By Dennis Norman, on May 7th, 2015 Flipping homes accounts for a smaller percentage of home sales today at about 4 percent of total home sales in the U.S., then in the recent past when they accounted for 6 percent of more of the homes being sold (6.8% at the recent peak in 1st quarter 2012), according to a report released today by RealtyTrac.

According to RealtyTrac, Baltimore Maryland is the best place to flip homes based upon the gross profit margin calculated as a return on investment (ROI) coming with a 94.1% ROI! Before you get too excited, don’t think that is what the investor walked away with, the gross margin is just based upon the difference between the purchase price and sale price and does not take into account any expenses for remodeling, resale, etc. As the table below shows, the next 4 out of 5 cities at the top of the list can all be found in Florida.

Memphis Tennessee is the metro area with the highest percentage of flips with home flipping accounting for over 10 percent (10.6%) of all the home sales. The table at the bottom lists the 20 markets with the highest percentage of flipping.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here. Continue reading “Baltimore Tops List Of Metros For Highest Returns From Flipping Homes“

By Dennis Norman, on May 6th, 2015 House flipping in St Louis accounted for just 2.4 percent of the home sales in the St Louis metro area during the first quarter of this year, according to data just obtained from RealtyTrac. This is a decline a 69 percent from a year ago when “flips” accounted for 7.7 percent of all St Louis home sales.

Highlights from the 1st Quarter 2015 report:

- There were 115 house flips during the 1st quarter of 2015

- This was a 57% decline from the prior quarter and a 69% decline from the 1st quarter of 2014

- Average days to flip a home during the quarter was 169

- Average purchase price was $79,398, average sale price $101,495

- Average gross margin on flips during the quarter was 22%

- Average gross return on investment during the quarter was 27.8% which is down from 47.9% a year ago

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here.

By Dennis Norman, on March 10th, 2015 If you are like a lot of people and see St Louis foreclosures, or REO’s (real estate owned by banks and other lending institutions as a result of foreclosure) as a good opportunity to buy a residence for yourself or as an investment either for rental or for “flipping”, you best have cash and be prepared to “buck up” if you want to succeed! I say this because cash buyers continue to dominate the REO and foreclosure market with 61% of all REO and Foreclosure sales this year in St Louis being cash sales thus far. As the table below shows, while the number of foreclosure sales has declined this year from last year at the same time, the percentage of them going to cash buyers has not.

Good deals on St Louis foreclosures are selling fast and often for list price or more.

For the month of February, in the five county core St Louis market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) there were 273 foreclosure or REO homes sold and they were sold, on average, at 98% of list price. If we drill down a little and find the “best” deals out of the gate, the ones that sell in the first 10 days, there were 48 foreclosure homes sold in February (18% of the overall total number of foreclosures sold) and they sold, on average, for 105% of the list price.

So, if you are planning on buying St Louis foreclosures, cash is king and, for the new deals that hit the market with an attractive price, realize that even a full price offer may not buy it. For some personal advice from me on how to be successful buying St Louis Foreclosures and REO’s, read my report here.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale HERE

Search St Louis Homes For Sale HERE

By Dennis Norman, on February 27th, 2015

Two zip codes in the city of St Louis made RealtyTrac’s list of “Zips with the highest gross returns (from flipping property)” for 4th quarter, 2014. The 63139 zip code, which includes the Dog Town area of St Louis, came in number 2 on the list with an average gross return on investment of 163.9% and the 63116 zip code, which includes Tower Grove South, Holly Hills, Dutchtown South and Bevo, came in 9th on the list with an average gross return on investment of 127.7%.

To be eligible to be considered for the list, there had to be at least 10 single family homes “flips” completed during the 4th quarter of 2014. In the 63139 area of St Louis, there were 18 such home flips during the quarter with an average purchase price of $9,000 and an average gross profit of $14,750 from the flip. In the 63116 zip area, there were 21 flips during the quarter with an average purchase price of $27,721 and an average gross profit of $35,407. The table below shows the data for all 10 top gross returns from flipping property zips in the U.S.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here.

Continue reading “Two St Louis Areas were the most profitable zips in the U.S. for flipping property in 4th quarter“

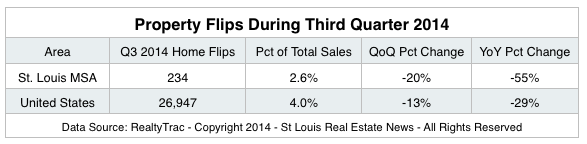

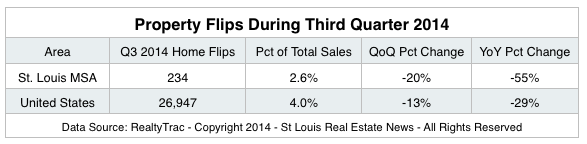

By Dennis Norman, on November 21st, 2014 Property “flips” in St Louis slowed during the 3rd quarter of this year to just 234 properties flipped in the St Louis MSA during the quarter making up 2.6% of overall home sales for the quarter, a decline of 20% from the quarter before and a decline of 55% from the third quarter of 2013, according to data just released by RealtyTrac. Property flipping is a term that has been loosely applied to a variety of real estate transactions but, for the purpose of this report, was considered to be when a single family home sold in during the third quarter had been sold within the previous 12 months.

Back in 1979, when I entered the real estate business, my focus was on buying property to resell and a “flip” at that time referred to a property I had under contract to buy that I managed to sell, or “flip” to someone else (often a competitor) with the closing of both my purchase and my sale taking place on the same day, hence a “flip”. So, in the last 35 years a flip has went from being a property bought and sold on the same day to one bought and sold within a year…hmm…

Find St Louis Property to Flip

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 7th, 2014 If you are one of the many parents of college-bound kids that is considering investing in a property to provide housing for your college student rather than waste money or dorms or rent, then this newly released info will help. Below is a list of the best college towns for renting property as well as the best college towns for flipping property, as compiled by RealtyTrac. St Louis didn’t make either list, actually nothing in Missouri did, however, many of the colleges and universities listed have plenty of kids attending from this area.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Want to find homes or condos that are available in college towns or get more detailed market information on one? Contact us and we’ll get you everything you need!

By Dennis Norman, on August 29th, 2014 Flipping property in the St Louis area has paid off for investors over the past year provided they have stayed out of the City of St Louis. “Flipping” or a “Flip” is a term used today to describe when a property is bought and then re-sold within a short time period. In St Louis County, the 3rd quarter of 2013 and the 3rd quarter of 2014, there were 658 properties flipped at an average gross profit of nearly 25 percent (24.56%) , according to a newly released report from RealtyTrac. During the same period there were 203 properties flipped in St Charles county with an average gross profit of 17.95%. It doesn’t look like investors in the City of St Louis fared so well though, with 184 flips during the period for an average loss of 3.85%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip

By Dennis Norman, on August 21st, 2014 Property flipping, which is basically buying a property and then reselling it immediately, or shortly thereafter, is occurring less frequently now in St Louis than it was, according to a report released today by RealtyTrac. According to the report, there were 289 houses flipped in the St Louis metro area during the 2nd quarter, down 44% from the first quarter and down 17% from the 2nd quarter of 2013. During the 2nd quarter of this year, 3.3% of all St Louis home sales were “flip” deals which, for the purpose of this report, were homes that were bought, then resold within a 12 month period.

The average gross profit on the properties flipped during the 2nd quarter of 2014 was $20,122, down significantly from the same period a year ago when the average gross profit was $36,858. Before you get too excited, I should point out, this is just the gross margin, the difference between the initial price paid and the resale price and does not take into account any repairs, improvements or other expenses related to that property or the transaction.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip

By Dennis Norman, on June 3rd, 2014 The best places to flip property in the U.S. are, with the exception of Wright County Minnesota, all east of the Mississippi extending from as far north on the east coast as New York to as far south as Florida, according to a report just released by RealtyTrac. For this report, RealtyTrac looked at property that was “flipped” (bought and then resold within the same period…often times done by an investor for profit) during the one-year period from April 2013 through March 2014, and ranked the counties based upon the gross return on investment made in those flips. One thing to keep in mind, this is just a “gross margin” or simply the difference between what the house was bought for and then resold for during the period without taking into account the expenses involved in the acquisition and sale, cost of rehab and improvements that were done or carrying cost.

Here in St Louis there are only two counties that were including in the report, St. Charles County and St Louis County (in which they included the city of St Louis as well). For St Charles county there were 98 flips during the one-year period and the average gross return on investment was 66.95%. For St Louis County (and city) there were 399 flips with an average gross return on investment of 25.32%. There is a US interactive heat map below where you can look up info for counties around the country.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip Continue reading “Where Are The Best Places To Flip Property?“

By Dennis Norman, on April 16th, 2014 Everyone loves a deal! When it comes to buying a house, over the past few years there have been many “deals” out there as a result of the housing market meltdown. However, now that the worst of it is over, and many markets have already started recovering, the question for many are “where in St Louis can home buyers find a good deal?“. This is not easy to answer and what is a “good deal” for a home buyer looking for a place to call home for the foreseeable future is not necessarily going to be viewed in the same way by an investor looking to buy rental property or for something to flip. However, the are some basic market indicators that buyers can follow to point them in the right direction.

By looking at different types of market data it is pretty easy to determine what markets or neighborhoods are still challenged and where opportunities may be found out. Below are tables and charts that will help find those neighborhoods:

(We work hard on this and sure would appreciate a “Like”)

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here.

Continue reading “Where in St Louis can home buyers find a good deal?“

By Dennis Norman, on March 23rd, 2014 Homeowners are feeling more optimistic about their investment in their homes as reflected in a new Rasmussen Reports survey which shows only 18% of homeowners think their homes is worth less today than when they bought it. This is down from 24% in the last survey and is the lowest level since the survey began 3 years ago.

On the flip side, more than half (57%) of homeowners surveyed feel their home is worth more today than when they first bought it.

To find out what your home is worth, you can check out the online resources below, or you are always welcome to contact me:

By Dennis Norman, on December 27th, 2013  The table below shows the top 25 St Louis neighborhoods where the prices of homes listed for sale have increased in the prior 90 days. This could be an indicator of rising home prices in the area or could be an indicator of a lot of investor or speculator activity resulting in homes being purchased and immediately put back out on for sale to “flip” it at a higher price. This is why it is always important to look at more than just one statistic when trying to determine what is going on in a particular market and why it is imperative that you deal with a real estate professional that has access to real-time, accurate data and knows how to interpret it. The table below shows the top 25 St Louis neighborhoods where the prices of homes listed for sale have increased in the prior 90 days. This could be an indicator of rising home prices in the area or could be an indicator of a lot of investor or speculator activity resulting in homes being purchased and immediately put back out on for sale to “flip” it at a higher price. This is why it is always important to look at more than just one statistic when trying to determine what is going on in a particular market and why it is imperative that you deal with a real estate professional that has access to real-time, accurate data and knows how to interpret it.

(Looking to find an agent like that? Contact me…I’ll help you out).

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “In What St Louis Neighborhoods Have Home Prices Increased?“

By Dennis Norman, on October 17th, 2013  House flipping in St Louis is on the rise according to the 3rd quarter house flipping report just released this morning by RealtyTrac, the foreclosure tracking gurus. What is “house flipping”? Well, back when I entered the real estate business (1979) and began buying and selling homes, a “flip” was referred to as a house we sold and would close the our purchase, as well as our resale, on the same day. Today, “flipping” is applied to a home that is bought and then resold within a short period, for the purposes of the RealtyTrac report, 6 months. House flipping in St Louis is on the rise according to the 3rd quarter house flipping report just released this morning by RealtyTrac, the foreclosure tracking gurus. What is “house flipping”? Well, back when I entered the real estate business (1979) and began buying and selling homes, a “flip” was referred to as a house we sold and would close the our purchase, as well as our resale, on the same day. Today, “flipping” is applied to a home that is bought and then resold within a short period, for the purposes of the RealtyTrac report, 6 months.

The RealtyTrac report shows, during the 3rd quarter, there were 346 houses flipped in the St. Louis metro area, a slight decrease (10%) from the prior quarter, but a 68% increase from a year ago. The average price paid for a St Louis flip was $124,102 and the average price it was resold at was $142,370. The table below shows complete data for the metro area as well as for St Louis City & County and St Charles county.

Interested in Flipping Property?

Buying Foreclosures is a good place to start.

Search St Louis Foreclosures HERE

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?)

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “House Flipping In St Louis Up 68 Percent From Year Ago“

By Dennis Norman, on June 6th, 2013  Dennis Norman,

Broker-Officer,

MORE, REALTORS St. Louis 4th Best City in the U.S. To Buy Bargain Real Estate

According to a report released today by RealtyTrac, St Louis is 4th on the list of the best cities in the U.S. to still be able to buy fixer-upper bargain homes. In compiling the list, RealtyTrac considered the number of homes each city had that were bank owned homes (REO’s), built before 1960 (indicating the opportunity to increase value by updating and/or improving) and had an estimated value below $100,000. The complete list of the top 15 cities is below as well as an interactive info-graphic.

To access St Louis foreclosures (REO’s) currently available for sale click here.

For Advice on How to Buy St Louis Foreclosures From An Investor that has bought and sold over 2,000 St Louis homes click here. Continue reading “St Louis Ranked As 4th Best City To Buy Fixer-Upper Bargain Homes“

By Dennis Norman, on May 3rd, 2013

In What Cities Can You Make The Most Money Flipping Homes?

Unfortunately, St. Louis did not make the list. However, that is actually a good thing as the cities at the top of RealtyTrac’s list of the top 25 cities in the U.S. for flipping homes are all cities that were hammered when the market crashed. This is not to say that the opportunity does not exist in St Louis to flip property for a profit or to make good buys for rental or other long term investment, it’s just the profits here may not be as large as in some markets.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Search St Louis Foreclosures For Sale

Continue reading “Where Can You Make The Most Money Flipping Homes?“

By Dennis Norman, on April 12th, 2013  “Nationwide, we’re not in a bubble,” says Glenn Kelman, CEO of online real estate company Redfin, however Washington D.C., Los Angeles, San Francisco and San Diego may be headed that direction, according to Redfin’s data. Redfin is not in St Louis so our city was not on their list but in the coming weeks I plan to do an analysis of the St Louis market in the same manner they did of other markets and will publish what I find at that time. In the meantime, here’s the info from Redfin. “Nationwide, we’re not in a bubble,” says Glenn Kelman, CEO of online real estate company Redfin, however Washington D.C., Los Angeles, San Francisco and San Diego may be headed that direction, according to Redfin’s data. Redfin is not in St Louis so our city was not on their list but in the coming weeks I plan to do an analysis of the St Louis market in the same manner they did of other markets and will publish what I find at that time. In the meantime, here’s the info from Redfin.

Continue reading “Washington DC And 3 California Cities Most Likely To See Housing Bubble“

By Dennis Norman, on July 13th, 2012  Here’s some good news to end our week with: In St. Louis the number of homeowners that are underwater on their mortgage (owe more than their home is worth), otherwise known as being in a “negative equity” position, dropped to 90,196 homeowners, or 16.1 percent of all St. Louis homeowners with a mortgage, in the first quarter of this year, down from 101,829 St Louis homeowners, or 18.1 percent during the prior quarter, according to a report just released by Corelogic. Continue reading “Number of St Louis Homeowners with Negative Equity on the Decline; Short sale help for Sellers and Buyers“ Here’s some good news to end our week with: In St. Louis the number of homeowners that are underwater on their mortgage (owe more than their home is worth), otherwise known as being in a “negative equity” position, dropped to 90,196 homeowners, or 16.1 percent of all St. Louis homeowners with a mortgage, in the first quarter of this year, down from 101,829 St Louis homeowners, or 18.1 percent during the prior quarter, according to a report just released by Corelogic. Continue reading “Number of St Louis Homeowners with Negative Equity on the Decline; Short sale help for Sellers and Buyers“

By Dennis Norman, on October 20th, 2011  Today’s existing home sales report from the National Association of REALTORS® shows existing home sales in September were at at a seasonally adjusted-annual rate of 4.91 million units which is a decrease of 3.0 percent from the month before, an increase of 11.3 percent from a year ago and is the second highest rate of home sales since March 2011 when it was 5.09 million. Continue reading “Home sales and prices decline in September“ Today’s existing home sales report from the National Association of REALTORS® shows existing home sales in September were at at a seasonally adjusted-annual rate of 4.91 million units which is a decrease of 3.0 percent from the month before, an increase of 11.3 percent from a year ago and is the second highest rate of home sales since March 2011 when it was 5.09 million. Continue reading “Home sales and prices decline in September“

By Dennis Norman, on August 16th, 2011  The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland. Continue reading “FBI Report Shows Mortgage Fraud Continues at Elevated Levels“ The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland. Continue reading “FBI Report Shows Mortgage Fraud Continues at Elevated Levels“

By Dennis Norman, on May 20th, 2011  UGH… UGH…

According to a survey conducted by Harris Interactive® on behalf of Trulia and RealtyTrac, 54 percent of American adults believe that recovery in the housing market will not happen until 2014 or later. In a previous survey, six months ago, 42 percent of American adults said they thought the market would turn around by 2012 or had already turned around, but now only 23 percent think this will happen. Continue reading “Survey shows over half American adults think housing recovery is years away“

By Dennis Norman, on February 17th, 2011  The Mortgage Bankers Association released the results of it’s National Delinquency Survey for the 4th quarter of 2010 and it shows very mixed results. On the positive side of things, overall mortgage loan delinquency in the U.S. has dropped to 8.22 percent which is the lowest rate since 4th quarter 2008 when the rate was 7.88 percent. On the flip side of the coin, the overall foreclosure rate for the quarter was 4.63 percent which ties the highest rate on record which was hit in the 1st quarter of 2010. Continue reading “Mortgage loan delinquency hits 2 year low; foreclose rate ties highest on record“ The Mortgage Bankers Association released the results of it’s National Delinquency Survey for the 4th quarter of 2010 and it shows very mixed results. On the positive side of things, overall mortgage loan delinquency in the U.S. has dropped to 8.22 percent which is the lowest rate since 4th quarter 2008 when the rate was 7.88 percent. On the flip side of the coin, the overall foreclosure rate for the quarter was 4.63 percent which ties the highest rate on record which was hit in the 1st quarter of 2010. Continue reading “Mortgage loan delinquency hits 2 year low; foreclose rate ties highest on record“

By Dennis Norman, on January 31st, 2011  The Federal Housing Administration (FHA) announced the temporary waiver of the “anti-flipping” rule has been extended through December 31, 2011. In my opinion the “anti-flipping” rule was a bad idea to start with and in the current housing market the last thing we need is anything to discourage investors from buying homes so this is a good move by FHA. The Federal Housing Administration (FHA) announced the temporary waiver of the “anti-flipping” rule has been extended through December 31, 2011. In my opinion the “anti-flipping” rule was a bad idea to start with and in the current housing market the last thing we need is anything to discourage investors from buying homes so this is a good move by FHA.

Continue reading “FHA Extends ‘Anti-Flipping Waiver’“

By Dennis Norman, on January 7th, 2011  The real estate market has not been very nice to us over the past 3 years or so and we are all anxious to see the light at the end of the tunnel. With that in mind, and 2011 in front of us, where is the real estate market headed in 2011? Before I take my humble stab at answering this question I need to remind you I am not an economist nor do I have a PhD behind my name, in fact I have nothing behind my name. All I can offer is a whole lot of experience “in the trenches“….as a broker, investor, developer…. Continue reading “Where is the real estate market headed in 2011?“ The real estate market has not been very nice to us over the past 3 years or so and we are all anxious to see the light at the end of the tunnel. With that in mind, and 2011 in front of us, where is the real estate market headed in 2011? Before I take my humble stab at answering this question I need to remind you I am not an economist nor do I have a PhD behind my name, in fact I have nothing behind my name. All I can offer is a whole lot of experience “in the trenches“….as a broker, investor, developer…. Continue reading “Where is the real estate market headed in 2011?“

By Dennis Norman, on December 28th, 2010  It seems we always need to find someone to blame for our problems… It seems we always need to find someone to blame for our problems…

When it comes to the meltdown in the housing market that has taken place over the past three years there has been no lack of finger pointing by many inside and outside the industry as to factors that either caused or contributed to the collapse of the housing market. Sub-prime lending, Wall Street, mortgage fraud, the mortgage industry, banks, community reinvestment act, real estate brokers and agents, fannie mae, freddie mac, federal government over-regulation, federal government under-regulation, appraisers, unemployment, the economy in general, “flipping”, sellers, buyers and more have been blamed in one way or another for the collapse. In my humble opinion and, based upon my 30+ years of experience in the industry, I would say all the aforementioned played a part in the collapse and certainly no one thing could have caused this mess on its own, it was a combination of several things that led up to the “perfect storm”. Continue reading “Making Appraisers the Scapegoat“

By Dennis Norman, on September 7th, 2010  Dennis Norman When I first entered the real estate business in 1979, at the age of 18 which seems so long ago) foreclosures were a mystery to most people and certainly no one looking for a home to live in looked to buy a foreclosure. Homes that were being foreclosed upon were advertised in legal newspapers that no one other than some speculators, attorneys and bankers subscribed to basically. Here in St. Louis I was one of a couple of handfuls of real estate investors that would do the research then go out and try to buy foreclosures to resell. Continue reading “The Five Best Places to Find Foreclosure Bargains“

By Dennis Norman, on August 10th, 2010  Dennis Norman A report just released by CoreLogic estimate the financial impact of short-sale fraud to be $310 million annually. It is estimated there is fraud in one in every 53 short sale transactions resulting in an unnecessary loss to the lender of $41,000 per transaction on average. Continue reading “Report Shows Fraud in Short-Sales Cost Lenders $310 Million Annually“

By Dennis Norman, on June 23rd, 2010  Dennis Norman So, you have the money to pay on your ‘underwater’ mortgage, or to afford the reduced payment amount offered to you under the HAMP program, but think, rather than throw good money after bad you’ll just do like so many borrowers are doing and ‘walk-away‘? Well, if you have any plans to buy a house again in, say the next seven years, particularly with a Fannie Mae loan, think again.

Today Fannie Mae announced policy changes to “encourage borrowers to work with their servicers”. These policy changes include, a seven-year “lock-out” period for borrowers that default that had the capacity to pay, or did not complete a workout alternative offered to them in good faith. Those borrowers will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure. Borrowers that in fact do have extenuating circumstances may be eligible for a new home loan in a shorter period.

“We’re taking these steps to highlight the importance of working with your servicer,” said Terence Edwards, executive vice president for credit portfolio management. “Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time.”

Thinking about a “Strategic Default”?

There has been a lot of talk lately about borrower’s that “strategically default”; for example, borrowers that have the ability to pay their mortgage payments but stop doing so in the hopes they can get out from under their home in an easier method than selling it in a down market, particularly if they are underwater on their mortgage.

Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstances. These policy changes were announced in April, in Fannie Mae’s Selling Guide Announcement SEL-2010-05.

By Dennis Norman, on June 18th, 2010  Dennis Norman According to a press release issued by the FBI, nearly 500 people have been arrested in a nationwide mortgage fraud take-down as part of “Operation Stolen Dreams.” This operation was launched on March 1, 2010 and, according to the FBI, has lead to a total of 485 arrests, 330 convictions and the recovery of nearly $11 million. The FBI estimates that losses from a variety of fraud schemes are estimated to exceed $2 billion.

Operation Stolen Dreams is the government’s largest mortgage fraud take-down to date. But FBI Director Robert S. Mueller cautioned that there is still much work to be done. The Bureau is currently pursuing more than 3,000 mortgage fraud cases, he said, which is almost double the number from the last fiscal year.

“The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.” “The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.”

A few examples:

-

In Miami, on Wednesday two people were arrested for targeting the Haitian-American community, claiming they would assist them with immigration and housing issues. Instead, they used victims’ personal information to produce false documents to obtain mortgage loans.

-

In California, a prominent home builder used straw buyers to sell his houses at inflated prices. The scheme inflated prices on other homes in the area, creating artificially high comparable sales and affecting the overall new-home market.

-

And in Detroit yesterday, FBI agents arrested several individuals in a $130 million scheme orchestrated by the local chapter of a motorcycle gang. The conspirators posed as mortgage brokers, appraisers, real estate agents, and title agents and used straw buyers to obtain around 500 mortgages on only 180 properties.

The FBI says to combat the problem, their National Mortgage Fraud Task Force helps identify mortgage frauds such as loan origination schemes, short sales, property flipping, and equity skimming. In addition, they have 23 mortgage fraud task forces in “hot spots” around the country, from California and Texas to Florida and New York.

Unlike previous mortgage fraud sweeps, Operation Stolen Dreams focused not only on federal criminal cases, but also on civil enforcement and restitution for victims. Federal agencies participating included the Department of Housing and Urban Development, the Treasury Department, the Federal Trade Commission, the Internal Revenue Service, the U.S. Postal Inspection Service, and the U.S. Secret Service. Many state and local agencies were also involved in the operation.

The FBI has produced a video for consumers to help make you aware of the scams that are out there and show you how to avoid them. To watch the video click the link below:

FBI Video on Common Mortgage Fraud Scams

By Robert Fishel, on March 24th, 2010  PLASTIC TAKES PRIORITY. PLASTIC TAKES PRIORITY.

Consumers are paying more attention to their credit card payments and making sure they are current according to a newly released report from TransUnion.

The credit information management company analyzed 27 million anonymous consumer records randomly sampled during the six quarters from 2008 to 2009. Their selection criteria included consumers with at least one credit card and a current mortgage.

Consumers who are delinquent on their credit cards and current on their mortgages decreased to 3.6% from 4.1% in the time period of the study.

However, during the first quarter of 2008 a “flip” occurred where the percentage of consumers with current credit card balances and delinquent mortgages rose. This trend continued during the study time period logging an increase to 6.6% from 4.3%.

“Conventional wisdom has always been that, when faced with a financial crises, consumers will pay their secured obligations first, specifically mortgages,” stated Sean Reardon, author of the study in the company’s analytics and decisioning business unit.

This flip was more pronounced in the Florida and California markets and also for the lowest-scoring segment of the consumer market.

Analysts predict that this flip would revert since the worst of the recession has passed, but apparently that has not been the case according to TransUnion .

St. Louis Mortgage Interest Rates – March 24, 2010 *

- 30-year fixed-rate mortgage 5.00% no points

- 15-year fixed-rate mortgage 4.375% no points

- 5/1 adjustable rate mortgage 3.750% no points

- FHA/VA 30-year fixed rate mortgage 5.25%

- Jumbo 5/1 ARM 4.125% no points

For more information or if you have questions on mortgage rates in St. Louis you may contact me by phone at my direct line, (314) 372-4319, email at rfishel@paramountmortgage.com or you can visit our company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower.

This information is provided by this author and this site for informative purposes only and is not warranted or guarteed in any way.

|

Recent Articles

|

The table below shows the top 25 St Louis neighborhoods where the prices of homes listed for sale have increased in the prior 90 days. This could be an indicator of rising home prices in the area or could be an indicator of a lot of investor or speculator activity resulting in homes being purchased and immediately put back out on for sale to “flip” it at a higher price. This is why it is always important to look at more than just one statistic when trying to determine what is going on in a particular market and why it is imperative that you deal with a real estate professional that has access to real-time, accurate data and knows how to interpret it.

The table below shows the top 25 St Louis neighborhoods where the prices of homes listed for sale have increased in the prior 90 days. This could be an indicator of rising home prices in the area or could be an indicator of a lot of investor or speculator activity resulting in homes being purchased and immediately put back out on for sale to “flip” it at a higher price. This is why it is always important to look at more than just one statistic when trying to determine what is going on in a particular market and why it is imperative that you deal with a real estate professional that has access to real-time, accurate data and knows how to interpret it.

Here’s some good news to end our week with: In St. Louis the number of homeowners that are underwater on their mortgage (owe more than their home is worth), otherwise known as being in a “negative equity” position, dropped to 90,196 homeowners, or 16.1 percent of all St. Louis homeowners with a mortgage, in the first quarter of this year, down from 101,829 St Louis homeowners, or 18.1 percent during the prior quarter, according to a report just released by Corelogic.

Here’s some good news to end our week with: In St. Louis the number of homeowners that are underwater on their mortgage (owe more than their home is worth), otherwise known as being in a “negative equity” position, dropped to 90,196 homeowners, or 16.1 percent of all St. Louis homeowners with a mortgage, in the first quarter of this year, down from 101,829 St Louis homeowners, or 18.1 percent during the prior quarter, according to a report just released by Corelogic.  Today’s existing home sales

Today’s existing home sales  The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland.

The FBI released it’s Mortgage Fraud Report for 2010 showing that mortgage fraud continued at elevated levels in 2010 and was consistent with levels seen in 2009. The top states for mortgage fraud activity in 2010 were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland.

“The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.”

“The staggering totals from this sweep highlight the mortgage fraud trends we are seeing around the country,” Attorney General Holder said. “We have seen mortgage fraud take on all shapes and sizes—from schemes that ensnared the elderly to fraudsters who targeted immigrant communities.”