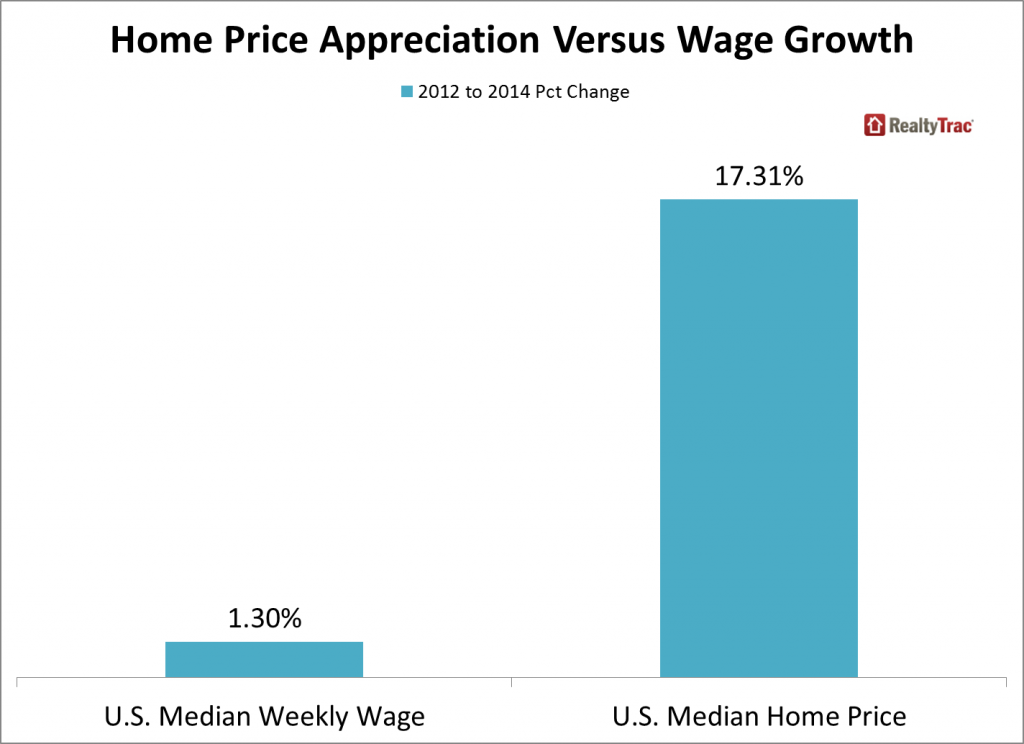

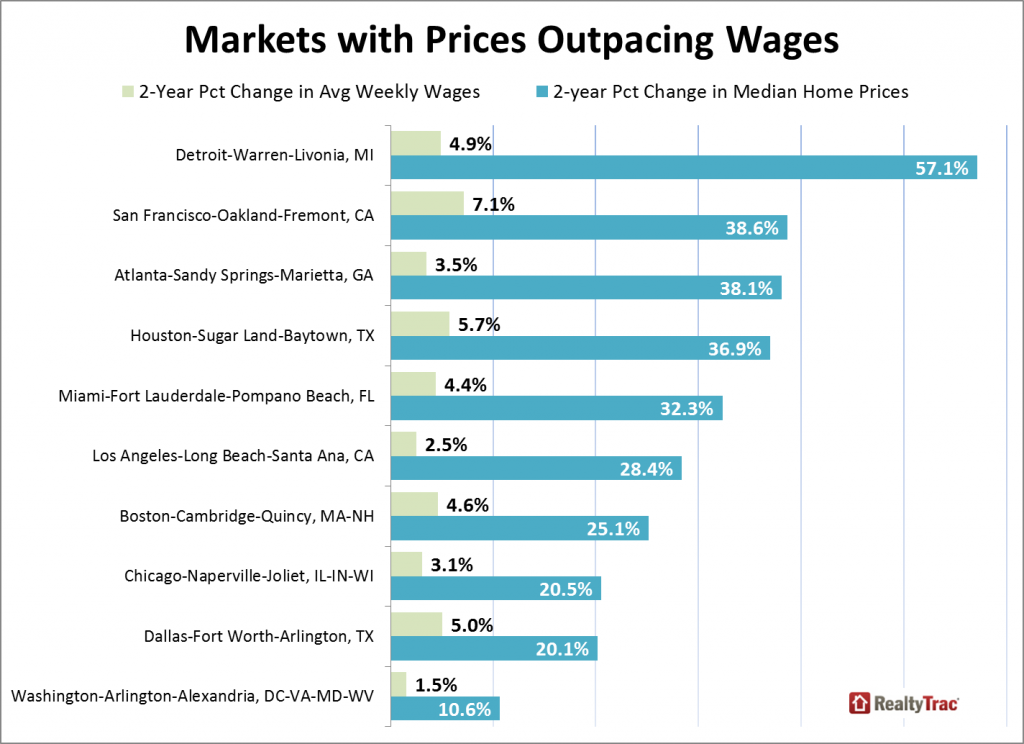

RealtyTrac published a report earlier this week revealing median home prices in the U.S. increased over the past two years at a rate 13 times greater than what wages increased during the same period. RealtyTrac’s report included a chart (below) showing several metropolitan areas throughout the U.S. where, over a recent two year period, home prices were outpacing wages and that “either wages are going to need to go up or (home) prices are going to need to at least flatten out and wait for wages to catch up.”

St Louis Home Price Appreciation Versus St Louis Wage Growth:

As I often remind everyone, all real estate is local, so I wanted to look at local data to see how St Louis shaped up in an analysis similar to the one done by RealtyTrac. I was particularly interested in the outcome of my analysis since it wasn’t that long ago I wrote an article questioning whether home prices in St Louis were too low and now, on a national level, the discussion seems to be perhaps they are too high.

Search ALL St Louis Homes For Sale

See ALL Homes That Will Be Open In St Louis This Weekend

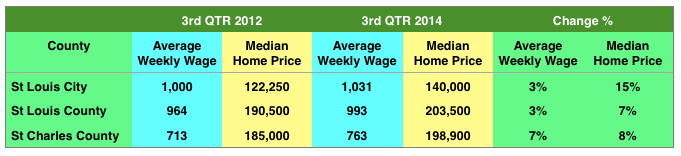

For my analysis, I looked at the average weekly wage for the 3rd quarter of 2014 (the most recent data available) and compared that with two years prior to compute the increase in wages, then looked at the median price of homes sold during the 3rd quarter of 2014 and compared that with the median price of homes sold during the 3rd quarter of 2012. I did this for the City of St Louis, St Louis County and St Charles County. As the table below shows, the results for here in St Louis differ significantly from the national data. The city of St Louis is where the gap between home price appreciation and wage growth was the greatest and even there, home prices had only increased at a rate 5 times higher than than wages, still a significant amount, but a far cry from 13 times like at the national level. St Louis County home price appreciation was just slightly over double the rate of wage growth and in St Charles County home prices and wages have risen at nearly the same rate.

Given that, as my earlier article illustrated, St Louis home prices may have already been low and, as illustrated in that article, the relationship between home prices and income supports some price growth, I don’t see St Louis having a problem at this time as there was room for home prices to increase at a faster rate than wages as they were too out of whack the other direction to start with. Having said that, obviously this is not a trend that can be sustained forever as there has to be some relationship between home price appreciation and wage increases otherwise we end up with another bubble bursting….but not in 2015, not in St Louis.

St Louis Home Price Appreciation Versus Wage Growth

Source: MORE, REALTORS – Copyright 2015 – All Rights Reserved