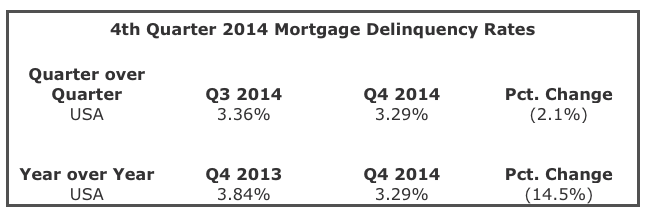

Mortgage Delinquencies (borrowers that are 60 days or more late on their house payment) declined in the 4th quarter of 2014 marking the 12th consecutive quarter of declines in the mortgage delinquency rate, according to data just released by TrasnUnion. As the table below shows, the mortgage delinquency rate for the 4th quarter of last year was 3.29%, a decline of 2.1% from the quarter before and a decline of 14.5% from the 4th quarter of 2013.

Foreclosures and better borrowers are the reason…

Ezra Becker, vice president of research and consulting at TrasnUnion, said the improvement in mortgage delinquencies are driven “primarily by the ongoing clearance of the foreclosure backlog” and also notes that recent borrowers “have been performing exceptionally well“.

Young borrowers show best improvement….

Although mortgage delinquencies improved for all age groups, the youngest group (age 30 and under) had the largest improvement from a year ago with the mortgage delinquency rate dropping to 2.21% for 4th quarter 2014, a 24.3% decline from a year ago when the delinquency rate was 2.92%.

More home loans to “Non-Prime” borrowers…

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Get Pre-Approved for a home loan or see how much you can save by refinancing

Data Source: TransUnion