red flags St. Louis buyers and agents spot the moment they step inside a home.

These signs are not dealbreakers by themselves, but they tell a story. And sometimes, they tell it loudly.

Let’s take a Continue Reading →

By Karen Moeller, on December 2nd, 2025

There is something happening in real estate that numbers and charts don’t capture. It is quieter than the headlines and more personal than the market updates. If you have spent any time talking with agents across the St. Louis metro, you can feel it immediately.

A lot of agents are carrying a kind of tired that goes deeper than being busy. It is the tired that comes from trying to hold everything together alone. The tired that comes from constant change. The tired that comes from giving so much of yourself to a career you love but not always feeling Continue Reading →

By Karen Moeller, on December 1st, 2025

There is a quiet change happening in the St. Louis real estate market, and it is not about interest rates or home prices. It is about the number of agents still actively working. After years of more agents than available transactions, the count is finally tightening. And honestly, this is not a bad thing for buyers and sellers.

In every market cycle, people enter the business when it looks easy and step out when it becomes clear that real estate requires consistency, knowledge, and true day-to-day commitment. What we are seeing now is the industry balancing itself out

Why the Continue Reading →

By Karen Moeller, on November 28th, 2025

Every year around this time, the same question starts popping up in my texts, emails and casual conversations:Should I list my home during the holidays or wait for the spring market?

It is a fair question. When your holiday to-do list already feels as long and heavy as Jacob Marley’s chain, the idea of packing, staging and keeping the house show-ready can feel like too much. But the truth is, the holiday season behaves very differently in St. Louis than most people expect.

Here are the answers to the questions homeowners are asking right now.

Q: Do homes really sell Continue Reading →

By Dennis Norman, on November 27th, 2025

As the St. Louis housing market heads into the final months of 2025, mortgage rates continue their upward trajectory, affecting both potential homebuyers and sellers in the region. The 30-year fixed mortgage rate has risen to 6.22%, marking an increase of 0.02% from last week. Similarly, the 15-year fixed rate saw a hike, now standing at 5.78%, up by 0.03%. Other loan types, including the 30-Year FHA and 30-Year Jumbo, also experienced rate increases, indicating a broader trend of rising rates across various mortgage products.

For St. Louis area buyers, these rate hikes mean higher monthly payments, potentially impacting affordability Continue Reading →

By Dennis Norman, on November 27th, 2025

While Thanksgiving has become a well-established American tradition, many people may not realize that it wasn’t always a national holiday. That changed in 1863, when President Abraham Lincoln issued a proclamation during the heart of the Civil War, calling on Americans to observe a national day of Thanksgiving on the last Thursday of November. This historic act laid the foundation for the holiday as we know it today.

Lincoln’s proclamation came at a time of deep division and suffering. Yet, he noted the many blessings still enjoyed by the nation: peace with foreign powers, growing industry and agriculture, and an Continue Reading →

By Cathy Lirette, on November 26th, 2025 Real estate moves fast. Between showings, negotiations, inspections, and closings, it’s easy to stay focused on the next task. But when I slow down and look at the work I get to do, I’m reminded how grateful I am for this career. It’s shaped me, challenged me, and given me a deeper sense of purpose than I ever expected.

What means the most to me is the trust my clients place in me. They invite me into one of the biggest decisions of their lives and rely on me to guide them honestly, protect their interests, and help steady things Continue Reading →

By Karen Moeller, on November 26th, 2025

The City of St. Louis has approved a major change that will quietly reshape how land is valued, bought, and sold inside the city limits. The minimum buildable lot size, previously set at 4,000 square feet, has now been reduced to 1,500 square feet. It is one of the biggest zoning shifts the city has made in decades, and it affects far more than developers. Homeowners, sellers, and buyers should understand how this change works and what it means for property value.

This update creates new possibilities, but it also introduces new considerations for anyone involved in a real estate Continue Reading →

By Karen Moeller, on November 25th, 2025

The White House is one of the most recognized historic residences in the country, and like many older homes in the St. Louis region, it requires continual upkeep. During Donald Trump’s presidency, several major renovation projects took place. Regardless of politics, these updates offer valuable lessons for anyone who owns or is planning to renovate an older home.

Here are five practical takeaways.

1. Old homes need real infrastructure work

The West Wing’s major HVAC replacement showed how essential it is to update aging systems. St. Louis homeowners in pre-1960 homes face similar challenges with older ductwork, undersized returns, and Continue Reading →

By Karen Moeller, on November 24th, 2025

The City of St. Louis has begun accepting applications for the new Impacted Tenants Fund, a relief program created to support renters who were forced to relocate after their homes were condemned or damaged beyond habitability during the May 16 tornado. The program provides a one-time payment equal to one month of rent, calculated using the 2025 HUD Fair Market Rate for the size of the former unit. Applications are processed through Employment Connection.

The fund was established under Ordinance 71840 and financed through federal American Rescue Plan dollars. Although the program was authorized in 2024, Continue Reading →

By Dennis Norman, on November 24th, 2025

If you’re a landlord renting out a condo in Missouri, you need to understand a key risk that can cost you, even if your mortgage is current. Missouri Statute 448.3-116 gives the condo association an automatic lien for unpaid assessments or fines. This lien attaches from the moment the debt becomes due and can be foreclosed like a mortgage. And yes, this applies even when the tenant is the one supposed to be paying the fees.

The statute goes further. If the unit owner is more than 60 days delinquent on assessments, the association has the right to demand that Continue Reading →

By Karen Moeller, on November 24th, 2025

St. Louis buyers, builders, and longtime residents have been asking a quiet question over the last few years: Why does it feel like there are fewer tear down opportunities in the older suburbs?

You would think that with aging housing stock, the supply of buildable lots would naturally increase over time. But the opposite is happening, and the reason has nothing to do with builders, zoning boards, or construction trends. It starts inside the homes themselves.

Homeowners in their seventies and eighties are staying put longer than any previous generation. They have stable tax Continue Reading →

By Dennis Norman, on November 21st, 2025

The St Louis City real estate market showed a dynamic shift in October 2025, with homes selling for a median price of $223,000. This marks a 6.19% increase compared to October 2024’s median of $210,000. However, it also reflects an 8.98% decrease from September 2025, when the median sold price was $245,000. The median list price for homes in October 2025 was $205,000, representing a 10.87% drop from $230,000 in October 2024. Additionally, home sales totaled 255, down 16.12% from 304 sales in October 2024.

The chart below, available exclusively from MORE, REALTORS®, illustrates these market trends and provides further Continue Reading →

By Dennis Norman, on November 20th, 2025

In November 2025, St. Louis homebuyers are seeing a slight reprieve in mortgage rates as the 30-year fixed rate dips to 6.36%, down by 0.02% from previous levels. This decrease, along with a minor reduction in the 15-year fixed rate to 5.85%, reflects a downward trend in the market, offering potential buyers a modestly improved borrowing cost environment. The 30-year Jumbo and FHA loans also experienced slight declines, with rates at 6.44% and 5.99%, respectively. However, the 30-year VA rate saw an increase, demonstrating a mixed bag for specific loan products.

For those considering entering the St. Louis housing market, Continue Reading →

By Dennis Norman, on November 20th, 2025

The Franklin County real estate market continues to show robust growth as we move into November 2025. Homes in the area sold for a median price of $273,500 in October 2025, marking a 7.25% increase from the previous year when the median price was $255,000. This upward trend also reflects a 2.43% rise from September 2025’s median price of $267,000.

The median list price in October 2025 was $303,000, a significant 14.34% jump from $265,000 in October 2024. The number of home sales also saw a notable increase, with 133 homes sold in October 2025 compared to 112 in Continue Reading →

By Dennis Norman, on November 19th, 2025

The St. Louis County real estate market saw notable changes in October 2025, with homes selling for a median price of $292,950. This marks an increase of 4.63% compared to October 2024, when the median sold price was $280,000. However, this figure represents a slight decrease of 0.69% from September 2025, when the median sold price was $295,000.

The median list price in October 2025 was $239,999, showing a significant decrease of 13.51% from $277,500 in October 2024. Despite this drop in list prices, the number of home sales increased, with 1,246 homes sold in October 2025, up 7.51% from Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|