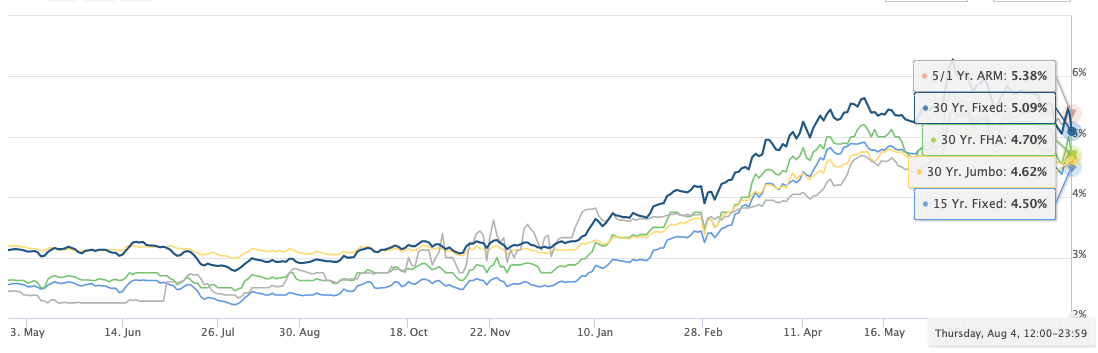

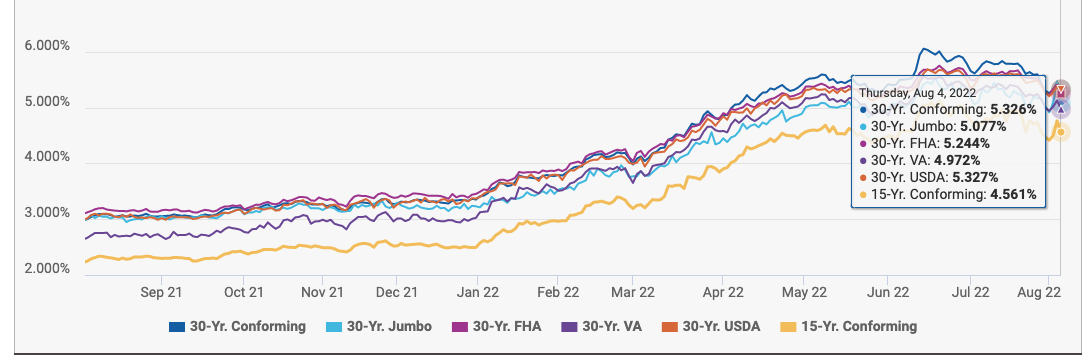

I saw dozens and dozens of headlines yesterday reporting that mortgage interest rates had fallen below 5% on a 30-year fixed rate mortgage. The catch is on the day that was reported, yesterday, interest rates were actually above 5% on a 30-year fixed-rate loan. As our chart below shows, the MND Rate index was reporting 5.09% and, below that, Optimalblue was reporting 5.326%. Both of the aforementioned charts are updated daily and considered by many in the industry to have the most current and accurate information.

How could all the big headlines be wrong?

Well, actually the articles I scanned were not wrong in what they were reporting, the headline would just give many home buyers a different impression perhaps than what was actually being reported. What prompted the headlines was yesterday, like every week on Thursday, the Freddie Mac Primary Mortgage Market Survey® (PMMS®) results were released. In Freddie Mac’s report, it showed the average 30-year fixed rate mortgage was 4.99% (see the Freddie Mac chart at bottom). The catch is, the survey is done from Monday through Wednesday of the week and then the results reported on Thursday. Many lenders submit their rates to Freddie Mac on Monday meaning by the time the report comes out they are 3-days old. A lot happens in the mortgage market in 3-days, in fact a lot can happen during one day. Oh yeah, the other thing worth noting is if you read the details on the Freddie Mac survey the stated rate was only obtained by paying 0.80 in points, so 8/10 of 1% of the loan amount would be paid up front to get that rate.

Freddie Mac’s Survey Is Very Valuable and Relevant

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

The PMMS® goes back to 1971 and is, as far as I know, the most comprehensive and accurate source of historical mortgage rate data, with the key word being “historical”.

MND Rate index and Optimal Blue are more current but still a day late…

The two charts I referenced at the beginning of the article that are shown below (and you can access live versions of by clicking on the chart) are better indicators of current mortgage rates but they are still reporting day-old information and, like Freddie Mac, are based upon national data.

This is yet another example of why you really need a good real estate agent working with you while in the market for a home. A good agent, such as the “Masters Of Real Estate” that can be found in our firm, MORE, REALTORS® will have relationships with trusted local lenders and access to the current rates for our area. They will do a lot more for you than just get you rates too such as letting you know how you can lock in an interest rate even before you have found a home to buy or during a long period of time such as is needed when building a new home.

MND Rate Index

(click on chart for live, interactive chart)

OBMMI (Optimalblue) Rates

(click on chart for live, interactive chart)

Freddie Mac Primary Mortgage Market Survey® (PMMS®)

(click on chart for live, interactive chart)

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]